Global and China Automobile Brake System (Disc Brake, Drum Brake, ABS, EBD/CBC, EBA/BAS/BA/AEB, ESC/ESP/DSC, AUTO HOLD) Industry Report, 2016-2020

-

June 2016

- Hard Copy

- USD

$2,700

-

- Pages:180

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

YSJ096

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

In 2015, the global market size of automotive braking system exceeded USD50 billion, and that of China’s automotive braking system came to over RMB60 billion. With the saturation of automobile market, the global and Chinese automotive braking system markets have leveled off. It is expected during 2016-2020 that the global and Chinese automotive braking system markets will grow at an average annual rate of 4.4% and 7.3%, respectively. And electronic control system may become the main driving force behind the industry development.

In China’s braking system market, manufacturers mainly develop towards ABS, braking force distribution (EBD/CBC, etc.), brake assist (EBA/BAS/BA), Vehicle Stability Control (ESC/ESP, DSC, etc.), AUTO HOLD, and so forth. Among them, ABS and EBD/CBC have the highest assembly rate of close to 90%; vehicle stability control develops very fast, with the assembly rate approaching 50%; brake assist and AUTO HOLD, benefiting from the development of autonomous driving technology, are seeing rapid growth in assembly rate.

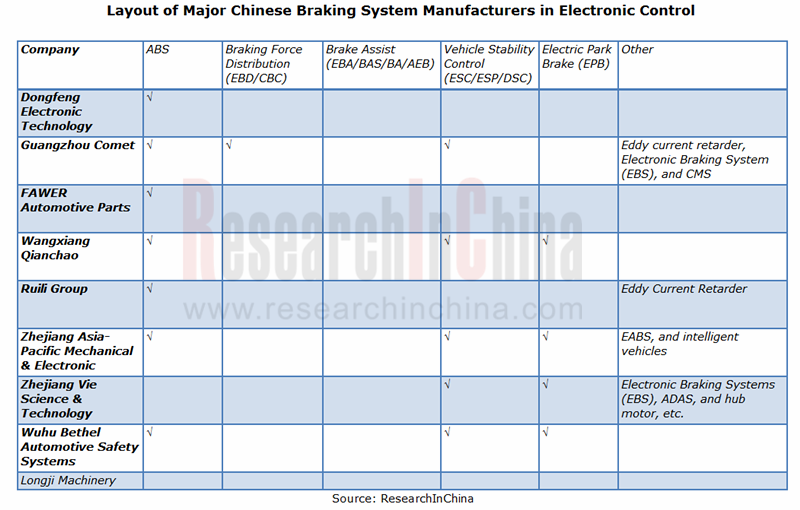

At present, the Chinese braking system manufacturers are working to make layout in electronic control, particularly in ABS, Vehicle Stability Control (ESC/ESP/DSC), and Electric Park Brake (EPB). The advanced enterprises, such as Zhejiang Asia-Pacific Mechanical & Electronic and Zhejiang Vie Science & Technology, have entered the fields of intelligent drive and telematics.

Zhejiang Asia-Pacific Mechanical & Electronic, one of the leading Chinese braking system manufacturers, mainly operates an array of products including disc brakes, drum brakes, brake pumps, vacuum boosters, and ABS, etc. It now has an annual capacity of 1 million sets of automotive electronic control system. At present, the company is actively developing automotive electronics, and, based on ABS, gradually makes technological breakthroughs in EPB, ESC, and EABS. Currently, the company is entitled to supply ABS and EPB to auto makers like Chery, SAIC, and FAW, and is expected to achieve small-lot supply in 2016. Additionally, it has obtained eligibility for supplying ESC and EABS to Dongfeng Motor and Nissan.

Zhejiang Vie Science & Technology is also an important braking system manufacturer in China. In 2015, the company realizedmassive supply of its independently developed and industrialized ABS, and completed the EBS development and vehicle matching test. Meanwhile, it was developing ESC and EPB, etc. In February 2016, the company planned to invest RMB267 million in automotive EBS project. When the design capacity is achieved, the company will have a capacity of 200,000 sets/a ABS and 50,000 sets/a EBS, with the revenue and net income estimated to add annually RMB426 million and RMB66.82 million, respectively.

