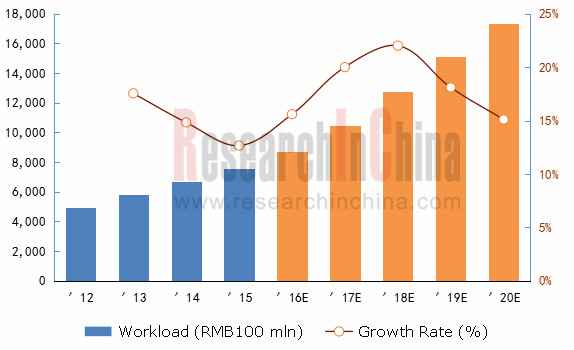

The huge Chinese automobile market always stimulates the demand for auto repair & beauty. According to the National Bureau of Statistics of China, the country's car ownership reached 172 million at the end of 2015, rising 11.7% over last year. Chinese auto repair & beauty market size amounted to RMB754.8 billion in 2015, jumping by 12.66% year on year. In future, the market size will show an annual growth rate of 19.17% during 2015-2020 with the consumers’ enhanced maintenance awareness and longer ownership time, and the market scale will report RMB1.7364 trillion in 2020.

Chinese Auto Repair & Beauty Market Size, 2012-2020E

Source: ResearchInChina

As for the competitive landscape, the main participants in China's auto repair industry include 4S stores, franchised maintenance service stations, comprehensive repair workshops, fast repair chain stores, special repair shops and a large number of roadside shops. There are more than 400,000 registered maintenance &repair enterprises which are divided into three categories with nearly 5 million employees in China, embracing at least 370,000 non-4S stores. The industry features a low concentration rate.

In China, auto 4S stores charge very high although their service quality is excellent, while repair shops and roadside repair shops claim low fees but their services vary dramatically, which cannot make consumers feel assured. Well-known chain stores offer the prices between 4S stores and roadside repair shops, embodying obvious cost advantages.

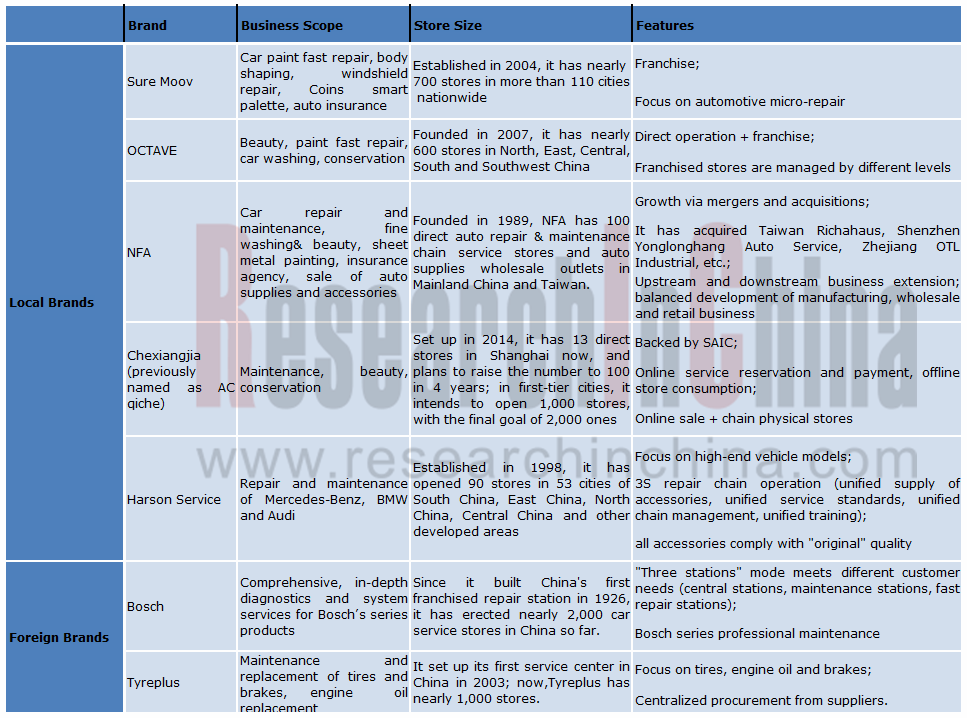

Currently, foreign brands Bosch and Michelin, as well as local brands Harson Service, Sure Moov and NFA have forged brand chain effect and enjoy better reputation. Bosch and Sure Moov have realized national layout, and other enterprises are actively expanding the network and making the layout rationally.

Under Bosch Group, Bosch Car Service is one of the largest independent automotive service networks in the world with a history of more than 95 years and boasting more than 17,000 service stations in over 150 countries. Its services consist mainly of comprehensive services and fast services, involving "vehicle maintenance inclusive of sheet metal & paint business and fast repair services" and "car beauty, car maintenance and tire services". The two types of services adopt franchise mode. Up to now, Bosch Car Service has opened 2,000 franchised stores in China.

Founded in 1989, NFA is listed on the Hong Kong Stock Exchange (00360.HK) and has more than 100 direct auto repair & maintenance chain service stores and auto supplies wholesale outlets in Mainland China and Taiwan. Its domestic auto repair & beauty subsidiaries contain New Focus Aiyihang, Changchun Quangda, Shanghai New Focus and New FocusYonglonghang. In addition, the company also operates New Focus Lighting & Power Technology (Shanghai) Co., Ltd. which involves in the production of automotive products. Therefore, the company holds a perfect aftermarket industrial chain.

Comparison between Major Independent Chain Auto Repair & Beauty Brands in China

Source: ResearchInChina

The enormous market potentials of the auto repair & beauty industry have attracted various investors to compete in the field, which not only injects adequate capital to the market, but also brings multiple innovative business models. For instance, Taobao, Jingdong (JD) and other Internet giantspump much capital in acquiring or creating start-ups, and then erect the O2O business model hereof. Meanwhile, some parts manufacturers and distributors move back into the downstream of the industry chain, so as to step in the auto repair & beauty industry; for example, Mobil No.1 keeps an eye on lubricating oil, and mailuntai.cn focuses on tire distribution; most of these companies expand the original product-based business to auto repair & beauty business.

The report highlights the following:

Overview of China auto repair & beauty industry (including definition, classification, industrial chain, industry policies and development trends, etc.);

Overview of China auto repair & beauty industry (including definition, classification, industrial chain, industry policies and development trends, etc.);

The overall market size of China's auto aftermarket industry (including automobile industry, used car market, car rental, automobile insurance, etc.);

The overall market size of China's auto aftermarket industry (including automobile industry, used car market, car rental, automobile insurance, etc.);

The overall market size of China auto repair & beauty industry (including market size, investment and financing, competition pattern, channels and regional analysis);

The overall market size of China auto repair & beauty industry (including market size, investment and financing, competition pattern, channels and regional analysis);

Innovative business models of China auto repair & beauty industry (including the Internet +, parts +, etc.);

Innovative business models of China auto repair & beauty industry (including the Internet +, parts +, etc.);

Profile, financial standing, service facilities, service networks and financing of 11 auto repair & beauty chain enterprises including Bosch, Michelin Tyreplus, Sure Moov, OCTAVE, AutoPrince, AnjiAutobund, NFA, Harson Service, Taobao Car, Chexiangjia and y1s.cn.

Profile, financial standing, service facilities, service networks and financing of 11 auto repair & beauty chain enterprises including Bosch, Michelin Tyreplus, Sure Moov, OCTAVE, AutoPrince, AnjiAutobund, NFA, Harson Service, Taobao Car, Chexiangjia and y1s.cn.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...