Global and China HD Map Industry Report, 2016

-

Sep.2016

- Hard Copy

- USD

$2,400

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

SK005

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

Global and China HD Map Industry Report, 2016 by ResearchInChina is mainly concerned with the following:

Acquisition modes and technical analysis of HD maps;

Acquisition modes and technical analysis of HD maps;

Market situation of global self-driving cars, covering structure and classification of autonomous driving, as well as domestic and foreign markets and policy environment;

Market situation of global self-driving cars, covering structure and classification of autonomous driving, as well as domestic and foreign markets and policy environment;

Market situation of global HD maps, including status quo, layout, and development trends;

Market situation of global HD maps, including status quo, layout, and development trends;

HD map industry chain, involving lidar, cameras, positioning systems, IMU, and algorithms, etc.;

HD map industry chain, involving lidar, cameras, positioning systems, IMU, and algorithms, etc.;

Analysis of 7 major Chinese and foreign HD map providers, containing technical analysis as well as development and future trends of HD map business.

Analysis of 7 major Chinese and foreign HD map providers, containing technical analysis as well as development and future trends of HD map business.

At present, there are mainly four types of enterprises that dominate the layout in the HD map field: internet firms, auto makers, sensor vendors, and digital map providers.

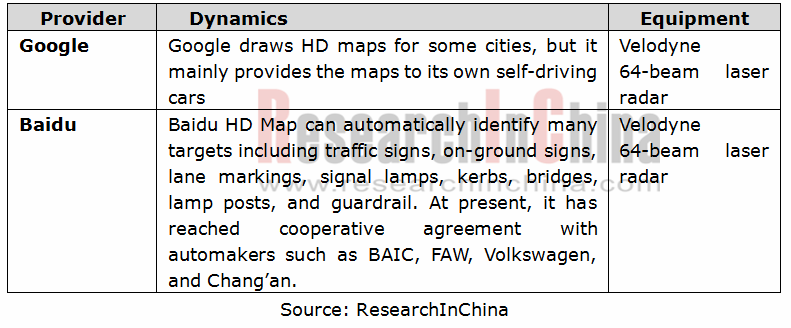

I) Internet Firms

Internet tycoons like Google and UBER have, through acquisitions, obtained map data resources before producing HD maps based on their own algorithms and cloud computing capabilities. Google acquired a large number of digital map providers like Keyhole, Skybox, and Waze. In China, however, ground mapping is a highly confidential sector and therefore sets a higher entry threshold, which gives a big advantage to the Chinese digital map providers and turns away foreign players. Currently, there are 166 internet companies with mapping qualifications in China, and Internet giants like Baidu and Alibaba have through acquisitions occupied an important position in the Chinese map industry. Among them, Baidu purchased RITU and Alibaba bought AutoNavi.

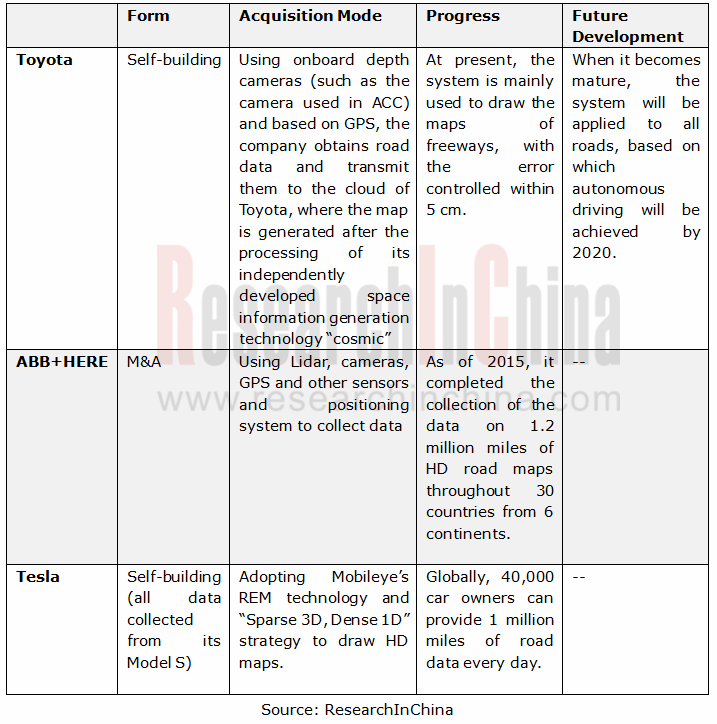

II) Auto Makers

Car makers make their presence in HD maps mainly through M&As and self-building. For example, Toyota adopted onboard camera data to build HD maps via crowdsourcing, while Mercedes-Benz, Audi, and BMW jointly acquired HERE, a map provider under Nokia. Automakers-led layout could help promote the data traffic between HD maps and autonomous driving. Moreover, auto makers can fully open CAN bus port internally, which would bring benefits to the testing of HD map-based autonomous driving scheme.

