Global and China Power Battery Management System (BMS) Industry Report, 2018-2025

-

July 2018

- Hard Copy

- USD

$3,600

-

- Pages:208

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

YS016

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

Battery management system (BMS), a key part of battery electric and hybrid vehicles, is primarily composed of battery electronics (BE) and battery control unit (BCU), with the former being responsible for collecting current, voltage and temperature data of battery and transmitting them to BCU and the latter for information exchange with other control units.

BMS has three core functions: cell monitoring, SOC (State of Charge) estimation and battery cell equalization. BMS monitors the working temperature and quantity of electricity of lithium battery cell and automatically takes measures to equalize the charging and discharging current and prevent the overheating temperature. Enabling EV power battery to gain best performance and the longest life cycle under any circumstances, BMS is a kind of crucial technology to develop electric vehicle.

A total of 1.1659 million new energy passenger cars were sold worldwide in 2017, an upsurge of 55.9% from a year earlier, showing great popularity of and a significant rise in market recognition of new energy vehicles. Global sales of new energy vehicles are expected to sustain a CAGR of around 45% between 2018 and 2020.

Foreign power battery BMS generally employs active equalization technology, resulting in higher cost per vehicle, but at the same time experiences annual decline of 10%-15% in price. The BMS market size will have a much slower growth rate than power battery output. Global BMS output value was USD4.7 billion in 2017, and is expected to exceed USD6 billion in 2019 and hit USD11.17 billion in 2025, representing a CAGR of 11.6% from 2017 to 2025.

Traditional auto parts vendors represented by Denso and Preh have seized the initiative by dint of their key roles in vehicle supply chain. Denso as the most important supplier of parts for Toyota has provided BMS modules to vehicle models like Prius and Camry Hybrid successively, while Preh not only supplies products to BMW i series BEVs but vigorously explores the Chinese market by resorting to the resources of its parent company Joyson Electronics.

Cell vendors like LGC attempt to narrow the functional range of BMS and make it simple and universal, and to spin off software and data services as a separate supply to automakers. Among carmakers, Tesla BMS is mature and sophisticated and its next-generation technology will be applicable to bigger battery cell.

China sold 777,000 new energy vehicles in 2017, including 556,000 passenger cars; new energy bus production plummeted by 16.4% in 2017 due to considerable impact from declined subsidies and is expected to stabilize at around 90,000 units over the next few years.

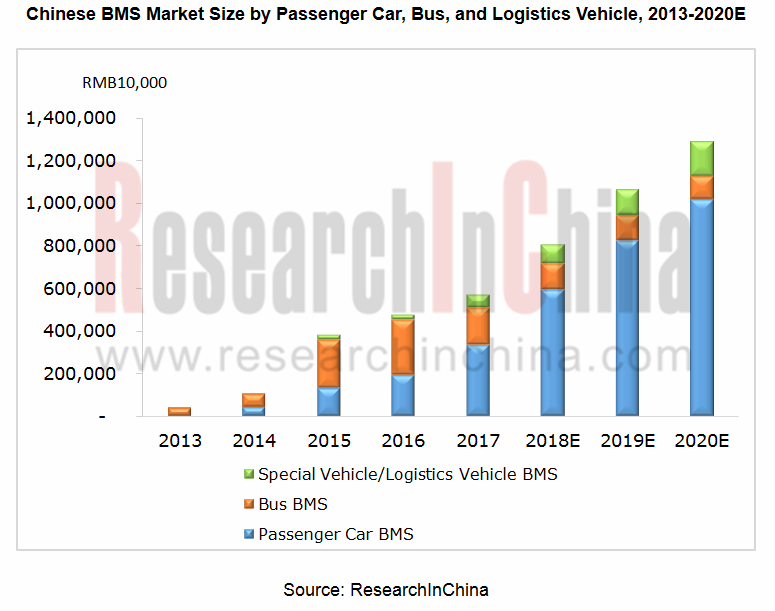

The market space for BMS was RMB5.69 billion in China in 2017, largely due to: 1) battery electric bus sales was lower than expected, and bus BMS price suffered an annualized decline of 10%-15% because of lower technical barriers and intense market competition; 2) more and more passenger cars and logistics vehicles carries ternary battery and larger amount of electricity, leading to higher requirements on safety performance of battery pack and more use of BMS active equalization technology. Passenger car BMS will prevail in the Chinese BMS market which is expected to be worth RMB12.87 billion in 2020.

