China Electric Vehicle Drive Motor Industry Report, 2018-2022

-

Dec.2018

- Hard Copy

- USD

$3,200

-

- Pages:153

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

LT045

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

The Chinese market size of electric motors and motor controllers posted RMB20.2 billion in 2017 and is projected to approach RMB30 billion in 2020. The market will be expanding if the integrated electric drive solutions grow popular and the three including electric motor, reducer and motor controller are increasingly fused into one or if the N-to-1 integration of functions like electric motor, reducer, motor controller, DC/DC and power distribution unit is brought into a reality, at which the majority of electric motor and motor controller companies are attempting.

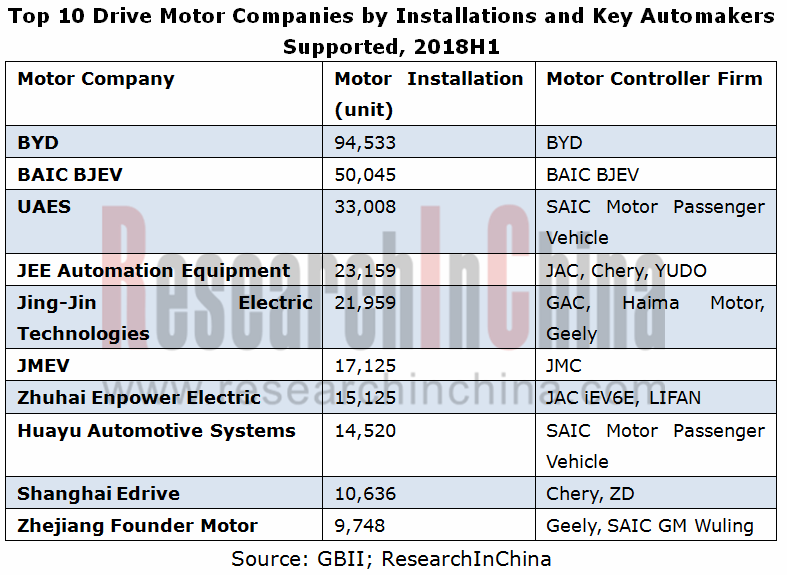

In the first half of 2018, a total of 405,000 electric motors were equipped by more than 160 suppliers to the new energy vehicle (NEV) in China. Despite there are numerous firms in the electric motor market for the moment, the electric motor market concentration is on a rapidly rise in 2018 judging from installations.

In the first half of 2018, the top ten players by motor shipments held a lion’s share of 71.53% together, a jump of 13.97 percentage points from the same period of 2017. Elaborately, the highest installation touched 94,500 units, while over 110 firms were each with motor shipment of less than 1,000 units. As the market concentration climbs, the gap between motor companies is broadening. Besides the automakers that supply electric motors by themselves, such competitors are growing advantageous, as United Automotive Electronic Systems (UAES), JEE Automation Equipment, Jing-Jin Electric Technologies, Shanghai Edrive, and Zhejiang Founder Motor.

Most Chinese electric motor and motor controller manufacturers have sprung up from the new energy commercial vehicle market with a low entry barrier and harboring numerous enterprises. While the market becomes concentrated and subsidies descend, the electric motor makers are confronted with the amounting pressure from the rising prices of raw materials and a fall in profits.

By types, permanent magnet synchronous motor plays a key part in the electric motor market, with its installations (mainly for passenger cars) finding a 78.4% share in all motor installations to new energy vehicle in China in 2017, asynchronous AC motor swept 21.5% by installations and got primarily utilized in commercial vehicle, and other types of electric motors seized 0.1% or so. Permanent magnet synchronous motor is currently the best choice for electric passenger cars and sees a burgeoning market share.

In general, competition between electric motor and motor controller suppliers will prick up and gross margin of products will be volatile as the subsidies for new energy vehicle are going down in the next a few years. In the medium term, the industrial pattern will remain unchanged in Chinese new energy vehicle market (key roleplaying by automakers as well as the battery, electric motor and motor controller producers as the suppliers of core components).

The report highlights the following:

Development of new energy vehicle (NEV) drive motor industry in China (including industrial chains, cost analysis, business model, competitive landscape and key players competing each other, and elaboration on competitive patterns of passenger vehicle and commercial vehicle drive motors), and analysis on status quo and development tendencies of drive motor technologies;

Development of new energy vehicle (NEV) drive motor industry in China (including industrial chains, cost analysis, business model, competitive landscape and key players competing each other, and elaboration on competitive patterns of passenger vehicle and commercial vehicle drive motors), and analysis on status quo and development tendencies of drive motor technologies;

22 Chinese and 6 global drive motor companies (operation, development strategy, supply chain, NEV drive motor business, etc.);

22 Chinese and 6 global drive motor companies (operation, development strategy, supply chain, NEV drive motor business, etc.);

New energy vehicle (NEV) drive motor industry (definition and classification of vehicle drive motors, analysis on upstream and downstream industry chains);

New energy vehicle (NEV) drive motor industry (definition and classification of vehicle drive motors, analysis on upstream and downstream industry chains);  Environments for industry operation (policy climate, NEV market development and impact to the vehicle drive motor industry).