III) Sensor Vendors

Using camera chips installed in cars, Mobileye is collecting data through crowdsourcing to make 3D maps. Its Road Experience Management software can identify specific road information like road markings. The bandwidth that it needs is only about 10KB per kilometer. Mobileye’s entry into HD map is to provide turnkey autonomous driving solutions for its future development.

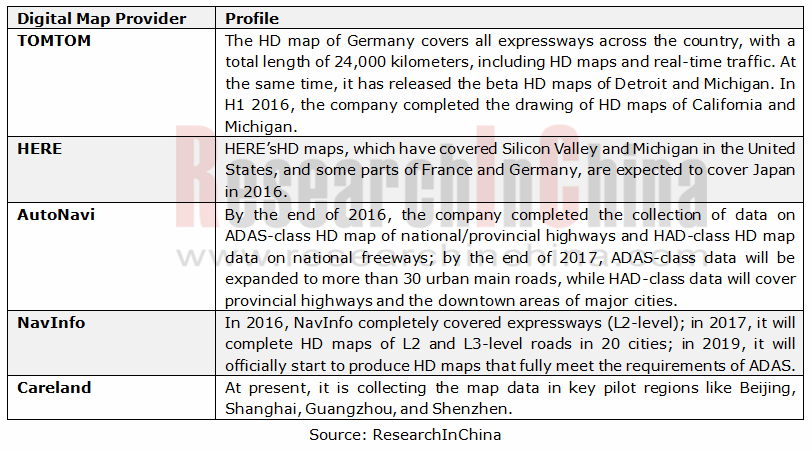

IV) Digital Map Providers

Digital map providers, including foreign companies like Apple and TomTom and domestic ones such as Tencent, NavInfo, Xiaomi, and Careland, can complement each other's advantages at a minimum cost.

Overall, autonomous driving is now dominated by automakers, and they will not completely open their underlying data on vehicles to HD map providers. Thus, many auto makers (like Audi, Mercedes-Benz, and BMW), obtain HD map data sources by acquiring digital map providers. In contrast, due to a lack of experience in fault tolerance and underlying data of vehicles, Internet companies end up cooperating with automakers.

1 Overview of HD Map

1.1 Definition

1.2 Composition

1.3 Features

1.4 Merits

1.5 Classification

2 Map Acquisition Schemes

2.1 Acquisition Modes of General Map

2.1.1 Collection by Walking

2.1.2 Collection by Backpack

2.1.3 Collection by Bicycle

2.1.4 Other Collection Means

2.2 Acquisition Modes of HD Map

2.2.1 Collection by Special Vehicle

2.2.2 Collection by Crowdsourcing

3 Global HD Map Market

3.1 Overview of Autonomous Driving

3.1.1 Definition and Overview

3.1.2 Development Trend of Autonomous Driving in the World

3.2 Development of HD Map in the World and China

3.2.1 Global

3.2.2 China

3.3 Development Trend

4 Upstream Industry Chain of HD Map

4.1 Lidar

4.1.1 Operating Principle

4.1.2 Composition

4.1.3 Application in HD Map

4.1.4 Market Size

4.2 Camera

4.2.1 Operating Principle

4.2.2 Application in HD Map

4.2.3 Market Size

4.3 Positioning System

4.3.1 Operating Principle

4.3.2 Application in HD Map

4.4 Inertial Navigation System

4.4.1 Operating Principle

4.4.2 Application in HD Map

4.4.3 Market Size

4.5 Algorithms

4.5.1 Path Planning Algorithm

4.5.2 SLAM Algorithm

5 Major Foreign HD Map Providers

5.1 Google

5.1.1 Profile

5.1.2 Operation

5.1.3 Google’s Self-Driving Cars

5.1.4 HD Map Business

5.2 TomTom

5.2.1 Profile

5.2.2 Operation

5.2.3 HD Map Business

5.2.4 HD Map Acquisition Vehicle

5.3 HERE

5.3.1 Profile

5.3.2 Operation

5.3.3 HD Map Business

5.4 Mobileye

5.4.1 Profile

5.4.2 Operation

5.4.3 Products

5.4.4 HD Map Business

6 Key HD Map Providers in China

6.1 Baidu

6.1.1 Profile

6.1.2 Operation

6.1.3 Products

6.1.4 HD Map Business

6.2 AutoNavi

6.2.1 Profile

6.2.2 HD Map Business

6.3 NavInfo

6.3.1 Profile

6.3.2 Operation

6.3.3 Products

6.3.4 HD Map Business

6.3.5 Core Competitiveness

Map-Matching Function of HD Map

Composition Structure and Functions of HD Map

Features of HD Map

Difference between ADAS-level and HAD-level HD Maps

Way of Collection by Backpack

Backpack-mode Collection Equipment

Way of Collection by Bicycle

Interface of AutoNaviTaojin (Original Autonavi gxdtaojin)

