China Driving Recorder Industry Report, 2015-2019

-

Dec.2015

- Hard Copy

- USD

$2,400

-

- Pages:100

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

YSJ092

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

Chinese driving recorder market continues to heat up amid growing concerns over traffic accident disputes, such as Pengci, a word referring to fake accidents for extorting money. Driving recorder sales volume is estimated at around 13 million sets in China in 2015, representing a year-on-year surge of 85.71%. Notwithstanding, compared with huge car ownership, the installation rate of driving recorder in China is less than 5%, far below that in Japan, Taiwan, and Russia, indicating enormous potential for market growth.

In 2015, driving recorders are no longer confined to the function of preventing Pengci, but experience significant changes in function and shape. As to the function, besides driving recording, more and more products integrate Wi-Fi, rearview reverse parking camera, voice recognition, and navigation. Regarding the shape, smart rearview mirror leads the trend. Most companies have already developed or are developing such products, and add operating system, 3G module, ADAS, navigation, voice action, and gesture recognition, with the products developing towards intelligent driver assistant system. The integration of navigation has some impact on on-board navigation market.

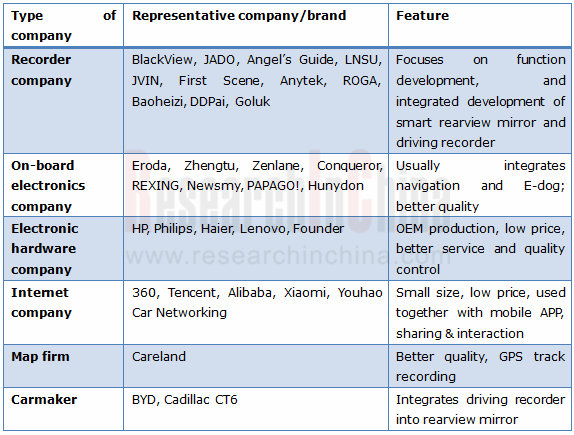

Companies are rushing into driving recorder field and use it as a medium to make layout in telematics. In addition to makers of on-board terminals including driving recorder and navigator, Internet firms, map companies, and automakers also want to get a piece of the pie. Internet and map companies aim to capture user resources, and carmakers wish to make their way into the driving recorder OEM market.

Internet companies that make aggressive actions include Qihoo 360 Technology, Tencent, Alibaba, and Xiaomi.

In May 2015, Qihoo 360 Technology launched 360 driving recorder, which has built-in Ambarella A7 image processor and 2-inch 1296P 160° wide-angle TFT display, and is sold at RMB299. 200,000 sets of the product were sold on Nov 11, 2015.

In Oct 2015, Tencent and DDPai jointly launched “QQ IoT driving recorder”. After DDPai and “QQ IoT” are connected, DDPai driving recorder can be added to “My Device” on QQ, and access and operations to the driving recorder can be gained.

In Oct 2015, JADO launched smart rearview mirror “Vision” carrying Alibaba’s YunOS operating system.

On Nov 24, 2015, Xiaoyi Technology under Xiaomi launched a driving recorder. The product has a 2.7-inch 165° wide-angle 16:9HD LED display, uses Ambarella A7LA70 chip (supposedly), supports a max. resolution of 1296P (2304×1296), and can record 60fps 1080P videos. In addition, it also carries ADAS, analyzing the data on lane, vehicle speed, and vehicle distance, and giving the alarm. The crowd-funding price is RMB289.

Representative Driving Recorder Companies in China

Source: China Driving Recorder Industry Report, 2015-2019 by ResearchInChina

China Driving Recorder Industry Report, 2015-2019 by ResearchInChina highlights the followings:

Development of global driving recorder;

Development of global driving recorder;

Driving recorder shipments, market size, development characteristics, competitive landscape, and development trends in China;

Driving recorder shipments, market size, development characteristics, competitive landscape, and development trends in China;

Development of driving recorder market segments in China;

Development of driving recorder market segments in China;

Chinese driving recorder chip market pattern;

Chinese driving recorder chip market pattern;

Development of driving recorder chip suppliers in China, including profile, operation, main driving recorder solutions and features of products;

Development of driving recorder chip suppliers in China, including profile, operation, main driving recorder solutions and features of products;

Development of driving recorder producers in China, covering profile, operation, features of products, and development strategy.

