ADAS and Autonomous Driving Industry Chain Report 2018 (VII) - L4 Autonomous Driving Startups

ADAS and Autonomous Driving Industry Chain Report 2018 (VII) - L4 Autonomous Driving Startups at 205 pages in length focuses on researching L4 autonomous driving startups as well as HD map and V2X for L4 autonomous driving.

Of the report series (seven reports), the previous five introduce commercialized ADAS, vision, automotive radar, computing platform, system integration, and low-speed autonomous driving which is to be commercially available soon. The last two reports highlight eventually to-be-commercialized commercial vehicle automated driving and L4 passenger car autonomous driving, respectively.

There have long been two camps in the implementation path of automated driving: Camp A mainly comprised of European and Asian OEMs advocates a progressive path evolving from L2 and L3 to L4 and L5 step by step; Camp B represented by Google stands for a radical path going straight to L4 and above.

In 2018, Camp A believes more firmly that L3 cannot be avoided and L2.5 and L2.75 should be derived from between L2 and L3, and L3.5 from between L3 and L4. To secure the reliability of human and computer driving together, it becomes an important subject to monitor human driver.

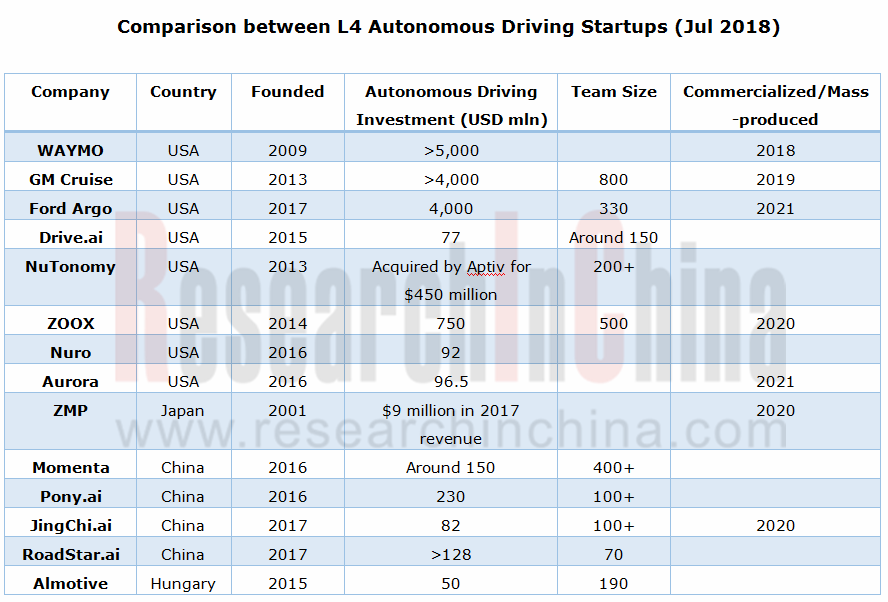

Camp B is more confident as well, as WAYMO sees its market capitalization climb to USD175 billion and tests tens of thousands of self-driving cars on roads.

The operational design domain (ODD) of WAYMO self-driving car is confined to just hundreds of square kilometers for the moment; L2-L3 self-driving cars at Camp A can travel on most roads. So the two camps will continue to live in peace with each other in the short run.

In July 2018, John Krafcik, WAYMO’s CEO, admitted that it would take a longer time than expected for the prevalence of autonomous vehicles.

There are at least four technical barriers needing to be surmounted in pushing ahead with L4 from designated scenarios to public roads: first, mass-production of powerful computing platforms; second, stronger sensing capabilities and lower cost of sensors; third, improvement of related technical standards; fourth, inadequate infrastructure. L4 automated driving start-ups will still depend on raised funds to survive in the next two to three years.

We have discussed computing platform and sensor in the previous reports. But L4 development will affect the existing landscape of sensor companies.

Considering too high sensor cost, WAYMO develops by itself all sensor systems it needs, including LiDAR. GM Crusie bought Strobe, a LiDAR company, and Ford Argo acquired Princeton Lightwave, a company engaged in LiDAR. WAYMO can cut 90% cost by developing LiDAR independently; GM Cruise indicates that it can use Strobe’s system to integrate all sensors into one chip, lowering LiDAR cost by 99%.

In addition to sensors, the automated driving leaders also design core computing chips themselves, for example, WAYMO, Tesla and Baidu are all developing their own AI-powered chips.

Singulato, an emerging Chinese automaker indicates that: conventional automotive design is a kind of separate design when it comes to intelligent driving capabilities, that is, separate data cannot be combined for multi-scenario application. In other words, a front ADAS company has a set of sensors of its own and another automated parking company also uses different sensors from others. They cannot share sensor data, which means the waste of resources. Singulato adopts integrated design at the beginning, using same sensors to implement more than a dozen of ADAS functions. And such design also makes subsequent OTA update easier.

Against the backdrop of growing integration, traditional ADAS and sensor companies need to rethink their market orientation in an era of L4.