The report highlights the following:

Market size and competitive landscape of global automotive braking system;

Market size and competitive landscape of global automotive braking system;

Market size, import and export, competitive landscape, development trend of automotive braking system in China;

Market size, import and export, competitive landscape, development trend of automotive braking system in China;

Development of China’s brake market segments, including disc brakes, drum brakes, pneumatic brakes, and hydraulic brakes;

Development of China’s brake market segments, including disc brakes, drum brakes, pneumatic brakes, and hydraulic brakes;

Assembly rate, market size, and development of China’s electronic control market (ABS, EBD/CBC, EBA/BAS/BA/AEB, ESC/ESP/DSC, and AUTO HOLD);

Assembly rate, market size, and development of China’s electronic control market (ABS, EBD/CBC, EBA/BAS/BA/AEB, ESC/ESP/DSC, and AUTO HOLD);

Development of global and China braking system suppliers, including product type, financial indicators, capacity, output and sales volume, production bases, industrial layout, and development trend, etc.

Development of global and China braking system suppliers, including product type, financial indicators, capacity, output and sales volume, production bases, industrial layout, and development trend, etc.

1 Industry Overview

1.1 Definition

1.2 Structure

1.3 Classification

1.4 Supply Chain

2 Global Market

2.1 Market Environment

2.1.1 Global Automotive Output, 2010-2015

2.1.2 Global Automotive Output by Model, 2010-2015

2.1.3 Development Trend

2.2 Market Size

2.3 Competitive Landscape

3 Chinese Market

3.1 Market Environment

3.1.1 Policy Environment

3.1.2 Industry Environment

3.2 Market Size

3.3 Import and Export

3.3.1 Import

3.3.2 Export

3.4 Competitive Landscape

3.4.1 Major Enterprises

3.4.2 Market Share

3.4.3 Development Trend

3.5 Supply Chain

3.5.1 Brake

3.5.2 Brake Lining

3.5.3 Brake Master Cylinder

3.5.4 Vacuum Booster

3.5.5 Brake Hose

3.5.6 Brake Wheel Cylinder

3.5.7 Brake Disc

3.5.8 ABS

3.5.9 Wheel Speed Sensor

3.6 Development Trend

4 Market Segments

4.1 By Brake Type

4.1.1 Disc Brake

4.1.2 Drum Brake

4.1.3 Assembling

4.2 By Power Type

5 Electronic Brake Control Market

5.1 ABS

5.1.1 Overview

5.1.2 Market Size

5.1.3 Competitive Landscape

5.1.4 Supply Relationship

5.2 Braking Force Distribution (EBD/CBC, etc.)

5.2.1 Overview

5.2.2 Market Size

5.3 Brake Assist (EBA/BAS/BA, etc.)

5.3.1 Overview

5.3.2 Market Size

5.3.3 Competitive Landscape

5.3.4 Autonomous Emergency Braking (AEB)

5.4 Vehicle Stability Control (ESC/ESP/DSC, etc.)

5.4.1 Overview

5.4.2 Policies and Regulations

5.4.3 Market Size

5.4.4 Supply Relationship

5.5 AUTO HOLD

5.5.1 Overview

5.5.2 Market Size

6 Major Global Companies

6.1 Bosch

6.1.1 Profile

6.1.2 Operation

6.1.3 Braking System Business

6.1.4 Performance in China

6.1.5 Companies in China

6.2 Continental

6.2.1 Profile

6.2.2 Operation

6.2.3 Braking System Business

6.2.4 Business in China

6.3 ZF TRW

6.3.1 Profile

6.3.2 Operation

6.3.3 Braking System Business

6.3.4 Business in China

6.4 ADVICS

6.4.1 Profile

6.4.2 Operation

6.4.3 Braking System Business

6.4.4 Business in China

6.5 Mando

6.5.1 Profile

6.5.2 Operation

6.5.3 Braking System Business

6.5.4 Business in China

6.6 Nissin Kogyo

6.6.1 Profile

6.6.2 Operation

6.6.3 Braking System Business

6.6.4 Business in China

6.7 Hyundai Mobis

6.7.1 Profile

6.7.2 Operation

6.7.3 Braking System Business

6.7.4 Business in China

6.8 Akebono Brake

6.8.1 Profile

6.8.2 Operation

6.8.3 Braking System Business

6.8.4 Business in China

6.9 WABCO

6.9.1 Profile

6.9.2 Operation

6.9.3 Braking System Business

6.9.4 Business in China

6.10 KNORR

6.10.1 Profile

6.10.2 Operation

