Global and China ADAS Camera Industry Chain Report, 2015-2020

-

June 2016

- Hard Copy

- USD

$2,700

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZLC032

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,900

-

With the enhancement of worldwide automotive safety standards and automotive electronization as well as people's growing demand for safe driving, the global ADAS market has entered a rapid growth stage, which further promotes the radical development of the car camera market.

1.Global Market:

In 2015, the global front camera shipments hit 9.1 million, and that of rear view and surround view cameras totaled37.4 million. With the gradual escalation of ADAS penetration, the global car camera shipments will grow steadily. By 2020, the global front camera shipments will reach 33 million, and that of rear view and surround view cameras will add up to 97.9 million.

In 2015, the global shipments of rear view systems and surround view systems arrived at 13.8 million and 5.9 million sets respectively. In the next few years, the figures will be in the high growth phase and will soar to 25.1 million units and 18.2 million sets by 2020 respectively.

Currently, the global ADAS vision system vendors include Magna, Clarion, TRW (ZF), Continental, Autoliv, Valeo, etc.. In 2015, Magna, Hitachi, TRW (ZF) and Continental seized the market share of 15%, 13%, 11% and 10% relatively. Wherein, the surround view system market is mainly occupied by Clarion and Valeo, which enjoyed a combined 40% market share in 2015; 20%of the rear view system market is dominated by automobile manufacturers, while independent suppliers Magna and Panasonic grasped the highest market share of 30% in 2015 jointly.

2. Chinese Market:

At present, China’s car camera capacity is about 25.7 million. With the continuous expansion, the annual capacity is expected to exceed 100 million to 109.5 million by 2020. In 2015, Chinese car camera OEM market size equaled to 10 million; by 2020, it is expected to reach 38.65 million.

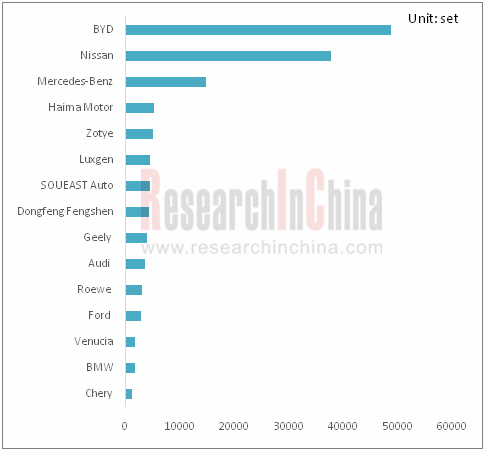

From January to April of 2016, China preinstalled 152,000 sets of surround view system and 132,000 sets of fatigue monitoring system; the pre-installations in 2016 are expected to be 460,000 and 400,000 sets respectively. By 2020, the pre-installed capacity will jump to 1.35 million and 1.15 million sets separately.

TOP15 Chinese Automobile Vendors by Surround View System Pre-installation, Jan-Apr 2016

?

?

Source: ResearchInChina

The report includes the following aspects:

Overview (including definition, classification, characteristics, industry chain and application) of ADAS cameras;

Overview (including definition, classification, characteristics, industry chain and application) of ADAS cameras;

Overview of global and China ADAS camera industry, including status quo and trends;

Overview of global and China ADAS camera industry, including status quo and trends;

Analysis on ADAS camera industry chain, embracing market size and competitive pattern of camera modules, CMOS sensors and system integration;

Analysis on ADAS camera industry chain, embracing market size and competitive pattern of camera modules, CMOS sensors and system integration;

Analysis on major ADAS camera vendors, including 6 ADAS camera module vendors, 7 CMOS sensor vendors, 6 systems integrators and a chip and algorithm vendor.

Analysis on major ADAS camera vendors, including 6 ADAS camera module vendors, 7 CMOS sensor vendors, 6 systems integrators and a chip and algorithm vendor.

