ADAS and Autonomous Driving Industry Chain Report 2018 (III)– Automotive Radar

ADAS and Autonomous Driving Industry Chain Report 2018 – Automotive Radar at 284 pages in length highlights the followings:

Introduction to automotive radar

Automotive radar market size and forecast

Application trends of automotive MMW radar

Application trends of automotive LiDAR

Global automotive radar companies

Chinese automotive radar companies

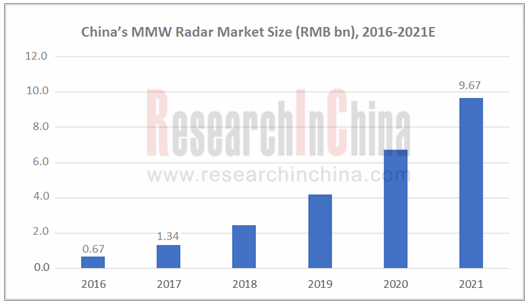

Automotive radars mainly fall into MMW radar, LiDAR and ultrasonic radar. According to the report, China’s MMW radar market size reached approximately RMB1.34 billion in 2017, a figure projected to hit RMB9.67 billion in 2021, with an AAGR of about 70.6% between 2016 and 2021.

LiDAR has been a favorite of capital market since 2017. But as things now stand, MMW radar is the fastest-growing market. The report suggests in the first five months of 2018, installment of OEM MMW radars for passenger cars in China reached as many as 1.406 million units, a year-on-year spurt of 112.7%.

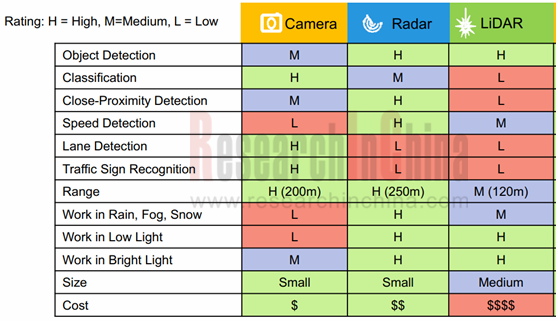

By comparing the three types of sensors in the chart below, MMW radar outperforms LiDAR synthetically at the present stage.

As concerns MMW radar market segments, 24GHz radar still prevails in shipment. In the early days, 24GHz radar was often used for short and mid-range detection, while 77GHz radar found its way into long-range detection. As the technology gets improved with lower cost and better performance, there is a tendency for 77GHz radar to replace 24GHz radar. The year 2017 saw shipments of 77GHz MMW radars for LCA/RCTA soar.

In terms of total volume, 24GHz side-looking short range radar (SRR) is now still the mainstream, for example, some OEMs like Mercedes-Benz and PSA which generally use forward-looking long range radars (LRR) also employ 24GHz radars, leaving such a type of radar with a rosy prospect in the short run; additionally, most new products of world-renowned suppliers including Bosch and Continental will have a frequency band of 76-77GHz. So it is expected that 77GHz radar will forereach 24GHz radar in market size around 2020.

Traditional tier1 suppliers such as Bosch, Continental and Hella still rule the roost in MMW radar market, taking the lion’s share of the market. Chinese MMW radar vendors foray into the OEM market in efforts to cooperate with home automakers though starting from the aftermarket.

Muniu Tech has received orders for tens of thousands of its radars from aftermarket. WHST Co., Ltd. has acquired OEM orders for its 24Ghz rear side radars from a Chinese auto brand -- Changfeng Leopaard. It is expected that at least ten new models in 2019 will utilize the MMW radars from WHST Co., Ltd.

LiDAR has been an innovation hotspot in autonomous driving area at home and abroad. Traditional auto giants and startups without exception invest more in LiDAR and stage mergers & acquisitions. As for technology, mechanical multi-beam LiDAR has been applied massively in self-driving prototype cars, but solid-state LiDAR is more applicable to mass production if used in automobiles, being a future development trend of radar.

In current stage, LiDAR still faces some challenges, for instance, uncertain technology roadmaps, high price and hard to meet automotive requirements. Meanwhile, the maturing technology, next-generation high precision MMW radar for imaging, will be a competitor of LiDAR.

LiDAR technology is and yet developing by leaps and bounds, increasingly incentivizing LiDAR suppliers. In 2018, Quanergy would produce LiDARs in its partner, Sensata’s plant in Changzhou City, Jiangsu Province, China, with capacity initially reaching estimated 10 million units and expectedly climbing to hundreds of millions of units to meet the rising market demand, said Louay Eldada, a co-founder and the CEO of Quanergy at the beginning of this year.

Apart from Quanergy, some Chinese LiDAR players like RoboSense, Surestar, Hesai and LeiShen Intelligent System also have constructed their own factories and are expanding capacity. LiDAR market is predicted to boom in 2021.

MMW radar and LiDAR each have merits and demerits in size, price, applied scene, imaging, ranging, positioning and object detection. Both of them fall short of requirements self-driving cars demand in perception of external environment. Fusion of radar and camera is a solution to acquisition of more accurate environment data and redundancy increase in a bid to secure ADAS and automated driving system’s stability and safety in full measure.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...