Report on Chinese Automakers’ Telematics Products in 2019

-

Jun.2019

- Hard Copy

- USD

$3,000

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

LY008

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

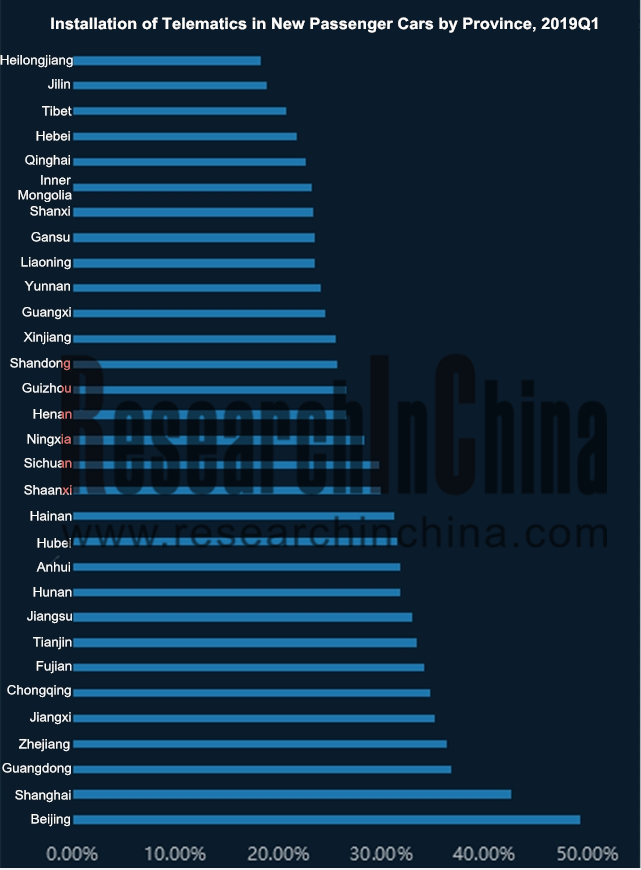

It is Shown from the Findings of Our Research on Chinese Automakers’ Telematics Products: Telematics is Available to 49% New Vehicles in Beijing, Compared with a Mere 18% in Heilongjiang.

In the first quarter of 2019, Beijing, Shanghai and Guangdong stay ahead of other provinces in availability of telematics in new passenger cars, with rates of 49.2%, 42.5% and 36.7%, respectively; Jilin and Heilongjiang were left behind with installation rates of 18.9% and 18.2%, respectively, far below the country’s average of 30.2%, according to Report on Chinese Automakers’ Telematics Products in 2019 we released recently.

Automotive telematics solution falls into built-in and external types. Built-in telematics system enables vehicles with direct connectivity; external telematics system offers connectivity for vehicles via a smartphone or other devices. Built-in telematics system has become the mainstream configuration for new vehicles as ever more of them used the system in recent two years, making the external type give its way to it. In 2018, telematics (built-in + external) installation rate in China just rose a bit.

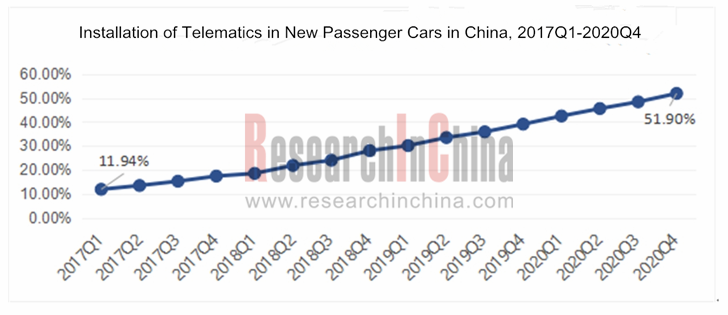

Only in terms of built-in telematics system, installation of telematics in new vehicles has soared, expectedly up to 51.9% in the fourth quarter of 2020 compared with a mere 11.94% in the first quarter of 2017.

