Global and China Lead-acid Battery (Starting Battery, Power Battery, Energy Storage Battery, Communication Backup Power) Industry Report, 2016-2018

-

Aug.2016

- Hard Copy

- USD

$2,600

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

LT031

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,800

-

Lead-acid battery industry is a typical one of high energy consumption and heavy pollution. A large amount of electricity is consumed and pollutants such as lead dust/fume, acidic leaded wastewater, acid fog, and waste residues are discharged during the process of production. The center of global lead-acid battery production continues to transfer from developed countries to developing nations. As China’s share of global lead-acid battery output has risen from 35% in 2010 to 42% in 2015, the country’s development of lead-acid battery industry is of great significance to the world.

Global lead-acid battery demand amounted to 494.82 million KVAh in 2015, up 3.5% from a year ago, with China seeing a slowdown in demand growth rate and the rest of the world maintaining average growth rate of around 2%-3%. With enhanced efforts by the Chinese government to regulate lead-acid battery industry in the aspect of environmental protection since 2015 and the effect of lithium battery replacing lead-acid battery, global lead-acid battery demand growth is expected to fall along with that in China in the future, stabilizing at 2%-3%.

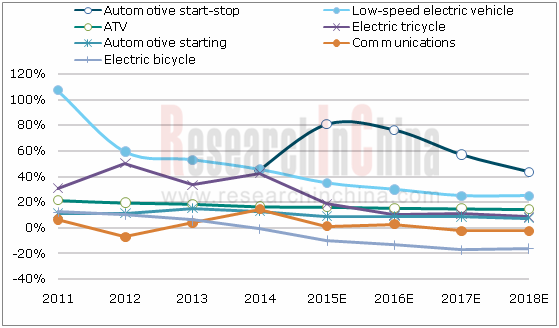

China’s demand for lead-acid battery dropped by 7.3% to 196.214 million KVAh and lead-acid battery revenue fell 4.9% to RMB147 billion in 2015. The demand for the lead-acid battery for electric bicycle increased by -11.8%, the lead-acid battery for automotive starting 8.3%, the lead-acid battery for electric tricycle 21.6% and low-speed electric vehicle 35%, and the lead-acid battery for communications around 1%.

Since 2015, affected by the effect of lithium battery substitution, the demand for the lead-acid battery for electric bicycle has dropped quickly; sluggish demand from upstream sectors resulted in significantly slower growth in demand for the lead-acid battery for automotive starting and electric tricycle. In addition, as the year 2015 is the deadline for cleaning up excess capacity and the capacity causing severe pollution, a large number of small lead-acid battery producers can’t get access permits, and have to stop production for rectification or produce secretively, leading to further slower apparent growth rate.

Johnson Controls is the world’s largest lead-acid battery producer with a 15.7% market share in 2015. In spite of this, the company is suffering a sustained decline in market share from as high as 26% in 2010. As companies continue to expand capacity, the advantage of market leader is waning. Meanwhile, as China pursues the elimination of outdated capacity, the market space for small companies keeps narrowing. Attracted by emerging markets (lithium battery and PV), some companies (like Panasonic) reduces investment in lead-acid battery.

Lead-acid battery finds wide applications in transportation, communications, power, and railway industries. Starting battery (automobile, motorcycle), power battery (electric bicycle, electric tricycle, low-speed electric vehicle, ATV/special-purpose electric vehicle), and communications back-up power hold a combined 90% share of total lead-acid battery consumption.

Over the next couple years, the demand for the automotive start-stop battery and Pb-C energy storage battery is expected to grow at a compound annual rate of 30%-40%, the battery for low-speed electric vehicle 25%-30%, the battery for electric tricycle and ATV/special-purpose electric vehicle around 10%-15%, and automotive starting battery within 9%.

For now, the lead-acid battery for communications back-up power, energy storage, and electric bicycle will be hardest hit by lithium battery in the short term. It is expected the application of lead-acid battery in communications back-up power will shrink slightly and the demand for the lead-acid battery for electric bicycle will see a negative annual growth of above 15% over the next few years.

