China EV (Electric Vehicle) Motor Controller Market Report, 2015

-

Oct.2015

- Hard Copy

- USD

$2,700

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

NQB001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

From January to August of 2015, China sold 108,654 new energy vehicles, showing a skyrocketing growth of 270% year on year. Benefiting from the rapid development of new energy vehicles, the motor controller market will value more than RMB1.8 billion in 2015. It is projected that by 2017 this figure will rise to 280,000 sets and that the market size will hit RMB4.6 billion, with an AAGR of as much as 93%.

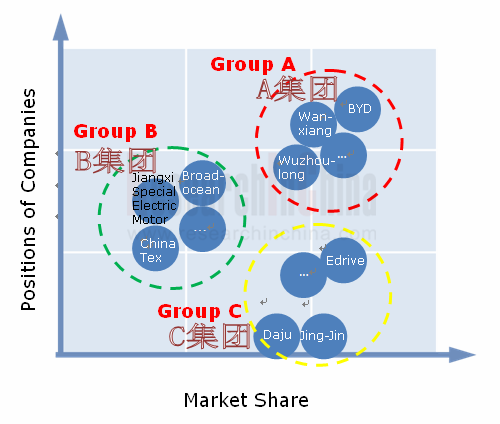

Currently, there are over 30 electric vehicle drive motor manufacturers in China, which can be divided into three strategic groups by strategic positions within the industry:

Group A consists of carmakers veteran in the production of conventional vehicles and auto parts;

Group B consists of enterprises with experience in the production of other types of motors;

Group C consists of motor enterprises established especially for electric vehicle.

With the ballooning of automotive drive motor system, these three strategic groups not only compete with each other, but also realize win-win by giving full play to their advantages.

Strategic Groups of Motor Drive System

Source: China EV (Electric Vehicle) Motor Controller Market Report, 2015 by ResearchInChina

By capacity, all manufacturers are lavishing more capital to expand production lines, and enhancing their core competitiveness even through mergers and acquisitions, take example for Broad-ocean Motor that acquired Shanghai Edrive in 2015 for RMB3.5 billion to fetch more than 30% market share and become a new overlord of motor drive system; the electric vehicle manufacturing base Phase II of CSR Times was completed in December 2014, and will develop annual capacity of 10,000 electric buses as well as 20,000 sets of powertrain assembly and key components after going into operation; Jing-Jin Electric Technologies will produce 100,000 sets of products and export them to the US at the end of 2015 as scheduled.

As for business focus, the domestic passenger car companies have mostly built their own drive system production lines, while independent drive system suppliers primarily compete in large and medium-sized buses. A few independent motor manufacturers such as Broad-ocean Motor, Shanghai Edrive and Hangzhou Devos have entered the supply chain of mainstream passenger car makers.

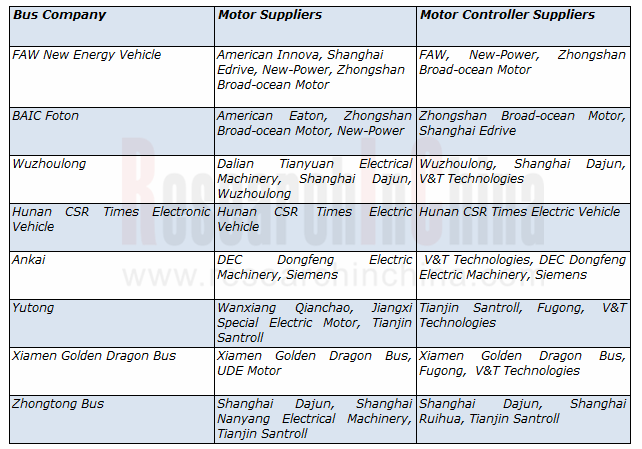

Main Motor and Controller Suppliers of Major Electric Bus Manufacturers in China

Source: China EV (Electric Vehicle) Motor Controller Market Report, 2015 by ResearchInChina

Regarding competition, foreign motor companies are ambitious. For example, Bosch, Continental, SKF, Hitachi, Fuji Electric, Mitsubishi Electric and other companies only export motors to China now instead of producing drive motors in China. But, they quickly seized the orders for the first batch of new energy vehicles (especially hybrid buses), marking a big challenge for Chinese local players.