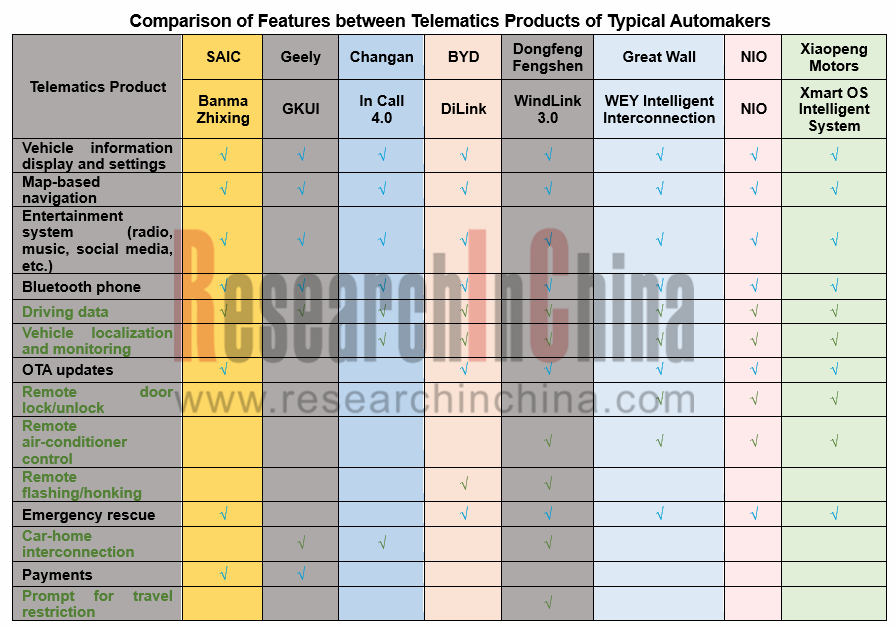

The report compares and analyzes telematics products of more than 10 Chinese automakers from the aspects as follows: features, technology providers, human-machine interaction, communications, map and navigation, voice, big data and service, dashboard and central console, car owner’s APP, remote control, cloud technology, in-vehicle infotainment, mobility services, life services, car-home interconnection deployment, pre- and after-sale services, charge mode, installation of telematics products, installation by province and municipality, etc.

1 China Telematics Industry

1.1 Overview of Telematics

1.1.1 Definition

1.1.2 System Architecture

1.1.3 Industry Chain

1.1.4 Telematics Based on Big Data Platform Extends to Service Ecosystem Market

1.1.5 Development Stage

1.2 Telematics Market

1.2.1 Installation of Telematics in New Passenger Cars in China, 2017Q1-2020Q4

1.2.2 Telematics Installation of Main Passenger Car Brands, 2017-2019

1.2.3 Installation of Telematics in New Vehicles by Province, 2017Q1-2019Q1

1.2.4 Installation and Market Shares of Main Telematics Products, 2018-2019

1.3 Telematics Development Trends

1.3.1 Telematics Terminal

1.3.2 Trend toward Integration between Service Ecosystem and Map-based Navigation

1.3.3 Related Laws, Regulations and Standards are Getting Improved

1.3.4 Multi-channel Interaction and Fusion

1.3.5 Heuristic Active Telematics Voice Service

1.3.6 Vehicle Entertainment Contents are Getting Enriched

2 Comparison of Features between Telematics Products of Typical Automakers

2.1 Comparison of Overall Telematics Layout

2.1.1 Overview of Telematics Products of Main Automakers

2.1.2 Telematics Products and Development Plans of Automakers

2.1.3 Telematics Technologies and Service Suppliers of Main Automakers

2.1.4 Comparison of Human-computer Interaction Functions between Main Automakers

2.1.5 4G is the First Choice for Telematics Communications and Manufacturers are Working to Deploy 5G