6.10.3 Braking System Business

6.10.4 Business in China

7 Key Chinese Enterprises

7.1 Zhejiang Asia-Pacific Mechanical & Electronic

7.1.1 Profile

7.1.2 Operation

7.1.3 Braking System Business

7.1.4 Major Customers

7.1.5 Electronic Braking Business

7.1.6 Smart Car Business Layout

7.1.7 Development Prospects

7.2 Zhejiang Vie Science & Technology

7.2.1 Profile

7.2.2 Operation

7.2.3 Braking System Business

7.2.4 Major Customers

7.2.5 Smart Car Business Layout

7.2.6 New Projects

7.3 Wuhu Bethel Automotive Safety Systems

7.3.1 Profile

7.3.2 Operation

7.3.3 Major Customers

7.3.4 Raw Material Supply

7.3.5 Production Capacity

7.4 Wangxiang Qianchao

7.4.1 Profile

7.4.2 Operation

7.4.3 Braking System Business

7.5 FAWER Automotive Parts

7.5.1 Profile

7.5.2 Operation

7.5.3 Braking System Business

7.6 Ruili Group

7.6.1 Profile

7.6.2 Operation

7.6.3 Braking System Business

7.7 Guangzhou Comet

7.7.1 Profile

7.7.2 Operation

7.7.3 Braking System Business

7.8 Chongqing Juneng

7.8.1 Profile

7.8.2 Braking System Business

7.9 Dongfeng Electronic Technology

7.9.1 Profile

7.9.2 Operation

7.9.3 Braking System Business

7.10 Longji Machinery

7.10.1 Profile

7.10.2 Operation

7.10.3 Braking System Business

8 Summary and Forecast

8.1 Market Summary and Forecast

8.2 Enterprise Summary and Forecast

Structure of Automotive Braking System

Four Major Functional Modules of Automotive Braking System

Main Types of Auxiliary Braking System for Commercial Vehicle

Supply Chain of Main Parts of Automotive Braking System in China

Global Automotive Output, 2010-2015

TOP 20 Countries by Automotive Output, 2015

Global Output of Passenger Vehicles, 2010-2015

Global Output of Commercial Vehicles, 2010-2015

Global Automobile Output, 2016-2020E

Percentage of Global Auto Parts by Market Size, 2015

Global Market Size of Automotive Braking System, 2014-2020E

Global Competitive Landscape of Foundation Brake Market

Global Competitive Landscape of Electronic Braking Control System

China's Policies and Standards for Braking System

Automobile Output in China, 2010-2020E

Value Percentage of Auto Parts in China

Market Size of Automotive Braking System, 2014-2020E

Import Volume and Value of Automotive Braking System in China, 2011-2016

Major Import Origins of Automotive Braking System in China, 2015

Major Import Origins of Automotive Braking System in China, Jan.-Feb. 2016

Export Volume and Value of Automotive Braking System in China, 2011-2016

Major Export Destinations of China-madeAutomotive Braking System, 2015

Major Export Destinations ofChina-made Automotive Braking System, Jan.-Feb. 2016

Major Chinese Braking System Manufacturers and Their Operation

Apparent Consumption of Automotive Braking System in China, 2015

Automotive Braking System Market Share of Major Enterprisers in China, 2015

Major Brake Manufacturers and Supported Customers in China

Major Brake Lining Manufacturers and Supported Customers in China

Major Brake Master Cylinder Manufacturers and Supported Customers in China

Major Vacuum Booster Manufacturers and Supported Customers in China

Major Brake Hose Manufacturers and Supported Customers in China

Major Brake Wheel Cylinder Manufacturers and Supported Customers in China

Major Brake Disc Manufacturers and Supported Customers in China

Major ABS Manufacturers and Supported Customers in China

Major Wheel Speed Sensor Manufacturers and Supported Customers in China

Difference between Drum Brake and Disc Brake

Percentage of Rear Brakes for Passenger Vehicles in China by Type, 2014-2020E

Assembling Quantity of Automotive Drum Brake and Disc Brake in China, 2014-2020E

Types of Braking System Equipped in Automobiles in China (by Power Type)

Assembling Quantity of Pneumatic Braking System and Hydraulic Braking System in China, 2010-2020E