From the perspective of products, drive motor technology will head toward permanent magnet, digitization and integration in the next five to ten years. Enterprises mainly compete with each other in motor control and integrated technology, while China still lags far behind foreign counterparts dramatically in terms of critical IGBT chip packaging technology and R & D of the 3rd-generation silicon carbide (SiC) IGBT.

1. Electric Vehicle Market

1.1 Sales Volume

1.2 Chinese and Foreign EVs

1.3 Market Structure

1.4 Major Policies

1.4.1 Fiscal Subsidy Policy

1.4.2 Demonstration & Promotion Policy

1.4.3 Other Policies

2 Overview of Motor Controller

2.1 Product Definition

2.2 Working Principle

2.3 Product Classification

2.4 Policy Environment

2.5 Development Trend

2.5.1 Market Trend

2.5.2 Technology Trend

3 Drive Motor Controller Market

3.1 Market Size

3.2 Industry Profits

3.3 Modes of Supply

3.4 Competitive Landscape

3.5 Development of Major Players

3.6 IGBT Market

4 Controller Manufacturers in China

4.1 Shanghai Edrive Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 EV Controller Business

4.2 Shenzhen Inovance Technology Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 EV Controller Business

4.3 Shanghai Dajun Technologies, Inc.

4.3.1 Profile

4.3.2 Operation

4.3.3 Electric Vehicle Business

4.3.4 EV Development Strategy

4.4 Tianjin Santroll Electric Automobile Technology Co., Ltd.

4.4.1 Profile

4.4.2 EV Controller Business

4.5 Beijing Siemens Automotive E-Drive System Co., Ltd.

4.6 Broad-Ocean Motor EV Co., Ltd.

4.6.1 Profile

4.6.2 Operation

4.6.3 EV Controller Business

4.7 Hunan CSR Times Electric Vehicle Co., Ltd.

4.7.1 Profile

4.7.2 Operation

4.7.3 EV Controller Business

4.7.4 Drive Motor Investment and Capacity

4.8 BYD Company Limited

4.8.1 Profile

4.8.2 Operation

4.8.3 EV Controller Business

4.9 Jing-Jin Electric Technologies (Beijing) Co., Ltd.

4.9.1 Profile

4.9.2 EV Controller Business

4.10 DEC Dongfeng Electric Machinery Co., ltd.

4.10.1 Profile

4.10.2 EV Controller Business

4.11 China Tex Mechanical & Electrical Engineering Ltd.

4.11.1 Profile

4.11.2 Operation

4.11.3 EV Controller Business

4.12 Shenzhen V&T Technologies Co., Ltd.

4.12.1 Profile

4.12.2 Revenue

4.12.3 Sales Mode

4.12.4 Main Clients

4.13 Fujian Fugong EV Tech Co., Ltd.

4.14 Prestolite E-Propulsion Systems (Beijing) Limited (PEPS)

4.15 Chroma ATE Inc.

4.15.1 Profile

4.15.2 Operation

4.15.3 Electric Vehicle Business

4.15.4 EV Development Strategy

4.16 Delta Electronics, Inc.

4.16.1 Profile

4.16.2 Operation

4.16.3 EV Controller Business

5 IGBT Suppliers

5.1 Fuji Electric

5.1.1 Profile

5.1.2 Operation

5.1.3 Electric Vehicle Business

5.1.4 EV Development Strategy

5.2 Infineon

5.2.1 Profile

5.2.2 Operation

5.2.3 Electric Vehicle Business

5.2.4 EV Development Strategy

5.3 Denso

5.3.1 Profile

5.3.2 Operation

5.3.3 Electric Vehicle Business

5.4 ROHM

5.4.1 Profile

5.4.2 Operation

5.4.3 Electric Vehicle Business

5.5 IR

5.5.1 Profile

5.5.2 Operation

5.5.3 Electric Vehicle Business

5.6 Semikron International

5.6.1 Profile

5.6.2 Operation

5.6.3 Electric Vehicle Business

6 Inverter Manufacturers

6.1 Hitachi Automotive Systems

