China Low-speed Electric Vehicle (LSEV) Industry Report, 2019-2025

-

July 2019

- Hard Copy

- USD

$3,400

-

- Pages:152

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZHP095

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

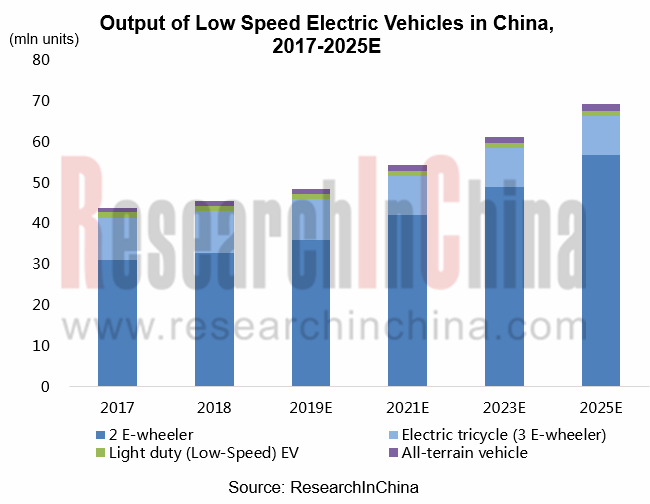

In 2018, about 45.42 million low-speed electric vehicles (LSEV) were produced in China, a 3.9% rise on an annualized basis (a 1.6-fold figure compared with China’s output of 27.81 million automobiles in the year), but LSEV witnessed a slowdown in growth rate due to policy impact. With the enforcement of new national standards, the electric vehicle industry gets regulated further and is expected to show a CAGR of 6.0% or so between 2019 and 2025.

The LSEV market is largely dominated by electric bicycle and electric tricycle, both of which held a combined share of roughly 95% by output in 2018.

Electric bicycle: China produced a total of 32.78 million electric bicycles in 2018, representing a CAGR of 14.2% from 2010 to 2018; and ownership of electric bicycles was in excess of 230 million units and showed a CAGR of over 10% during 2010-2018. The fact that the new national standards are being implemented brings about a higher industry threshold. Also, the provinces and municipalities of China have issued their transitional policies for electric bicycle whose growth rate will decelerate in the upcoming years and whose CAGR will stand at 6% to 9% between 2019 and 2025.

Electric tricycles: Due to environmental policies, the Chinese electric tricycle market has been downsizing in the past two years. The output in 2018 posted 10.23 million units with a year-on-year decrease of 1.1%. In 2019, local governments introduced policies to tighten management on electric tricycles (for instance, Shenzhen city plans to cancel all express delivery and sanitation electric tricycles two years later). It is expected that the Chinese electric tricycle market will continue to shrink in the next few years, and the output will fall to 9.44 million units in 2025. Additionally, the less competitive producers have been eliminated amid the sluggish low-speed electric tricycle market, making the branding of the industry more concentrated.

Low-speed electric vehicle (LSEV): In 2018, China issued a policy prohibiting new capacity of low-speed electric vehicles. In 2019, Technical Conditions of Four-Wheel Low-Speed Electric Vehicles was released to drag down the growth rate of the LSEV market sharply. The CAGR in 2010-2018 remained as high as 45.4%, with a slight increase of 0.2% in 2018. As some companies stop producing low-speed electric vehicles to wait for the implementation of technical standards, the LSEV output is anticipated to edge down in 2019.

All-terrain vehicle (ATV): the market starts late in China and has yet to mature, with a small size. In 2018, 1,074,000 ATVs were made in the country, 18.2% more than in the previous year, making the market the only thriving segment in low speed electric vehicle industry. However, over 95% of Chinese ATVs are for export as the country’s demand is limited. Therefore, China’s ATV market is vulnerable to overseas market situation.

In competition, Yadea and Aima are the two key players in the electric bicycle market, together grabbing around 25% shares in 2018; the electric tricycle market is dominated by Kingbon and Zongshen; Levdeo as a bellwether in the LSEV market seized 21.4% shares in 2018, closely followed by YOGOMO 11.2% and Shifeng 7.5%; the ATV market is an oligopoly with Cfmoto Power and Linhai holding a combined over 80%.

In China, a surge in rural road mileage will favor expansion of the LSEV market as such vehicles are hugely demanded in the third- and fourth-tier cities. Also, the issuance of the new national standard will help regulate the market as a boon for its growth in the long run, in spite of a shift in the industry thereof.

