China EV (Electric Vehicle) Motor Controller Industry Report, 2016-2020

-

July 2016

- Hard Copy

- USD

$2,900

-

- Pages:230

- Single User License

(PDF Unprintable)

- USD

$2,700

-

- Code:

LT029

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,000

-

- Hard Copy + Single User License

- USD

$3,100

-

Battery, motor and ECU are the three core components of new energy vehicle. EV drive control is one of core technologies for EV. Design of motor controller and development of control algorithm are critical factors determining performance of the whole drive system.

Motor controller prices vary greatly depending on specification and performance, generally RMB30,000-50,000 for large bus and RMB5,000-15,000 for passenger vehicle. PHEV and HEV usually adopt multi-motor architecture, including TM motor and ISG motor, thus resulting in higher costs of motor controller.

Furthermore, the evolution of EV e-drive system to wheel-side motor or wheel hub motor will also increase the cost of motor controller and complicate control strategy.

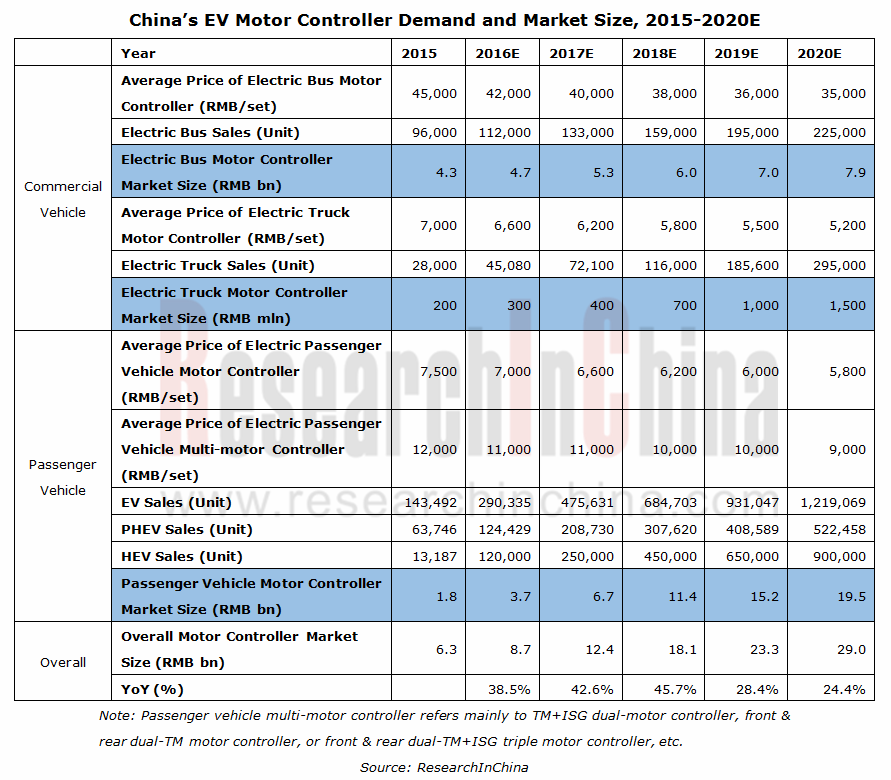

In such case, China’s demand for EV motor controller was 380,000 sets, generating a market size of around RMB6.3 billion (currently concentrated in commercial vehicle field) and, driven by new energy vehicle and conventional hybrid vehicle, estimated to swell to RMB29 billion in 2020 when passenger vehicle will prevail.

In particular, as hybrid vehicles are expected to be mass-produced on a large scale, either Corun Hybrid System Technology (CHS) co-funded by Geely and Hunan Corun New Energy or localization of Toyota THS will expand the market of homegrown motor controller in China.

Currently, the Chinese EV motor controller market is dominated by domestic brands, compared to fractional share of foreign products at the stage of market fostering and early development due to higher prices and other reasons.

BYD became the largest vendor in the Chinese electric passenger vehicle motor controller market with a share of 28.6% by shipment in 2015. The company purchases IGBT modules to assemble motor controllers which are supplied to its own passenger vehicle production bases. Other players with higher market share are Zhongshan Broad Ocean Motor (including Shanghai E-drive), Zhuhai Enpower Electric, Shenzhen Inovance Technology, and UAES.