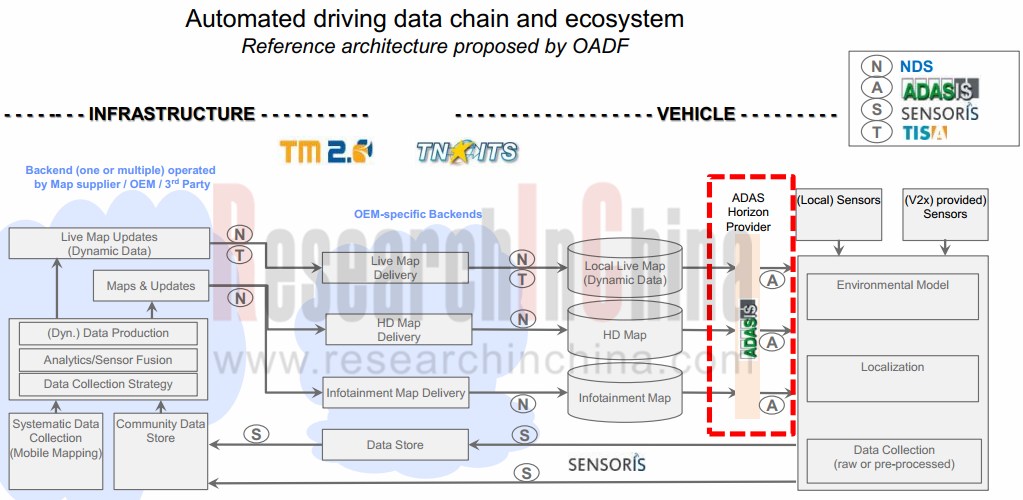

The number of sensors grows to a dozen and even dozens in the evolution from L2 to L4, generating a data traffic surge. Improvement in supporting facilities, mainly a better perception system, includes introduction of HD map and V2X, which also bring about massive data flow. Data confluence of various perception systems make acquisition, fusion and processing of autonomous driving data flow a focus in industrial competition and cooperation.

Absence of a universally accepted standard for acquisition and transmission of sensor (including HD map) data hinders the development of the industry. Hence, standards organizations like ADASIS, SENORIS, SIP-ADUS, CAICV HD MAP WG and ONEMAP have been initiated.

The year 2018 sees continued improvement in autonomous driving industry chain and influx of capital. As the market prospects of L4 become more visible, HD map and V2X, the auxiliaries of L4, are chased by enterprises and capital.

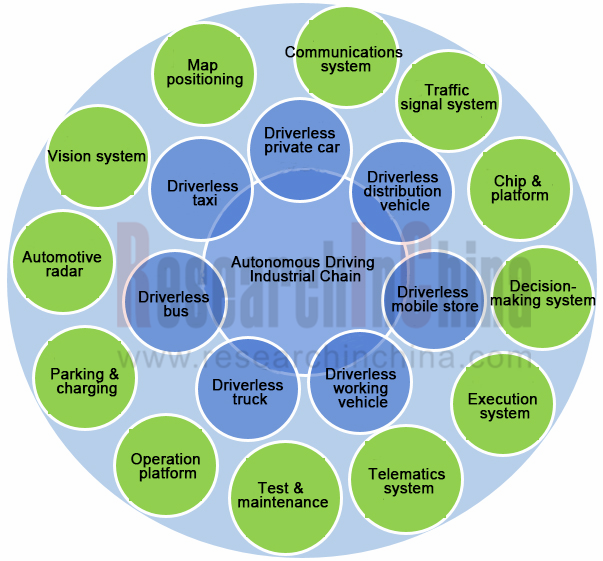

ResearchInChina tries to make an overall view of several hundreds of enterprises in autonomous driving industry and present a full picture of the industry via seven industrial-chain reports, 1,400 pages in total, whilst many problems are found, such as irrational layout, unclear orientation, disconnection from industrial chain, and lack of security policy.

As shown in the following diagram, the autonomous driving industry chain is so complicated that it’s a challenge for any enterprise to have a overall grasp of development trends.

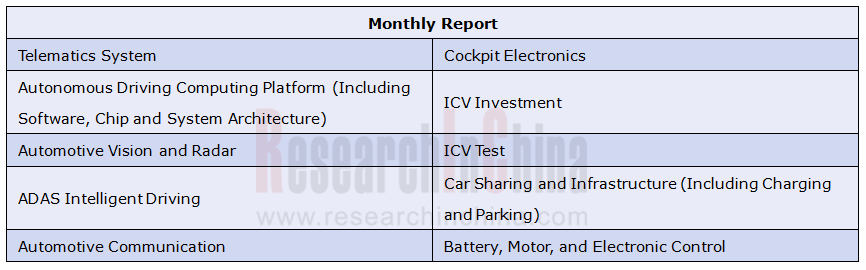

Dozens of times larger than the L2 market, the L4 market will take more than five years to grow mature in China. Tracking autonomous and ICV industry, ResearchInChina will release a weekly report every week and ten monthly reports every month, helping enterprises to see where the industry goes, take in competitive landscape, and seize opportunities in intelligent & connected and autonomous driving markets.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...