The new standard also spurs lithium battery vehicle industry. In 2019, roughly 15% of low speed electric vehicles are expected to carry lithium batteries, compared with a mere 5% in 2013.

China Low-speed Electric Vehicle (LSEV) Industry Report, 2019-2025 highlights the following:

Overview of the LSEV industry in China (definition, classification, Industry Characteristics s, etc.);

Overview of the LSEV industry in China (definition, classification, Industry Characteristics s, etc.);

Market segment-electric bicycle industry (relevant policies, market size, competitive landscape, development trends, etc.);

Market segment-electric bicycle industry (relevant policies, market size, competitive landscape, development trends, etc.);

Market segment- electric tricycle industry (relevant policies, market size, regional pattern, competitive landscape, etc.)

Market segment- electric tricycle industry (relevant policies, market size, regional pattern, competitive landscape, etc.)

Market segment-LSEV industry (relevant policies, market size (Shandong and Hebei), competitive landscape, etc.)

Market segment-LSEV industry (relevant policies, market size (Shandong and Hebei), competitive landscape, etc.)

Market segment-all-terrain vehicle (market size, regional pattern, market price, competitive landscape, etc.);

Market segment-all-terrain vehicle (market size, regional pattern, market price, competitive landscape, etc.);

Market for relevant key parts (battery, motor, motor controller, and BMS);

Market for relevant key parts (battery, motor, motor controller, and BMS);

16 major LSEV manufacturers (Yadea, AIMA, SUNRA, BYVIN, Jinpeng, Dojo, YOGOMO, Shifeng Group, Tokng, Fulu Vehicle, LEVDEO, Lichi, Rainchst, Hebei Yudea, DURABLEV and Han Tang) (profile, financial position, leading products, etc.) and 7 BMS manufacturers.

16 major LSEV manufacturers (Yadea, AIMA, SUNRA, BYVIN, Jinpeng, Dojo, YOGOMO, Shifeng Group, Tokng, Fulu Vehicle, LEVDEO, Lichi, Rainchst, Hebei Yudea, DURABLEV and Han Tang) (profile, financial position, leading products, etc.) and 7 BMS manufacturers.