From the perspective of industrial chain, IGBT module is the most core upstream component of motor controller. Global market size of EV IGBT module was about USD1 billion in 2015. Fairchild, Infineon, and ST have an upper hand in automotive IGBT market. However, Chinese BYD now is also engaged in IGBT. China accounts for about 1/3 of global IGBT demand but imports over 90% of its own demand. The IGBT modules produced by local companies are primarily used in low-power fields, such as air conditioner, induction heating, etc.

EV motor controller now employs mainly silicon-based IGBT module. However, SiC-dominated wide bandgap semiconductor devices have overcome the limitations of silicon-based semiconductor devices in terms of withstand voltage level, operating temperature, switching loss, and switching speed. For example, Nissan’s Leaf has integrated motor, speed reducer, and controller. This represents a trend in which the product can be more compact and standardized.

Another aspect of system integration is functional integration. EV may serve as an energy storage element of new energy grid in future, requiring bidirectional correlation of vehicle and grid (V2G). Vehicle-mounted motor control inverter can also be used as the inverter between battery and grid for charging and grid feedback, thus realizing integration of motor drive and bidirectional charger.

China EV (Electric Vehicle) Motor Controller Industry Report, 2016-2020 by ResearchInChina highlights the followings:

Main technology roadmaps and development trends of EV motor controller;

Main technology roadmaps and development trends of EV motor controller;

Upstream IGBT & thin-film capacitor and downstream EV industry (market size, competitive landscape, main policies, etc.);

Upstream IGBT & thin-film capacitor and downstream EV industry (market size, competitive landscape, main policies, etc.);

EV motor controller (industrial policy, market size, supply chain, and competitive landscape), global mainstream EV motor electronic control system;

EV motor controller (industrial policy, market size, supply chain, and competitive landscape), global mainstream EV motor electronic control system;

19 Chinese EV motor controller enterprises (operation, motor controller business and technology, etc.);

19 Chinese EV motor controller enterprises (operation, motor controller business and technology, etc.);

6 global IGBT vendors (operation, business in EV field, etc.);

6 global IGBT vendors (operation, business in EV field, etc.);

8 global automotive inverter companies (operation, business in EV field, etc.)

8 global automotive inverter companies (operation, business in EV field, etc.)

1 Overview of Motor Controller

1.1 Definition

1.2 Operating Principle

1.3 Classification

1.4 Development History of Main Technology Roadmaps

1.4.1 Si IGBT Motor Controller

1.4.2 SiC IGBT Motor Controller

1.5 Technology Trend

1.5.1 Modularization

1.5.2 Intelligentization

1.5.3 Integration

2 Industrial Chain

2.1 Upstream IGBT Market

2.1.1 Development of IGBT

2.1.2 Market Size

2.1.3 Competitive Landscape

2.1.4 Supply Chain

2.1.5 EV IGBT

2.1.6 Dynamics of IGBT

2.2 Upstream Thin-film Capacitor Market

2.2.1 Market Size

2.2.2 Industrial Chain and Manufacturing Process

2.2.3 Competitive Landscape

2.2.4 EV Thin-film Capacitor

2.3 Downstream EV Market

2.3.1 Overall

2.3.2 Electric Passenger Vehicle

2.3.3 Electric Commercial Vehicle

2.3.4 Main Policies

3 EV Motor Controller Market

3.1 Policy Environment

3.2 Market Size

3.3 Industry Profit

3.4 Supply Mode

3.5 Competitive Landscape

3.6 Development of Major Enterprises

3.7 Global Mainstream New-energy Vehicle Motor Electronic Control Systems

3.7.1 Tesla Model S

3.7.2 Nissan Leaf

3.7.3 Mitsubishi Outlander PHEV

3.7.4 BMW i3

3.7.5 Chevrolet Volt

3.7.6 Volkswagen e-Golf

3.7.7 Audi A3 e-tron

3.7.8 Ford Fusion/C-Max

3.7.9Toyota Prius (PHEV and HEV)

4 Chinese EV Motor Controller Enterprises

4.1 Shanghai E-drive Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 EV Motor Controller Business

4.1.4 Technical Features

4.1.5 Supply Chain

4.2 Shenzhen Inovance Technology Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 EV Motor Controller Operation and Development Strategy

4.2.4 EV Motor Controllers and Technical Features

4.3Shanghai Dajun Technologies, Inc.

