China Vehicle Inspection Industry Report, 2016-2020

-

July 2016

- Hard Copy

- USD

$2,500

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZJF088

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

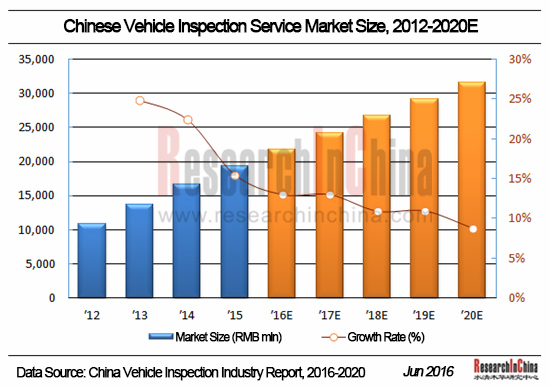

As the Chinese automobile market expands rapidly, car ownership has continued to rise, amounting to 172 million units by the end of 2015. To ensure traffic safety and protect environment, regulatory authorities including the Ministry of Public Security and the Ministry of Environmental Protection have intensified their efforts for vehicle inspection, fueling a boom in the Chinese vehicle inspection market. Vehicle inspection market, based on difference of business, can be divided into vehicle inspection service market and vehicle inspection system market, with the former having a market scale of RMB19.269 billion and the latter RMB2.816 billion in 2015, up 15.5% and 10.3% from a year ago, respectively.

?

?

Vehicle inspection service enterprises can be divided into state-owned ones and private ones according to their nature. State-own enterprises include mainly National Motor Vehicle Quality Supervision and Inspection Center (Chongqing), Guangdong Automotive Test Center Co., Ltd., Wuhan Vehicle Test Equipment Institute Co., Ltd., National Passenger Car Quality Supervision and Inspection Center (Tianjin Automotive Test Center), etc. Private firms cover Anhui Xiayang Motor Vehicle Inspection Co. Ltd., Jiangsu Jiecheng Motor Vehicle Inspection Co., Ltd., TangshanJingdong Grand Health Co., Ltd. etc. Large state-owned enterprises provide full inspection services covering safety of vehicle/parts, environmental friendliness, and overall performance with powerful comprehensive strength, whereas private players, because of their weak inspection capability, offer only a few inspection services and gain an edge over state-owned counterparts in some regional markets.

Vehicle inspection system market features obviousregionality. In China, the majority of systems are supplied by local businesses in regions where customers are highly concentrated, place few annual orders, and generate small sales size. There are a small number of large companies in the sector with great R&D strength and broad coverage of business, represented chiefly by Shenzhen Anche Technologies Co., Ltd. (with fairly complete product lines consisting of safety inspection, environmental inspection, comprehensive inspection, and automobile off-assembly-line inspection), LAUNCH TECH Co., Ltd. (a company listed on HKEx, providing automotive diagnosis, inspection, and maintenance products, and now focusing on golo car cloud platform dominated by diagnostic system based on which other system businesses are developed), Shijiazhuang Huayan Traffic Technology Co., Ltd. (Huayan Technology), Nanhua Instruments Co., Ltd. (an A-share listed company with existing products including motor vehicle emissions inspection instruments, vehicle environmental inspection system, vehicle safety inspection instruments, and vehicle safety inspection system), and Chengdu Chengbao Development Co., Ltd.

China Vehicle Inspection Industry Report, 2016-2020 focuses on the followings:

Vehicle inspection in China (definition & classification, development trend, laws & regulations, development of relevant sectors, etc.);

Vehicle inspection in China (definition & classification, development trend, laws & regulations, development of relevant sectors, etc.);

China’s vehicle inspection service industry (market size, competitive landscape, development trend, etc.);

China’s vehicle inspection service industry (market size, competitive landscape, development trend, etc.);

China’s vehicle inspection system industry (market size, competitive landscape, development trends, etc.);

China’s vehicle inspection system industry (market size, competitive landscape, development trends, etc.);

Ten vehicle inspection system companies (LAUNCH TECH, Shenzhen Anche Technologies, Shijiazhuang Huayan Traffic Technology, Nanhua Instruments, Chengdu Chengbao Development, Bosch Diagnostics, Zhejiang Jiangxi Auto Inspection Equipment, Cosber, Qingdao Hongsheng Automobile Testing Equipment, and Chengdu Iyasaka Technology Development) (profile, business performance, revenue structure, R&D costs, inspection system business, development strategy, etc.);