1. Overview of LSEV Industry

1.1 Definition and Classification of LSEV

1.2 Industry Characteristics

1.2.1 Intense Competition

1.2.2 Geographical Concentration

1.3 Market Size

2. Development of Two-wheeled Electric Vehicle Industry

2.1 Standard of Two-wheeled Electric Vehicle

2.2 Policies

2.3 Market Size

2.4 Regional Pattern

2.5 Competitive Landscape

2.6 Industry Forecast

3. Development of Three-wheeled Electric Vehicle Industry

3.1 Standard of Three-wheeled Electric Vehicle

3.2 Market Size

3.3 Development in Major Regions

3.4 Competitive Landscape

4. Development of LSEV Industry

4.1 Policies on Four-wheeled Electric Vehicle

4.1.1 National Policies and Standards

4.1.2 Local Policies

4.2 Market Size

4.3 Development in Major Regions

4.3.1 Shandong

4.3.2 Hebei

4.4 Competitive Landscape

4.5 Mini Electric Vehicle

5. Development of All-Terrain Vehicle Industry

5.1 Market Size

5.2 Regional Development

5.3 Market Price

5.4 Competitive Landscape

6. Main Parts Market

6.1 Battery

6.1.1 Status Quo and Trends of LSEV Battery

6.1.2 Major Manufacturers and Competitive Landscape

6.1.3 Products of Major Manufacturers

6.1.4 Advantages and Disadvantages of Major Manufacturers

6.2 Motor

6.2.1 Major Manufacturers and Competitive Landscape

6.2.2 Products of Major Manufacturers

6.2.3 Advantages and Disadvantages of Major Manufacturers

6.3 Motor Controller

6.3.1 Major Manufacturers and Competitive Landscape

6.3.2 Products of Major Manufacturers

6.3.3 Advantages and Disadvantages of Major Manufacturers

6.4 BMS

6.4.1 Technical Analysis

6.4.2 Market Analysis

7. Chinese LSEV Manufacturers

7.1 AIMA

7.1.1 Profile

7.1.2 Operation

7.1.3 Production

7.1.4 Major Products

7.1.5 Production Bases

7.1.6 Sales Network

7.2 Yadea

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Marketing Network

7.2.5 Production Bases

7.3 BYVIN

7.3.1 Profile

7.3.2 Electric Bicycle

7.3.3 Electric Tricycle

7.3.4 LSEV

7.3.5 Main Production Bases

7.3.6 Smart Electric SUV BYVIN V7

7.4 SUNRA

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Production and Marketing

7.4.5 Two-wheeled Electric Vehicle

7.4.6 Electric Tricycle

7.4.7 Electric All-terrain Vehicle

7.4.8 Marketing Network

7.4.9 Production Bases

7.4.10 Investment Projects by IPO

7.5 Jinpeng

7.5.1 Profile

7.5.2 Major Products

7.5.3 Main Production Bases, and Production and Sales

7.5.4 Full-series Lithium Battery Product Launched

7.6 YOGOMO

7.6.1 Profile

7.6.2 Output and Sales Volume

7.6.3 Independent Operation of YOGOMO Brand

7.6.4 Major Products

7.6.5 YOGOMO’s Main Production Bases

7.6.6 YOGOMO Renamed as LinkTour

7.7 Shifeng Group

7.7.1 Profile

7.7.2 Operation

7.7.3 Production

7.7.4 Shifeng Central Research Institute

7.7.5 Strategic Planning

7.8 Tokng

7.8.1 Profile

7.8.2 Major Products

7.8.3 Strategic Cooperation between Shandong Tangjun Ouling Automobile Manufacture and Camel Group

7.9 Fulu Vehicle

7.9.1 Profile

7.9.2 Major Products

7.9.3 Fulu Vehicle Invested RMB 160 mln to Establish Test Center

7.9.4 Fulu Vehicle Opened Li-ion Battery Era

7.9.5 Strategic Adjustment

7.10 Dojo

7.10.1 Profile

7.10.2 Major Products

7.10.3 Production Bases and Capacity

7.10.4 Dojo’s Gaoyou Base Was Officially Put into Operation

7.11 LEVDEO

7.11.1 Profile

7.11.2 Major Products

7.11.3 Production Base

7.11.4 Important Technology

7.12 Lichi

7.12.1 Profile

7.12.2 Revenue

7.12.3 Major Products

7.12.4 Development Strategy

7.13 Rainchst

7.13.1 Profile

7.13.2 Major Products

7.13.3 Production Bases

7.14 Hebei Yudea New Energy Technology Group Co., Ltd.

7.14.1 Profile

7.14.2 Major Products

7.14.3 Production Base

7.14.4 Main Qualifications

7.14.5 Yudea’s 200,000 NEVs/a Project Makes Its Home in Neijiang, Sichuan

7.15 DURABLEV

7.15.1 Profile

7.15.2 Major Products

7.16 Han Tang Electric Vehicle

7.16.1 Profile

7.16.2 Major Products

7.16.3 Development Strategy

8. LSEV BMS Manufacturers

8.1 Shenzhen Tian-Power Technology Co., Ltd.

8.1.1 Profile

8.1.2 Major Products

8.2 Addenda Technology (Guangzhou) Co., Ltd.

8.2.1 Profile

8.2.2 Major Products

8.3 Shenzhen Guoxin Power Technology Co., Ltd.

8.3.1 Profile

8.3.2 Major Products

8.3.3 Partners

8.4 Jiangxi Keran Technology Co., Ltd.

8.4.1 Profile

8.4.2 Major Products

8.5 Hangzhou Gold Electronic Equipment INC., Ltd.

8.5.1 Profile

8.5.2 Major Products

8.6 Changsha Juli Electric Technology Co., Ltd.

8.6.1 Profile

8.6.2 Major Products

8.7 Xi’an Jindee Electrical Technology Co., Ltd.

8.7.1 Profile

8.7.2 Major Products

Main Classifications of LSEVs

Main Types of Tricycles on the Market

Economic Benefits Comparison between LSEV and Other Types of Vehicles

Main Applications of LSEV

Output of LSEV by Product in China, 2017-2025E

Technical Standards of Electric Bicycle (1999 Version, 2015 Amendment, and 2018 Draft)

Policies on Electric Bicycle in China in Recent Years

Electric Bicycle Forbidding Policies Promulgated by Some Cities in China

Adjustment of New National Standard Policy on Electric Bicycle

Areas that Launched Electric Bicycle Transition Policy as of June 2019

Output of Electric Bicycles in China, 2010-2025E

Ownership of Electric Bicycles in China (million units), 2009-2025E

Production Structure of Electric Bicycles by Region in China, 2018

Ranking of Electric Bicycle Manufacturers by Sales Volume in China, 2018

Mileage of Rural Roads in China, 2013-2019

Market Structure of Electric Bicycles (by Battery Type) in China, 2013-2019

Key Reference Indicators in Technical Requirements on Electric Tricycle for Express Delivery