2.1.6 Automakers and Communication Firms Make Joint Efforts to Promote the Development of 5G Telematics

2.1.7 Map-based Navigation Service Suppliers of Typical Automakers

2.1.8 Voice Technology Suppliers of Typical Automakers

2.2 Comparison of Functions between Telematics Software and Hardware

2.2.1 Comparison of Highlights between Telematics Products of Typical Automakers

2.2.2 Comparison of Features between Telematics Products of Typical Automakers

2.2.3 Comparison of Telematics Big Data and Service between Typical Automakers

2.2.4 Comparison of Dashboard and Central Console between Typical Automakers

2.2.5 Comparison of Voice Control Functions between Typical Automakers

2.2.6 Comparison of Telematics APP Capabilities between Typical Automakers

2.2.7 Comparison of Remote Control Functions between Typical Automakers

2.2.8 Cloud Technology Suppliers and Functions Available of Typical Automakers

2.3 Telematics Services

2.3.1 Operating Value-added Service

2.3.2 Telematics Service Ecosystem is Expanding

2.3.3 Comparison of Vehicle Entertainment Capabilities between Typical Automakers

2.3.4 Comparison of Mobility Services between Typical Automakers

2.3.5 Comparison of Telematics-based Living Services between Typical Automakers

2.3.6 Car-home Interconnection Layout of Typical Automakers

2.3.7 Comparison of Telematics-based Pre- and After-sale Services between Typical Automakers

2.3.8 Comparison of Telematics Service Charge Mode between Typical Automakers

3 Telematics Products of Traditional Chinese Auto Brands

3.1 Passenger Car Telematics Products of SAIC

3.1.1 Overview of Passenger Car Telematics Products of SAIC

3.1.2 Telematics Suppliers and Partners of SAIC

3.1.3 Voice Control & Recognition

3.1.4 New Map-based Navigation Technology—AR-Driving

3.1.5 SAIC Telematics: IVI OS and APP

3.1.6 SAIC Telematics: Network Communications

3.1.7 SAIC Big Data Applications

3.1.8 SAIC Telematics: Dashboard & Central Console

3.1.9 MG HS Cockpit

3.1.10 MG HS Service Ecosystem

3.1.11 Installation of Passenger Car Telematics Products of SAIC, 2017Q1-2019Q1

3.1.12 Installation of SAIC AliOS by Province, 2017Q1-2019Q1

3.2 Geely GKUI

3.2.1 Overview of Geely GKUI

3.2.2 GKUI System Core

3.2.3 G-ID

3.2.4 GKUI Cloud Platform

3.2.5 Geely GKUI: User Interface (UI)

3.2.6 Geely GKUI: Map-based Navigation

3.2.7 Geely GKUI: Payment Platform

3.2.8 Geely GKUI: Network Communications

3.2.9 Geely GKUI: Intelligent Vehicle Voice Assistant

3.2.10 Geely GKUI: 5G NR Technology Co-developed with Others

3.2.11 Geely GKUI: Ecosystem Partners

3.2.12 Digital Operation Plan of Geely

3.2.13 Installation of Telematics Products of Geely, 2017Q1-2019Q1

3.2.14 Installation of Geely GKUI by Province, 2017Q1-2019Q1

3.3 Changan

3.3.1 Overview of Changan In-Call

3.3.2 Main Functions of In-Call

3.3.3 In-Call: Map-based Navigation

3.3.4 In-Call: Zhiyin Huoban APP

3.3.5 Intelligent Voice Assistant—“Xiaoan”

3.3.6 In-Call: Network Communications

3.3.7 Changan Embarks on Joint Development of LTE-V and 5G Telematics

3.3.8 Set up a Joint Venture with Tencent in Intelligent Connected Vehicle Field

3.3.9 InCall Partnered with JD Weilian

3.3.10 In-Call: Ecosystem Partners

3.3.11 Changan “Dubhe” Strategy

3.3.12 Changan Intelligent Connection Plan

3.3.13 Installation of Telematics Products of Changan, 2017Q1-2019Q1