Ten vehicle inspection system companies (LAUNCH TECH, Shenzhen Anche Technologies, Shijiazhuang Huayan Traffic Technology, Nanhua Instruments, Chengdu Chengbao Development, Bosch Diagnostics, Zhejiang Jiangxi Auto Inspection Equipment, Cosber, Qingdao Hongsheng Automobile Testing Equipment, and Chengdu Iyasaka Technology Development) (profile, business performance, revenue structure, R&D costs, inspection system business, development strategy, etc.);

Eight vehicle inspection service agencies (Guangdong Automotive Test Center, Shanghai Motor Vehicle Inspection Center, XiangyangDa’an Automobile Test Center, National Motor Vehicle Quality Supervision and Inspection Center (Chongqing), Anhui Xiayang Motor Vehicle Inspection, Jiangsu Jiecheng Motor Vehicle Inspection, Tangshan Jingdong Grand Health, and Hangzhou Automobile General Performance Testing Center) (profile, business performance, revenue structure, inspection business, development strategy, etc.)

Eight vehicle inspection service agencies (Guangdong Automotive Test Center, Shanghai Motor Vehicle Inspection Center, XiangyangDa’an Automobile Test Center, National Motor Vehicle Quality Supervision and Inspection Center (Chongqing), Anhui Xiayang Motor Vehicle Inspection, Jiangsu Jiecheng Motor Vehicle Inspection, Tangshan Jingdong Grand Health, and Hangzhou Automobile General Performance Testing Center) (profile, business performance, revenue structure, inspection business, development strategy, etc.)

1 Vehicle Inspection Industry

1.1 Definition and Classification

1.2 Development

1.3 Laws and Policies

1.3.1 Motor Vehicle Inspection Equipment & System Regulators

1.3.2 Motor Vehicle Inspection Service Regulators

1.3.3 Laws and Regulations

1.3.4 Industrial Policies

1.3.5 Standards

2 AutomobileIndustry

2.1 Output & Sales Volume

2.2 Car Ownership

3. Vehicle Inspection System Market

3.1 Market Size

3.2 Competitive Landscape

3.3 Trend

4. Vehicle Inspection Service Market

4.1 Market Size

4.2 Competitive Landscape

4.3 Trend

5. Vehicle Inspection System Enterprises

5.1 Launch Tech

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 golo Car Cloud-based Diagnostic System