Development of driving recorder producers in China, covering profile, operation, features of products, and development strategy.

1 Definition and Classification of Driving Recorder

1.1 Definition

1.2 Development

1.3 Classification

1.4 Structure

2 Development of Driving Recorder

2.1 Global Driving Recorder Market Size

2.1.1 Global

2.1.2 Japan

2.1.3 Taiwan

2.1.4 Russia

2.2 Chinese Driving Recorder Market Size

2.2.1 Sales Volume

2.2.2 Market Size

2.2.3 Competitive Landscape

2.2.4 Sales Channel

2.2.5 Development Characteristics

2.2.6 Internet Firms’ Layout

2.2.7 M&As

2.3 Development of Industry Chain

2.3.1 Overview

2.3.2 Master Chip

3 Development of Market Segments

3.1 Display CDR

3.2 Non-display WIFI Recorder

3.3 Smart Rearview Mirror

3.3.1 Definition

3.3.2 Application

3.3.3 Major Companies

3.3.4 Functions of Product

3.3.5 Development Trends

4 Major Chip Companies

4.1 Ambarella

4.1.1 Profile

4.1.2 Operation

4.1.3 Driving Recorder Business

4.2 Novatek

4.2.1 Profile

4.2.2 Operation

4.2.3 Main Products

4.2.4 Driving Recorder Business

4.3 Allwinner Technology

4.3.1 Profile

4.3.2 Operation

4.3.3 Main Products

4.4 Sunplus Technology

4.4.1 Profile

4.4.2 Operation

4.4.3 Driving Recorder Business

4.5 Syntek

4.5.1 Profile

4.5.2 Operation

4.5.3 Driving Recorder Business

4.6 SQ Technology

4.6.1 Profile

4.6.2 Operation

4.6.3 Driving Recorder Business

5 Major Players

5.1 PAPAGO,Inc.

5.1.1 Profile

5.1.2 Operation

5.1.3 Driving Recorder

5.1.4 Supply Chain

5.1.5 Strategic Planning

5.2 Youhao Car Networking

5.2.1 Profile

5.2.2 Operation

5.2.3 Main Products

5.2.4 Suppliers

5.2.5 Strategic Planning

5.3 Shenzhen Soling Industrial

5.3.1 Profile

5.3.2 Operation

5.3.3 Primary Business

5.3.4 Strategic Planning

5.4 CARCAM Electronic.Black View

5.4.1 Profile

5.4.2 Primary Business

5.4.3 Strategic Planning

5.5 JADO.JADO

5.5.1 Profile

5.5.2 Primary Business

5.5.3 Strategic Planning

5.6 Qihoo 360

5.6.1 Profile

5.6.2 Primary Business

5.6.3 Strategic Planning

5.7 vYou.DDPai

5.7.1 Profile

5.7.2 Primary Business

5.7.3 Strategic Planning

5.8 Jeavox.Angel’s Guide

5.8.1 Profile

5.8.2 Primary Business

5.8.3 Strategic Planning

5.9 LNSU Electronic & Technology.LNSU

5.9.1 Profile

5.9.2 Primary Business

5.9.3 Strategic Planning

5.10 Shenzhen JFK Electronic.JVIN

5.10.1 Profile

5.10.2 Primary Business

5.10.3 Strategic Planning

5.11 Aladdin.First Scene

5.11.1 Profile

5.11.2 Primary Business

5.12 Jiafeng Zhuoyue.REXING

5.12.1 Profile

5.12.2 Primary Business

5.13 Anytek

5.13.1 Profile

5.13.2 Primary Business

5.13.3 Strategic Planning

5.14 Hunydon

5.14.1 Profile

5.14.2 Primary Business

5.15 Zenlane

5.15.1 Profile

5.15.2 Primary Business

5.15.3 Strategic Planning

5.16 Wei Jia Yi Technology.ROGA

5.16.1 Profile

5.16.2 Primary Business

5.17 Baoheizi

5.17.1 Profile

5.17.2 Primary Business

5.18 Careland

5.18.1 Profile

5.18.2 Primary Business

5.18.3 Strategic Planning

5.19 Coagent

5.19.1 Profile

5.19.2 Operation

5.19.3 Primary Business

5.19.4 Strategic Planning

6 Summary and Forecast

6.1 Market Size

