Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019

Automated parking system (APS) or automated parking assistant (APA) can measure the distance and angle between vehicle body and surroundings, collect sensor data to work out operation flow whilst automatically tuning the steering wheel, brake and throttle to pull into the parking space. Automated parking system can be divided by technical grades into semi-automatic parking (automatic steering only), fully automated parking (inclusive of automatic steering and automatic forwarding & reversing), autonomous valet parking (AVP), among others.

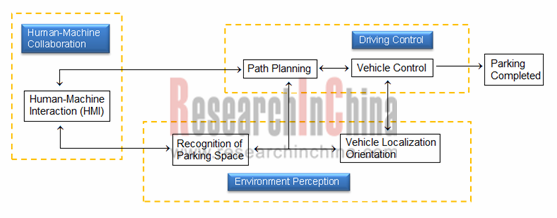

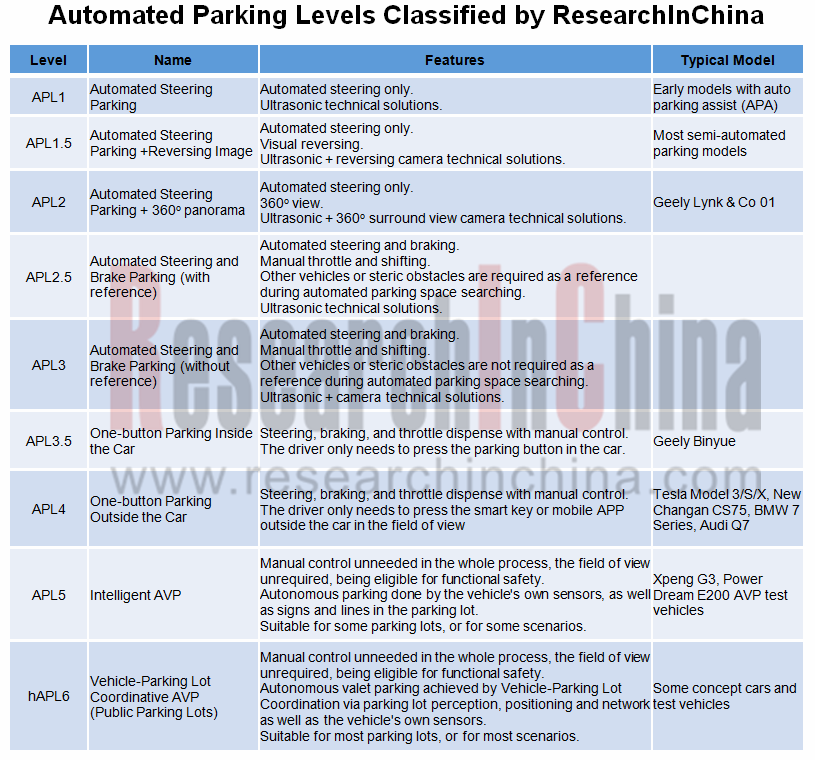

Automated parking system is generally composed of environment perception system, central control system (path planning system) and execution system (vehicle control system). Taking the diversity of automated parking systems into account, ResearchInChina recently rolled out the Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019 where all automated parking systems are classified into nine levels including APL1, APL1.5, APL2, APL2.5, APL3, APL3.5, APL4, APL5 and APL6. (See the table below)

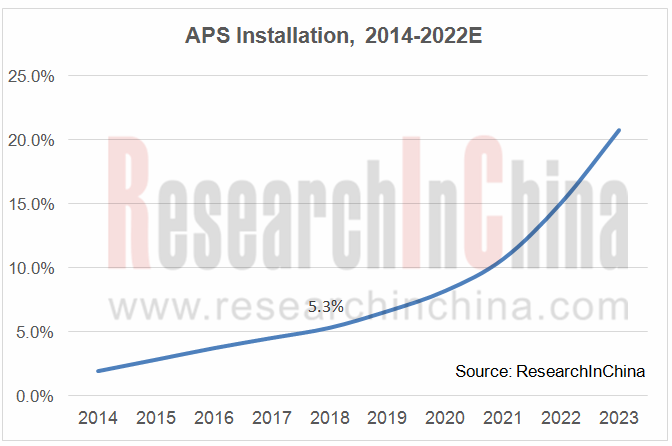

According to ResearchInChina, the APS configuration rate of passenger vehicles in Chinese market was 5.3% in 2018, a not high figure due to technical immaturity shown as follows:

In the mass-produced vehicle models with APS, the automated parking system still desires to be improved in real experience and is faced with system recognition error and the occurrence of scratches.

Most APS renders ultrasonic sensors for monitoring parking spaces, but ultrasonic sensors are vulnerable to surface stains & defects, raindrops, ice, snow, etc., and thus fail to be brought into full play.

Recognition of parking space and the process of automated parking are subject to environmental factors. The currently mass-produced APS system, for example, usually cannot recognize well lids, pits or loose kerbs, tiny objects on the parking space, among others.