The Chinese power battery BMS market will show the trends as follows over the years:

1) As concerns policy, National Technical Committee of Auto Standardization (NTCAS) is drafting national BMS standards out of consideration for requirements on NEV safety. BMS technical norms become ever stringent;

2) As the penetration rate of ternary lithium battery rises, higher requirements are posed on battery safety management;

3) What matters most to BMS are active cell balancing and design of SOC estimation algorithm. The light-asset hardware design companies will enjoy higher profitability;

4) Carmakers and battery cell vendors have their plans to extend into BMS industry chain. Due to technical barriers and constraint of R&D investments, it is hard for upstream and downstream enterprises to carry inroad ambition. So, it is a rational act to outsource BMS solutions.

5) The technical innovation-oriented third-party BMS companies which strictly control quality and costs and build in-depth cooperation with carmakers and battery producers are highly likely to win out from the fierce competition. It has become a trend that carmakers invest in BMS enterprises.

The report covers the following:

EV market development in China and the world (overview, market size, vehicle output, sales volume, etc.);

EV market development in China and the world (overview, market size, vehicle output, sales volume, etc.);

Development of global BMS industry (status quo, forecast, market size, technology trend, etc.);

Development of global BMS industry (status quo, forecast, market size, technology trend, etc.);

Development of BMS industry in China (status quo, forecast, price & cost, market size, competitive pattern, supply relation, technology trend, etc.);

Development of BMS industry in China (status quo, forecast, price & cost, market size, competitive pattern, supply relation, technology trend, etc.);

Major global BMS companies (companies’ and subsidiaries’ revenue, revenue structure, net income, R&D, products, supply to carmakers, developments, business in China, etc.);

Major global BMS companies (companies’ and subsidiaries’ revenue, revenue structure, net income, R&D, products, supply to carmakers, developments, business in China, etc.);

Leading BMS companies in China, involving independent third parties, battery cell manufacturers, and automakers (OEM) (companies’ and subsidiaries’ revenue, revenue structure, net income, R&D, products, supply to carmakers, latest projects, etc.);

Leading BMS companies in China, involving independent third parties, battery cell manufacturers, and automakers (OEM) (companies’ and subsidiaries’ revenue, revenue structure, net income, R&D, products, supply to carmakers, latest projects, etc.);

Key players in BMS chip industry (revenue, revenue structure, net income, BMS chip solutions, etc.).

Key players in BMS chip industry (revenue, revenue structure, net income, BMS chip solutions, etc.).