Environments for industry operation (policy climate, NEV market development and impact to the vehicle drive motor industry).

1 Electric Vehicle (EV) Drive Motor Industry

1.1 Introduction to Drive Motor

1.2 Introduction to Drive Motor Controller

1.3 Applications of Drive Motor

1.3.1 Battery Electric Vehicle (BEV)

1.3.2 Hybrid Electric Vehicle (HEV)

2 China Electric Vehicle (EV) Industry

2.1 Policies

2.1.1 Policy on Fiscal Subsidies

2.1.2 Policy on Battery Recycling

2.1.3 Preferential Tax Policy

2.1.4 Production License Policy

2.2 EV Market

2.2.1 Global Market

2.2.2 Chinese Market

3 China Electric Vehicle (EV) Drive Motor Industry

3.1 Industrial Chain

3.2 Market Size

3.3 Major Manufacturers and Competition

3.3.1 Competitive Landscape

3.3.2 Competition in Passenger Vehicle Drive Motor

3.3.3 Competition in Bus Drive Motor

3.4 Technology Trends

3.4.1 Status Quo of Technologies

3.4.2 Trend – Permanent Magnetization

3.4.3 Trend -- Integration

3.4.4 Trend -- Digitalization

3.4.5 Trend – Hub Motor

3.4.6 Status Quo and Outlook of Electric Vehicle (EV) Hybrid Drive and Hybrid Braking Systems

4 Major Chinese Drive Motor Companies

4.1 Zhongshan Broad-Ocean Motor Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 Development Strategy

4.1.4 EV Motor Business

4.1.5 Investments in and Production Capacity of Drive Motor

4.2 Shanghai Edrive Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 Supply Chain

4.2.4 Drive Motors and Technologies

4.2.5 Investments in and Production Capacity of Drive Motor

4.3 Hunan CRRC Times Electric Vehicle Co., Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 Drive Motors

4.3.4 R&D

4.3.5 Investments in and Production Capacity of Drive Motor

4.4 Wanxiang Qianchao Co., Ltd.

4.4.1 Profile

4.4.2 Operation

4.4.3 EV Motor Business

4.5 Shanghai DAJUN Technologies

4.5.1 Profile

4.5.2 Operation

4.5.3 Supply Chain

4.5.4 Drive Motors

4.6 Jing-Jin Electric Technologies

4.6.1 Profile

4.6.2 Operation

4.6.3 EV Motor Business

4.7 Zhejiang Founder Motor

4.7.1 Profile

4.7.2 Operation

4.7.3 Supply Chain

4.7.4 Drive Motors

4.7.5 Investments in Drive Motor

4.7.6 Production Capacity of Drive Motor

4.8 Wolong Electric Group Co., Ltd.

4.8.1 Profile

4.8.2 Operation

4.8.3 EV Motor Business

4.9 Xinzhi Motor Co., Ltd.

4.9.1 Profile

4.9.2Operation

4.9.3 EV Motor Business

4.10Jiangxi Special Electric Motor Co., Ltd. (JSMC)