Growth Rates of Demand for Lead-acid Battery from Downstream Industry Segments, 2011-2018E

The report focuses on the followings:

Global and China’s lead-acid battery industry (status quo of development, industrial policies, orientation of technological development);

Global and China’s lead-acid battery industry (status quo of development, industrial policies, orientation of technological development);

Global and China’s lead-acid battery industry (industry size, demand, import & export, competition pattern, demand forecast for the next few years);

Global and China’s lead-acid battery industry (industry size, demand, import & export, competition pattern, demand forecast for the next few years);

Competitive products (lithium battery, NI-MH battery, Pb-C battery) faced by lead-acid battery (comparison of technologies, applications, costs, shipments & trends, and major market participants);

Competitive products (lithium battery, NI-MH battery, Pb-C battery) faced by lead-acid battery (comparison of technologies, applications, costs, shipments & trends, and major market participants);

Application industries of lead-acid battery, covering automobile, back-up power & energy storage, electric bicycle, electric tricycle, low-speed electric vehicle, and ATV/special-purpose electric vehicle (status quo of development, demand for lead-acid battery, and market share of major lead-acid battery participants in the segments);

Application industries of lead-acid battery, covering automobile, back-up power & energy storage, electric bicycle, electric tricycle, low-speed electric vehicle, and ATV/special-purpose electric vehicle (status quo of development, demand for lead-acid battery, and market share of major lead-acid battery participants in the segments);

5 global lead-acid battery players (operation, technologies, customers, development planning, and output & sales);

5 global lead-acid battery players (operation, technologies, customers, development planning, and output & sales);