1. Overview of BMS

1.1 Definition of Power Battery

1.2 Definition of BMS

1.2.1 Definition

1.2.2 Classification and Technical Features

1.2.3 Core Functions

2. Policies on BMS

2.1 New Energy Vehicle Industry Policy

2.1.1 Purchase Tax Reduction & Exemption Policy

2.1.2 Fiscal Subsidies for Purchase

2.1.3 Fiscal Subsidies for Use

2.2 Battery Industry Policy

2.2.1 Standard Conditions for Automotive Power Battery Industry

2.2.2 Regulations on New Energy Vehicle Manufacturers and Products Access

2.2.3 Regulations on Investment in the Automobile Industry (Draft)

2.2.4 National Standards for Power Battery (GB/T)

2.2.5 National Standards for Recycling of Power Battery (GB/T)

2.2.6 Promoting Development of Power Battery Industry

2.2.7 MOST Special-Program Indicators for Performance Appraisal

2.3 Policies Being Made

2.3.1 National Standards for BMS

2.4 Charging Pile Construction

3. Global BMS Market

3.1 Global EV Market

3.2 Market Situation

3.3 Market Size

3.4 Technology Trends

3.5 Supporting

3.6 Market Forecast (2018-2025)

4. Chinese BMS Market

4.1 Chinese EV Market

4.2 Price & Cost

4.3 Market Size

4.4 Competitive Landscape

4.5 Technology Roadmap

4.6 Development Trends

4.7 Market Forecast (2018-2025)

5. Global BMS Vendors

5.1 Denso (Japan)

5.1.1 Profile

5.1.2 BMS Business

5.2 Calsonic Kansei (Japan)

5.2.1 Profile

5.2.2 BMS Business

5.3 Hitachi Automotive Systems (Japan)

5.3.1 Profile

5.3.2 BMS Business

5.4 Mitsubishi Electric (Japan)

5.4.1 Profile

5.4.2 BMS Business

5.5 Hyundai Kefico (Korea)

5.5.1 Profile

5.5.2 BMS Business

5.6 LG Chem (Korea)

5.6.1 Profile

5.6.2 BMS Business

5.7 SK Innovation (Korea)

5.7.1 Profile

5.7.2 BMS Business

5.8 Tesla Motors (USA)

5.8.1 Profile

5.8.2 BMS Business

5.9 Lithium Balance (Denmark)

5.9.1 Profile

5.9.2 BMS Products

5.9.3 BMS Application

5.9.4 Presence in China

5.10 Vecture (Canada)

5.10.1 Profile

5.10.2 BMS Products

5.10.3 Application of BMS Products

5.10.4 Industrial Layout

5.11 Rimac Automobili (Croatia)

5.11.1 Profile

5.11.2 BMS Products

5.11.3 BMS Application

5.12 Digi-Triumph Technology (Taiwan)

5.12.1 Profile

5.12.2 BMS Business

5.13 Clayton Power (Denmark)

5.13.1 Profile

5.13.2 BMS Business

6. Chinese BMS Vendors (Independent Third Parties)

6.1 Huizhou E-power Electronics

6.1.1 Profile

6.1.2 BMS Business

6.2 Shenzhen Klclear Technology

6.2.1 Profile

6.2.2 BMS Business

6.3 SINOEV (Hefei) Technologies

6.3.1 Profile

6.3.2 BMS Products

6.4 Ningbo Joyson Electronic Corp. (German Preh GmbH)

6.4.1 Profile

6.4.2 BMS Business

6.5 Harbin Guantuo Power Equipment Co., Ltd.

6.5.1 Profile

6.5.2 BMS Products

6.6 Anhui LIGOO New Energy Technology Co., Ltd.

6.6.1 Profile

6.6.2 BMS Business

6.7 Ningbo Bate Technology Co., Ltd.

6.7.1 Profile

6.7.2 BMS Business

6.8 Ningbo Longway Electrical Co., Ltd.

6.8.1 Profile

6.8.2 BMS Products

6.9 Shenzhen Antega Technology Co., Ltd.

6.9.1 Profile

6.9.2 BMS Products

6.10 Wuhu Tianyuan Automobile Electric Co., Ltd.

6.10.1 Profile

6.10.2 BMS Products

6.11 Shenzhen Battsister Tech. Co., Ltd.

6.11.1 Profile

6.11.2 BMS Business

7. Chinese BMS Vendors (OEMs)

7.1 BYD

7.1.1 Profile

7.1.2 BMS Business

7.2 BAIC BJEV

7.2.1 Profile

7.2.2 BMS Business

7.3 Hangzhou Genwell-Power Co., Ltd.

7.3.1 Profile

7.3.2 BMS Business

8. Chinese BMS Vendors (Power Battery)

8.1 Beijing Pride New Energy Battery Technology Co., Ltd.

8.1.1 Profile

8.1.2 BMS Business

8.2 CATL

8.2.1 Profile

8.2.2 BMS Business

8.3 Hefei Guoxuan High-tech Power Energy Co., Ltd.

8.3.1 Profile

8.3.2 BMS Business

8.4 China Aviation Lithium Battery Co., Ltd.

8.4.1 Profile

8.4.2 BMS Business

8.5 Sunwoda Electronic Co., Ltd.

8.5.1 Profile

8.5.2 BMS Business

8.6 Winston Battery

8.6.1 Profile

8.6.2 BMS Products

9. Global BMS Chip Vendors

9.1 Analog Devices (USA)

9.1.1 Profile

9.1.2 Operation

9.1.3 Revenue Structure

9.1.4 Gross Margin

9.1.5 BMS Solutions

9.2 Texas Instruments (USA)

9.2.1 Profile

9.2.2 Operation

9.2.3 Revenue Structure

9.2.4 Gross Margin

9.2.5 Status Quo and Prospects of BMS Chip Business

9.3 Infineon (Germany)

9.3.1 Profile

9.3.2 Operation

9.3.3 Revenue Structure

9.3.4 Gross Margin

9.3.5 Status Quo and Prospects of BMS Chip Business

Power Battery System

Production Cost Breakdown of Power Battery System

BMS Cost Proportion of Battery System, 2018

Power Battery Pack System of Typical Battery Manufacturers

Major Participants of BMS Industry Chain

Downstream of BMS Industry Chain

Four Modules and Functions of BMS

MIIT’s Catalogue for the First 17 Batches of Models Exempt from Purchase Tax

Subsidy Standards for 10m+ Urban Public Bus Demonstration Promotion, 2009-2012

Subsidy Standards for Demonstration Promotion of Passenger Vehicles for Public Services and Lightweight Commercial Vehicles, 2009-2012