5.2 Nanhua Instruments

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 R&D Costs

5.2.6 Output and Sales

5.2.7 Vehicle Inspection System and Equipment

5.2.9 Development Prospects

5.3 Chengdu Chengbao Development

5.3.1 Profile

5.3.2 Vehicle Safety Inspection System

5.3.3 Vehicle Emission Monitoring System

5.3.4 Competitiveness

5.4 Shijiazhuang Huayan Traffic Technology

5.4.1 Profile

5.4.2 Operation

5.4.3 Main Products

5.4.4 Competitiveness

5.4.5 Latest Developments

5.5 Shenzhen Anche Technologies

5.5.1 Profile

5.5.2 Main Products

5.5.3 Major Customers

5.6 Bosch Diagnostics

5.6.1 Profile

5.6.2 Main Products

5.7 Zhejiang Jiangxi Auto Inspection Equipment

5.7.1 Profile

5.7.2 Main Products

5.8 Cosber

5.8.1 Profile

5.8.2 Main Products

5.8.3 Latest Developments

5.9 Qingdao Hongsheng Automobile Testing Equipment

5.9.1 Profile

5.9.2 Main Products

5.9.3 Marketing Network

5.10 Chengdu Iyasaka Technology Development

5.10.1 Profile

5.10.2 Main Products

6. Vehicle Inspection Service Agencies

6.1 Guangdong Automotive Test Center Co., Ltd.

6.1.1 Profile

6.1.2 Inspection Capability

6.1.3 Vehicle Inspection

6.1.4 Emission and Energy Conservation Inspection

6.1.5 Collision Safety Inspection

6.1.6 Parts Inspection

6.2 Shanghai Motor Vehicle Inspection Center

6.2.1 Profile

6.2.2 Inspection Capability

6.2.3 Vehicle Inspection

6.2.4 Emission Inspection

6.2.5 Passive Safety

6.2.6 Parts Inspection

6.2.7 New Energy Vehicle Inspection

6.3 XiangyangDa’an Automobile Test Center

6.3.1 Profile

6.3.2 Inspection Capability and Qualifications

6.3.3 Inspection Items

6.4 National Motor Vehicle Quality Supervision and Inspection Center (Chongqing)

6.4.1 Profile

6.4.2 Inspection Capability and Qualifications

6.4.3 Inspection Items

6.5 Hangzhou Automobile General Performance Testing Center Co., Ltd.

6.5.1 Profile

6.5.2 Inspection Capability and Qualifications

6.5.3 Inspection Business

6.6 Anhui Xiayang Motor Vehicle Inspection

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Qualifications

6.6.5 Inspection Items

6.6.6 Major Inspection Stations

6.7 Jiangsu Jiecheng Motor Vehicle Inspection

6.7.1 Profile

6.7.2 Operation

6.7.3 Inspection Capability and Qualifications

6.8 Tangshan Jingdong Grand Health

6.8.1 Profile

6.8.2 Operation

6.8.3 Revenue Structure

6.8.4 Qualifications

6.8.5 Main Inspection Lines

Diagram of Motor Vehicle Inspection System

Classification of Motor Vehicle Inspection Systems

Diagram of Motor Vehicle Safety Inspection System

Technological Evolution in Motor Vehicle Inspection Industry

Laws and Regulations on Motor Vehicle Inspection

Policies on Motor Vehicle Inspection

China’s Automobile Output, 2010-2020E

China’s Automobile Ownership, 2007-2020E

Chinese Vehicle Inspection System Market Size, 2010-2015

Competition among Major Vehicle Inspection System Enterprises in China

Number of Inspection Agencies for Per 10k Vehicles Worldwide

Chinese Vehicle Inspection System Market Size, 2016-2020E

Requirement on Vehicle Inspection Frequency in China

Chinese Vehicle Inspection Service Market Size, 2008-2015

Chinese Vehicle Inspection Service Market Size, 2016-2020E

Revenue and Net Income of LAUNCH TECH, 2011-2015

LAUNCH TECH’s Revenue from Main Businesses, 2014-2015

Concept of Golo Car Cloud Platform

Golo Car Cloud Platform

Golo Remote Diagnostic System

Revenue and Net Income of Nanhua Instruments, 2011-2015

Nanhua Instruments’ Revenue from Main Products, 2011-2015

Gross Margin of Nanhua Instruments’ Main Products, 2011-2015

Nanhua Instruments’ R&D Costs and Growth Rate, 2011-2015

Output, Sales Volume and Inventory of Nanhua Instruments’ Main Products, 2014-2015

Nanhua Instruments’ Main Motor Vehicle Emission Inspection Instruments

Nanhua Instruments’ Main Motor Vehicle Emission Inspection Systems

Nanhua Instruments’ Main Headlight Inspection Instruments

Nanhua Instruments’ Typical Motor Vehicle Safety Inspection System (NHST-03)

Operating Revenue and Net Income of Nanhua Instruments, 2015-2020E

Specifications of Motorcycle Inspection System of Chengdu Chengbao Development

Specifications of Free Cylinder of Chengdu Chengbao Development

Specifications of Vehicle Corrector of Chengdu Chengbao Development

Specifications of Suspension Steering and Clearance Tester of Chengdu Chengbao Development

Specifications of Vehicle Suspension Inspection Bench of Chengdu Chengbao Development

Chengdu Chengbao Development’s DCG-10DA Driving-mode Vehicle Emission Test System

Chengdu Chengbao Development’s DCG-10DV Driving-mode Vehicle Emission Test System

Specifications of Chengdu Chengbao Development’s Driving-mode Vehicle Emission Test System (Heavy-duty Diesel Vehicle)

Chengdu Chengbao Development’s DCG-10DB riving-mode Vehicle Emission Test System

Revenue and Net Income of Shijiazhuang Huayan Traffic Technology, 2011-2015

Performance Parameters of Main Chassis Dynamometers of Shijiazhuang Huayan Traffic Technology

Shijiazhuang Huayan Traffic Technology’s Vehicle Dimension Measurement System

Specifications of Shijiazhuang Huayan Traffic Technology’s Vehicle Chassis Clearance Inspection Benches

Shijiazhuang Huayan Traffic Technology’s Roller Reaction-force Brake Inspection Bench