1 Overview of ADAS Camera

1.1 Definition

1.2 Classification

1.3 Features

1.4 Industry Chain

1.5 Applications

1.5.1 Lane Departure Warning

1.5.2 Automatic Emergency Braking System

1.5.3 Night Vision System

1.5.4 Parking Assist

1.5.5 Fatigue Monitoring and Early Warning

2 Overview of Global and Chinese ADAS Camera Industry

2.1 Global Market

2.2 Chinese Market

2.2.1 Status Quo

2.2.2 Market Size

2.2.3 Capacity

2.2.4 Surround View System Market

2.2.5 Fatigue Monitoring Market

2.3 Trends

3 ADAS Camera Industry Chain

3.1 Camera Module

3.1.1 Market Size

3.1.2 Competitive Pattern

3.2 CMOS Sensor

3.2.1 Market Size

3.2.2 Competitive Pattern

3.2.3 Supply

3.3 System Integration

3.3.1 Market Size

3.3.2 Competitive Pattern

4 ADAS Camera Module Vendors

4.1 ZF TRW

4.1.1 Profile

4.1.2 Operation

4.1.3 Business Analysis

4.2 MCNEX

4.2.1 Profile

4.2.2 Operation

4.2.3 Business Analysis

4.3 Gentex

4.3.1 Profile

4.3.2 Operation

4.3.3 Business Analysis

4.4 Fujitsu Ten

4.4.1 Profile

4.4.2 Operation

4.4.3 Business Analysis

4.5 Sony

4.5.1 Profile

4.5.2 Operation

4.5.3 Business Analysis

4.6 BYD

4.6.1 Profile

4.6.2 Operation

4.6.3 Business Analysis

5 CMOS Sensor Vendors

5.1 ON Semiconductor

5.1.1 Profile

5.1.2 Operation

5.1.3 Business Analysis

5.2 Sony

5.2.1 Profile

5.2.2 Business Analysis

5.3 Toshiba

5.3.1 Profile

5.3.2 Operation

5.3.3 Business Analysis

5.4 Samsung Electronics

5.4.1 Profile

5.4.2 Operation

5.4.3 Business Analysis

5.5 Omnivision

5.5.1 Profile

5.5.2 Operation

5.5.3 Business Analysis

5.6 GalaxyCore

5.6.1 Profile

5.6.2 Business Analysis

5.7 Superpix Micro Technology

5.7.1 Profile

5.7.2 Operation

5.7.3 Business Analysis

6 System Integration Vendors

6.1 Magna

6.1.1 Profile

6.1.2 Operation

6.1.3 Business Analysis

6.2 Continental

6.2.1 Profile

6.2.2 Operation

6.2.3 Business Analysis

6.3 Valeo

6.3.1 Profile

6.3.2 Operation

6.3.3 Business Analysis

6.4 Autoliv

6.4.1 Profile

6.4.2 Operation

6.4.3 Clients

6.4.4 Business Analysis

6.5 Panasonic

6.5.1 Profile

6.5.2 Operation

6.5.3 Business Analysis

6.6 Clarion

6.6.1 Profile

6.6.2 Operation

6.6.3 Business Analysis

7 Chip and Algorithm Vendor --- Mobileye

7.1 Profile

7.2 Operation

7.3 Business Analysis

Significant Milestones in Camera-based Applications

Comparison of Solutions between Monocular Cameras and Binocular Cameras

Comparison of Specifications between Car Cameras and Cellphone Cameras

Comparison of Performance between Pre-installed Cameras and Post-installed Cameras

