Global and China Automotive Lighting Industry Report, 2019-2025

-

May 2019

- Hard Copy

- USD

$3,000

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

CYH087

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

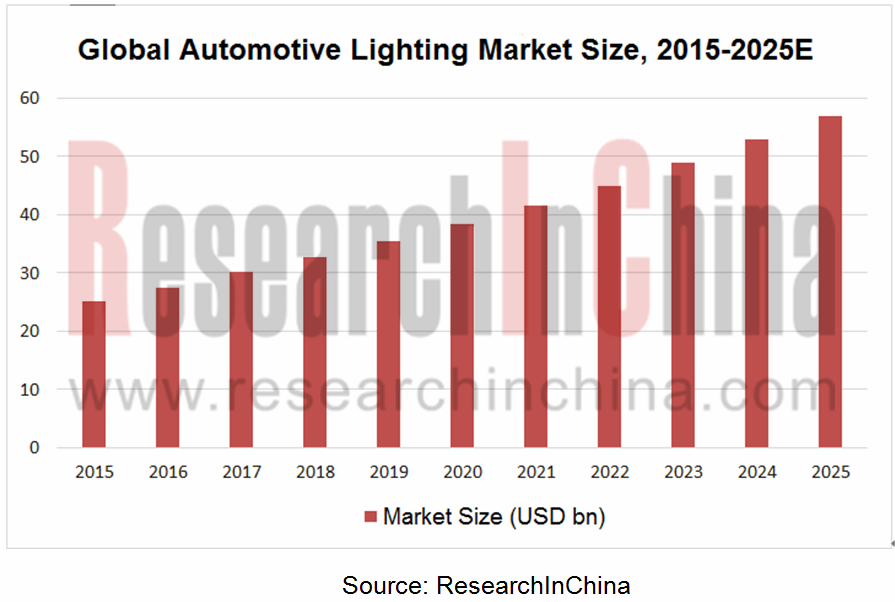

Global automotive lighting market was worth about $32.8 billion with a year-on-year increase of 8.6% in 2018, and the figure is predicted to reach $57.0 billion in 2025 as demand for intelligent lamps, especially automotive LED lamps picks up. The penetration of automotive LED headlamps stood at 23% in 2018, and is expected to hit around 60% in 2025, thank to declining cost and better performance of such lamps.

As automobiles are growing smart, intelligent automotive lamps become a megatrend first in the form of ADB (Adaptive Driving Beam) and AFS (Adaptive Front-Lighting System). Wherein, AFS installation rate has sustained steady growth over the years, up from 10.0% in 2015 to 16.8% in 2018, a figure expected to be a whopping 30% or so in 2025. Also, digital intelligent automotive lamps come to the front, being currently available to the high-class vehicle models. Examples include Digital Light Mercedes-Benz launched in 2018, Audi matrix LED intelligent headlight, and WEY LED intelligent pixel headlamp rolled out in 2019, all of which render digital technology to project light for interactions between pedestrians and vehicles, between vehicles and vehicles.

In China, the automotive lighting market will become ever larger with its size showing a CAGR of roughly 9% between 2019 and 2025, because LED with a low penetration in the market still has a rosy prospect and passenger car sales will continue to rise as a whole in the country.

Global automotive lighting market are now almost monopolized by giants like France’s Valeo, Italy’s Magneti Marelli, Germany-based Hella and Japanese companies Koito and Stanley, which together command over 70% of the global market. Among them, Koito boasts a virtually 25% market share. These big names have a customer base covering all global automakers, and are expanding their regional markets. The oligarchic pattern will hardly change in the near future.

In the Chinese automotive lighting market, joint ventures like Shanghai Koito Automotive Lamp Co., Ltd., Guangzhou Stanley Electric Co., Ltd., Changchun Hella Faway Automotive Lighting Co., Ltd. and Valeo Lighting Hubei Technology Center Co., Ltd. are the main players, accounting for a collective 70% of the highly-concentrated market. Local manufacturers just offer low-tech products such as tail lamps and small lights, with low market shares. The bellwether Changzhou Xingyu Automotive Lighting System Co, Ltd. takes a mere 6% share, but the company is likely to edge into automakers’ supplier systems as it increased R&D budget in recent years.

Global and China Automotive Lighting Industry Report, 2019-2025 highlights the following:

Laser/OLED/AFS/ADB/nigh vision system technologies;

Laser/OLED/AFS/ADB/nigh vision system technologies;

Global and China automotive lighting markets (size, competitive pattern and forecast);

Global and China automotive lighting markets (size, competitive pattern and forecast);

Global automotive lighting manufacturers.

Global automotive lighting manufacturers.

1. Headlamp Design

Headlamp Manufacturing Process

Tail Lamp Manufacturing Process

Headlamp Design

New-generation LED Headlamp of Mercedes-Benz

CTS Headlamp Design of Cadillac

Headlamp Design of Honda and LEXUS

Headlamp Design of Audi and BMW

LED Headlamp of Audi A8

LED Headlamp of Audi AICON

2. Laser/OLED/AFS/ADB/Night Vision System/Intelligent Digital Headlamp

Laser Headlamp of BMW

Laser Headlamp of Audi Sport Quattro

Laser Headlamp of Audi R8 LMX

OLED Tail Lamp

OLED Tail Lamp of Audi

OLED Tail Lamp of Mercedes-Benz

Penetration Rate of AFS/ADB, 2015-2025E

AFS Profile and System Structure

AFS ECU

AFS Working Principle

LED PIXELATED AFS Developed by OSRAM

HBA (High Beam Assist)/ Adaptive Driving Beam (ADB)