Subsidy Standards for Electric Passenger Vehicle in China, 2013-2015

Subsidy Standards for Electric Bus in China, 2013-2015

Subsidy Standards for Electric Passenger Vehicle (BEV & PHEV) in China, 2016

Subsidy Standards for Electric Bus (BEV &PHEV) in China, 2016

Subsidy Standards for Full-cell Vehicle in China, 2016

Requirements for Battery Electric Driving Mileage of New Energy Vehicles in China

Subsidy Standards for New Energy Bus, 2017

Subsidy Standards for New Energy Passenger Vehicle in China, 2017

Subsidy Standards for New Energy Truck and Special Vehicle in China, 2017

Promotion & Application Subsidy Standards for Full-cell Vehicle in China, 2017

Subsidy Standards for New Energy Passenger Cars in China, 2018

Subsidy Standards for New Energy Truck and Special Vehicle in China, 2018

Subsidy Standards for Electric Bus (BEV &PHEV) in China, 2018

Subsidy Standards for Full-cell Vehicle in China, 2018

Central Subsidy Standards for Electric Passenger Vehicle in China, 2013-2019

Central Subsidy Standards for New Energy Bus and Truck in China, 2013-2019

Subsidy Standards for Energy-saving and New Energy Buses under Operation, 2015-2019

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (First Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Second Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Third Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Fourth Batch)

China's Perfect Electric Vehicle Standard System

Newly Released National Standards on Power Battery, 2015

GB / T 31467 Power Battery System Standards

MOST Special-Program BMS Indicators for Performance Appraisal in 2017

General Flow (CARTAC) for Battery System Test

Charging Piles of Province-Level Administrative Regions, Apr 2018

Global Electric Passenger Car Sales Comparison (Major Countries or Regions), 2014-2017

Global Top 20 Electric Passenger Cars by Sales Volume, 2014-2017

China Top10 Electric Passenger Cars by Sales Volume, 2015-2017

Global New Energy Vehicle (EV & PHEV) Monthly Sales Volume, 2014-2017

Global Electric Passenger Car (EV & PHEV) Sales Volume, 2012-2020E

Power Battery Suppliers of 69 Foreign Mainstream New Energy Vehicle (EV&PHEV) Models, 2017

Global Automotive BMS Output Value by Type, 2013-2019E

Global Power Lithium Battery Output, 2013-2021E

Analysis of Active and Passive Equalization Technologies

Costs and Applications of Global BMS Active and Passive Balancing Technologies

BMS Management Frameworks Adopted by Global Mainstream Automobile Enterprises

Global Main Electric Vehicle Models and BMS Supported

Major Global BMS and Battery Suppliers for New Energy Vehicles

Global Electric Passenger Car (EV&PHEV) Sales Growth (units), 2018-2025E

Global Hybrid Electric Passenger Car (HEV) Sales Growth (units), 2018-2025E

Global Electric Passenger Car (EV&PHEV) BMS Market Size (USD bn), 2018-2025E

Global Hybrid Electric Passenger Car (HEV) BMS Market Size (USD bn), 2018-2025E

China's Vehicle Ownership, Output and Sales Volume, 2010- 2018E

China's Electric Vehicle Output and Sales Volume, 2010-2018Q1

Monthly Output of Electric Vehicles (Passenger Cars and Commercial Vehicles) in China, 2016-2017

China’s Sales Volume of Electric Passenger Cars (EV&PHEV), 2011-2020E

Output of Electric Bus (EV&PHEV) in China, 2011-2020E

Output of Battery Truck/Logistics Vehicle in China, 2013-2020E

China's BMS Market Size (by Passenger Car, Bus, Logistics Vehicle), 2013-2020E

China's New Energy Passenger Vehicle BMS Market Size by Product, 2020E

China’s BMS Market Size (by Passenger Car, Bus and Logistics Vehicle), 2016-2020E