4.3.1 Profile

4.3.2 Development History

4.3.2 Operation

4.3.3 Business Model

4.3.4 EV Motor Controllers and Technical Features

4.3.5 Business in EV Field

4.3.6 Development Strategy in EV Field

4.4 Tianjin Santroll Electric Automobile Technology Co., Ltd.

4.4.1 Profile

4.4.2 EV Business

4.4.3 EV Power Systems and Technical Features

4.4.4 Development Strategy in EV Field

4.5 Zhongshan Broad-Ocean Motor Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 EV Motor Controller Business

4.5.4 R&D

4.5.5 Development Strategy

4.6 United Automotive Electronic Systems Co., Ltd. (UAES)

4.6.1 Profile

4.6.2 Production and R&D

4.6.3 EV Motor Controller Business

4.7 Hunan CRRC Times Electric Vehicle Co., Ltd.

4.7.1 Profile

4.7.2 Operation

4.7.3 EV Controller Business

4.7.4 Dynamics of Drive System Business

4.8 BYD

4.8.1 Profile

4.8.2 Operation

4.8.3 EV Motor Controller Business

4.9 Zhuhai Enpower Electric Co., Ltd.

4.9.1 Profile

4.9.2 Revenue and Costs

4.9.3 Sales Model

4.9.4 Major Customers

4.9.5 EV Motor Controller Business

4.9.6 R&D

4.9.7 Motor Controller Development Strategy

4.10 Shenzhen V&T Technologies Co., Ltd.

4.10.1 Profile

4.10.2 Revenue and Costs

4.10.3 Sales Model

4.10.4 Major Customers

4.10.5 EV Motor Controller Business

4.10.6 R&D

4.10.7 Motor Controller Development Strategy

4.11 Fujian Fugong Power Technology Co., Ltd.

4.11.1 Profile

4.11.2 Cooperation with Overseas Partners

4.11.3 New-energy Vehicle Drive Assembly Business

4.11.4 Capacity Planning

4.12 Chroma ATE Inc.

4.12.1 Profile

4.12.2 Operation

4.12.3 EV Motor Controller Business

4.12.4 Development Strategy in EV Field

4.13 Delta Electronics

4.13.1 Profile

4.13.2 Operation

4.13.3 Business in EV Field

4.14 Jing-Jin Electric Technologies (Beijing) Co., Ltd.

4.14.1 Profile

4.14.2 EV Motor Controller Business

4.15 DEC Dongfeng Electric Machinery Co., Ltd.

4.15.1 Profile

4.15.2 EV Controller Business

4.16 Nidec (Beijing) Drive Technologies Co., Ltd.

4.16.1 Profile

4.16.2 Operation

4.16.3 EV Motor Controller Business

4.17 Time High-Tech Co., Ltd.

4.17.1 Profile

4.17.2 EV Motor Controller Business

4.18 JEE Automation Equipment Co., Ltd.

4.18.1 Profile

4.18.2 EV E-drive Business

4.19 Shandong Deyang Electronics Technology Co., Ltd.

4.19.1 Profile

4.19.2 EV E-drive Business

4.20 Beijing Siemens Automotive E-Drive System Co., Ltd.

4.21 Prestolite E-Propulsion Systems (Beijing) Limited

5 IGBT Suppliers

5.1Fuji Electric

5.1.1 Profile

5.1.2 Operation

5.1.3 Business in EV Field

5.1.4 Development Strategy in EV Field

5.2 Infineon

5.2.1 Profile

5.2.2 Operation

5.2.3 Business in EV Field

5.2.4 Development Strategy in EV Field

5.3 Denso

5.3.1 Profile

5.3.2 Operation

5.3.3 Business in EV Field

5.4 ROHM

5.4.1 Profile

5.4.2 Operation

5.4.3 Business in EV Field

5.5 IR

5.5.1 Profile

5.5.2 Operation

5.5.3 Business in EV Field

5.6 Semikron

5.6.1 Profile

5.6.2 Operation

5.6.3 Business in EV Field

6 Inverter Manufacturers

6.1 Hitachi Automotive Systems

6.1.1 Profile

6.1.2 Operation

6.1.3 Business in EV Field

6.2 Mitsubishi Electric

6.2.1 Profile

6.2.2 Operation

6.2.3 Business in EV Field

6.3 Meidensha

6.3.1 Profile

6.3.2 Operation

6.3.3 Business in EV Field

6.4 Toshiba

6.4.1 Profile

6.4.2 Operation

6.4.3 Business in EV Field

6.5 Hyundai Mobis

6.5.1 Profile

6.5.2 Operation

6.5.3 Business in EV Field

6.6 Delphi

6.6.1 Profile

6.6.2 Operation

6.6.3 Business in EV Field

6.7 Bosch

6.7.1 Profile

6.7.2 Operation