HBA (High Beam Assist) Must Be with LED Headlamp

HBA (High Beam Assist) Image Sensor

Gentex Smart Beam Overview

HW-Architecture of SmartBeam

Night Vision Overview

FLIR PathfindIR and Lens

Night Vision Static

BMW Night Vision

Night Vision Trend

FIR Camera Market Volume and ASP, 2012-2020E

Introduction to FLIR

Digital Automotive Lamps

Mercedes-Benz Digital Headlamp

WEY LED Intelligent Pixel Headlamp

BYD “Dragon Beam” Automotive Lamp

Development Trends of Automotive Lighting

Main Directions of Automotive Lighting

3. Automotive Lighting Market and Industry

Global Automotive Lighting Market Size, 2015-2025E

Automotive Lighting Market by Position, 2018

Global Headlamp Shipments by Technology, 2015-2025E

Installation of Automotive Lamps in Vehicle Models on Sale by Technology, 2018

Vehicle Models with LED Headlamps and Their Prices, 2019

Automotive Taillamp Source by Technology, 2013-2030E

Revenue of World’s Major Automotive Lighting Vendors, 2015-2018

M&A Events in Automotive Lighting Industry, 2018

Market Share of World’s Major Headlamp Manufacturers (by Shipment), 2018

Supply Ratio of Key Suppliers of Automotive Lighting System for Toyota and Honda, 2018

Supply Ratio of Key Suppliers of Automotive Lighting System for Renault-Nissan and GM, 2018

Supply Ratio of Key Suppliers of Automotive Lighting System for Ford and VW, 2018

Supply Ratio of Key Suppliers of Automotive Lighting System for Hyundai, 2018

Automotive Lighting Market Size in China, 2015-2025E

Market Share of Major Automotive Lamp Manufacturers in China

Supply Relationship between Chinese Automotive Lamp Manufacturers and Carmakers

4. Automotive Lighting Companies

Revenue and Operating Margin of Koito, FY2006-FY2019

Revenue and Operating Income of Koito by Region, FY2015-FY2018

Koito’s Technology Development Direction: Laser and OLED

Development Course of Koito’s LED Headlamp

Koito’s LED ARRAY/ADB

Koito’s LED Headlamp and Tail Lamp

Introduction to Koito’s Subsidiaries in China

Organization Structure of Hella

Profile of Hella

Hella’s Revenue by Region

Hella’s Product Lines

Development Course of Hella’s Headlamp

Hella Static Bend Light/Cornering Light

Hella Headlamps Modules

Hella Adaptive Frontlighting System (AFS)

Hella Camera-based Lighting Systems

Hella VCOL/ACOL

Hella Matrix Headlamps

Hella Matrix LED

Hella’s Automotive Lighting Subsidiaries in China

Developments of Hella in China

Revenue and Shipment of Automotive Lighting, 2010-2018

Car Models with Automotive Lighting’s Lamps

Automotive Lighting’s Subsidiaries in China

Revenue and Operating Income of Stanley Electric, FY2006-FY2019

Stanley Electric’s Revenue by Region, FY2010-FY2018

Stanley Electric’s Subsidiaries in China

Profile of ZKW

Revenue and Workforce of ZKW, 2010-2018

Revenue and Gross Margin of Valeo, 2008-2018

Valeo’s Revenue from Visibility Systems by Region

Automotive Lighting Partners of Valeo

Valeo Roadmap

Valeo Beamatic Premium

Application of Valeo’s Beamatic Premium

Functions of Valeo’s Beamatic Premium

Valeo AFS Adaptive Front Lighting

Valeo LED Headlamp

LED Headlamp Clients of Valeo

Valeo’s Automotive Lighting Companies in China

Revenue and Operating Margin of Ichikoh, FY2006-FY2019

Technology Direction of Ichikoh

Ichikoh’s Revenue by Region

Car Models with Ichikoh’s Products

Ichikoh Adaptive Driving Beam

ICHIKOH Camera Monitor System

Ichikou Communication Lighting

Revenue and Operating Margin of SL Lighting, 2009-2019

SL Lighting’s Revenue by Business, 2010-2018

SL Lighting’s Revenue by Region, 2014-2018

SL Lighting’s Subsidiaries in China

Profile of Varroc

Varroc’s Lamps

Revenue, Profits, Assets and Liabilities of Varroc TYC Auto Lamps, 2011-2018

Profile of TYC

Revenue and Operating Margin of TYC, 2005-2018

Global Presence of TYC

Revenue and Operating Margin of DEPO, 2006-2018

Monthly Revenue of DEPO, 2015-2018

Output and Sales Volume of DEPO, 2009-2018

Global Presence of DEPO

DEPO’s Base in Taiwan

DEPO’s Base in Mainland China

Revenue and Operating Margin of Ta Yih Industrial, 2004-2018

Main Clients of Ta Yih Industrial

Revenue and Operating Margin of Changzhou Xingyu Automotive Lighting Systems, 2007-2018

Client Structure of Changzhou Xingyu Automotive Lighting Systems, 2008-2018

Sales of Automotive Lamps of Changzhou Xingyu Automotive Lighting Systems, 2011-2018

Jiangsu Tongming Vehicle Lamps

Nanning Liaowang Automobile Lamp

Laster Tech

Global Presence of Laster Tech

Revenue and Gross Margin of Laster Tech, 2008-2018

Car Models with Laster Tech’s Products

Main Clients of Laster Tech

Main Clients of Laster Tech

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...