Number of Vehicle Models Supported by BMS Companies, 2017

Number of Vehicle Models Supported by Battery Manufacturers Operating Their Own BMS Business

Number of Vehicle Models Supported by Third-party BMS Companies

Number of Vehicle Models Supported by Companies Adopting the Model of “BMS+PACK”

Number of Vehicle Models Supported by Automakers Operating Their Own BMS

Technical Parameter Comparison between Mainstream Chinese and Foreign BMS Suppliers

Comparison between Active and Passive Balancing Technologies

Balancing Technologies of Main BMS Vendors in China

Ranking of Electric Vehicle BMS Patents (by Company), 2016

Electric Passenger Car (EV&PHEV) Sales Growth in China (units), 2018-2025E

Electric Passenger Car (EV&PHEV) BMS Market Size in China (RMB bn), 2018-2025E

Electric Commercial Vehicle (EV&PHEV) Sales Growth in China (units), 2018-2025E

Electric Commercial Vehicle (EV&PHEV) BMS Market Size in China (RMB bn), 2018-2025E

Sales Structure of Denso’s Automotive Business, FY2014-FY2018

Sales of Denso’s Powertrain Equipment Division, FY2012-FY2018

Denso’s Sales Structure by Client, FY2016

Denso’s Sales Structure by Client, FY2017

Denso’s Sales Structure by Client, FY2018

Denso’s R & D Investment, FY2012-FY2018

Vehicle Models Supported by Denso's BMS

Calsonic’s Revenue and Net Income, FY2010-FY2017

Vehicle Models Supported by Calsonic Kansei's BMS, 2012-2018

48V Lithium-ion Battery Pack of Hitachi Automotive Systems for Mild Hybrid Vehicles

Specifications of 48V Lithium-ion Battery Pack for Mild Hybrid Vehicles

Revenue of Mitsubishi Electric by Business, FY2018

Kefico’s Revenue and Net Income, 2010-2017

Equity Structure of LG Chemical

LGC’s Operating Results, 2007-2017

LGC’s Revenue by Region, 2017

LGC’s Revenue by Product, 2017

Power Battery Business Framework of LG Chemical

BMS of LG Chemical

Power Lithium Batteries and BMS Technical Parameters of SKI

Tesla’s Revenue from Power System and Related Components, 2011-2017

Smart fortwo Electric Vehicles

Toyota’s RAV4 EV

Battery Pack Dismantling of Tesla Model S

Scalable BMS (s-BMS)

Integrated BMS (i-BMS)

British Tennant 500ZE

TMHE Electric Forklifts

ECOTRUCK7500 Electric Garbage Collection Trucks

Customers of Lithium Balance

Overview of Lithium Balance’s Agents in China

Hybrid Kinetic Group’s Battery Electric Buses Intalled with Lithium Balance BMS

Vecture's BMS

Vecture’s Development Planning for BMS

Vecture’s Battery Balancing BMS

Parameters of Vecture’s BMS

Application of Vecture's Products

Community Smart Grid Projects

‘Eve’ Project

Rimac’s R-BMS2

Rimac’s Concept_One

Application of Digi-Triumph’s BMS Products

Digi-Triumph’s BMS Products

Digi-Triumph’s Main Co-partners

Clayton BMS

Revenue and Net Income of Epower Electronics, 2011-2017

BMS Products of Epower Electronics

Some Partners of Epower Electronics

Operating Results of Klclear Technology, 2012-2017

BMS Revenue of Klclear Technology by Application, 2015-2017

Battery Electric Bus BMS

BMS Function Modules of Klclear Technology

BMS Solution of Klclear Technology

Some Partners of Klclear Technology

BMS Products and Functions of Klclear Technology

BMS Products of Klclear Technology

BMS Active Equalization Technology of Klclear Technology

Battery Assembly of JAC iEV5

Electronics Division and Products of Joyson Electronics

BMW’s i3BMS

Preh’s Revenue, 2010-2017

Preh’s Global Divisions

BMS of 48V Hybrid Power System

BF101 BMS

Waterproof Series (BC111/BS111/BS113/BS313)