Expansion of Automotive Braking System from Mechanical Braking to Electronic Braking and Body Control Electronics

ABS Assembly Rate of Automobiles in China, 2014-2020E

ABS Assembly Quantity of Automobiles in China, 2014-2020E

ABS Supply Relationship of Passenger Vehicle Enterprises in China

ABS Suppliers of Major Commercial Vehicle Makers in China

Braking Force Distribution (EBD/CBC, etc.) Assembly Rate and Quantity of Passenger Vehicles in China, 2014-2020E

Brake Assist (EBA/BAS/BA) Assembly Rate and Quantity of Passenger Vehicles in China, 2014-2020E

Supply Relationship between Major Brake Assist (EBA/BAS/BA) Suppliers and OEMs in China and around the World

Global AEB Policies by Region/Country

ESP Naming of Enterprises

Global ESP Regulations by Region/Country

Vehicle Stability Control (ESC/ESP/DSC, etc.) Assembly Rate and Quantity of Passenger Vehicles in China, 2014-2020E

Vehicle Stability Control (ESC/ESP/DSC, etc.) Suppliers of China’s Top 10 OEMs by Passenger Vehicle Sales Volume, 2015

Supply Relationship between Major Vehicle Stability Control (ESC/ESP/DSC, etc.) Suppliers and OEMs in China

AUTO HOLD Assembly Rate and Quantity of Passenger Vehicles in China, 2014-2020E

Revenue of Bosch, 2010-2015

Revenue Structure of Bosch, 2015

Main Bosch Chassis Control System Products

Development History of Bosch Automotive Electronics Business

Main Supported Models of Bosch Braking System and Electronic Control System Products

Bosch’s Revenue in China, 2012-2015

Bosch’s Subsidiaries in China that are Engaged in Automobiles and Intelligent Transportation Technology

Continental’s Revenue & EBIT, 2009-2016

Continental’s Revenue by Division and Number of Employees, 2015

Revenue, EBIT, and Number of Employees of Continental’s Chassis & Safety Division, 2016Q1

Main Products of Continental’s Chassis & Safety Division

Main Supported Models of Continental’s Braking System and Electronic Control System Products

Main Products of ZF TRW’s Chassis System and Electronic Parts Divisions

Main Supported Models of ZF’s Braking System and Electronic Control System Products

ZF TRW’s Subsidiaries in China

Revenue and Profit of ADVICS, FY2013-FY2015

Number of Employees of ADVICS, FY2013-FY2015

Revenue Structure of ADVICS by Business, FY2013-FY2015

Main Products of ADVICS

Main Supported Models of ADVICS’s Braking System and Electronic Control System Products

ADVICS’s Subsidiaries in China

Organizational Structure of Mando

Revenue and Net Income of Mando, 2013-2015

Revenue of Mando by Business, 2012-2014

Market Share of Mando’s Products in South Korean OEMs. 2014

Mando’s Product Capacity and Output, 2012-2014

Main Supported Models of Mando’s Braking System and Electronic Control System Products

Mando’s Subsidiaries in China

Revenue and Net Income of Nissin Kogyo, FY2013-FY2016

Revenue of Nissin Kogyo by Region, FY2013-FY2015

Revenue of Nissin Kogyo by Business, FY2013-2015

Main Supported Modes of Nissin Kogyo Braking System and Electronic Control System Products

Revenue and Operating Margin of Hyundai Mobis, 2006-2015

Production Bases of Hyundai Mobis in South Korea

Main Supported Modes of Hyundai Mobis’ Braking System and Electronic Control System Products

Subsidiaries of Hyundai Mobis in China

Revenue and Net Income of Akebono Brake, FY2011-FY2016

Revenue Proportion of Akebono Brake’s Major Customers, FY2014-FY2016

Akebono Brake’s Main Automotive Brake Products

Main Supported Modes of Akebono Brake’s Braking System and Electronic Control System Products

Akebono Brake’s Subsidiaries in China

Revenue and Operating Income of WABCO, 2013-2015

WABCO’s Revenue by Region, 2014-2015

WABCO’s Main Products

WABCO’s Subsidiaries in China

Revenue and Net Income of Knorr-Bremse, 2011-2015

Main Products of Knorr-Bremse’s Commercial Vehicle Division

Subsidiaries of Knorr-Bremse’s Commercial Vehicle Division in China

Revenue and Net Income of Zhejiang Asia-Pacific Mechanical & Electronic, 2011-2015