Specifications of Shijiazhuang Huayan Traffic Technology’s Power Absorption Device

Specifications of Shijiazhuang Huayan Traffic Technology’s Exhaust Analyzers

Specifications of Shijiazhuang Huayan Traffic Technology’s Opacimeters

Specifications of Shijiazhuang Huayan Traffic Technology’s Flow Analyzers

Main Products of Shenzhen Anche Technologies

Diagram of Shenzhen Anche Technologies’ Networked Monitoring System

Key Parts of Shenzhen Anche Technologies’ Vehicle Inspection System

Products and Customers of Shenzhen Anche Technologies

Main Products of Bosch Diagnostics

Main Products of Zhejiang Jiangxi Auto Inspection Equipment

Main Inspection Products of Cosber

Safety and General Performance Inspection Lines of Cosber

Cosber’s Pollutant Inspection System

Cosber’s KLFT Vehicle Off-Assembly-Line Inspection Series for Vehicle Manufacturing Plants

Main Vehicle Inspection Systems of Qingdao Hongsheng Automobile Testing Equipment

Major Domestic Marketing Offices of Qingdao Hongsheng Automobile Testing Equipment

Vehicle Inspection Products of Chengdu Iyasaka Technology Development

Main Equipment in Guangdong Automotive Test Center’s Vehicle Inspection Lab

Main Equipment in Guangdong Automotive Test Center’s Emission Inspection Lab

Main Equipment in Guangdong Automotive Test Center’s Parts Inspection Lab

Authorized Qualifications of Shanghai Motor Vehicle Inspection Center

Vehicle Inspection Contents of Shanghai Motor Vehicle Inspection Center

Main Equipment and Systems in Shanghai Motor Vehicle Inspection Center’s Vehicle Emission Lab

Main Equipment and Systems in Shanghai Motor Vehicle Inspection Center’s Engine Emission Lab

Main Inspection Systems in Shanghai Motor Vehicle Inspection Center’s Heavy-duty Vehicle Emission Lab

Emission Inspection Contents of Shanghai Motor Vehicle Inspection Center

Passive Safety Inspection Contents of Shanghai Motor Vehicle Inspection Center

Vehicle Parts Inspection Contents of Shanghai Motor Vehicle Inspection Center

New Energy Vehicle Inspection Contents of Shanghai Motor Vehicle Inspection Center

Major Inspection Qualifications of XiangyangDa’an Automobile Test Center

Major Test Sites of XiangyangDa’an Automobile Test Center

Compulsory Inspection Items Announcement of XiangyangDa’an Automobile Test Center

Inspection Items of National Motor Vehicle Quality Supervision and Inspection Center (Chongqing)

Qualifications of Hangzhou Automobile General Performance Testing Center

Main Inspection Businesses of Hangzhou Automobile General Performance Testing Center

Revenue and Net Income of Anhui Xiayang Motor Vehicle Inspection, 2012-2015

Revenue Structure of Anhui Xiayang Motor Vehicle Inspection by Business, 2012-2015

Revenue Structure of Anhui Xiayang Motor Vehicle Inspection by Region, 2014-2015

Major Safety Inspection Qualifications of Anhui Xiayang Motor Vehicle Inspection

Major Environmental Inspection Qualifications of Anhui Xiayang Motor Vehicle Inspection

Major Motor Vehicle Safety Inspection Items of Anhui Xiayang Motor Vehicle Inspection

Major Motor Vehicle Environmental Inspection Items of Anhui Xiayang Motor Vehicle Inspection

Revenue and Profit of Major Inspection Stations of Anhui Xiayang Motor Vehicle Inspection, 2015

Revenue and Net Income of Jiangsu Jiecheng Motor Vehicle Inspection, 2013-2015

Major Safety Inspection Qualifications of Jiangsu Jiecheng Motor Vehicle Inspection

Main Inspection Equipment of Jiangsu Jiecheng Motor Vehicle Inspection

Revenue and Net Income of Tangshan Jingdong Grand Health, 2013-2015

Revenue Structure of Tangshan Jingdong Grand Health by Business, 2013-2015

Major Safety Inspection Qualifications of Tangshan Jingdong Grand Health

Major Environmental Inspection Qualifications of Tangshan Jingdong Grand Health

Main Manufacturing Equipment and Inspection Lines of Tangshan Jingdong Grand Health

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...