4.10.1 Profile

4.10.2 Operation

4.10.3 EV Motor Business

4.11 China Tex Mechanical & Electrical Engineering Ltd.

4.11.1 Profile

4.11.2Operation

4.11.3 EV Motor Business

4.12 Zhejiang Unite Motor Co., Ltd.

4.12.1 Profile

4.12.2Operation

4.12.3 EV Motor Business

4.13 Others

4.13.1 Dalian Motor Group Co., Ltd.

4.13.2 Shenzhen Greatland Electrics Inc.

4.13.3 United Automotive Electronic Systems Co.,Ltd. (UAES)

4.13.4 Shandong Lanji New Energy Vehicle Co., Ltd.

4.13.5 HUAYU Automotive Systems Co., Ltd.

4.13.6 Jiangsu Weiteli Motor Limited By Share Ltd.

4.13.7 Wuxi Myway Electronic Technologies Co., Ltd.

4.13.8 Shanghai Yingshuang Electric Machinery Co., Ltd

4.13.9 Jinzhou Halla Electrical Equipment Co., Ltd.

5 Global Drive Motor Companies

5.1 Robert Bosch

5.1.1 Profile

5.1.2 Operation

5.1.3 EV Motor Business

5.2 ZF Friedrichshafen AG

5.2.1 Profile

5.2.2Operation

5.2.3 EV Motor Business

5.3 Continental AG

5.3.1 Profile

5.3.2Operation

5.3.3 EV Motor Business

5.4 Aisin AW

5.4.1 Profile

5.4.2Operation

5.4.3 EV Motor Business

5.5 MOBIS

5.5.1 Profile

5.5.2Operation

5.5.3 EV Motor Business

5.6 AC Propulsion (ACP)

5.6.1 Profile

5.6.2 EV Motor Business

5.7 SIEMENS

5.7.1 Profile

5.7.2Operation

5.7.3 EV Motor Business

Composition of Drive Motor’s Driving System

Comparison of Parameters between EV Drive Motor and Conventional Motors

Classification of EV Drive Motor

Technical Features of EV Drive Motors by Type

Parameters of EV Drive Motors by Type

Block Diagram of Drive Motor Controller

Control Strategies and Current Application of Drive Motors by Type

Structure of BEV Drive Motor System

Working Principle and Application of HEV Drive Motor System

Structure of MHEV Drive Motor System

Structure of Range-extended Power System

Drive Motor System of BYD Tang PHEV

Dual-motor Hybrid Engine of Toyota Prius

China’s New Energy Passenger Car Subsidy Standards, 2018

Comparison of Subsidy Standards among Electric Buses in China (Central Finance), 2018

Monthly Sales of NEVs (EV&PHEV) Worldwide, 2014-2018

Ranking of Global NEV Enterprises by Sales, Jan-Sept 2018

Sales of Electric Passenger Cars (EV&PHEV) Worldwide, 2014-2022E

Production and Sales of EVs in China, 2011-2018.1-9

Monthly Production of EVs (Special Vehicles & Commercial Vehicles) in China, 2016-2017

China’s Production of Electric Buses, 2016-2017

China’s Production of Battery Electric Trucks, 2015-2017

Market Share of Battery Electric Passenger Car Enterprises in China, 2018.1-9

Monthly Sales of Electric Passenger Cars in China, 2017-2018.1-9

Ranking of New Energy Passenger Car Sales in China by Auto Model, Jan-Sep 2018

Sales of New Energy Passenger Car (EV&PHEV) Enterprises in China, 2016-2018(Jan.-Sept.)

Price Structure of Permanent Magnet Synchronous Drive Motor

Cost Structure of Motor Controller

Global Automotive Drive Motor/Inverter Market Size, 2015-2030E

Global BEV Drive Motor Market Size, 2015-2030E

China’s EV Drive Motor System Market Size, 2014-2020E

China’s New Energy Vehicle Drive Motor Shipments, 2013-2018H1

Main Types of Drive Motor and System Enterprises

Installations of Top10 Drive Motor Manufacturers and Top10 Controller Manufacturers, 2017

Automakers and Vehicle Models Backed by Top10 Drive Motor Manufacturers (Excluding OEMs), 2017

Installations and Supported Automakers of Top10 Drive Motor Manufacturers, 2018H1

Main Drive Motor and Controller Manufacturers in China

Seven Supply Modes of Motor and Controller Manufacturers in China

Motor Controller IGBT Manufacturers Worldwide

Motor Industry Distribution and Supply Relationship

Types of Motors Adopted by China-made Battery Electric Passenger Cars, 2017

Types of Motors Adopted by China-made Battery Electric Passenger Cars, 2015

Supply Relationship between Major Electric Bus Drive Motors and Controllers in China

Drive Comparison between Centralized and Hub Motors

Structure of Electric Drive Systems of Top10 Best-selling EVs Worldwide, 2016H1

Special Plan for China Electric Vehicle Industry during the 12th Fiver-year Plan Period (2011-2015)

Methods and Effects of Motor and Controller Integration

BorgWarner (Left) and ZF (Right)’s Drive Motor and Single-stage Reducer Integration

Digitalization of Motor Control System

IGBT Technology Roadmap

Block Diagram of Driving System of Hub Motor with Inner Rotor Structure

Hub Motor Applicable to Various New Energy Vehicle Models

Operation of Zhongshan Broad-Ocean Motor, 2014-2018Q3

Revenue Structure of Zhongshan Broad-Ocean Motor (by Sector), 2018H1

Revenue Structure of Zhongshan Broad-Ocean Motor (by Region), 2013-2018H1

Gross Margin of Zhongshan Broad-Ocean Motor, 2012-2018H1

Gross Margin of Zhongshan Broad-Ocean Motor (by Product), 2014-2018H1

Ten-year Development Strategy of Zhongshan Broad-Ocean Motor

Ten-year Development Strategy and Executors of Zhongshan Broad-Ocean Motor

Production and Sales of New Energy Vehicle Powertrains of Zhongshan Broad-Ocean Motor, 2014-2017