10 Chinese lead-acid battery companies (operation, technologies, customers, development planning, and output & sales).

10 Chinese lead-acid battery companies (operation, technologies, customers, development planning, and output & sales).

1. Overview of Lead-acid Battery Industry

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.1.3 Purpose

1.2 Industry Chain

1.3 Industry Characteristics

2. Development of Global Lead-acid Battery Industry

2.1 Policy Environment and Trend Analysis

2.2 Demand and Market Size

2.3 Regional Competition Pattern

2.4 Pattern of Competition among Enterprises

3. Development of Lead-acid Battery Industry in China

3.1 Policy Environment

3.2 Demand and Market Size

3.3 Regional Competition Pattern

3.4 Pattern of Competition among Enterprises

3.5 Demand Forecast

4. Substitute Products Market

4.1 Lithium-ion Battery

4.1.1 Technology

4.1.2 Price

4.1.3 Applications

4.1.4 Global and China’s Shipments and Demand

4.1.5 Major Global and Chinese Participants

4.2 Ni-MH Battery

4.2.1 Technology

4.2.2 Applications

4.2.3 Global and Chinese Market Size

4.2.4 Major Global Participants

4.3 Ni-Cd Battery

4.3.1 Technology

4.3.2 Applications

4.3.3 Price

4.4 Pb-C Battery

4.4.1 Technology

4.4.2 Applications

4.4.3 Price

4.5 Fuel Cell

4.5.1 Technology

4.5.2 Applications

4.5.3 Price

4.6 Comprehensive Comparison

5. Development of Upstream and Downstream Applications

5.1 Upstream Applied Materials

5.1.1 Lead Smelting Industry

5.1.2 Sulfuric Acid Production Industry

5.2 Automobile Industry

5.2.1 Automotive Output & Sales and Demand for Lead-acid Battery

5.2.2 Pattern of Competition among Automotive Start-Stop Lead-acid Battery Companies

5.3 Back-up and Energy Storage (Fixed)

5.3.1 Power Energy Storage Technology and Application

5.3.2 Power Chemical Energy Storage Industry Size and Demand for Lead-acid Battery

5.3.3 Communications Back-up Battery Industry and Demand for Lead-acid Battery

5.3.4 Competition Pattern of Market for Back-up and Energy Storage Lead-acid Battery

5.3.5 Future Development Trends of Back-up and Energy Storage Lead-acid Battery

5.4 Electric Bicycle and Tricycle Industry

5.4.1 Electric Bicycle Output and Market Size

5.4.2 Demand for Lead-acid Battery from Electric Bicycle in China

5.4.3 Competition Pattern of Lead-acid Battery for Electric Bicycle

5.4.4 Electric Tricycle Output and Market Size

5.4.5 Demand for Lead-acid Battery from Electric Tricycle in China

5.4.6 Competitive Pattern of Lead-acid Battery for Electric Tricycle

5.5 Low-speed Electric Vehicle Industry

5.5.1 Low-speed Electric Vehicle Output and Market Size

5.5.2 Demand for Lead-acid Battery from Low-speed Electric Vehicle in China

5.5.3 Competition Pattern of Lead-acid Battery for Low-speed Electric Vehicle

5.6 ATV/Special-purpose Vehicle

5.6.1 ATV/Special-purpose Vehicle Output in China

5.6.2 Demand for Lead-acid Battery from ATV/Special-purpose Vehicle in China

6. Major Players in China

6.1 Johnson Controls

6.1.1 Profile

6.1.2 Operation

6.1.3 Project and Capacity

6.1.4 Main Products and Customers

6.1.5 Core Competitiveness

6.1.6 Technology Development

6.2 Exide Technologies

6.2.1 Profile

6.2.2 Operation

6.2.3 Production Bases

6.2.4 Main Products and Customers

6.2.5 Sonnenlicht

6.2.6 Core Competitiveness

6.2.7 Technology Development

6.3 GS Yuasa

6.3.1 Profile

6.3.2 Operation

6.3.3 Project and Capacity

6.3.4 Main Products and Customers

6.3.5 Core Competitiveness

6.3.6 Technology Development

6.4 C&D

6.4.1 Profile

6.4.2 Project and Capacity

6.4.3 Main Products and Customers

6.4.4 Core Competitiveness

6.4.5 Technology Development

6.5 HOPPECK

6.5.1 Profile

6.5.2 Operation

6.5.3 Main Projects

6.5.4 Main Products and Customers

6.5.5 Core Competitiveness

6.6 PANASONIC

6.6.1 Profile

6.6.2 Operation

6.6.3 Business Layout

6.6.4 Main Products and Customers

6.6.5 Core Competitiveness

6.6.6 Technology Development

6.7 Tianneng Power

6.7.1 Profile

6.7.2 Operation

6.7.3 Project and Capacity

6.7.4 Main Products and Customers

6.7.5 Core Competitiveness

6.7.6 Technology Development

6.8 Chaowei Power

6.8.1 Profile

6.8.2 Operation

6.8.3 Project and Capacity

6.8.4 Main Products and Customers

6.8.5 Core Competitiveness

6.8.6 Technology Development

6.9 Camel Group

6.9.1 Profile

6.9.2 Operation

6.9.3 Project and Capacity

6.9.4 Main Products and Customers

