OEM ADAS and Autonomous Driving Strategy Research: At least Billions of Dollars and Thousands of Software Engineers are Required.

The new trends “electrification, networking, intelligence and sharing” led by autonomous driving are disrupting the traditional automotive industry.

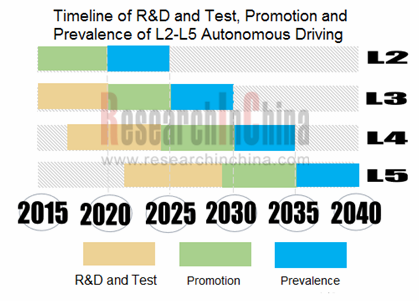

Yet, barriers to L4 and above autonomous driving are so high that no one can image. WAYMO that has spent over a decade and billions of dollars on the technology, has slowed its pace of commercialization even if being far ahead of its rivals, and has admitted that the fully automated driving will take time. As Waymo CEO John Krafcik said in late 2018, though driverless cars are “truly here”, they aren’t ubiquitous yet and autonomy always will have some constraints for decades to come.

Source: ResearchInChina

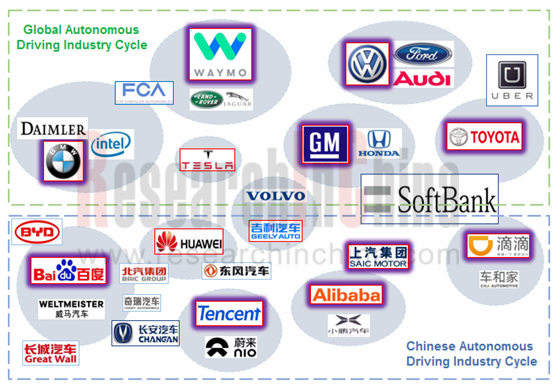

This means that autonomous driving costs too much and those who shell out for it will face long-term loss. To cope with the challenges posed by Waymo, traditional OEMs are forming alliances. Examples include the partnership among Daimler, BMW and Intel (Mobileye) and the collaborations between GM and Honda, VW and Ford.

Source: ResearchInChina

Typical leagues in China embrace Baidu + Weltmeister, Alibaba + Xpeng Motors and Didi + CHE Automotive. Traditional Chinese automakers prefer not to partner with only one or two of the four IT giants (Baidu, Alibaba, Tencnet and Huawei) but keep an open cooperative relationship with all of them. SAIC is striving to foster its own ecosystem by investing many start-ups.

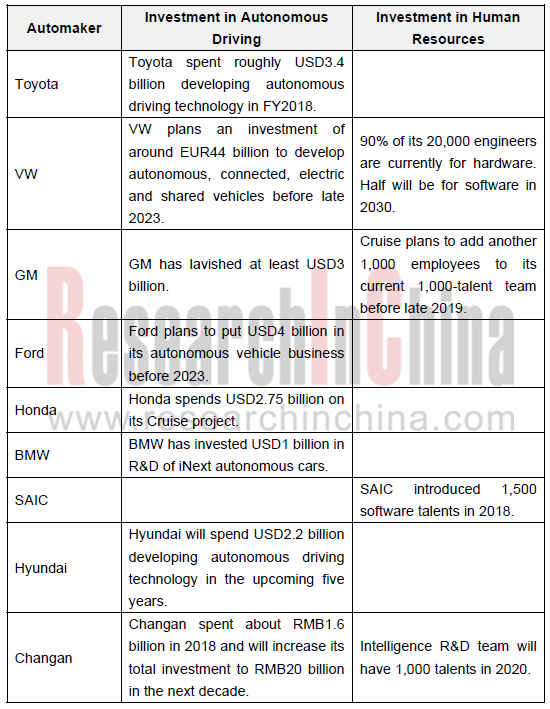

Besides the way of cooperation for complementing with each other and apportioning research and development and operation expenses, OEMs are also racing to invest more in recruiting software engineers.

“Software will account for 90 percent of future innovations in the car. Today, our 20,000 developers are 90 percent hardware-oriented. That will change radically by 2030. Software will account for half of our development costs”, says Herbert Diess, CEO of Volkswagen, which means VW’s software engineers will be 10,000 or so.

American tech firms make enormous investments in autonomous driving as well. Apple autonomous car team claims 5,000 people, and Uber possesses about 1,500.

Autonomous driving market has been an arena for big names, and other small and medium players have to take sides.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...