ADAS and Autonomous Driving Industry Chain Report 2018-2019 -- Automotive Vision

Vision sensor, a key sensor for ADAS and autonomous driving was galloping ahead in the past year along with the relentless march of LiDAR and radar technologies.

Automotive camera is just tending to pack network clustering, night vision, inward-looking and 3D capabilities.

Network Clustering

In 2018 Continental AG launched MFC500, its fifth-generation automotive camera with image resolution of 1-to-8 megapixels. Continental projects to mass-produce it in 2020. The camera is interlinked with the environment: by connecting it to the electronic horizon (‘eHorizon’) and ‘Road Database’, road information and landmarks can be transmitted to and received from the cloud to locate the vehicle and enable proactive driving.

Bosch third-generation camera with a detection range of 150 meters will go into mass production in 2019. Bosch will also build an automotive camera perception network among its OEM customers worldwide through “Bosch Road Signature” (a crowd-sourced localization service that enables automated vehicles to determine their exact position).

What Bosch and Continental have done is identical with Mobileye’s autonomous driving roadmap.

But Mobileye has set about putting its technology into practical use when its peers are still working on development. Mobileye Aftermarket announced a raft of partnerships and collaborations with ride-hailing leaders, municipalities and governmental agencies that will enable the mapping of city streets around the world, including London and New York, through the deployment of Mobileye 8 Connect? in thousands of ride-hailing vehicles. From early 2019 on, the fleets equipped with Mobileye 8 Connect will harvest valuable information on city streets and infrastructure to create high-definition crowd-sourced maps through Mobileye’s Road Experience Management (REM) – a critical enabler of full autonomy.

Mobileye has partnered with BMW, Nissan and Volkswagen that collectively had two million cars with EyeQ4 system-on-chips collecting road data in 2018. In Japan, Mobileye collaborated with Zenrin and Nissan on using REM technology to collect data of all highways in the country. Mobileye and its Chinese partners like SAIC, Great Wall Motor and NIO work together to push on REM program.

There is reason to believe that Chinese IT giants will follow suit. Examples include Alibaba striving to develop cooperative vehicle infrastructure system (CVIS), Hikvision that enjoys superiorities in camera field and invests Wuhu Sensorthch Intelligent Technology Co., Ltd., a radar firm, and Tus-Holdings Co., Ltd which acquired Suzhou INVO Automotive Electronics Co., Ltd., a developer of ADAS. These players grab some first-mover advantage in vehicle-to-infrastructure (V2I) camera-based network clustering perception system.

Inward-looking: half of vision-based ADAS firms are developing DMS

Driver monitoring systems (DMS) is largely needed by commercial vehicle ADAS and will be a standard configuration for future L3 passenger cars. Half of vision-based ADAS companies are developing DMS, including EyeSight, Shenzhen Autocruis Technology Co., Ltd., Roadefend Vision Technology (Shanghai) Co., Ltd., Whetron Electronics Co., Ltd., Wuhan JIMU Intelligent Technology Co., Ltd., Minieye, Beijing Smarter Eye Technology Co., Ltd. and Black Sesame Technologies.

EyeSight, an Israeli start-up founded in 2005, provides driver monitoring, gesture recognition and user perception and analysis technologies. Its software-based automotive sensing solutions need support from infrared (IR) or time of flight (TOF) sensors.

Black Sesame Technologies has developed in-vehicle monitoring systems with capabilities of face recognition-based driver authority authentication, driver fatigue monitoring, bad driving behavior monitoring and occupant monitoring.

In February 2019 Shanghai Baolong Automotive Corporation released a range of automotive sensor products from dynamic vision sensor, 77G/24G radar, stereo forward-looking system, infrared thermal imager for night vision and diver warning system to face recognition system.

Night Vision

Continental AG rolled out MFC500, a fifth-generation automotive camera capable of night vision.