Gross Margin of Zhejiang Asia-Pacific Mechanical & Electronic, 2011-2015

Revenue of Zhejiang Asia-Pacific Mechanical & Electronic by Product, 2014-2015

Gross Margin of Zhejiang Asia-Pacific Mechanical & Electronic by Product, 2012-2015

Ranking of Zhejiang Asia-Pacific Mechanical & Electronic in China’s Automotive Braking System, 2010-2014

Revenue from Top 5 Customers of Zhejiang Asia-Pacific Mechanical & Electronic, 2015

EBS Supported Enterprises and Models of Zhejiang Asia-Pacific Mechanical & Electronic

Layout of Zhejiang Asia-Pacific Mechanical & Electronic in Intelligent Vehicle Industry Chain

Products of Forward Innovation

“Tima Cloud” Telematics Comprehensive Application System

Revenue, Net Income, and Gross Margin of Zhejiang Asia-Pacific Mechanical & Electronic, 2015-2020E

Revenue and Net Income of Zhejiang Vie Science & Technology, 2011-2015

Gross Margin of Zhejiang Vie Science & Technology, 2011-2015

Revenue of Zhejiang Vie Science & Technology by Product, 2014-2015

Gross Margin of Zhejiang Vie Science & Technology by Product, 2014-2015

Main Commercial Vehicle Products of Zhejiang Vie Science & Technology

Main Passenger Vehicle Products of Zhejiang Vie Science & Technology

Major Customers of Zhejiang Vie Science & Technology

Operating Indices of Wuhu Bethel Automotive Safety Systems, 2013-2015

Operating Revenue of Wuhu Bethel Automotive Safety Systems, 2013-2015

Top 5 Customers of Wuhu Bethel Automotive Safety Systems, 2013-2015

Procurement of Main Raw Materials of Wuhu Bethel Automotive Safety Systems, 2013-2015

Top 5 Raw Material Suppliers of Wuhu Bethel Automotive Safety Systems, 2013-2015

Production Lines and Capacity of Wuhu Bethel Automotive Safety Systems, 2015

Revenue, Net Income, and Gross Margin of Wangxiang Qianchao, 2013-2016

Operating Revenue and Gross Margin of Wangxiang Qianchao by Business, 2014-2015

Operating Revenue and Gross Margin of Wangxiang Qianchao by Region, 2014-2015

Braking System Subsidiaries of Wangxiang Qianchao

Output and Sales Volume of Wangxiang Qianchao by Product, 2014-2015

Revenue, Net Income, and Gross Margin of FAWER Automotive Parts, 2013-2016

Operating Revenue and Gross Margin of FAWER Automotive Parts by Region, 2014-2015

Operating Revenue and Gross Margin of FAWER Automotive Parts by Business, 2014-2015

Braking System Subsidiaries of FAWER Automotive Parts

Output and Sales Volume of FAWER Automotive Parts by Product, 2014-2015

Revenue of Ruili Group, 2010-2014

Gross Profit and Net Income of Ruili Group, 2010-2014

Revenue Structure of Ruili Group, 2011-2014

Development History of Products of Ruili Group

Revenue, Gross Margin, and Net Income of Guangzhou Comet, 2014-2015

Revenue and Net Income of Guangzhou Comet’s Holding Subsidiaries, 2015

Revenue from Main Products of Guangzhou Comet, 2014-2015

Main ABS Supply Relationship of Chongqing Juneng

Revenue, Net Income, and Gross Margin of Dongfeng Electronic Technology, 2013-2016

Operating Revenue and Gross Margin of Dongfeng Electronic Technology by Business, 2014-2015

Output and Sales Volume of Dongfeng Electronic Technology by Product, 2014-2015

Revenue, Net Income, and Gross Margin of Longji Machinery, 2013-2016

Operating Revenue and Gross Margin of Longji Machinery by Business, 2014-2015

Output and Sales Volume of Longji Machinery by Product, 2014-2015

Subsidiaries and Joint Stock Companies of Longji Machinery, 2015

Global and China Automotive Braking System Market Size

Assembly Rate of Electronically Controlled Braking System for Passenger Vehicles in China by Type,

Layout of Major Chinese Brake System Manufacturers in Electronic Control

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...