Main Parameters of Guantuo Power’s BMS

BMS of GuanTuo Power

Some Customers of LIGOO New Energy Technology

EK-FT-12 Commercial Vehicle BMS (Enhanced)

LIGOO BMS (B3 Series) for Light Vehicle

LIGOO BMS (B5 Series) for Medium and Large Vehicle

LIGOO BMS (B1 Series) for Mine Vehicle

Major Customers of Ningbo Bate Technology

BMS of SAIC Roewe 750HEV

Main Parameters of Ningbo Bate Technology’s BMS

BMS- 200 LF of Ningbo Longway Electrical

BMS- 36 LF of Ningbo Longway Electrical

24V100AH Power Lithium BMS

BMS of Wuhu Tianyuan

Main Parameters of Wuhu Tianyuan’s BMS

BMS-108 Electric Vehicle Battery Management Series

Battsister’s Co-partners

BYD’s EV Sales Volume, 2011-2020E

Design of BYD’s Battery PACK and BMS

BMS Protection IC of BYD Microelectronics

Architecture of BESK’s Power Battery Pack

FBM-BMS Passive Balanced BMS of Hangzhou Genwell-Power

ABM-BMS Active Balanced BMS of Hangzhou Genwell-Power

Efficientcy and Service Life of Hangzhou Genwell-Power’s ABM-BMS

Major BMS Clients of Hangzhou Genwell-Power

Equity Structure of Beijing Pride New Energy Battery Technology, 2016

Equity Structure of Beijing Pride New Energy Battery Technology, 2017

Operation Results of Beijing Pride New Energy Battery Technology, 2011-2017

Revenue Contribution of Beijing Pride New Energy Battery Technology’s Top 5 Clients, 2015-2016

Customers and Cooperation Areas of Beijing Pride New Energy Battery Technology

CATL’s Operating Results, 2008-2017

Top 5 Customers of CATL, 2015-2017

BMS Product Parameter of CATL’s Electric Bus

BMS Product Parameter of CATL’s Electric Passenger Car

BMS Product Parameter of CATL’s Power Storage System

Business Performance of Hefei Guoxuan High-tech Power Energy, 2009-2017

Guoxuan’s High-tech BMS

R&D System of Guoxuan High-tech

Equity Structure of China Aviation Lithium Battery, 2017

Business Performance of China Aviation Lithium Battery, 2010-2017

Revenue and Net Income of Sunwoda Electronic, 2010-2017

Revenue Structure of Sunwoda Electronic by Product, 2017

Major Indicators of Sunwoda Electronic’s BMS

BMS Development Plan of Sunwoda Electronic

GTBMS005A-MC 11 Color-screen BMS

Solutions of Major Global BMS Chip Vendors

ADI’s Revenue and Gross Margin, 2007-2017

ADI’s Net Income and Net Profit Margin, 2007-2017

ADI’s Revenue by Product, 2007-2014

ADI’s Revenue (by Region), 2010-2017

ADI’s Revenue (by Industry), 2017

ADI’s Gross Margin Growth, 2008-2017

ADI’s HEV/ EV Lithium Battery Management Solutions (≤150 V)

ADI’s HEV/ EV Lithium Battery Management Solutions (≥300 V)

TI’s Revenue and Gross Margin, 2007-2017

TI’s Net Income and Net Profit Margin, 2007-2017

TI’s Revenue (by Product), 2007-2017

TI’s Revenue (by Region), 2010-2017

TI’s Gross Margin Growth, 2007-2017

Operating Margin of TI’s Main Products, 2008-2017

Overview of TI’s Battery Management Products

IT’s BMS Structure (Pure Hardware/Host Control)

TI’s Hybrid and Battery Electric Vehicle Solutions

TI’s BMS Solutions

TI’s BMS

IFX’s Revenue and Gross Margin, FY2009-FY2017

IFX’s Net Income and Net Profit Margin, FY2009-FY2017

IFX’s Revenue (by Division), FY2009-FY2017

IFX’s Revenue (by Region), FY2009-FY2017

IFX’s Gross Margin Growth, FY2009-FY2017

IFX’s Transformer Equalization Method-XC886

Revenue of IFX’s Automotive Electronics Division, FY2009-FY2017

Major Clients of IFX’s Automotive Electronics Division

IFX’s BMS Solutions

IFX’s Revenue in China, FY2009-FY2017

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...