Car Camera Industry Chain

Main Features of Car Cameras

ADAS Applications of Car Cameras

Principles of Lane Departure Warning System

Lane Detection Cameras

Composition of Automatic Emergency Braking System

Working Principles of Automatic Emergency Braking System

FCW System Configurations in New Cars, 2000-2015

AEB System Configurations in New Cars, 2000-2015

Composition and Structure of Night Vision System

Classification of Night Vision Technology

Working Principles of Park Assist System

Method of Driver State Detection in DM System

Cognitive Dimension of Driver State Determination in DM System

Global Shipments of Front Cameras, 2014-2020E

Global Shipments of Rear View and Surround View Systems, 2014-2020E

Global Shipments of Rear View and Surround View System Cameras, 2014-2020E

Major Enterprises Entering the Car Camera Industry Chain in China

China’s Car Camera OEM Market Size, 2015-2020E

China’s Car Camera Capacity, 2014-2020E

China’s Pre-installations of Surround View Systems (by Vendor), 2016

China’s Pre-installations of Surround View Systems, 2016-2020E

China’s Pre-installations of Surround View System Cameras, 2016-2020E

China’s Pre-installations of Fatigue Detection Systems (by Vendor), 2016

China’s Pre-installations of Fatigue Detection Systems, 2016-2020E

National Policies on Promoting the Popularization of ADAS

Global Shipments of Car Camera Modules, 2014-2020E

Global Market Share of Car Camera Module Vendors, 2015

Global CMOS Image Sensor Market Share (by Sector), 2015

Global CMOS Image Sensor Market Share (by Sector), 2020E

Global CMOS Image Sensor Market Size, 2014-2020E

Global Automotive CMOS Image Sensor Market Size, 2015-2020E

Global Market Share of Automotive CMOS Image Sensor Vendors, 2015

Supporting Relationships between Japanese Automakers and ADAS Sensor Suppliers

Supporting Relationships between U.S/Korean/Chinese Automakers and ADAS Sensor Suppliers

Supporting Relationships between European Automakers and ADAS Sensor Suppliers

Global Shipments of Rear View and Surround View Systems, 2014-2020E

Global Market Share of ADAS Vision System Suppliers, 2015

Global Market Share of Surround View System Suppliers, 2015

Global Market Share of Rear View System Suppliers, 2015

ZF TRW’s Revenue and Net Income, 2010-2015

ZF TRW’s Revenue Structure (by Division), 2010-2015Q1

ZF TRW’s Revenue Structure (by Region), 2010-2014

ZF TRW’s Revenue Structure (by Customer), 2010-2014

ZF TRW’s Gross Margin, 2010-2015Q1

ZF TRW’s Car Camera Applications

ZF TRW’s Car Camera Module Customers

MCNEX’s Sales, 2013-2015

MCNEX’s Sales (by Product)

MCNEX’s Camera Module Sales (by Region)