6.1.1 Profile

6.1.2 Operation

6.1.3 Electric Vehicle Business

6.2 Mitsubishi Electric

6.2.1 Profile

6.2.2 Operation

6.2.3 Electric Vehicle Business

6.3 Meidensha

6.3.1 Profile

6.3.2 Operation

6.3.3 Electric Vehicle Business

6.4 Toshiba

6.4.1 Profile

6.4.2 Operation

6.4.3 Electric Vehicle Business

6.5 Hyundai Mobis

6.5.1 Profile

6.5.2 Operation

6.5.3 Electric Vehicle Business

6.6 Delphi

6.6.1 Profile

6.6.2 Operation

6.6.3 Electric Vehicle Business

6.7 Bosch

6.7.1 Profile

6.7.2 Operation

6.7.3 Electric Vehicle Business

6.8 Continental

6.8.1 Profile

6.8.2 Operation

6.8.3 Electric Vehicle Business

China’s Electric Vehicle Sales Volume, 2011-2017E

Share of Electric Vehicle in China Automobile Market, 2011-2014

Share of Electric Vehicle in U.S. Automobile Market, 2011-2014

Sales Volume of Electric Vehicles in Europe, USA, Japan and China, Jan.-Jun. 2015

Market Structure of Electric Vehicles in China by Power Type, 2013-2017E

Market Structure of Electric Vehicles in China by Model, 2013-2017E

Subsidy Standards for Electric Passenger Car in China, 2013-2020

Subsidy Standards for Electric Bus in China, 2016

Subsidy Standards for Electric Bus in China, 2014-2015

Subsidy Standards for Fuel Cell Vehicle in China, 2016

EV Promotion Plan and Completion Progress in Chinese Cities (Clusters), 2013-2015

EV Promotion Plan (Public Transport and Private Consumption) in China, 2014-2015

EV Promotion Quantities in Chinese Cities (Clusters), 2014

Models among 1st Three Batches of Purchase Duty-Free Catalog Approved by MIIT

Principles of EV Motor Controllers

Classification of EV Motor Controllers

Policies on EV Motor Controllers in China

R&D and Status Quo of Chinese and Foreign EV Motors and Controllers

Demand and Market Size of EV Motor Controllers in China, 2013-2017E

Gross Margins for Motor Controllers of Shenzhen Inovance Technology and Shenzhen V&T Technologies, 2011-2014

EV Motor Controllers’ Supply Modes in China

Market Share of Some EV Motor Controller Manufacturers in China, 2015

Motor and Controller Suppliers of Major Electric Bus Manufacturers in China

Major EV Motor Controller Manufacturers in China

Major Global Electric Vehicle IGBT (Insulated Gate Bipolar Transistor) Device Manufacturers

Equity Structure of Shanghai Edrive (before Acquisition)

EV Drive Motor System Shipments of Shanghai Edrive, 2013-2015Q1

Financial Indicators of Shanghai Edrive, 2009-2015

Main Products of Shanghai Edrive

Top 5 Customers of Shanghai Edrive, 2014-2015Q1

Top 5 Suppliers of Shanghai Edrive, 2014-2015Q1

Revenue and Net Income of Shenzhen Inovance Technology, 2009-2015H1

Gross Margin of Shenzhen Inovance Technology, 2009-2015H1

Revenue of Shenzhen Inovance Technology by Product, 2012-2015H1

Gross Margin of Shenzhen Inovance Technology by Product, 2012-2015H1

EV Motor Controller Project Progress of Shenzhen Inovance Technology, 2014

Key R&D Project Progress of Shenzhen Inovance Technology, 2015

Main Financial Indicators of Shanghai Dajun Technologies, 2012-2015H1

Revenue and Operating Costs of Main Products of Shanghai Dajun Technologies, 2012-2014

Motor Drive System Capacity, Output, and Sales Volume of Shanghai Dajun Technologies, 2012-2014

