Global and China Speech Recognition Industry Report, 2015-2020

-

Apr.2016

- Hard Copy

- USD

$2,400

-

- Pages:102

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZLC030

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

Propelled by big data, mobile Internet, cloud computing, and other technologies, global intelligent voice industry has entered the stage of rapid application. Global intelligent voice market size was USD4.75 billion in 2014 and is predicted to grow 30.7% from a year ago to hit USD6.21 billion in 2015.

With intense involvement of Internet giants including Google, Microsoft, and Apple around 2010, global intelligent voice industry has gradually evolved from oligopoly to monopolistic competition. In 2015, speech recognition leader Nuance still took the first place with a market share of 31.1% but suffered a significant decline; Google, Microsoft, Apple, and IFLYTEK witnessed rapid share growth, standing at 20.7%, 13.4%, 12.9%, and 6.7%, respectively.

Thanks to national policy support and demand growth from downstream sectors, China’s intelligent voice industry also flourishes with an ever-expanding market size. In 2015, the Chinese intelligent voice market scale was estimated at RMB4.68 billion, a year-on-year surge of 53.1%, making up around 12% of the global market.

Traditional Chinese speech recognition companies mostly take a place in intelligent voice market by relying on domestic scientific research institutions, while new firms largely accelerate their presence in intelligent voice industry via financing. The majority of the Chinese intelligent voice market is held by iFLYTEK, Baidu, and Apple (a combined 79% share in 2015). To gain an advantage in market competition, Chinese speech recognition players have flooded into market segments such as intelligent in-vehicle, smart home, and wearable devices.

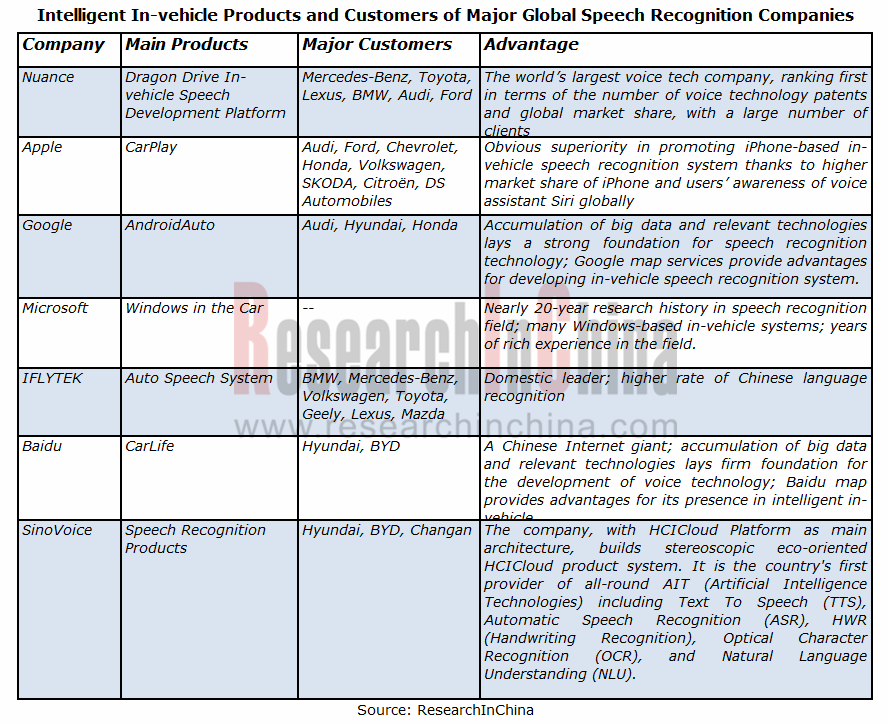

In intelligent in-vehicle field, speech recognition giants Nuance, Apple, Google, Microsoft, iFLYTEK, and Baidu have launched Dragon Drive in-vehicle speech development platform, CarPlay, AndroidAuto, Windows in the Car, Auto Speech System, and CarLife, respectively, and cooperated with carmakers to grab emerging intelligent in-vehicle market.

As the application of speech recognition technology in intelligent in-vehicle, smart home, and wearable devices goes deeper, global and Chinese intelligent voice market will maintain the momentum of rapid growth, reaching estimated USD19.17 billion and RMB25.14 billion in 2020, respectively.

Global and China Speech Recognition Industry Report, 2015-2020 highlights the followings:

Global intelligent voice industry (development history, status quo, business model, competitive landscape);

Global intelligent voice industry (development history, status quo, business model, competitive landscape);

China’s intelligent voice industry (current development, relevant policies, competitive landscape);

China’s intelligent voice industry (current development, relevant policies, competitive landscape);

Market segments of speech recognition technology (development of intelligent in-vehicle, smartphone, PC, smart home, and wearable devices, and speech recognition companies’ layout in these segments);

Market segments of speech recognition technology (development of intelligent in-vehicle, smartphone, PC, smart home, and wearable devices, and speech recognition companies’ layout in these segments);

7 foreign and 10 Chinese speech recognition technology-related companies (speech recognition business and application in automotive field).