HERE’s HD Map Acquisition Vehicle

Mobileye’s HD Map Crowdsourcing Collection Scheme

Grades of Autonomous Driving

Development Stages (Predicted) of Autonomous Driving

Two Technology Roadmaps of Autonomous Driving System

Autonomous Driving Modes of Traditional Automakers, Parts Suppliers and Internet Firms

Autonomous Vehicle Development of Major Overseas Companies

Popularization (Predicted) of Autonomous Driving

Global HD Map Providers and Their Maps

Dominant Role of Internet Firms in HD Map Field

Automakers’ Presence in HD Map Field

Cooperative Modes of HD Map Providers

Chinese HD Map Providers and Their Maps

Future Evolution of HD Map

Composition of Lidar and Functions of Components

Emergence of Point Cloud Data

China Lidar Market Size, 2020E

Global In-vehicle Cameras Market Size, 2016-2020E

In-vehicle Camera OEM Market Size in China, 2016-2020E

Global Shipments of In-vehicle Cameras, 2016-2020E

Parameters of Four Major Positioning Systems

Positioning Means of Four Major Positioning Systems (Civil Use)

Illustrative Diagram of GPS Point Positioning

Illustrative Diagram of Differential GPS

BDStar Navigation N280 Receiver and GPS-700 Series Antennas and Performance Parameters

Principle of Inertial Navigation System

Global Inertial Navigation System Market Size, 2016-2020E

Google’s Development History

Google Self-driving Car

Google’s Operation, 2011-2014

Google’s Tuned Prius

Google's Prototype Configuration

GoogleCar 3D Model

TomTom’s Services

TomTom’s Development History

TomTom’s Revenue, 2011-2015

TomTom’s Revenue by Business Segments, 2015

TomTom’s Revenue by Region, 2015

TomTomHD Map

ADAS Function of TomTom HD Map

Functions and Advantages of TomTom

Mapping Vehicle for TomTomHD Map

Data Processing Equipment for TomTom HD Map

TomTom’sRoadDNA Technology

HERE’s Revenue, 2013-2015

HERE HD Map

Characteristics of HERE HD Map

Composition Structure of HERE HD Map

Evolution of Mobileye Camera Sensor

Mobileye’s Solutions for Autonomous Driving

Mobileye’s Operation, 2011-2015

Mobileye’s Revenue by Market, 2013-2015

Mobileye’s Revenue by Region, 2015

Mobileye 560 and Its Parameters

Functions of Mobileye 5 Series Products

Functions of Mobileye 5 Series Display Unit

Mobileye’s Smartphone App Interface

Functions of Various Generations of Mobileye Sensors

Mobileye’s Isomeric Architecture

Mobileye’s EyeQ5 Chip Architecture

Mobileye’s HD Map Technology (REM)

REM System Identification for Feasible Paths

Mobileye’s Roadbook Strategy

Layout of Baidu Telematics

Ecological Architecture of Baidu Telematics

Baidu’s Operation, 2011-2015

Main Functions of Baidu CarLife

Cooperative Auto Enterprises of CarLife

Baidu MyCar Architecture

Four Features of Baidu MyCar

Six Advantages of Baidu Speech System

Self-Driving Cars Developed by Baidu and BMW

Velodyne HDL-64E Structure Chart

VelodyneHDL-64E Parameters

HD Map Data Acquisition Vehicles Developed by Baidu and Changan

Velodyne HDL-32E Structure Chart

Velodyne HDL-32E Parameters

AutoNavi’s HD Map Production Plan

ADAS-level Acquisition Vehicle

HAD-level Acquisition Vehicle

VMX-450 Composition

Riegl VMX-450 System Architecture

VQ-450 Laser Scanner Structure

VQ-450 Performance Parameters

VMX-450-CS6 Camera

VMX-450-CS6 Parameters

Hierarchical Acquisition System of AutoNavi HD Map

NavInfo’s Navigation Electronic Map Product Diagram

NavInfo’s Vehicle Navigation Customers

NavInfo’s Operation, 2011-2015

Development of NavInfo’s Main Business, 2011-2015

NavInfo’s Layout in Telematics, 2011-2015

NavInfo’s Strategic Planning

NavInfo’sNavigation Electronic Map Compiling Products

Dynamic Traffic Information Service Diagram

WeDrive3.0 Eco-platform

NavInfoTraffic Index Platform

NavInfo’s Industry Application Products

NavInfo’s HD Map Diagram

NavInfo’sHD Map Test Vehicle

Typical Scenarios and Contents of HD Map

NavInfo’s HD Map Development Paths

NavInfo’s HD Map Solutions

NavInfo’s HD Map Data Specification

NavInfo’s HD Map and Location Sensing Product Series

NavInfo’s HD Map Product Roadmap

WeDrive 3.0 Cloud Service Platform for Autonomous Driving

NavInfo’s R&D Costs, 2011-2015

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...