6.7.3 Business in EV Field

6.8 Continental

6.8.1 Profile

6.8.2 Operation

6.8.3 Business in EV Field

Principle of EV Motor Controllers

Classification of EV Motor Controllers

IGBT Power Module and Motor Controller for 2nd-generation Prius

IGBT Power Module and Motor Controller for 3rd-generation Prius

Structure of Hitachi 1st-generation Motor Controller

Structure of Hitachi 2nd-generation Motor Controller

Hitachi Double-sided Pin-Fin IGBT Module and 3rd-generation Motor Controller

Bosch’s 3rd-generation Automotive IGBT Power Module

Bosch’s Motor Controller- INV2CON

Bosch’s Motor Controller- INVCON2.3

Continental’s EPF2 Series Motor Controllers

Continental’s New Generation of Motor Controllers

SiC (Left) and Si (Right) Motor Controllers Co-developed by Toyota and Denso

Meidensha’s SiC Motor Controller and Motor AIO (All-In-One)

Application of IGBT by Voltage

IGBT Technology Evolution and Players Involved

Development History of 1st-6th-generation IGBT Technologies

Global IGBT Market Size by Application, 2014-2016

Selling Price, Shipments, and Market Size Change of IGBT, 2014-2020E

Chinese IGBT Market Size, 2014-2020E

Market Share of Global Major IGBT Vendors, 2015

Market Share of Major Enterprises in China’s IGBT Industry, 2014

Global Major EV IGBT Vendors

Global IGBT Industry Supply Chain

China’s IGBT Industry Supply Chain

Local Companies in China’s IGBT Industry Chain and Their Products

Global Downstream Market of IGBT Module by Field, 2014

Global Downstream Market of IGBT Module by Field, 2020E

Global EV IGBT Market Size, 2014-2020E

Maximum Voltage and Current of Controllable Power Semiconductor on the Market

Level of Power Module Integration

Comparison of Parameters of Major Materials and Silicon

Physical Parameters of Different Semiconductor Materials

SPT+ IGBT Structure

Diagram of Trench-gate IGBT and CSTBT

Structure of an RC-IGBT from ABB

Global Capacitor Market Size, 2009-2019E

Chinese Capacitor Market Size, 2009-2019E

China’s Film Capacitor Output and Sales Volume, 2010-2014

Film Capacitor Industry Chain

Film Capacitor Manufacturing Process and Barriers

Major Film Capacitor Vendors at Home and Abroad

Comparison of Electric Passenger Vehicle Sales Volume Worldwide (Major Countries/Regions), 2013-2015

Monthly Sales Volume of New Energy Vehicles (EV&PHEV) Worldwide, 2014-2015

Comparison of Global Top20 Electric Passenger Vehicles by Sales Volume, 2013-2015

Sales Volume of Electric Passenger Vehicles (EV&PHEV) Worldwide, 2011-2020E

Car Ownership, Output and Sales Volume in China, 2010-2018E

China’s Output and Sales Volume of Electric Vehicles, 2010-2015

China’s Output of Electric Vehicles (EV&PHEV), Jan-Dec 2015

China’s Sales Volume of Electric Vehicles (EV&PHEV), 2011-2020E

China’s Sales Volume of Conventional HEV, 2012-2020E

China’s Sales Volume of Electric Passenger Vehicles (EV&PHEV), 2011-2020E

China’s Sales Volume of Electric Passenger Vehicles (EV&PHEV), Jan-Dec 2015

China’s Output of New Energy Passenger Vehicles (EV&PHEV) by Model, Jan-Dec 2015

China’s Output of Electric Commercial Vehicles, Jan-Dec 2015

China’s Electric Vehicle Promotion Schemes, 2014-2015

China’s Output of Electric Bus, Jan-Dec 2015

China’s Output of Battery Electric Truck, Jan-Dec 2015

China’s Sales Volume of Electric Commercial Vehicles (EV&PHEV), 2011-2020E

Subsidy Standard for Electric Passenger Vehicle in China, 2013-2020E

Subsidy Standards for Electric Bus in China, 2016

Subsidy Standards for Electric Bus in China, 2014-2015 (Central Finance)

