Global and China UBI Industry Report, 2017-2021

-

Oct.2017

- Hard Copy

- USD

$2,900

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$2,700

-

- Code:

ZJF110

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,100

-

- Hard Copy + Single User License

- USD

$3,100

-

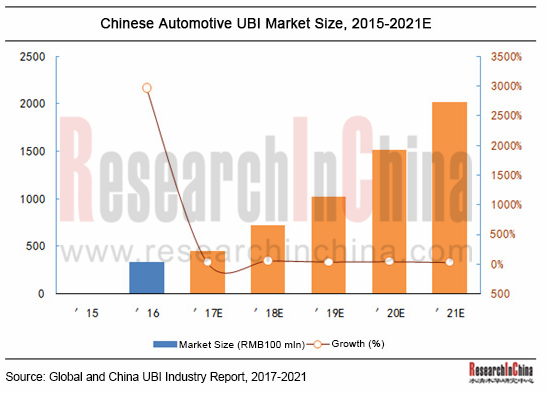

Starting in China in 2012, later than in foreign countries, UBI is primarily developed by mainly referring to foreign products and mature models. Auto insurance, always the largest subsector of property insurance in China, reported original premium income of RMB683.455 billion in 2016, up 10.3% from a year earlier and accounting for 78% of property-insurance original premium income. The reform of commercial car insurance rate management system was piloted from May 2015 and the market-oriented reform of car insurance rate was staged nationwide on July 1, 2016. Also, the rapid evolution of automotive IoT (Internet of Things) gives great impetus to the automotive UBI industry. The Chinese automotive UBI market is expected to value RMB201.8 billion in 2021 at a CAGR of 43.0%.

China’s UBI models are led by the “entities + insurers” one. Entities include OEMs, connected car firms, independent service providers, and big data companies.

1. OEMs + Insurers: OEMs usually cooperate with third parties and insurers in UBI field, represented by SAIC Motor + Cihon + CPIC. SAIC Motor and CPIC give a personalized quote for car insurance on auto models carrying OnStar according to consumers’ driving habits, mileage, and other factors. Cihon is responsible for data analysis and insurance model development.

2. Connected Car Platforms + Insurers: Connected car platforms are dominated by Aftermarket TSP (telematics service provider) in UBI field. For example, the insurer (PICC), via Shenzhen Autonet’s connected car platform, provides car owners with one-key insurance claim, quick settlement of claim, and inquiry of insurance status, and develops floating car insurance business.

3. Independent Service Providers + Insurers: Independent service providers usually acquire customer data via APP + OBD to work with insurers to develop UBI and at the same time provide customers with car maintenance and other services.

4. Big Data + Insurers: In UBI field, some insurers, on the one hand, have self-run platforms, such as Zhong An Online P&C Insurance’s O2O car insurance, and on the other hand, co-develop platforms with Internet businesses or other connected car firms. For instance, CPIC organized Internet companies with Baidu and invested in Atzuche. Big data companies employ various methods in UBI field, like Beijing Jingyou Times Information Technology, a provider of database and risk models.

Global and China UBI Industry Report, 2017-2021 highlights the following:

UBI overview (definition, pricing, value, methods of UBI data acquisition, etc.);

UBI overview (definition, pricing, value, methods of UBI data acquisition, etc.);

Foreign UBI markets (global; UBI in United States, Canada, UK, and Germany;

Foreign UBI markets (global; UBI in United States, Canada, UK, and Germany;

10 UBI companies and their products in United States, Canada, UK, Germany, and Italy);

10 UBI companies and their products in United States, Canada, UK, Germany, and Italy);

UBI business in China (future scale, drivers, entities, development trends);

UBI business in China (future scale, drivers, entities, development trends);

Local Chinese UBI companies (business, operation, and UBI products of China Life, PICC, Ping An Insurance, Carsmart, Zhong An Online P&C Insurance, Cihon, DiNA Technology, PingJia Technology, Shenzhen Dingran Information Technology, Shenzhen Autonet, Launch Tech, Renrenbao, MSD, Deren Electronic and Zebra-Drive)

Local Chinese UBI companies (business, operation, and UBI products of China Life, PICC, Ping An Insurance, Carsmart, Zhong An Online P&C Insurance, Cihon, DiNA Technology, PingJia Technology, Shenzhen Dingran Information Technology, Shenzhen Autonet, Launch Tech, Renrenbao, MSD, Deren Electronic and Zebra-Drive)