Major Clients of Shanghai Dajun Technologies, 2012-2014

Top Five Suppliers of Shanghai Dajun Technologies, 2013-2014H1

Development Course of Shanghai Dajun Technologies

Subsidiaries of Shanghai Dajun Technologies

Unprocessed Orders of Shanghai Dajun Technologies as of the End of 2014H1

Financial Indicators of Broad-Ocean Motor EV, 2012-2014

Financial Indicators of Hunan CSR Times Electric Vehicle, 2011-2014

Motor Controller Products of Hunan CSR Times Electric Vehicle

BYD’s Headcount, 2007-2014

Output and Sales Volume of BYD, 2010-2015H1

Revenue, Net Income & Gross Margin of BYD, 2007-2015H1

Revenue Breakdown of BYD by Product, 2007-2015H1

Gross Margin of BYD by Product, 2008-2015H1

Revenue Breakdown of BYD by Region, 2008-2015H1

Motor Controller Products of DEC Dongfeng Electric Machinery

New-energy Vehicle SRD Motors of China Tex Mechanical & Electrical Engineering

Revenue and Profit of Shenzhen V&T Technologies, 2011-2014

Revenue of Shenzhen V&T Technologies by Product, 2011-2014

Product Sales Mode of Shenzhen V&T Technologies, 2011-2014

Shenzhen V&T Technologies’ Top 5 Clients, 2011-2014

Major EV Motor Controller Clients of Shenzhen V&T Technologies

ATE's Footprint Worldwide

ATE's Financial Indicators (Consolidated), 2009-2015H1

ATE's Revenue by Division, 2015H1

EVT Technology’s Development History

Financial Indicators of Delta Electronics, 2009-2015H1

Delta Electronics’ Capacity, Output, and Output Value by Product, 2012-2014

Sales Volume of Delta Electronics by Product, 2012-2014

Main Financial Indicators of Fuji Electric, FY2010-FY2015

Fuji Electric’s Revenue and Operating Income by Division, FY2013-FY2015

Fuji Electric’s Revenue by Region, FY2011-FY2015

Infineon’s Global Ranking in Three Businesses, 2013

Infineon’s Revenue (by Region), FY2012-FY2014

Infineon’s Revenue (by Division), FY2012-FY2014

Infineon’s Main EV IGBT Products

Denso’s Headcount, FY2009-FY2014

Denso’s Revenue and Profit, FY2013-FY2015

Denso’s Operating Income and Net Income, FY2011-FY2015

Denso’s Revenue Structure by Division, FY2013-FY2015Q1

Denso’s Revenue Breakdown by Division, FY2013-FY2015Q1

Denso’s Revenue and Operating Profit (by Region), FY2013-FY2015

Denso’s Revenue Breakdown by Client, FY2010-FY2014

Denso’s Client Structure, FY2013-FY2014

NEDO’s Power Electronics Projects

ROHM’s Financial Indicators, FY2010-FY2015

ROHM’s Revenue Structure by Division, FY2014

ROHM’s Revenue Breakdown by Division, FY2014

IR's Revenue by Division, FY2012-FY2014

Hitachi Automotive Systems’ Revenue, FY2011-FY2015

Major EV Inverter Clients of Hitachi Automotive Systems

Mitsubishi Electric’s Financial Indicators, FY2010-FY2015

Mitsubishi Electric’s Revenue by Division, FY2014

Mitsubishi Electric's Major EV Inverter Clients

Meidensha’s Financial Indicators, FY2010-FY2015

Meidensha’s Revenue and Profit by Division, FY2014-FY2015

Meidensha’s Major EV Inverter Clients

Toshiba’s Revenue and Net Income, FY2010-FY2014

Toshiba’s Sales Structure by Division, FY2010-FY2014

Revenue of Toshiba’s Electronic Devices & Components Division, FY2010-FY2014

Toshiba’s Major EV Inverter Clients

Hyundai Mobis’ Revenue and Operating Margin, FY2005-FY2015Q1

Hyundai Mobis’ Major EV Inverter Clients

Delphi’s Headcount, 2011-2013

Delphi’s Revenue and Gross Margin, 2004-2015H1

Delphi’s Revenue and Operating Margin, 2007-2015H1

Delphi’s Revenue and EBITDA Ratio, 2007-2015

Delphi’s Revenue Structure by Division, 2012-2015H1

Delphi’s Revenue and Gross Margin by Division, 2010-2015H1

Delphi’s Major Growth Areas by Division, 2013-2016E

Delphi’s Revenue by Region, 2010-2014

Delphi’s Major Clients and Their Regional Distribution

Name list and Revenue Contribution of Delphi’s Top 5 Clients, 2012-2013

Delphi’s EV Product Distribution

Delphi’s Major EV Inverter Clients

Bosch’s Headcount, 2009-2014

Bosch’s Revenue & EBIT, 2009-2014

Bosch’s Revenue Structure by Division, 2012-2014

Bosch’s Revenue & EBIT from Automobile Division, 2012-2014

Bosch’s Revenue Structure by Region, 2012-2014

Bosch’s Revenue in Major Countries, 2012-2014

Bosch’s Major EV Inverter Clients

Continental’s Headcount, 2009-2014

Continental’s Revenue & EBIT, 2009-2015H1

Continental’s Revenue Structure by Division, 2009-2013

Continental’s Revenue Structure by Region, 2009-2013

Continental’s Major EV Inverter Clients

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...