With a boom in sharing economy, car sharing companies represented by Zipcar, Uber, Getaround, and Car2go have flourished, pushing forward the development of car sharing around the world.

Fully-developed car sharing in foreign countries is primarily divided into three models: car-hailing apps, P2P car rental, and timeshare rental with the first represented by Uber, Lyft, and Ola Cabs, the middle Getaround, Turo, and Flightcar, and the latter Zipcar, Car2go, NriveNow, and Autolib.

Uber, the world’s largest car-hailing app player, has so far obtained a dozen rounds of financing and now is valued at USD60 billion. The company has penetrated into a total of 447 cities in countries consisting of the United States, China, India, Singapore, Malaysia, etc.

The Chinese car sharing market is still in the phase of rapid growth but has showed huge potential. A series of laws & regulations and policies, including the Guidance on Promoting Green Consumption and the Guidance on Promoting the Development of New Energy Vehicle Timeshare Sector in Shanghai, have been introduced by the central government and local authorities so as to regulate and encourage the development of car sharing industry.

Car-hailing apps: A competitive landscape with DidiChuxing, YidaoYongche, Uber, ShenzhouZhuanche, 51 Yongche, Dida Pinche, and TiantianYongche as major players have taken shape in the Chinese car-hailing apps market. Orders for car-hailing services totaled about 2 billion in China in 2015, including 1.43 billion or 71.5% of the total amount from DidiChuxing, followed by Uber with a percentage of 18.3%.

DidiChuxing, a result of the merger between DidiDache and KuaidiDache, combines their own advantages. Having raised more than USD5 billion, it is the largest domestic car-hailing app platform in China valued at USD20 billion. The number of drivers connected to the platform had exceeded 14 million and registered users amounted to 250 million by the end of 2015.

P2P car rental: With PP Zuche rolling out its services in China, PP car rental platforms like Atzuche, UU Cars, Baojia, and KuaikuaiZuche have sprung up around China.

P2P car rental firms now rely heavily on financing for capital to expand business scope and grab customers. PP Zuche, with the largest amount of financing, got RMB500 million in financing in Sept 2015, the largest one in P2P car rental market.

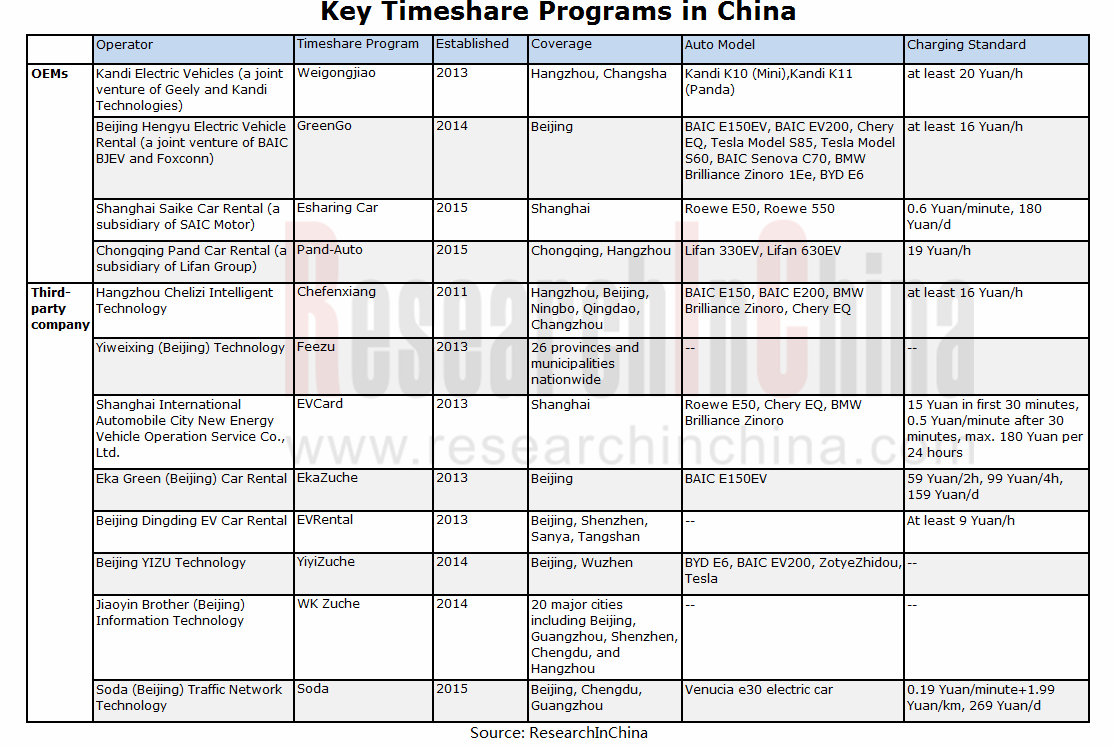

Timeshare: With growing heat-up of new-energy vehicle timeshare, localities have been active in developing new energy vehicle timeshare rental sector. And, new energy vehicle timeshare programs are being carried out in dozens of cities including Beijing, Shanghai, Hangzhou, and Shenzhen.

Propelled by favorable policies, carmakers, telematics enterprises, and Internet firms have flooded into the field. In addition, P2P car rental company- UU Cars announced in Oct 2015 that it would transform to timeshare model, plan to put 1,000 vehicles into operation by the end of 2015 and raise the figure to more than 6,000 units in the first half of 2016.

Major timeshare rental companies include Feezu, YiyiZuche, EVCard, WK Zuche, Soda, and EkaZuche. In addition, BAIC BJEV have launched GreenGo timeshare program, SAIC Motor E-sharing car, GeelyWeigongjiao, LifanPand-Auto, and Shou Qi Group Gofun.

The Chinese car sharing market will still be complementarily composed of car-hailing app firms, P2P car rental companies, and timeshare enterprises in the future.

Car-hailing apps market will be dominated by comprehensive mobile platforms represented by DidiChuxing and Uber; P2P car rental market will be further regulated with only two to three players surviving fierce competition; blossoming timeshare market will grow more mature under the joint efforts of market participants.

China Car Sharing Industry Report, 2016-2020 highlights the followings:

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...