Global automotive LiDAR sensor market was USD300 million in 2017, and is expected to reach USD1.4 billion in 2022 and soar to USD4.4 billion in 2027 in the wake of large-scale deployment of L4/5 private autonomous cars.

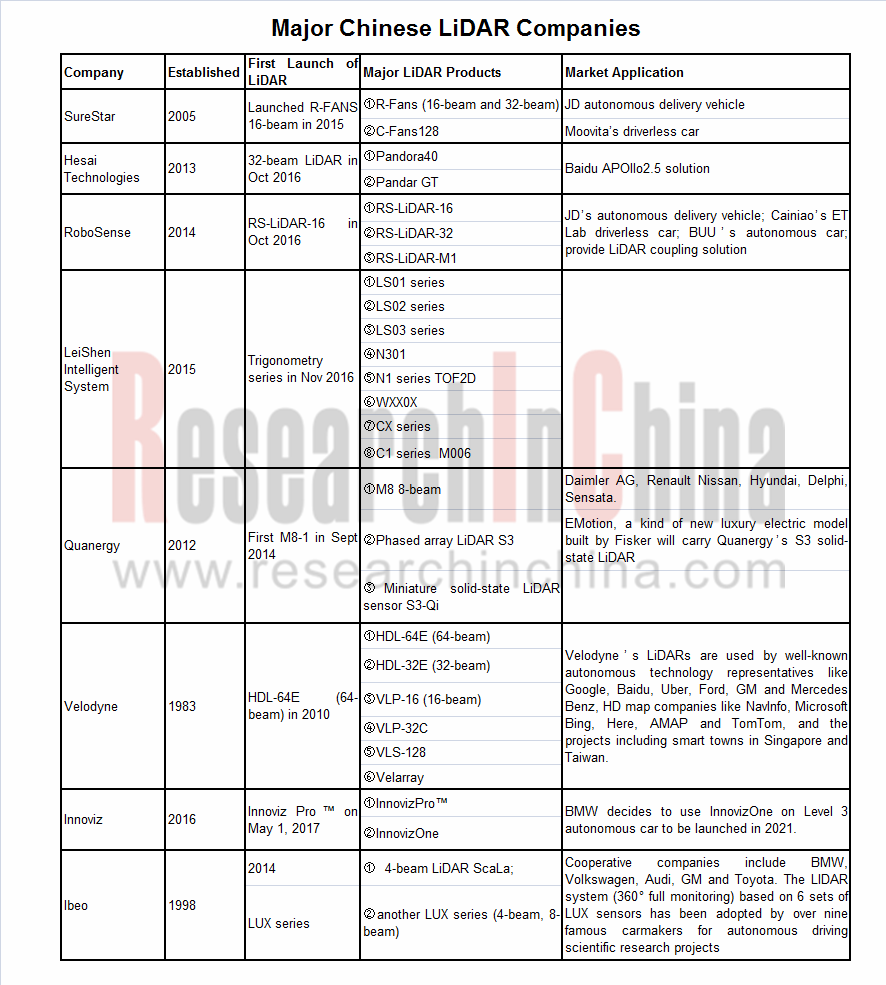

Being subject to autonomous driving technologies as well as laws and regulations, the autonomous driving companies has limited demand for LiDAR as yet. Mature LiDAR firms are mostly foreign ones, such as Valeo and Quanergy. Major companies that have placed LiDARs on prototype autonomous driving test cars are Velodyne, Ibeo, Luminar, Valeo and SICK. There are four firms that have already brought or plan to bring products to the market, specifically;

Continental SRL1: State-of-the-art LiDAR for Advanced Driver Assistance Systems, single-beam solid-state LiDAR, installed on Volvo XC60 and S60L;

Valeo SCALA Gen.1, mechanical 4-beam LiDAR, installed on Audi A8/A7/A6;

InnovizOne (MEMS solid-state LiDAR), will be installed on L3 autonomous car to be launched by BMW in 2021;

Quanergy S3 (OPA LiDAR), will be installed on new luxury electric model- Emotion built by Fisker.

Chinese LiDAR companies lag behind key foreign peers in terms of time of establishment and technology. LiDARs are primarily applied to autonomous logistic vehicles (JD and Cainiao) and self-driving test cars (driverless vehicles of Beijing Union University and Moovita). Baidu launched Pandora (co-developed with Hesai Technologies), the sensor integrating LiDAR and camera, in its Apollo 2.5 hardware solution.

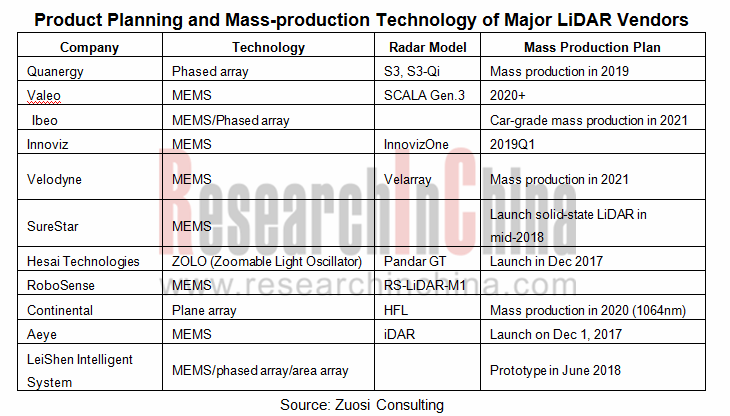

LiDAR will become smaller, solid-state and more cost-effective in the future. Solid-state LiDAR needs no rotating parts and hence is smaller and easily integrated in car body. Moreover, the reliability is improved and the costs can be reduced in great measure. So, the solid state of LiDAR will be an inevitable trend.

Most mainstream LiDAR vendors plan to launch solid-state radar around 2020, following technological routes of MEMS, OPA and Flash.

According to ADAS and autonomous driving plans of major OEMs, most of them will roll out SAE L3 models around 2020. Overseas OEMs: PAS SAE L3 (2020), Honda SAE L3 (2020), GM SAE L4 (2021+), Mercedes Benz SAE L3 (Mercedes Benz new-generation S in 2021), BMW SAE L3 (2021). Domestic OEMs: SAIC SAE L3 (2018-2020), FAW SAE L3 (2020), Changan SAE L3 (2020), Great Wall SAE L3 (2020), Geely SAE L3 (2020), and GAC SAE L3 (2020). The L3-and-above models with LiDAR are expected to share 10% of ADAS models in China in 2022. The figure will hit 50% in 2030.

Global and China In-vehicle LiDAR Industry Report, 2017-2022 focuses on the followings:

In-vehicle LiDAR market (status quo of application, market size forecast);

In-vehicle LiDAR market (status quo of application, market size forecast);

Leading in-vehicle LiDAR companies at home and abroad (development course, profile, financing, LiDAR products, product planning & technical direction, partners, etc.);

Leading in-vehicle LiDAR companies at home and abroad (development course, profile, financing, LiDAR products, product planning & technical direction, partners, etc.);

Trends of LiDAR Technologies and Costs.

Trends of LiDAR Technologies and Costs.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...