6.9.5 Core Competitiveness

6.9.6 Technology Development

6.10 China Shipbuilding Industry Group Power Co., Ltd.

6.10.1 Profile

6.10.2 Operation

6.10.3 Project and Capacity

6.10.4 Main Products and Customers

6.10.5 Core Competitiveness

6.10.6 Technology Development

6.11 Shandong Sacred Sun Power Sources Co., Ltd.

6.11.1 Profile

6.11.2 Operation

6.11.3 Project and Capacity

6.11.4 Main Products and Customers

6.11.5 Core Competitiveness and Technology Development

6.12 Zhejiang Narada Power Source Co., Ltd.

6.12.1 Profile

6.12.2 Operation

6.12.3 Project and Capacity

6.12.4 Main Products and Customers

6.12.5 Core Competitiveness and Technology Development

6.13 Vision Group

6.13.1 Profile

6.13.2 Operation

6.13.3 Project and Capacity

6.13.4 Main Products and Customers

6.13.5 Core Competitiveness

6.13.6 Technology Development

6.14 Dynavolt Renewable Energy Technology Co., Ltd.

6.14.1 Profile

6.14.2 Operation

6.14.3 Project and Capacity

6.14.4 Main Products and Customers

6.14.5 Core Competitiveness

6.14.6 Technology Development

6.15 Shuangdeng Group

6.15.1 Profile

6.15.2 Operation

6.15.3 Project and Capacity

6.15.4 Main Products and Customers

6.15.5 Core Competitiveness

6.15.6 Technology Development

6.16 Leoch International Technology Ltd.

6.16.1 Profile

6.16.2 Operation

6.16.3 Project and Capacity

6.16.4 Main Products and Customers

6.16.5 Core Competitiveness

6.16.6 Technology Development

Classification of Batteries

Chemical Principles of Lead-acid Battery

Classification of Lead-acid Battery by Usage

Market Shares of Different Applications of Lead-acid Battery in China by Demand, 2014

Cost Structure of Internal Materials of Lead-acid Battery

Global Lead-acid Battery Demand, 2010-2018E

Global Lead-acid Battery Market Size, 2010-2018E

Global Battery Market Size

Competitive Landscape of Global Lead-acid Battery Regions, 2014

Global Top 10 Lead-acid Battery Manufacturers, 2014

Policies on China’s Lead-acid Battery Industry, 2010-2014

Lead-acid Battery Market Demand in China, 2010-2015H1

Lead-acid Battery Market Size in China, 2010-2015H1

Lead-acid Battery Output in China by Province, 2012-2015H1

Statistics of Eliminated Backward Lead-acid Battery Capacity in China, 2014

Revenue of Major Lead-acid Battery Manufacturers in China, 2014

Top 10 Vehicle Starter Lead-acid Battery Export Enterprises, 2014

Top 10 Vehicle Starter Lead-acid Battery Export Destinations, 2014

Top 10 Sealed Lead Acid Battery Export Enterprises, 2014

Top 10 Sealed Lead Acid Battery Export Countries and Regions, 2014

Demand of Lead-acid Battery Industry in China, 2010-2018E

Demand Estimation of Lead-acid Battery Industry in China by Application, 2010-2018E

Market Shares of Different Applications of Lead-acid Battery in China by Demand, 2014

Lead-acid Battery Industry Scale in China, 2010-2018E

Lead-acid Battery Industry Scale by Application in China, 2010-2018E

Cost Structure of Lithium Battery

Specifications of Lead-acid and Lithium-ion Batteries

Price Trend of Lithium Iron Phosphate Batteries in China, 2011-2018E

Price Trend of Global Power Lithium Batteries for Electric Vehicles

Price Table of Major Batteries for Electric Bicycles, 2015

Applications of Lead-acid and Lithium Batteries

Shipments of Global Lithium Batteries by Demand, 2010-2018E

Market Share of Lithium Batteries in China by Application, 2014

Market Share of Global Small (Consumer Grade) Lithium Battery Companies, 2014

Market Share of Global Battery Manufacturers Supporting New Energy Passenger Vehicles, 2014

Output of Various Vehicle Models and Batteries, 2015

Market Share of Major Battery Manufacturers, 2015H1

Shipments of Major Battery Manufacturers, 2015H1 (MWh)

NiMH Battery Material System

Specifications of Lead-acid and NiMH Batteries

Market Share of Global NiMH Batteries by Application, 2014

Applications of Lead-acid and NiMH Batteries

Shipments and Market Size of Global Compact NiMH Battery, 2010-2015

Shipments and Market Size of Global Large-sized NiMH Battery, 2010-2015

NiMH Battery Market Size in China, 2011-2015

Market Share of Global Compact NiMH Battery Manufacturers, 2014

Sales Volume of Global New Energy Vehicles (EV/PHEV/HEV), 2009-2015

Specifications of Lead-acid and Ni-Cd Batteries

Applications of Lead-acid and Ni-Cd Batteries

Technical Performance Comparison between Lead-carbon Battery and Lead-Acid Battery

