ADAS and Autonomous Driving Industry Chain Report 2018 (I) - Computing Platform and System Architecture

ADAS and Autonomous Driving Industry Chain Report 2018 (I) - Computing Platform and System Architecture underscores the followings:

Introduction to ADAS and autonomous driving;

Introduction to ADAS and autonomous driving;

ADAS and autonomous driving market forecast;

ADAS and autonomous driving market forecast;

ADAS and autonomous driving strategy of carmakers including Geely, GM, SAIC, Dongfeng, Great Wall, GAC, Chang’an, NIO, Xpeng and BYTON;

ADAS and autonomous driving strategy of carmakers including Geely, GM, SAIC, Dongfeng, Great Wall, GAC, Chang’an, NIO, Xpeng and BYTON;

Software architecture of ADAS and autonomous driving, including AUTOSAR Classic and Adaptive, ROS 2.0 and QNX;

Software architecture of ADAS and autonomous driving, including AUTOSAR Classic and Adaptive, ROS 2.0 and QNX;

Hardware architecture of ADAS and autonomous driving, including automotive Ethernet, TSN, Ethernet switch and gateway, and domain controller;

Hardware architecture of ADAS and autonomous driving, including automotive Ethernet, TSN, Ethernet switch and gateway, and domain controller;

Safety certification of ADAS and autonomous driving, including ISO26262 and AEC-Q100;

Safety certification of ADAS and autonomous driving, including ISO26262 and AEC-Q100;

Study into processor firms, including NXP, Renesas, Texas Instruments, Mobileye, Nvidia, Ambarella, Infineon and ARM.

Study into processor firms, including NXP, Renesas, Texas Instruments, Mobileye, Nvidia, Ambarella, Infineon and ARM.

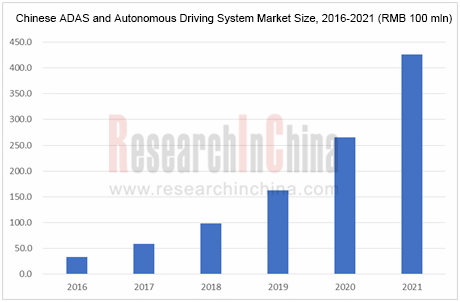

According to ResearchInChina, the Chinese ADAS and autonomous driving market was worth about RMB5.9 billion in 2017 and is expected to reach RMB42.6 billion in 2021 at an AAGR of 67% or so.

Automotive vision, MMW radar and ADAS are the market segments that develop first with the MMW radar market enjoying an impressive growth rate, closely followed by low-speed autonomous driving. While LiDAR, commercial-vehicle autonomous driving and passenger-car autonomous driving markets lag behind.

As the automobile enters an era of ADAS and autonomous driving, product iteration races up and lifecycle of products is shortened. The automotive market is far smaller than consumer electronics market but sees bigger difficulty in design and higher design and production costs than that in consumer electronics market. Thus automotive ADAS and autonomous driving processor is confronted with higher risks. Hence adequate financial and human resources are required to support the development of automotive ADAS and autonomous driving processors. Globally, only very a few enterprises like NXP and Renesas are capable of developing whole series of ADAS and autonomous driving processors.

With regard to safety certification, autonomous driving chips must attain ASIL B at least, a level only Renesas R-CAR H3 has reached for now. As GPU is a universal design and not car-dedicated design, it is hard to reach the certified safety level of ISO26262 from the point of design. The certification cycle of ASIL is up to two to four years.

Reliability, precision and functionality of stereo camera are well above that of mono camera, but as the stereo camera must use FPGA, it costs much. High costs restraint the application of the stereo camera only on luxury cars. However, with emergence of Renesas and NXP hardcore stereo processors, the stereo camera will be vastly used in ADAS and autonomous driving field, expanding from luxury models to mid-range ones.

With an explosive growth in data transmission, automotive Ethernet will become a standard configuration of the automobile, and Ethernet gateway or Ethernet switch is indispensable to autonomous driving.

