The report covers the following:

1. Composition and function of automotive seating

2. Size and Trends of global and Chinese automotive seating market

3. Competitive landscape and trends of global and China’s automotive seating industry

4. Automotive seating supply chain of major global and Chinese carmakers

5. Global and Chinese automotive seating manufacturers

Automotive seating industry, seemingly without technological barriers, is actually a capital-intensive business that does with high-tech expertise. First, automotive seating plants are usually adjacent to car factories, for the products are too large to be transported easily. Therefore, as carmakers add a new production base, automotive seating manufacturers need to follow up. In this case, substantial funds become a must. Second, safety, comfort, and light weight- three requirements on automotive seating- need rich technological accumulation and present high technological threshold. Moreover, a huge number of employees in automotive seating industry pose great challenges to managerial competencies.

Global automotive seating market has grown steadily on account of the two aspects. First, higher barriers in automotive seating industry lead to high market concentration and little competition. Automotive seating manufacturers have a greater say which enables them to raise prices constantly. Second, consumption is upgraded, a phenomenon starkly seen in China where consumers have higher requirements on automotive seating. Automotive seating saw an ASP of USD723 in 2010 with a market size of USD54 billion. The figures for 2015 were USD790 and USD70.1 billion. It is expected the market size will be valued at USD72.9 billion in 2016, and USD84.3 billion in 2020 when ASP arrives at USD865.

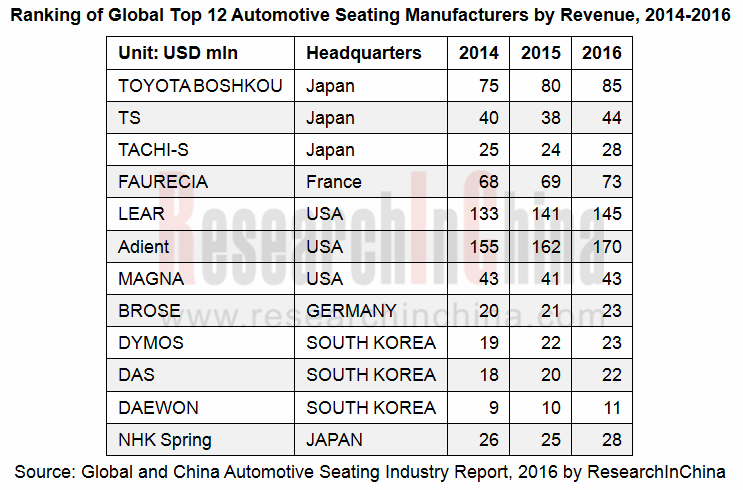

In automotive seating industry, Adient (a spin-off of Johnson Controls) and Lear are in the first camp, together holding about 48% of passenger car market. Adient has a broad customer base with almost all carmakers being its customers, while Lear provides products mainly for Ford, GM, BMW, and FCA and operates chiefly in North America and Europe but gets far less involved in the Asian-Pacific region. Adient seizes a dominant position in China with a market share of 40%.

Toyota Boshoku (a member of Toyota Group) and Faurecia (a subsidiary of PSA) fall into the second camp. Toyota Boshoku has been actively developing new customers outside Toyota in recent years. Faurecia serves mainly VW, PSA, and Renault-Nissan with its operations concentrated in Europe.

In the Chinese automotive seating market, almost all American cars and German cars are equipped with automotive seats from Adient and Lear, and among Japanese cars, all Honda cars carry automotive seats from TS, the majority of Toyota cars with automotive seats from Toyota Boshoku, and Nissan cars with automotive seats from a number of suppliers. Most of Chinese car brands use seats from joint ventures. Great Wall, BYD, Chery, and Geely adopt the model of partial own production and partial purchase from joint ventures. The joint ventures deliver cost-competitive products with better performance by relying on economy of scale and complete supply chain, while local brands retain their seating businesses just for enough say in negotiation with JVs and greater resilience in supply chain.

Most of Great Wall car seats come from its own seating business division and a few are provided by the joint venture between Great Wall and Yanfeng Johnson Controls. BYD’s car seats are largely supplied by its No. 16 business division and partly by Tachi-S, a three-party joint venture. Chery has low-end seats furnished by Wuhu Ruitai Auto Parts (a subsidiary of Chery) and high-end seats by Lear, making less and less purchase from Johnson Controls and GSK. Major suppliers of seats for Geely are Johnson Controls, Zhejiang Xindaimei Automotive Seating, and Zhejiang Jujin Automobile & Motor-cycle Accessories. Cooperation with South Korean Das provides solid support for Zhejiang Xindaimei Automotive Seating to gain a foothold in Geely. Zhejiang Jujin Automobile & Motor-cycle Accessories has investment from Geely and is also backed by Tachi-S.

As consumers pursue high-quality products, the ratio of home-grown seats will gradually fall, while that of JV seats will rise.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...