In 2018 Denso developed a new vision sensor which improves vehicle’s night vision by using a solid-state imaging device and unique lenses specifically designed for low-light conditions.

In 2018 Israel-based Foresight unveiled its QuadSight? quad-camera vision system. Using four-camera technology that combines two pairs of stereoscopic infrared and visible-light cameras, the system is designed to achieve near 100% obstacle detection with near zero false alerts in any weather or light conditions (including complete darkness, rain, haze, fog and glare).

3D Trend

3D sensing is now one of the key development orientations of camera technology.

AMS and Sunny Optical announced in November 2017 a joint plan to develop 3D sensing solutions for mobile devices and automotive application.

ZF is developing a kind of three-dimension interior observation system (3D IOS) that can detect occupants in a car and classify them to ascertain their sizes and positions as well as whether the occupant is manipulating the car willingly or monitoring the autonomous driving system.

Magna and Renesas collaborate in fusion of Magna’s eyeris? 3D surround-view camera system with the latter’s SoC (system-on-a-chip) to develop a more cost-effective 3D surround-view system especially for entry-level and mid-range cars.

Naturally, automotive 3D sensing not only relies on cameras but also takes advantage of either radar or LiDAR for 3D imaging. It is through using radar that Vayyar Imaging brings 3D imaging into a reality.

Vayyar Imaging announced in May 2018 to roll out millimeter wave 3D imaging system used chip. Vayyar’s 3D sensor can be utilized for obstacle detection, classification and simultaneous localization and mapping (SLAM). The embedded 3D sensor of Vayyar can scan the internal environment inside the car in real time and offer real-time imaging. Alerts will be sent to the drowsy driver through monitoring the vital signs of the occupant inside the car, or the guardian will be warned if the children and pets get off the car.

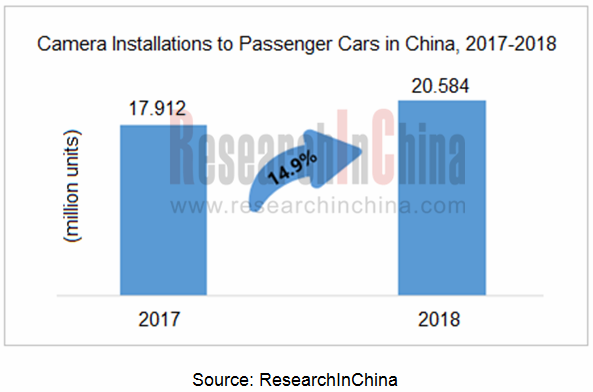

In 2018, the OEM installations of cameras (inclusive of front view, rear view, side view, interior view, surround view, driving recorder camera, among others.) to passenger car reached 20.584 million units with a year-on-year surge of 14.9%, of which front camera soared 28% YoY, surround-view camera shot up by 30.1% YoY, and stereo camera skyrocketed 170.3% YoY, according to ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Vision by ResearchInChina.

ADAS and Autonomous Driving Industry Chain Report, 2018-2019 of ResearchInChina covers following 17 reports:

1)Global Autonomous Driving Simulation and Virtual Test Industry Chain Report, 2018-2019

2)China Car Timeshare Rental and Autonomous Driving Report, 2018-2019

3)Report on Emerging Automakers in China, 2018-2019

4)Global and China HD Map Industry Report, 2018-2019

5)Global and China Automotive Domain Control Unit (DCU) Industry Report, 2018-2019

6)Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019

7)Cooperative Vehicle Infrastructure System (CVIS) and Vehicle to Everything (V2X) Industry Report, 2018-2019

8)Autonomous Driving High-precision Positioning Industry Report, 2018-2019

9)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Processor

10)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Lidar

11)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Radar

12)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Vision

13)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Passenger Car Makers

14)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– System Integrators

15)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Commercial Vehicle Automated Driving

16)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Low-speed Autonomous Vehicle

17)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– L4 Autonomous Driving

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...