Autosar will act as a standard configuration in ADAS and autonomous driving field.

CNN/DNN graphics machine leaning: GPU is most suitable when data is irrelevant to sequence. Nvidia GPU can be used in multiple fields except for automobile and finds shipments far higher than that of automotive ASIC, enjoying superiority in cost performance. TPU lifts speed and reduces power consumption (only 10% of that of GPU) at the expense of the precision of computation.

RNN/LSTM/reinforcement learning sequence-related machine learning: FPGA has distinct advantages, particularly in power consumption, consuming less than one-fifth of GPU under same performance. However, high-performance FPGA is incredibly costly. FPGA can also process graphics machine leaning and improve performance by reducing precision.

ASIC stands out by performance-to-power consumption ratio but has shortcomings of long development cycle, the highest development cost and the poorest flexibility. The unit price will be very high or firms will make losses if the shipments are small (at least annual shipments of 120 million units if 7-nanometer process is employed). Most ASICs for deep-learning graphics machine learning are similar to TPU.

Power consumption and cost performance are crucial in in-vehicle field. GPU is no doubt a winner in graphic machine learning. However, as algorithms are constantly improved, the ever low requirements on the precision of computation, and low power consumption will ensure a place of FPGA in graphics machine learning. FPGA has overwhelming advantages in sequence machine learning.

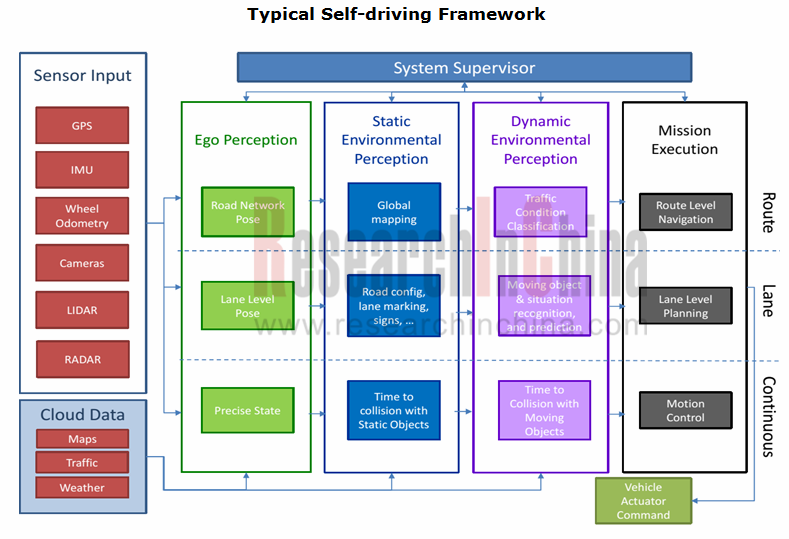

Autonomous driving can be divided into two types, one represented by Waymo, which has solved most of the problems concerning environmental perception and concentrates on behavior decision-making with computing architecture of CPU+FPGA (usually Intel Xeon 12-core and above CPU plus Altera or Xilinx’s FPGA; the other represented by Mobileye which has not solved all problems involving environmental perception and concentrates on it with computing architecture of CPU+GPU/ASIC.

CPU+GPU will be the mainstream in the short run, but CPU+FPGA/ASIC may dominate in the long term, largely due to continuous decline in the precision of computation of graphics because of improvement in algorithms and performance of sensors (LiDAR in particular), which is conducive to FPGA, while it is hardly for the power consumption of GPU to fall. It is easier for FPGA to meet car-grade requirements.

In chip contract manufacturing field, TSMC has won all 7-nanometer chip orders, including A12 exclusively provided for Apple, marking for the first time TSMC overtook Intel to become the vendor with the most advanced semiconductor manufacturing process, a must in the production of digital logic chip whose computing capability is underlined in AI autonomous driving.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...