Economical Comparison between Lead-carbon and Lead-Acid Battery Energy Storage Technology

Characteristic Comparison of Energy Storage Systems of Three Technologies

Peak-valley Time-of-Use (TOU) Electricity Price of Enterprises in Jiangsu Province

Peak-valley Electricity Price Difference of Different Levels of Voltage

Energy Storage Costs and Power Saving Benefits

Classification of Fuel Cells

Technical Advantages (I) of Communication Base Backup Power, Fuel Cell and Lead-acid Battery

Technical Advantages (II) of Communication Base Backup Power, Fuel Cell and Lead-acid Battery

Energy Efficiency up to 90% of Fuel Cell Cogeneration Project

Outlook of 42% Household Energy Provided by Fuel Cells in Japan

Economical Efficiency of Bloom Energy SOFC System

Applied Scenarios of Fuel Cell Backup Power Supply

Emergent Power Supply System of Ballard Fuel Cell

Ballard’s Calculation Parameters for Lead-acid Battery and Fuel Cell Costs

Fuel Cell Vehicle Development Roadmap of World’s Major Automakers

Cost Analysis of Fuel Cell System

Relation between Output and Cost of Fuel Cell System

Percentage of Cost of Parts for Fuel Cell System

Performance Comparison between Various Batteries

Development Orientation of Vehicle-use Battery

Key Components of Lead-acid Battery

Output of Refined Lead in China, 2010-2015H1

Output of Lead-acid Battery in China, 2010-2014

China’s Output of Lead and Secondary Lead

Top 10 Players by Sulfuric Acid Output in China in Recent Two Years

Output & Sales Volume and Ownership of Automobiles and Demand for Starter Lead-acid Batteries, 2010-2018E

Vehicle Starter Lead-acid Battery Industry Scale, 2010-2018E

Schematic Diagram of Vehicle Start-stop System

Shipments and Penetration of Vehicle Start-stop Battery System in China, 2013-2018E

Proportion of Vehicle Brands Loading Start-stop Batteries in China

Vehicle Start-stop Lead-acid Battery Market Size in China, 2013-2018E

Competitive Landscape of Vehicle Starter Lead-acid Battery Manufacturers in China, 2014

List of World’s Major Manufacturers of Vehicle Starter Battery

Market Layout of Major Start-stop Battery Manufacturers in China

Classification of Common Energy Storage Methods

Corresponding Energy Storage Capacity and Discharging Time of Different Energy Storage Technologies

Comparison of Main Electric Power Energy Saving Technologies

Installed Capacity of Various Electrochemical Energy Storage Technologies Worldwide

Application Proportion of Different Electrochemical Energy Storage Technologies in Different Countries

Usages of Electronic Energy Storage

Application of Energy Storage in Renewable Energy Field

Application of Energy Storage in Distributed Energy Field

Application of Energy Storage in V2G/V2H System Field

Cost of Different Energy Storage Technologies in Chinese Market

Cost of Different Energy Storage Technologies in U.S. Market

Policies on Energy Storage in China

Accumulative Installed Capacity of Global Electrochemical Energy Storage, 2009-2015

Market Share of Main Technical Routes of Global Energy Storage Systems, 2014

Accumulative Installed Capacity of Electrochemical Energy Storage in China, 2010-2015

Electrochemical Energy Storage Industry Scale in China, 2011-2018E

Performance and Cost Comparison of Three Mainstream Electrochemical Energy Storage Technologies, 2015

Electrochemical Energy Storage Lead-acid/Lead-carbon Battery Industry Scale in China, 2011-2018E

Fixed Asset Investments of Telecommunication Industry in China, 2010-2015

Construction of Mobile Phone Base Stations in China, 2010-2015H1

Lead-acid Battery Demand from Communication Backup Power Industry in China, 2010-2018E

Lead-acid Battery Demand Scale of Communication Backup Power Industry in China, 2010-2018E

Competitive Landscape of Communication Backup Lead-acid Battery Manufacturers in China, 2014