3.3.14 Installation of Changan InCall by Province, 2017Q1-2019Q1

3.4 BYD

3.4.1 Overview of BYD DiLink

3.4.2 BYD DiPad

3.4.3 BYD Di Cloud

3.4.4 BYD Di Ecosystem

3.4.5 BYD Di Openness

3.4.6 Smart Bracelet Key--Di Band

3.4.7 DiLink: Natural Speech Recognition

3.4.8 DiLink: Map-based Navigation

3.4.9 DiLink: Network Communications

3.4.10 D++ Open Ecosystem

3.4.11 DiLink: Suppliers and Partners

3.4.12 Installation of Telematics Products of BYD, 2017Q1-2019Q1

3.4.13 Installation of DiLink by Province, 2017Q1-2019Q1

3.5 Dongfeng WindLink

3.5.1 Overview of Dongfeng Fengshen WindLink3.0

3.5.2 Highlights of Dongfeng Fengshen WindLink3.0

3.5.3 WindLink3.0 Human-machine Interaction

3.5.4 WindLink Map-based Navigation

3.5.5 WindLink App 3.0

3.5.6 WindLink3.0 Network Communications

3.5.7 Dongfeng Fengshen Application Ecosystem

3.5.8 Suppliers and Partners

3.5.9 WindLink3.0 Development Plan

3.5.10 Installation of Telematics Products of Dongfeng, 2017Q1-2019Q1

3.5.11 Installation of WindLink by Province, 2017Q1-2019Q1

3.5.12 Installation of Venucia Intelligent Connection by Province, 2017Q1-2019Q1

3.6 Great Wall Motor

3.6.1 Great Wall WEY Intelligent Interconnection

3.6.2 Great Wall WEY·Road APP

3.6.3 WEY Intelligent Interconnection: Human-Machine Interaction

3.6.4 WEY Intelligent Interconnection: Voice Control & Recognition

3.6.5 WEY Intelligent Interconnection: Map-based Navigation

3.6.6 WEY Intelligent Interconnection: Infotainment System

3.6.7 WEY Intelligent Interconnection: Connectivity

3.6.8 WEY Intelligent Interconnection: Suppliers and Partners

3.6.9 WEY Intelligent Interconnection: Business Model

3.6.10 5G Intelligent Connectivity Layout

3.6.11 Cooperated with Baidu on Telematics

3.6.12 Launched “C+ Intelligent Strategy”

3.6.13 Cooperated with JD on Smart Home and Car Delivery

3.6.14 Installation of Telematics Products of Great Wall, 2017Q1-2019Q1

3.6.15 Installation of Haval Interconnection by Province, 2017Q1-2019Q1

3.6.16 Installation of WEY Intelligent Interconnection by Province, 2017Q1-2019Q1

4 Telematics Products of Emerging Chinese Auto Brands

4.1 NIO

4.1.1 Profile

4.1.2 NOMI Vehicle Artificial Intelligence System

4.1.3 Map-based Navigation

4.1.4 Human-Machine Interaction

4.1.5 NIO APP

4.1.6 NIO Service

4.1.7 Suppliers and Partners

4.1.8 “Car Delivery” Layout

4.2 Xiaopeng Motors

4.2.1 Profile

4.2.2 X-mart OS Intelligent System

4.2.3 Xiao P AI-driven Voice Assistant

4.2.4 XPENG APP

4.2.5 XPENG: Map-based Navigation

4.2.6 Alibaba Cloud Bastion Host Information Security Technology

4.2.7 XPENG: Human-Machine Interaction

4.2.8 XPENG: G3 Network Communications

4.2.9 Business Model

4.2.10 “XPENG+” Plan

4.2.11 XPENG Vehicle Application Ecosystem

4.2.12 XPENG: Telematics Suppliers and Partners

4.3 Weltmeister (WM Motor)

4.3.1 Profile

4.3.2 Weltmeister Zhixing App

4.3.3 Weltmeister EX5: Human-Machine Interaction

4.3.4 Weltmeister EX5: Main Parameter & Intelligent Interaction

4.3.5 Weltmeister EX5: Cockpit

4.3.6 Partners

4.3.7 Car-home Interconnection Layout

4.3.8 Ride-hailing Mobility Layout

4.3.9 Pioneer Service Plan

4.4 Byton

4.4.1 Profile

4.4.2 Human-Machine Interaction

4.4.3 Byton APP

4.4.4 Byton Experience

4.4.5 BYTON Life

4.4.6 Business Model

4.5 CHJ Automotive

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...