7 foreign and 10 Chinese speech recognition technology-related companies (speech recognition business and application in automotive field).

1 Speech Recognition Technology

1.1 Definition and Classification

1.2 Technical Principle

1.3 Industry Chain

2 Global Intelligent Voice Industry

2.1 Development History

2.2 Status Quo

2.3 Business Model

2.4 Competitive Landscape

3 Intelligent Voice Industry in China

3.1 Status Quo of Development

3.2 Relevant Policies

3.3 Competitive Landscape

4 Market Segments

4.1 Intelligent In-vehicle

4.2 Smartphone

4.3 PC

4.4 Smart Home

4.5 Wearable Devices

5 Major Foreign Speech Recognition Players

5.1 Nuance

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 R&D

5.1.5 Speech Recognition Business

5.1.6 Application in Automotive Field

5.2 Apple

5.2.1 Profile

5.2.2 Operation

5.2.3Revenue Structure

5.2.4 R&D

5.2.5 Speech Recognition Business

5.2.6 Application in Automotive Field

5.3 Google

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 R&D

5.3.5 Speech Recognition

5.3.6 Application in Automotive Field

5.4 Microsoft

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 R&D

5.4.5 Speech Recognition

5.4.6 Application in Automotive Field

5.5 IBM

5.5.1 Profile

5.5.2 Speech Recognition

5.6 MindMeld

5.7 Speaktoit

6 Major Chinese Speech Recognition Companies

6.1 iFlyTek

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D and Investment

6.1.6 Speech Recognition Business

6.1.7 Application in Automotive Field

6.1.8 Forecast and Outlook

6.2 Baidu

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 R&D

6.2.5 Speech Recognition Business

6.2.6 Application in Automotive Field

6.3 AI Speech

6.3.1 Profile

6.3.2 Speech Recognition Business

6.3.3 Application in Automotive Field

6.4 Unisound

6.4.1 Profile

6.4.2 Speech Recognition Business

6.4.3 Application in Automotive Field

6.5 ThinkIT

6.5.1 Profile

6.5.2 Speech Recognition Business

6.5.3 Major Customers

6.6 SinoVoice

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Gross Margin

6.6.5 R&D

6.6.6 Speech Recognition Business

6.6.7Application in Automotive Field

6.6.8 Forecast and Outlook

6.7 Pattek

6.7.1 Profile

6.7.2 Operation

6.7.3 Speech Recognition Technology

6.8 Mobvoi (Chumenwenwen)

6.8.1 Profile

6.8.2 Operation

6.9 d-Ear

6.9.1 Profile

6.9.2 Speech Recognition

6.10 Vcyber

6.10.1 Profile

6.10.2 Application in Automotive Field

7 Summary and Forecast

7.1 Overall Market

7.2 Competitive Landscape

7.2.1 Nuance: Declining Market Share; Actively Explores Emerging Markets

7.2.2 Google: A Latecomer Getting Ahead of Others; Its Biggest Advantage Lies in User Flows

7.2.3 Microsoft: Blossoming of Voice Application

7.2.4 SIRI: Higher Users’ Awareness Helped by Apple

7.2.5 IBM: Gradual Fading-out Because of Poor User Experience

7.2.6 iFlyTek: Unshakeable Speech Recognition Leader in China

Voiceprint Recognition Flowchart

Intelligent Voice Human-Computer Interaction Industry Chain

Level of Voice Technology Development

Development History of Global Intelligent Voice Industry

Global Intelligent Voice Market Size, 2011-2015

Speech Recognition Products of Global Speech Recognition Companies and Their Applications

Major M&A Cases of Global Speech Recognition Companies

Business Model of Speech Recognition Industry

Market Share of Global Intelligent Voice Companies, 2012

Market Share of Global Intelligent Voice Companies, 2015

China’s Intelligent Voice Market Size, 2013-2015

Policies on Chinese Speech Recognition Industry, 2010-2015

Major Chinese Speech Recognition Companies and Related Research Institutes

Market Share of Chinese Intelligent Voice Companies, 2012

Market Share of Chinese Intelligent Voice Companies, 2015

Financing Cases of Major Chinese Speech Recognition Companies

Global Automobile Output, 2012-2015

China’s Passenger Vehicle Output and Sales Volume, 2012-2015

China’s Automobile Ownership, 2012-2015

Intelligent In-vehicle Products of Major Global Speech Recognition Companies and Their Customers