Subsidy Standards for Full-cell Vehicle in China, 2016

Models among the Catalogue of Recommended Models for New Energy Vehicle Promotion and Application (New Version) (1st-2nd Batches)

Carmakers among the Catalogue of Recommended Models for New Energy Vehicle Promotion and Application (New Version) (1st Batch)

Carmakers among the Catalogue of Recommended Models for New Energy Vehicle Promotion and Application (New Version) (2nd Batch)

Models among 1st Three Batches of Purchase Duty-Free Catalog Approved by MIIT

Comparison of Taxes on ICE and EV in China

Catalogue of New-Energy Automobile Models Exempt from Vehicle Purchase Tax (1st Batch)

Catalogue of New-Energy Automobile Models Exempt from Vehicle Purchase Tax (2nd Batch)

Catalogue of New-Energy Automobile Models Exempt from Vehicle Purchase Tax (3rd Batch)

Policies on EV Motor Controller in China

EV Motor Controller Demand and Market Size in China, 2015-2020E

Gross Margin of Shenzhen Inovance Technology and Shenzhen V&T Technologies’ Motor Controller Business, 2011-2015

Supply Modes of EV Motor Controller in China

Market Share of Major Electric Passenger Vehicle Motor Controller Manufacturers in China, 2015

Motor and Controller Suppliers of Major Electric Bus Manufacturers in China

Motor and Controller Suppliers of Major Passenger Vehicle Manufacturers in China

Major EV Motor Controller Manufacturers in China

Tesla Front-drive Motor Controller

Tesla Rear-drive Motor Controller

Tesla Rear-drive Powertrain

Nissan Leaf E-drive System FF

Nissan Leaf E-drive Assembly

Nissan Leaf Supply System

Architecture of Mitsubishi Outlander PHEV

BMW i3 Drive Motor and Inverter Assembly

Voltec E-drive System

Volkswagen e-golf “Electric Engine Room” (Electric Motor (Middle), Motor Controller (Right))

Architecture of Audi A3 etron

Audi A3 etron Motor Controller (Integrating DCDC)

Ford C-Max Motor Controller

4th-generation Prius Electronic Control PCU

Equity Structure of Shanghai E-drive (Before/After being Acquired)

Operation System of Shanghai E-drive (After being Acquired)

Major Customers of Zhongshan Broad-Ocean Motor and Shanghai E-drive

Financial Indices of Shanghai E-drive, 2009-2016

Main Products of Shanghai E-drive

Production Base Construction of Shanghai E-drive

EV Drive Motor System Shipments of Shanghai E-drive, 2013-2015Q1

Core Patented Technologies of Shanghai E-drive

Top5 Customers of Shanghai E-drive, 2014-2015Q1

Top5 Suppliers of Shanghai E-drive, 2014-2015Q1

Revenue and Net Income of Shenzhen Inovance Technology, 2009-2016

Gross Margin of Shenzhen Inovance Technology, 2009-2016

Revenue of Shenzhen Inovance Technology by Product, 2012-2015

Gross Margin of Shenzhen Inovance Technology by Product, 2012-2015

Progress of Shenzhen Inovance Technology’s EV Motor Controller Projects, 2016Q1

Partners of Shenzhen Inovance Technology’s Automotive Electronics Business

Shenzhen Inovance Technology’s System Solutions for Plug-in Hybrid Bus

Main EV Motor Controllers and Their Applications of Shenzhen Inovance Technology

Business Performance of Shanghai Dajun Technologies, 2012-201

Main Materials Purchased by Shanghai Dajun Technologies

Technical Parameters of Shanghai Dajun Technologies’ N110WSA Motor Controller

Technical Parameters of Shanghai Dajun Technologies’ A360140J Motor Controller

Motor Drive System Output and Sales Volume of Shanghai Dajun Technologies, 2012-2015

Subsidiaries of Shanghai Dajun Technologies

Equity Structure of Tianjin Santroll Electric Automobile Technology

Main Financial Indices of Tianjin Santroll Electric Automobile Technology, 2014-2015

Structure of Santroll IV-generation Plug-in Hybrid System

Ratio of Battery Electric to CCBC in Typical Chinese Cities

Proportion of Actual Battery Electric Duration of Battery Electric Bus 803 in Tianjin