6.2 Market Structure

6.3 Development Trend

Representative Driving Recorders and Prices

Global Driving Recorder Market Size, 2014-2019E

Driving Recorder Sales Volume in China, 2013-2019E

Baidu Search Index of Driving Recorder, 2012-2015

Chinese Driving Recorder Market Size, 2013-2019E

Ranking of Driving Recorders by Sales Volume on Tmall on Nov 11, 2015

Top10 Driving Recorder Brands on JD, 2015

Market Share of Driving Recorders in China, 2015Q1

Major Driving Recorder Companies in China

Sales Channels for Driving Recorders in China

Representative Driving Recorder Companies in China

M&As in Driving Recorder (Including Smart Rearview Mirror) Field

Chinese Driving Recorder Master Chip Market Size, 2014-2019E

Global Driving Recorder Master Chip Market Size, 2014-2019E

Driving Recorder Industry Structure in China

Main Products of Chip Makers and Corresponding Video Pixel

Representative Chips and Identification Codes of Driving Recorder Main Control Solutions

Advantages of Mainstream Driving Recorder Companies

Parameters of Main Display Driving Recorders in China

Parameters of Main Non-display Driving Recorders in China

Smart Rearview Mirrors of Major Companies in China

Telematics Functions of Main Smart Rearview Mirrors in China

Revenue and Net Income of Ambarella, FY2011-FY2015

Revenue and Profit of Novatek, 2012-2015

Novatek’s Sales in Major Regions, 2013-2014

Main Products of Novatek

Applications of Novatek’s Main Products

Output and Output Value of Novatek’s Main Products, 2013-2014

Sales Volume and Value of Novatek’s Main Products, 2013-2014

Revenue and Profit of Allwinner Technology, 2012-2015

Gross Margin of Allwinner Technology, 2012-2015

Allwinner Technology’s Main Products and Their Applications

Operating Revenue Structure of Allwinner Technology by Product, 2012-2014

Smart Terminal Process Chip Business Revenue Structure of Allwinner Technology by Application, 2012-2014

Revenue and Profit of Sunplus Technology, 2013-2015

Operational Outlets of Sunplus Technology in Mainland China

Revenue and Profit of Syntek, 2012-2015

Revenue and Profit of SQ Technology, 2012-2015

Revenue and Profit of PAPAGO, 2013-2015

PAPAGO’s Sales in Major Regions, 2013-2014

Main Suppliers of PAPAGO

Top3 Suppliers of PAPAGO, 2013-2015

Top3 Trade Debtors of PAPAGO, 2013-2015

Revenue and Profit of Youhao Car Networking

Main Products of Youhao Car Networking

Revenue from Main Products of Youhao Car Networking, 2013-2015

Major Suppliers of Youhao Car Networking

Top5 Suppliers of Youhao Car Networking, 2013-2015

Revenue and Profit of Shenzhen Soling Industrial, 2012-2015

Gross Margin of Shenzhen Soling Industrial’s Smart CID System, 2013-2014

Major Partners of BlackView

Main Products of Jeavox

Revenue and Profit of Coagent, 2013-2015

Operating Revenue Structure of Coagent by Segment, 2013-2015

Operating Revenue Structure of Coagent by Product, 2013-2015

Global and Chinese Driving Recorder Market Size and Growth Rate, 2013-2019E

Chinese Driving Recorder Market Structure, 2015&2019E

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...