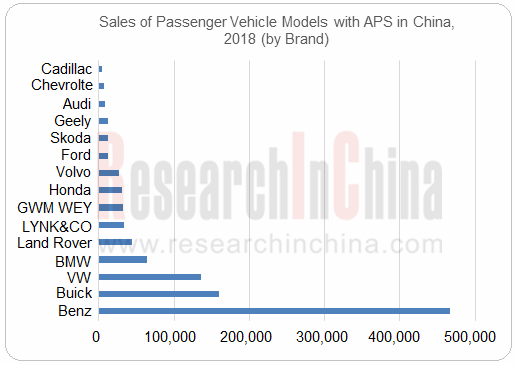

The current best-selling models with APS function are primarily from foreign automakers like Benz, Buick, Volkswagen, BMW and Land Rover as well as China-made premium brands LYNK&CO, Great Wall Motor’s WEY, etc.

As automotive intelligence technologies and sensor technologies in particular are developing apace, OEMs are beginning to apply more sensors in the automated parking system, facilitating maturity of the APS technologies. Automated parking has already been a highlight of new car sales.

Geely SUV Binyue is one of the five most successful new cars in Chinese market in 2018. It debuted on October 31, 2018, with the sales outnumbering ten thousand units and reaching 10,100 units in the first month of launch, 13,222 units in December 2018 and 14,627 units in January 2019. Binyue is provided with fully automated parking system that enables horizontal pull-in, vertical pull-in as well as horizontal pull-out by only a key-touch whilst the driver does not have any control on steering wheel, throttle and brake. Binyue has the automated parking level APL3.5.

CS75 (the hit model of Changan Automobile) has the APA4.0 parking system which enable a man standing outside the car to realize one-key parking. Only a touch on the automated parking button is needed, the car can search the tailgate automatically, and performs operations such as forwarding, reversing and wheel steering. The entire parking process needs no driver engagement. CS75 has an automated parking level at APL4.

BAIC plans to have the majority of its vehicle models be equipped with the automated parking technologies from July 2019.

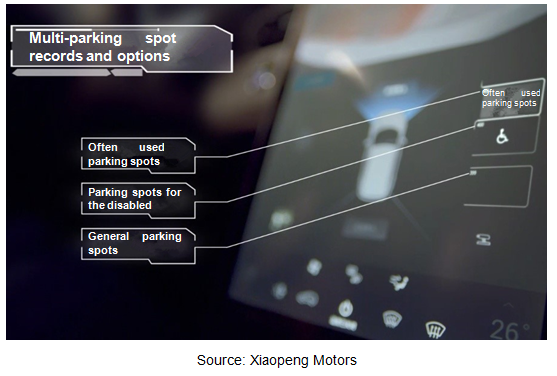

Among emerging car manufacturers, Xiaopeng Motors focuses on automatic parking. Xpeng G3 carries 20 environmental sensors including 12 ultrasonic sensors, 5 vision sensors and 3 radars. That XPENG uses numerous sensor systems to make parking spaces recognized more accurately and lift probability of success in parking is an effective solution to the problems of low parking space recognition and many unsuccessful parking cases, adding more automatic parking capabilities. Xiaopeng says that success rate of its car automatic parking system exceeds 70% compared with less than 5% in general automatic parking and Tesla’s 13%.

As automatic parking technology grows mature and OEMs invest more in APS, installation of such a system will soar from 2020 after years of slow increase, expectedly outstripping 20% in 2023.

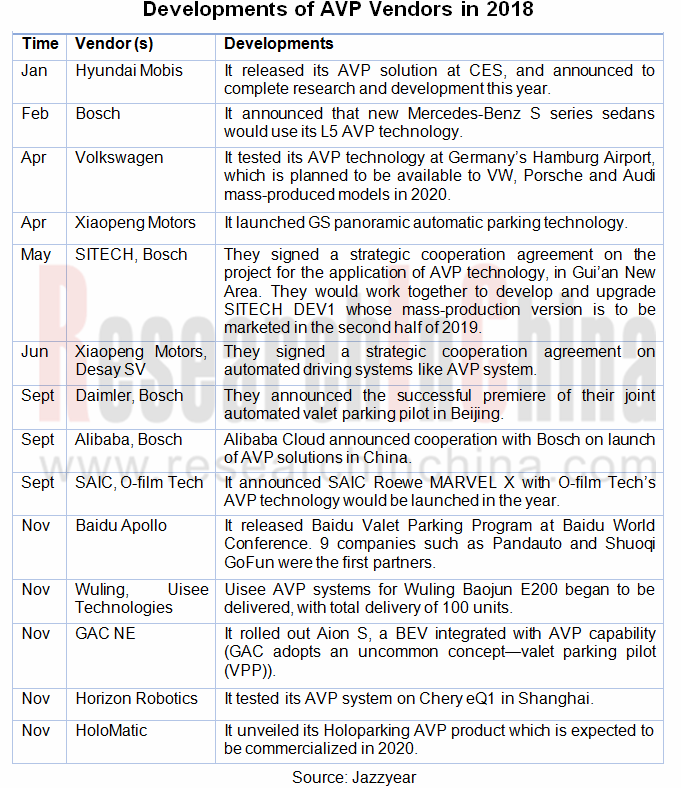

Traditional automakers follow an upgrading automated parking technology roadmap in ToC market, while Tier1 suppliers, technology firms and start-ups also have made an attempt to deploy automated valet parking (AVP) pilot projects at one go in ToB market.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...