1 Overview of UBI

1.1 Definition

1.2 Pricing

1.3 Value

1.4 Means of Acquisition

2 Global Telematics Insurance Market

2.1 Global

2.2 U.S. UBI Market

2.3 Canadian UBI Market

2.4 UK UBI Market

2.5 German UBI Market

3 Car Insurance and UBI Localization in China

3.1 Status Quo of Car Insurance in China

3.2 UBI Participants in China

3.2.1 OEMs + Insurance Companies

3.2.2 Telematics Platforms or Parts Suppliers + Insurance Companies

3.2.3 Independent Service Providers + Insurance Companies

3.2.4 Big Data Companies

3.2.5 Insurers

3.3 UBI Trends

3.3.1 Chinese UBI Market Size of RMB200 Billion in 2021

3.3.2 Market-based Reform of Car Insurance Rates Will Bring Unprecedented Opportunities to the Development of UBI

3.3.3 Diversified UBI Preferentials

3.3.4 Diversified Means of UBI Acquisition

3.3.5 Diversified Modes of Services Provided by Insurers

4 UBI Cases in Europe

4.1 UnipolSai

4.1.1 Profile

4.1.2 Operating Performance

4.1.3 UBI Business

4.2 Generali

4.2.1 Profile

4.2.2 UBI Business

4.3 Allianz

4.3.1 Profile

4.3.2 Operating Performance

4.3.3 UBI Business

4.4 Insure The Box

4.4.1 Profile

4.4.2 UBI Business

4.4.3 Advantages of InsuretheBox

4.5 RISK Technology

4.5.1 Profile

4.5.2 UBI Business

4.5.3 Methods of Risk Assessment

5 UBI Cases and Companies in North America

5.1 Progressive

5.1.1 Profile

5.1.2 UBI Business

5.1.3 Developments

5.2 State Farm

5.2.1 Profile

5.2.2 Operating Performance

5.2.3 UBI Business

5.3 Allstate

5.3.1 Profile

5.3.2 Operation

5.3.3 UBI Business

5.4 Desjardins

5.4.1 Profile

5.4.2 Operation

5.4.3 UBI Business

5.5 Hartford

5.5.1 Profile

5.5.2 Operation

5.5.3 UBI Business

6 UBI-related Companies in China

6.1 China Life Property & Casualty Insurance Co., Ltd.

6.1.1 Profile

6.1.2 UBI Business

6.2 PICC P&C

6.2.1 Profile

6.2.2 UBI Business

6.3 Ping An Property & Casualty Insurance Co. of China

6.3.1 Profile

6.3.2 Operation

6.3.3 UBI Business

6.4 Zhong An Online P&C Insurance Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 UBI Business

6.5 Carsmart

6.5.1 Profile

6.5.2 UBI Business

6.6 Cihon

6.6.1 Profile

6.6.2 UBI Business

6.6.3 Cooperative Mode of SAIC Motor, Cihon and CPIC

6.7 DiNA Technology

6.7.1 Profile

6.7.2 UBI Services

6.7.3 DiNa Telematics Function

6.7.4 DiNA’s Value to Insurers

6.8 PingJia Technology

6.8.1 Profile

6.8.2 UBI Business

6.9 Shenzhen Dingran Information Technology

6.9.1 Profile

6.9.2 UBI Business

6.9.3 Usage Mode

6.9.4 A-Round of Financing

6.10 Shenzhen Autonet

6.10.1 Profile

6.10.2 Insurance Solutions

6.10.3 Way of Cooperation with PICC and China Grand Auto

6.10.4 UBI by Day

6.10.5 Business Trends

6.11 Launch Tech

6.11.1 Profile

6.11.2 Operating Performance

6.11.3 UBI Business

6.12 MSD

6.12.1 Profile

6.12.2 UBI Business

6.12.3 News about MSD UBI Business

6.13 Nanjing Renrenbao Network Technology Co., Ltd.

6.13.1 Profile

6.13.2 UBI Chebao

6.13.3 UBI Lichengbao

6.14 Deren Electronic

6.14.1 Profile

6.14.2 UBI Business

6.14.3 UBI Products

6.15 Zebra-Drive

6.15.1 Profile

6.15.2 UBI Business

Main Parts of UBI System

Diagram of UBI Pricing Models

Diagram and Classification of UBI Parameters

Impact of UBI on Car Owners and Insurers

Comparison between UBI Data Acquisition Modes

Global Presence of UBI Companies, 2016

Global UBI Projects, Countries, and Number of Policies, 2015-2016

UBI Projects and Number of Policies in UK, United States, and Italy, 2015-2016

Pricing Models of Some UBI Companies in North America, Europe and Asia

UBI Business of U.S. Progressive, State Farm, and Allstate

Number of UBI Purchased by Young Drivers in UK, 2009-2016

PAY AS YOU DRIVE and THE IN-TELE-BOX UBI in UK

China’s Premium Income from Property Insurance and Car Insurance, 2012-2016

Total Premium Income and Car Insurance Premium Income of PICC, Ping An and CPIC, 2016

UBI Models Adopted by OEMs

UBI Models of Telematics Platforms or Parts Manufacturers

UBI Models Adopted by Independent Service Providers

UBI Models Adopted by Big Data Companies

UBI Models Adopted by Insurers

Chinese UBI Market Size, 2015-2021E

Process of Pilot Reform of Commercial Car Insurance Terms & Rates Management System

Foreign Main UBI Billing Modes

Optional Preferentials of a Foreign UBI Company

Changes in Driver's Data Acquisition Modes, 2015-2016

Some UBI Companies Using Mobile Phone APP to Collect Data at Home and Abroad

Organizational Structure of UnipolSai

Financial Position of UnipolSai, 2015-2017

Revenue and Profit of UnipolSai by Business, 2015-2017

Development Track and Strategic Path of UnipolSai’ Insurance Services, 2003-2018E

