In the automotive sector, MLCC is generally used in power system, safety system, comfort system, entertainment system and so forth. That intelligent driving functions prevail in cars brings strong demand for MLCC. As the intelligentization, networking and electrification of vehicles is galloping, it is expected by industry insiders that MLCC use in cars will soar by folds. In the era of intelligent connected battery electric vehicle (BEV), a single vehicle requires as 6 times MLCCs as that for a current common internal combustion engine.

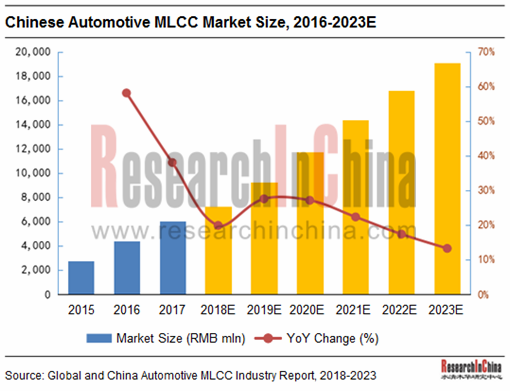

In recent years, electrification of cars is gathering momentum worldwide, and battery electric vehicle (BEV) output keeps soaring year after year, coupled with a steady rise in output of hybrids/PHEVs and smart fuel-efficient models as well as common internal combustion engines going intelligent, all of which serve as a spur to the demand for MLCC. As estimated, the Chinese market size of automotive MLCC will report RMB19.053 billion in 2023 (as compared with RMB6.044 billion in 2017), showing a CAGR of 21.1% between 2017 and 2023.

The well-known automotive MLCC vendors are mainly from Japan, South Korea, Europe & America, and Taiwan (China), of which Japanese companies consist of Murata, TDK, Taiyo Yuden, Kyocera, etc.; South Korean peer refers to Samsung Electro-Mechanics; and Taiwanese counterparts are Yageo and Walsin Technology.

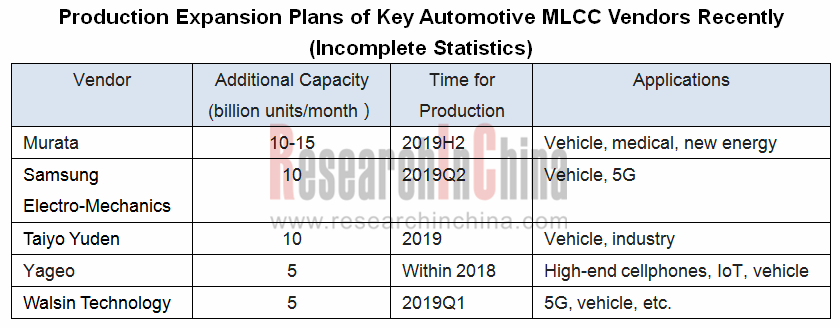

Currently, Murata is the vendor boasting the most market shares worldwide (29%; about 40% in the automotive MLCC market), with the production capacity of 960 billion units/year for the moment. Murata has slashed production of low-end MLCC and related delivery has drawn to an end over the past two years. In 2018, Murata invested $660 million for expanding production of MLCC for medical and automotive use and mass-production is anticipated in 2019.

Samsung Electro-Mechanics has sprung up and has been in the second place worldwide since it outperformed Japan-based TDK in 2009. Impacted by the explosion of Samsung NOTE7, Samsung Electro-Mechanics has tightened control on the quality of products and cut shipments over the recent years, while it planned to invest the additional 10 billion units/month MLCC for cars and 5G products.

TDK canceled product orders involving 700 million MLCCs in 360 models in 2017, and has transferred to focus on medium- and high-end products.

Chinese MLCC vendors has been developing apace over the recent years but are still engaged in supply for consumer electronics. Few companies like Fenghua Advanced Technology have rolled out the products in line with AEC-Q200 criterion. Due to weak strength, Chinese players are still hard to pose a threat to the MLCC giants from Japan, South Korea and Taiwan (China).

The report highlights the following:

MLCC industry overview (definition, classification, policies, etc.);

MLCC industry overview (definition, classification, policies, etc.);

Global and China MLCC markets (market size, production capacity, industrial chains, competitive landscape, etc.);

Global and China MLCC markets (market size, production capacity, industrial chains, competitive landscape, etc.);

Global and China automotive MLCC markets (market size, production capacity, competitive pattern, etc.);

Global and China automotive MLCC markets (market size, production capacity, competitive pattern, etc.);

Eleven automotive MLCC vendors including Murata, Samsung Electro-Mechanics, Kyocera, Taiyo Yuden, TDK, KEMET, Fenghua Advanced Technology, Walsin Technology, Yageo, HolyStone and Chemi-Con (profile, financials, hit products, R&D, manufacturing bases, technical features, etc.);

Eleven automotive MLCC vendors including Murata, Samsung Electro-Mechanics, Kyocera, Taiyo Yuden, TDK, KEMET, Fenghua Advanced Technology, Walsin Technology, Yageo, HolyStone and Chemi-Con (profile, financials, hit products, R&D, manufacturing bases, technical features, etc.);

Eight manufacturers in the upstream of MLCC, including Sakai Chemical Industry, Ferro, Prosperities Dielectrics, Shandong Sinocera Functional Material, Nippon Chemical Industrial, SHOEI, Sumitomo Metal Industries, and ESL.

Eight manufacturers in the upstream of MLCC, including Sakai Chemical Industry, Ferro, Prosperities Dielectrics, Shandong Sinocera Functional Material, Nippon Chemical Industrial, SHOEI, Sumitomo Metal Industries, and ESL.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...