Santroll V-generation ECU

Equity Structure of Zhongshan Broad-Ocean Motor

New Energy Vehicle Powertrain Revenue of Zhongshan Broad-Ocean Motor, 2012-2015

Zhongshan Broad-Ocean Motor’s 30KW Motor (YTD030W04) + Controller (KM6025W05) Drive Motor System

Zhongshan Broad-Ocean Motor’s New Energy Vehicle E-drive System Projects under Construction

Zhongshan Broad-Ocean Motor’s Presence in New Energy Vehicle Market

10-year Development Strategy of Zhongshan Broad-Ocean Motor

Production Bases and R&D Centers of UAES

R&D Centers of UAES

UAES’ E-drive Product Line

Test Equipment for UAES’ E-drive Business

UAES’ Planning for Power Electronic Controllers

UAES’ R&D Capability for Power Electronic Controllers

Structure and Specifications of UAES’ Single-motor Control Products

Structure and Specifications of UAES’ Dual-motor Control Products

Financial Indices of Hunan CRRC Times Electric Vehicle, 2011-2015

Motor Controllers of Hunan CRRC Times Electric Vehicle

BYD’s Workforce, 2007-2014

Car Output and Sales Volume of BYD, 2010-2015H1

Revenue, Net Income & Gross Margin of BYD, 2007-2016Q1

Revenue Breakdown of BYD by Product, 2007-2015

Gross Margin of BYD by Product, 2008-2015

Revenue Breakdown of BYD by Region, 2008-2015H1

Bidirectional-inversion Charging/Discharging Drive Motor Controller

BYD’s Bidirectional-inversion Charging/Discharging Technology

BYD’s Process Capability for Motor Controller

Main Motor Controller Production Lines and Key Equipment of BYD

Revenue and Net Income of Shenzhen V&T Technologies, 2011-2015

Revenue of Shenzhen V&T Technologies by Product, 2011-2015

Procurement and Purchase Prices of Main Raw Materials for Motor Controller of Shenzhen V&T Technologies, 2012-Jan-Sept 2015

Product Sales Model of Shenzhen V&T Technologies, 2011-2014

Top5 Customers of Shenzhen V&T Technologies, 2011-2014

Major Customers for Shenzhen V&T Technologies’ EV Motor Controllers, 2011-2014

Average Unit Price of Shenzhen V&T Technologies’ EV Motor Controllers, 2012-2015

EV Motor Controller Capacity and Utilization of Shenzhen V&T Technologies, 2012-2015

EV Motor Controller Sales Volume of Shenzhen V&T Technologies, 2012-2015

Shenzhen V&T Technologies’ Core Technologies for Motor Controller

Shenzhen V&T Technologies’ Projects with Raised Funds via IPO

Main Financial Indices of Fujian Fugong Power Technology, 2014-Oct 2015

Architecture of CHS Dual-mode Hybrid System

Diagram of Internal CHS Hybrid Transmission Case

Auto Models with CHS Hybrid System

Global Presence of Chroma ATE Inc.

Financial Indices of Chroma ATE Inc. (Group’s Consolidation), 2009-2015

Revenue Breakdown (by Division) of Chroma ATE Inc., 2014-2015

CR Series Motor Controller Product Line of Chroma ATE Inc.

Key Technical Parameters of CR Series Motor Controller of Chroma ATE Inc.

Financial Indices of Delta Electronics, 2009-2015

Capacity, Output and Output Value (by Product) of Delta Electronics, 2013-2015

Sales Volume (by Product) of Delta Electronics, 2014-2015

Jing-Jin Electric Technologies’ R&D of Key Equipment

Performance Parameters of 150KW Vehicle-used Motor Controller of Jing-Jin Electric Technologies