Competitive Landscape of Power Energy Storage Lead-acid Battery Manufacturers in China, 2014

Output of Electric Bicycles in China by Lead-acid Battery and Lithium Battery, 2010-2015

Permeability of Lead-acid and Lithium Battery Bicycles in China, 2010-2015

Ownership of Electric Bicycles in China, 2010-2015

Output of Electric Bicycles (by Region) in China, 2014

Electric Bicycle Industry Scale in China, 2010-2015

Price Table of Major Batteries for Electric Bicycles, 2015

Electric Bicycle Lead-acid Battery Demand

Electric Bicycle Lead-acid Battery Industry Scale

Market Share of Electric Bicycle Lead-acid Battery Manufacturers, 2013-2014

Output of Electric Tricycles in China, 2010-2018E

Ownership of Electric Tricycles in China, 2010-2018E

Electric Tricycle Lead-acid Battery Demand, 2010-2018E

Electric Tricycle Lead-acid Battery Industry Scale, 2010-2018E

Market Share of Electric Tricycle Lead-acid Battery Manufacturers in China, 2014

Main Technical Requirements of Low-speed Electric Vehicles (Shandong Province)

Main Specifications of Low-speed Electric Vehicles in China

Output of Low-speed Electric Vehicles in China, 2010-2018E

Ownership of Low-speed Electric Vehicles in China, 2009-2018E

Output of Low-speed Electric Vehicles in Shandong Province, 2010-2015H1

Rankings of Major Low-speed Electric Vehicle Manufacturers in China by Sales Volume, 2014-2015

Low-speed Electric Vehicle Market Size in China, 2010-2018E

Successive Accession of Some Traditional Automakers into the Mini Electric Vehicle Field

Advantages of Low-speed Electric Vehicles

Low-speed Electric Vehicle Lead-acid Battery Demand, 2010-2018E

Low-speed Electric Vehicle Lead-acid Battery Industry Scale, 2010-2018E

Market Share of Low-speed Electric Vehicle Lead-acid Battery Manufacturers in China, 2014