MCNEX’s Unit Price

Gentex’s Revenue and Net Income, 2011-2015

Gentex’s Automotive Product Revenue (by Region), 2013-2015

Gentex’s Automotive Product Revenue Structure (by Region), 2013-2015

Gentex’s Gross Margin, 2011-2015

Gentex’s R&D Expenditure, 2011-2015

Fujitsu Ten’s Revenue and Net Income, FY2012-2015E

Fujitsu Ten’s Revenue Breakdown (by Division), FY2013-2015E

Fujitsu Ten’s Revenue Structure (by Division), FY2013-2015E

Fujitsu Ten’s Multi-Angle Vision? System

Fujitsu Ten’s 360-degree Surround Video Hardware Structure

Fujitsu Ten’s 360-degree Surround Video Software System

Sony’s Revenue and Net Income, FY2014-2016

Sony’s Revenue Breakdown (by Division), FY2014-2016

Sony’s Revenue Structure (by Division), FY2014-2016

Sony’s Revenue Breakdown (by Region), FY2014-2016

Sony’s Revenue Structure (by Region), FY2014-2016

Sony Devices’ Revenue, FY2015-2016

BYD’s Revenue and Net Income, 2011-2015

BYD’s Revenue Breakdown (by Product), 2014-2015

BYD’s Revenue Breakdown (by Region), 2014-2015

BYD’s R&D Expenditure, 2014-2015

BYD’s Camera Module Product Structure

BYD’s Camera Modules

ON Semiconductor’s Revenue and Net Income, 2013-2015

ON Semiconductor’s Revenue Breakdown (by Division), 2013-2015

ON Semiconductor’s Gross Margin, 2014-2015

ON Semiconductor’s AR0135 Sensor Product Specifications

ON Semiconductor’s AR0237 Sensor Product Specifications

ON Semiconductor’s PYTHON25K Sensor Product Specifications

Sony Devices’ Revenue, FY2015-2016

Sony’s Latest CMOS Image Sensor Product

Sony’s IMX253-255LLR/LQR CMOS Sensor Parameters

Toshiba’s Revenue and Operating Income, FY2011-2015

Toshiba’s Revenue Breakdown (by Division), FY2014-2015

Toshiba’s Revenue Structure (by Division), FY2015

Toshiba’s R&D Expenditure, FY2011-2015

Toshiba’s ADAS Front and Surround Monitoring Solutions

Toshiba’s ADAS Monocular Camera Front Monitoring Solutions

Toshiba’s ADAS Monocular Camera Rear Monitoring Solutions

Toshiba’s CSA02M00PB Product Specifications

Samsung Electronics’ Revenue and Net Income, FY2014-2015

Samsung Electronics’ Revenue Breakdown (by Division), FY2014-2015

Omnivision’s Revenue and Net Income, FY2014-2016

Omnivision’s OV10642 CMOS Sensor Product Specifications

Omnivision’s OV10642 CMOS Sensor Product Features

GalaxyCore’s Main CMOS Image Sensor Products

Development Course of GalaxyCore CMOS Image Sensors

Superpix Micro Technology’s Revenue and Net Income, 2013-2015

Superpix Micro Technology’s Gross Margin, 2013-2015

Superpix Micro Technology’s R&D Expenditure, 2013-2015

Superpix Micro Technology’s Top 5 Customers, 2013-2015

Superpix Micro Technology’s Main Image Sensor Products

Magna’s Revenue and Net Income, 2010-2015

Magna’s Revenue Structure (by Product), 2010-2015

Magna’s Revenue Structure (by Region), 2010-2015

Magna’s Revenue Structure (by Customer), 2010-2015

Magna’s Gross Margin, 2010-2015

Magna’s ADAS Systems Based on Camera Technology

Magna’s Share in Global and North American Machine Vision Market, 2013

Front Camera System Gen 1.0

Front Camera System Gen2.0

Front Camera System Gen2.5

Front Camera System Gen3.0

Magna’s Camera Technology Roadmap

Continental’s Revenue and EBIT, 2009-2015

Continental’s Revenue Structure (by Division), 2011-2015

Continental’s Revenue Structure (by Region), 2011-2015

Continental’s R&D Expenditure, 2013-2015

Sales of Continental Chassis & Safety Division, 2011-2015

Continental’s ADAS Production Bases and R&D Centers Worldwide

Continental’s 360-degree Panoramic Parking Components

Continental’s Automated Driving Roadmap

ContiGuard? Integrated Active/Passive Safety System Functions

Continental’s Integrated Safety Algorithm

Valeo’s Revenue and Net Income, 2010-2015

Valeo’s Revenue Structure (by Division), 2010-2015

Valeo’s Revenue Structure (by Region), 2010-2015

Valeo’s Revenue Structure (by Market), 2010-2015

Valeo’s Gross Margin, 2010-2015

Revenue of Valeo CDA Division, 2010-2015

Valeo’s ADAS Camera Applications

Valeo’s CDA Camera Product Line

Development Route for Valeo’s ADAS and Camera Solutions

Autoliv’s Revenue and Net Income, 2010-2015

Autoliv’s Gross Margin, 2010-2015

Global Distribution of Autoliv

Global Distribution of Autoliv’s Factories

Autoliv’s Revenue Structure (by Product), 2010-2015

Autoliv’s Revenue Structure (by Region), 2010-2015

Autoliv’s Output (by Product), 2009-2014

Autoliv’s Customers with the Proportion of Sales Exceeding 10%, 2011-2015

Autoliv’s Sales Structure (by Customer), 2015

Autoliv’s Mono-vision Camera

Panasonic's Sales and Net Income, FY2014-2016

Panasonic's Revenue Breakdown (by Division), FY2014-2016

Panasonic's Revenue Structure (by Division), FY2014-2016

Panasonic's R&D Expenditure, FY2014-2016

Clarion’s Next-generation Panoramic Image Parking

Clarion’s Commercial Vehicle 360 Surround View System: Surroundeye

Mobileye's Revenue and Net Income, 2011-2015

Mobileye's Revenue Structure (by Division), 2012-2015

Mobileye's Gross Margin (by Division), 2014-2015

Mobileye's Revenue Breakdown (by Region), 2013-2015

Mobileye's Revenue Structure (by Region), 2015

Mobileye's Gross Margin, 2011-2015

Mobileye's Product Roadmap

Mobileye's Shipments, 2007-2016

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...