EV Motor Controllers of DEC Dongfeng Electric Machinery Co., Ltd

New Energy Vehicle SRD Motor of China Tex MEE

Battery Electric Power & Control System Assemblies of Time High-Tech

EV Power Control System Composition Solution of Time High-Tech

Key Technical Parameters of EV Motor Controller of Time High-Tech

Fuji Electric’s Financial Indices, FY2010-FY2016

Fuji Electric’s Revenue and Operating Income (by Business), FY2013-FY2016

Fuji Electric’s Revenue Breakdown (by Region), FY2011-FY2016

IGBT and SiC R&D Planning of Fuji Electric, 2015-2021

7th-generation IGBT Product Planning of Fuji Electric, 2016-2018

Industrial IGBT / SiC Loss Comparison, 2015-2017

Automotive Power Module Development Roadmap of Fuji Electric, 2005-2025

Global Rankings of Infineon’s Three Major Businesses, 2013

Infineon’s Revenue (by Region), FY2013-FY2015

Infineon’s Revenue (by Division), FY2013-FY2015

Infineon EiceDRIVER? Family IGBT Modules

Denso’s Workforce, FY2011-FY2015

Denso’s Sales and Profits, FY2013-FY2015

Denso’s Operating Income and Net Income, FY2011-FY2015

Denso’s Revenue Structure (by Division), FY2013-FY2015Q1

Denso’s Revenue Breakdown (by Division), FY2013-FY2015Q1

Denso’s Sales and Operating Income (by Region), FY2013-FY2015

Denso’s Revenue Breakdown (by Customer), FY2010-FY2014

Denso’s Client Structure, FY2013-FY2014

Power Electronics Projects of Japanese NEDO

ROHM’s Financial Indices, FY2010-FY2015

ROHM’s Revenue Breakdown (by Business), FY2012-FY2017

ROHM’s Revenue Breakdown (by Region), FY2012-FY2017

ROHM’s Revenue Breakdown (by Application), FY2012-FY2017

Main Technical Parameters of ROHM’s Vehicle-used IGBT Module

Development History of ROHM’s SiC Products

SiC-based Power Device Lineup of ROHM

IR’s Revenue Breakdown (by Division), FY2012-FY2014

Operation of Semikron

Key IGBT Brands of Semikron

Product Portfolio of Semikron’sSKiM modules

Key Features of Semikron’sSKiM modules

Product Portfolio of Semikron’sSKiiP IPM

Key Features of Semikron’sSKiiP IPM

Structure of Semidron’s SKAI Power Electronic Platform

Product Portfolio of Semikron’s SKAI Power Electronic Platform

Key Features of Semikron’s SKAI Power Electronic Platform

Revenue of Hitachi Automotive Systems, FY2011-FY2015

Hitachi Automotive Systems’ Major Customers for Its EV Inverters

Mitsubishi Electric’s Financial Indices, FY2010-FY2015

Mitsubishi Electric’s Revenue (by Business), FY2015

Mitsubishi Electric’s Major Customers for Its EV Inverters

Meidensha’s Financial Indices, FY2012-FY2016

Meidensha’s Revenue and Profits (by Division), FY2014-FY2015

Meidensha’s Major Customers for Its EV Inverters

Toshiba’s Revenue and Net Income, FY2011-FY2015

Toshiba’s Revenue Structure (by Business), FY2011-FY2015

Revenue of Toshiba’s Electronic Devices & Components Division, FY2011-FY2015

Toshiba’s Major Customers for Its EV Inverters

Revenue and Operating Margin of Hyundai Mobis, FY2006-FY2015

Hyundai Mobis’ Major Customers for Its EV Inverters

Delphi’s Workforce, 2011-2015

Delphi’s Revenue and Gross Margin, 2004-2015H1

Delphi’s Financial Indices, 2013-2015

Delphi’s Revenue Structure (by Division), 2011-2015

Delphi’s Gross Margin (by Division), 2010-2015

Main Growth Fields of Delphi’s Divisions, 2013-2016

Delphi’s Revenue Breakdown (by Region), 2010-2014

Delphi’s Major Customers and Regional Distribution

Delphi’s Major Customers and Revenue Contribution Rates, 2015

Delphi’s Product Distribution in EV Field

Technical Features of Delphi’s EV Inverters

Major Customers of Delphi’s EV Inverters

Bosch’s Workforce, 2010-2015

Bosch’s Revenue and EBIT, 2010-2015

Bosch’s Revenue Structure (by Division), 2012-2014

Revenue and EBIT of Bosch Automotive Division, 2012-2014

Bosch’s Revenue Structure (by Region), 2012-2014

Bosch’s Sales in Major Countries, 2012-2014

Bosch’s Major Customers for Its EV Inverters

Continental’s Workforce, 2009-2014

Continental’s Revenue and EBIT, 2009-2015H1

Continental’s Revenue Structure (by Division), 2008-2013

Continental’s Revenue Structure (by Region), 2008-2013

Continental’s Major Customers for Its EV Inverters

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...