Output of ATV in China, 2010-2015

Output of Forklift Market Segments in China, 2013-2015H1

Top 5 Electric Sightseeing Vehicle Manufacturers in China by Sales Volume, 2014

Top 10 Forklift Manufacturers in China by Sales Volume, 2014

ATV/Special Vehicle Lead-acid Battery Demand, 2010-2018E

ATV/Special Vehicle Lead-acid Battery Industry Scale, 2010-2018E

Key Financial Indicators of Johnson Controls, 2011-2015

Revenue of Johnson Controls by Segment, FY2013-FY2015

Distribution and Capacity of Johnson Controls’ Business in China

Battery Brands of Johnson Controls

Key Financial Indicators of Exide Technologies, FY2010-FY2013

Applications and Main Brands of Exide Technologies’ Batteries

Revenue and Operating Income of GS Yuasa, FY2012-FY2016

Revenue Structure of GS Yuasa by Product, FY2015

Revenue Structure of GS Yuasa by Region, FY2014-FY2015

Subsidiaries of GS Yuasa in China

Shanghai Production Base of C&D

Main Products of C&D

Revenue and Employees of HOPPECKE, 1998-2015

Main Products of HOPPECKE

Key Financial Indicators of Tianneng Power, 2009-2015H1

Revenue Structure of Tianneng Power by Product, 2014-2015

Distribution of Tianneng Power’s Production Bases

Capacity of Tianneng Power’s Production Bases

Product Layout of Tianneng Power

Revenue of Tianneng Power by Product, 2013-2015

Customer Group of Tianneng Power

Revenue and Profit of Chaowei Power, 2011-2015

Gross Margin and Net Profit Margin of Chaowei Power, 2011-2015

Distribution of Chaowei Power’s Production Bases

Lead-acid Battery Capacity of Chaowei Power, 2011-2015

Revenue of Chaowei Power by Product, 2013-2015

Major Customers of Chaowei Power

Number of Changwell Power’s Independent Dealers, 2011-2015

Revenue and Net Income of Camel Group, 2010-2015

Revenue of Camel Group by Region, 2013-2015

Capacity of Camel Group, 2013-2014

Revenue of Camel Group by Product, 2013-2015

Gross Margin of Camel Group by Product, 2013-2015

Business Planning of Camel Group

Major Customers of Camel Group

Revenue and Net Income of China Shipbuilding Industry Group Power, 2010-2015

Revenue of China Shipbuilding Industry Group Power by Region, 2013-2015

Revenue Structure of China Shipbuilding Industry Group Power by Region, 2013-2015

Main Projects under Construction of China Shipbuilding Industry Group Power, 2015H1

Revenue of China Shipbuilding Industry Group Power by Product, 2013-2015

Revenue Structure of China Shipbuilding Industry Group Power by Product, 2013-2015

Gross Margin of China Shipbuilding Industry Group Power by Product, 2013-2015

Top 5 Customers of China Shipbuilding Industry Group Power, 2014

Revenue and Net Income of Shandong Sacred Sun Power Sources, 2009-2015

Revenue of Shandong Sacred Sun Power Sources by Region, 2013-2015

Revenue Structure of Shandong Sacred Sun Power Sources by Region, 2013-2015

Battery Sales Volume of Shandong Sacred Sun Power Sources, 2013-2014

Revenue of Shandong Sacred Sun Power Sources by Product, 2013-2015

Revenue Structure of Shandong Sacred Sun Power Sources by Product, 2013-2015

Gross Margin of Shandong Sacred Sun Power Sources by Product, 2013-2015

Major Customers of Shandong Sacred Sun Power Sources

Revenue and Net Income of Narada Power Source, 2010-2015

Revenue of Narada Power Source by Region, 2012-2014

Revenue Structure of Narada Power Source by Region, 2012-2014

Capacity of Narada Power Source

Part of Bid-winning Energy Storage Projects on Lead-carbon Battery Technical Route of Narada Power Source

Revenue of Narada Power Source by Sector, 2013-2015

Revenue Structure of Narada Power Source by Sector, 2013-2015

Revenue of Narada Power Source by Product, 2013-2014

Revenue Structure of Narada Power Source by Product, 2013-2014

Gross Margin of Narada Power Source by Industry, 2013-2015

Gross Margin of Narada Power Source by Product, 2013-2014

Revenue and Net Income of Vision Group, 2009-2015

Revenue and Gross Margin of Vision Group by Region, 2014-2015

Capacity of Vision Group, 2011-2014

Output and Sales Volume of Vision Group, 2013-2014

Revenue and Gross Margin of Vision Group by Product, 2014-2015

Major Customers of Vision Group

Top 5 Customers of Vision Group (Export Sales), 2011-2014

Revenue and Net Income of Dynavolt Tech, 2009-2015

Operating Revenue of Dynavolt Tech by Region, 2013-2015

Gross Margin of Dynavolt Tech by Region, 2013-2015

Output and Sales Volume of Dynavolt Tech, 2013-2014

Operating Revenue of Dynavolt Tech by Product, 2013-2015

Gross Margin of Dynavolt Tech by Product, 2013-2015

Major Customers of Dynavolt Tech

Revenue of Shuangdeng Group, 2012-2014

Key Financial Indicators of Leoch International, 2009-2015

Revenue of Leoch International by Region, 2013-2015

Capacity of Leoch International, 2011-2015

Revenue of Leoch International by Product, 2013-2015

Major Customers of Leoch International

Output of China Lead-acid Battery Industry, 2010-2018E

Output Estimation of China Lead-acid Battery Industry (by Application), 2010-2018EPercentages of Different Applications (by Demand) of China Lead-acid Battery Industry, 2014

China Lead-acid Battery Industry Scale in China, 2010-2018E

Scale Estimation of China Lead-acid Battery Industry (by Application), 2010-2018E

Battery Development Direction of Key Global and Chinese Enterprises

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...