Comparison of Mobile Mapping System of Global Speech Recognition Enterprises

Intelligent In-vehicle Layout of Global Speech Recognition Enterprises

Global Smartphone Shipments and YoY Growth Rate, 2013-2015

China’s Smartphone Shipments and YoY Growth Rate, 2013-2015

Comparison of Major Global Voice Assistant Products

Global PC Shipments and YoY Growth Rate, 2012-2015

Application of Intelligent Voice Technology in Smart Home

Market Size and YoY Growth Rate of China’s Wearable Device Industry, 2013-2015

Wearable Devices of Major Global Speech Recognition Enterprises

Revenue and Net Income of Nuance, FY2012-FY2015

Revenue Breakdown of Nuance (By Business), FY2012-FY2015

Revenue Structure of Nuance (By Business), FY2012-FY2015

Revenue Breakdown of Nuance (By Region), FY2013-FY2015

R&D Costs of Nuance, FY2012-FY2015

Major Partners of Nuance

Main Functions of Nuance’s Dragon Drive Automotive Assistant

Revenue and Net Income of Apple, FY2013-FY2015

Revenue Breakdown of Apple (by Region), FY2013-FY2015

Revenue Structure of Apple (by Region), FY2013-FY2015

Revenue Breakdown of Apple (by Product), FY2013-FY2015

Revenue Breakdown of Apple (by Product), FY2013-FY2015

Sales Volume of Apple’s Main Products, FY2013-FY2015

R&D Costs of Apple, FY2013-FY2015

Revenue and Net Income of Google, 2011-2015

Revenue Breakdown of Google (by Product), 2013-2015

Revenue Structure of Google (by Product), 2013-2015

Revenue Breakdown of Google (by Region), 2013-2015

Revenue Structure of Google (by Region), 2013-2015

R&D Costs of Google, 2013-2015

Revenue and Net Income of Microsoft, FY2011-FY2015

Revenue Breakdown of Microsoft (by Division), FY2013-FY2015

Revenue Structure of Microsoft (by Division), FY2013-FY2015

R&D Costs of Microsoft, FY2013-FY2015

Major Investors of MindMeld

Business Model of iFLYTEK

Revenue and Net Income of iFLYTEK, 2012-2015

Revenue Breakdown of iFLYTEK (by Product), 2012-2015

Revenue Structure of iFLYTEK (by Product), 2012-2015

Revenue Breakdown of iFLYTEK (by Region), 2013-2015

Main Products of iFLYTEK

Gross Margin of iFLYTEK (by Product), 2013-2015

R&D Costs of iFLYTEK, 2012-2015

Non-Public Offering Fundraising Projects of iFLYTEK, 2015

Function Component Modules and Structure of InterReco

Function of Aitalk 3.0

Function Component Modules and Structure ofInterVeri 2.1

Revenue and Net Income of iFLYTEK, 2015-2020E

Revenue and Net Income of Baidu, 2012-2015

Revenue Breakdown of Baidu (by Product), 2012-2015

Revenue Structure of Baidu (by Product), 2012-2015

R&D Costs of Baidu, 2012-2015

Cooperative Partners of Baidu Speech

Main Solutions of Unisound

Major Partners of Unisound

Intelligent Vehicular Cases of Unisound

Ownership Structure of ThinkIT

Performance Indicators of ThinkITSpeech Recognition Engine

Technical Features of ThinkITSpeech Recognition Engine

Performance Indicators of ThinkIT Voiceprint Recognition

Cooperative Partners of ThinkIT

Development History of SinoVoice

Revenue and Net Income of SinoVoice, 2013-2015

Revenue Breakdown of SinoVoice (by Product), 2013-2015

Revenue Structure of SinoVoice (by Product), 2013-2015

Top 5 Customers of SinoVoice, 2013-2015

Major Sales Contracts of SinoVoice, 2015

Gross Margin of SinoVoice, 2013-2015

R&D Costs of SinoVoice, 2013-2015

Major Customers of SinoVoice

SinoVoice’s Speech Recognition Applications in Automotive Field

Revenue and Net Income of SinoVoice, 2014-2020E

Financial Indicators of Pattek, 2013-2014

Development History of Mobvoi

Ownership Structure of Mobvoi

Financial Indicators of Mobvoi

Main Speech Recognition Related Products of d-Ear

Major Partners of Vcyber

Cooperation Model of VcyberYujiahuanying

Global Intelligent Voice Market Size, 2015-2020E

Chinese Intelligent Voice Market Size, 2015-2020E

Nuance’s Acquisition of Innovation-oriented Enterprise to Enrich Product Line

Google’s Acquisitions in Intelligent Voice Field

Google Now’s Market Share Investigated by TEC Hnalysis Research, 2015

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...