Major Subsidiaries of Zhongshan Broad-Ocean Motor

Equity Structure of Shanghai Edrive (before Acquisition)

Capacity and Sales of Drive Motor System of Shanghai Edrive, 2013-2017

Operating Results of Shanghai Edrive, 2009-2018H1

Types and Parameters of Drive Motor System of Shanghai Edrive

Dimensions and Appearance of Drive Motor System of Shanghai Edrive

Ranking by Monthly Sales of Public Buses, 2017

Types and Parameters of Drive Motors Made by Hunan CRRC Times Electric Vehicle

Revenue and Net Income of Wanxiang Qianchao, 2013-2018H1

Revenue Structure of Wanxiang Qianchao (by Product), 2013-2018H1

Revenue Breakdown of Wanxiang Qianchao (by Product), 2011-2016H1

Revenue Structure of Wanxiang Qianchao (by Region), 2011-2016H1

Wanxiang Qianchao’s Revenue from Top 5 Customers, 2015

Gross Margin of Wanxiang Qianchao, 2012-2016H1

Gross Margin of Wanxiang Qianchao (by Product), 2011-2016H1

Operating Performance of Shanghai DAJUN Technologies, 2012-2017

Major Customers of Shanghai DAJUN Technologies

Drive Motor Product System of Shanghai DAJUN Technologies

Parameters and Application of Drive Motor s of Shanghai DAJUN Technologies

Specifications of Drive Motors Made by JJE

ISG Hybrid - Maintenance-Free Plug-In Hybrid System of JJE

EMAT Drive Assembly of JJE

Revenue and Net Income of Zhejiang Founder Motor, 2012-2018Q1-Q3

Revenue of Zhejiang Founder Motor (by Product), 2014-2018H1

Revenue Structure of Zhejiang Founder Motor (by Region), 2012-2018H1

Gross Margin of Zhejiang Founder Motor, 2012-2018H1

Framework and Layout in EV Drive Control Field

Revenue and Net Income of Wolong Electric Group, 2011-2018Q1-Q3

R&D Expenditure of Wolong Electric Group, 2011-2018H1

Revenue Structure of Wolong Electric Group (by Product), 2011-2017

Revenue Structure of Wolong Electric Group (by Region), 2012-2017

Gross Margin of Wolong Electric Group, 2011-2018 H1

Gross Margin of Wolong Electric Group (by Product), 2011-2017

Revenue and Net Income of Xinzhi Motor, 2012-2018

Revenue Structure of Xinzhi Motor (by Product), 2015-2018H1

Revenue Structure of Xinzhi Motor (by Region), 2011-2016H1

Xinzhi Motor’s Revenue from Top 5 Customers, 2015

Gross Margin of Xinzhi Motor, 2011-2018H1

Gross Margin of Xinzhi Motor (by Product), 2015-2018H1

Revenue and Net Income of Jiangxi Special Electric Motor, 2011-2018Q1-Q3

Revenue Structure of Jiangxi Special Electric Motor (by Product), 2018H1

Revenue Structure of Jiangxi Special Electric Motor (by Region), 2013-2018H1

Gross Margin of Jiangxi Special Electric Motor, 2012-2018Q1-Q3

Gross Margin of Jiangxi Special Electric Motor (by Product), 2015-2016H1

Jiangxi Special Electric Motor’s Subsidiaries Involved in EV Business

Drive Motor R&D of Jiangxi Special Electric Motor

Specifications of EV SRD Motor Made by China Tex MEE

Revenue and Net Income of Bosch, 2013-2017

R&D Expenditure of Bosch, 2013-2017

Revenue Structure of Bosch (by Business), 2017

Revenue of ZF Friedrichshafen AG (by Business), 2016-2017

R&D Expenditure of ZF Friedrichshafen AG, 2013-2017

Revenue of ZF Friedrichshafen AG (by Region), 2016-2017

Revenue of Continental AG, 2016-2018Q3

Revenue Structure of Continental AG (by Division), 2017

Revenue and Operating Income of Aisin AW, FY2015-FY2018

Revenue Structure of Aisin AW (by Division) and Aisin AW’s Revenue from Main Customers, FY2017-FY2018

Revenue Structure of Aisin AW (by Region), FY2018

Revenue and Net Income of Hyundai Mobis, 2017-2018H1

Order Analysis of Hyundai Mobis, 2018H1

Customers and Product Progress of Hyundai Mobis, 2018H1

Profit, Assets and Liabilities of Siemens, FY2014-FY2018

Specifications and Appearance of Passenger Car Drive Motor of Siemens

Composition of Commercial Vehicle ELFA Drive System of Siemens

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...