Non-life Insurance Services of UnipolSai, 2012-2018E

Illustration of Unibox

Advantages of UnipolSAI UBI

Financial Position of Generali, 2015-2017H1

Computation Steps of Generali

Interface of Pago como conduzco

Global Presence of Allianz

Total Premium of Allianz, 2013-2016

Revenue and Profit of Allianz, 2012-2017

Comprehensive Loss Ratio of Allianz, 2012-2016

Operation of Allianz by Business, 2015-2017

Allianz’s Global Partners in the Automotive Industry

Optional UBI Index Libraries of IMS

UBI-based Auto Insurance Application Modules

BonusDrive APP

Insurance Application Steps of Insurethebox

Elements and Functions of Black Box

Advantages of InsuretheBox

Application of Risk Technology’s Telematics in Insurance Business

Claim Ratio of Risk Technology

Cases of Risk Technology in Score Evaluation

Revenue and Net Income of Progressive, 2011-2017

Mobile Phone APP Interface Diagram of Progressive's Snapshot Project

Progressive’s Telematics Box

Premium Income and Growth Rate of State Farm, 2010-2016

Promised Loss Ratio of State Farm, 2010-2016

Net Income of State Farm, 2010-2016

Usage Steps of DSS

Renewal Discounts between DSS Users and Non-DSS Users

Optional Discounts of State Farm

Premium Income and Net Income of Allstate, 2011-2017

Revenue of Allstate by Business, 2017

Quarterly Premium Income and Effective Policy Volume of Allstate, 2014-2017

Product Display of Allstate's DriveWise OBD

Service Contents on Allstate's Drivewise APP

Other Discounts on DriveWise

Main Business Distribution of Desjardins Insurance

Financial Position of Desjardins Insurance, 2013-2017

Revenue of Desjardins Insurance by Business, 2015-2017

Diagram of Ajusto Small Wireless Device

Ajusto Program with Telematics Device

Diagram of Ajusto Interface

Driving Scores vs. Preferential Margin of Desjardins Insurance

Revenue and Net Income of Hartford, 2012-2016

Revenue Structure of Hartford, 2016

Optional Discounts of Hartford’s Auto Insurance

Revenue of China Life Property & Casualty Insurance, 2015-2016

Revenue and Profit of China Life Property & Casualty Insurance by Coverage, 2016

Main Functions of Autofun Box

Revenue and Net Income of PICC P&C, 2012-2016

Insurance Amount, Premium Income and Profit of PICC P&C by Coverage, 2016

Revenue of Ping An by Business, 2015-2016

Revenue Structure of Ping An Insurance by Business, 2016

UBI Preferentials of I'chezaixian

Operating Revenue and Profit of Zhong An, 2014-2017

Operating Revenue of Zhong An by Coverage, 2014-2017

OBD Box of Baobiao Auto Insurance

Telematics Solutions for the Insurance Industry

3 APP Functional Modules of Autofun Box

UBI Business Architecture of Carsmart

Profile of Cihon

Main Function Modules of Cihon’s UBI Client

Calculation Methods of Cihon UBI

Profile of Cihon’s UBI

Profile of DiNA Technology

UBI Driving Behavior Scoring Factors of DiNA Technology

Diagram of Che Xing Zhe APP User Interface

Profile of PingJia Technology

Main Products and Functions of PingJia Technology

Big Data Solutions of PingJia Technology

UBI Model Development Process of PingJia Technology

Insurance Partners of PingJia Technology

Profile of Shenzhen Dingran Information Technology

Diagram of Lubi’s OBD Box

Diagram of Lubi’s APP Interface

Profile of Shenzhen Autonet

Business Model of Shenzhen Autonet

Cooperative Mode of Shenzhen Autonet, China Grand Auto and PICC P&C

Features and Service Process of Insurance by Day

Main Performance Parameters of Di Di Hu's Hardware Products

FRMS of Shenzhen Autonet

Profile of Launch Tech

Cooperative Enterprises of Launch Tech

Revenue and Net Income of Launch Tech, 2014-2017

Business Models of Launch Tech

Applications Based on golo Cloud Platform

Diagram of Enterprise Chain of MSD

Diagram of MSD OBD

Diagram of MSD APP

Screening of Driving Behavior Data and UBI Modeling

Workflow Chart of MSD UBI Service

Diagram of MSD Simplified Insurance Claim Flow

Diagram of Enterprise Chain of Renrenbao

Diagram of Mobile Chebao Interface

Diagram of Lichengbao's Interface

Diagram of Lichengbao's Purchase Interface

Diagram of Enterprise Chain of Deren Electronic

Deren Electronic's UBI Business Plans

Dedao TSP's Solution Path Diagram

Diagram of Dedao TSP's Intelligent Hardware T.30

Diagram of Dedao TSP's Intelligent Hardware PA54

Diagram of Dedao TSP's Application Service Platform

Strategic Partners of Zebra-Drive

Analysis Models of Zebra-Drive

Intelligent Driving System of Zebra-Drive

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...