China’s Electric Tricycle Output, 2014-2025E

China’s Electric Tricycle Output by Market Segment, 2018

China’s Electric Tricycle Ownership, 2009-2025E

Major Electric Tricycle Production Bases and Sales Regions in China

China’s Electric Tricycle Competition Pattern, 2018

Partial Contents of Three Meetings of Work Team for Low Speed Electric Vehicle Standard Formulation, 2016

Local Policies on LSEV in Major Regions

Interpretation of Local Policies and Regulations on LSEV in Recent Years

Regulations on LSEV in Shandong (Trial) (Part)

Regulations on LSEV in Some Cities in Shandong

Provisions on Relevant Technical Indicators in Regulations on LSEV in XingtaiCity (Trial)

China’s Low-speed Electric Vehicle Output, 2010-2025E

China’s Low-speed Electric Vehicle Ownership, 2010-2025E

Geographical Distribution of China LSEV Industry

Shandong’s Low-speed Electric Vehicle Output, 2010-2025E

National Share of Shandong’s Low-speed Electric Vehicle Output, 2018

Shandong’s Monthly Low-speed Electric Vehicle Output, 2016-2019

Low Speed Electric Vehicle Sales Distribution in China, 2018

Major LSEV Players in China

Ranking of Chinese Low Speed Electric Vehicle Manufacturers by Sales Volume, 2015-2018

Changes in Requirements on Subsidies for New Energy Passenger Vehicle, 2017 & 2018 & 2019

Subsidies for New Energy Passenger Vehicle, 2017 vs 2018 vs 2019

Main Technical Indicators of Some Best-selling Minicars

Main Approaches of Low Speed Electric Vehicle Manufacturers to Obtain Electric Vehicle Production Qualification

ATV (All-Terrain Vehicle) Output in China, 2009-2025E

ATV Sales Volume in China, 2010-2025E

Export Volume of All-Terrain Golf Cart in China, 2013-2019

ATV Sales Volume in China’s Main Regions, 2018

Price Comparison of ATV in China and Overseas Countries

Most-Applied ATVs in China

ATV Manufacturers in North America

Ranking of Sightseeing Vehicle Manufacturers in China by Sales Volume, 2017-2018

Export of Major ATV Players in China, 2017

Sales Volume of Forklift in China by Market Segment, 2015-2019E

Performance Comparison of EV Batteries

Comparison of Typical Lead-acid and Lithium Battery Vehicles

Major Battery Supplier’s Share in Two-wheeled and Three-wheeled Electric Vehicle Market, 2018

Major Battery Suppliers’ Share in Low-speed Electric Vehicle Market, 2018

Chaowei Power’s Main Batteries for LSEV

Tianneng Power’s Main Batteries for LSEV

Sacred Sun’ s Sealed Lead-acid Batteries for Electric On-road Vehicle

Comparison of Chaowei Power and Tianneng Power

Economical Efficiency Comparison of Motor for LSEV

Capacity of Major Motor Manufacturers in Two-wheeled and Three-wheeled Electric Vehicle Industries in China

Motor Supply Relationship for LSEV in China

Shandong Xindayang’s Main Motors for Two-wheeled and Three-wheeled Electric Vehicles

Ananda’s Main Motors

Boyu’s Main Motors of LSEV

YuchengFutong Motor’s Main Motors

Motor Controller Scheme for LSEV

Capacity of Major Manufacturers of Motor Controller for Electric Bicycle in China

Capacity of Major Manufacturers of Motor Controller for Electric Vehicle in China

Deyang Electronic Technology’s Main Motor Controllers

Ananda’s Main Controllers

Wuxi Jinghui Electronics’ Main EV Controllers

Tianneng Power’s Main Motor Controllers

Shanghai Edrive’s Motor Control Systems for LSEV

Tianjin Santroll Electric Automobile Technology’s Main Motor Controllers for LSEV

V&T’s Main EV Controllers

LSEV Motor Controller Products of Zhuhai Enpower Electric

Major LSEV BMS Manufacturers in China

Revenue and Net Income of AIMA, 2015-2018

Revenue Structure of AIMA by Product, 2015-2018

AIMA’s Electric Vehicle Output, 2010-2019

Performance Parameters of MINE and Snow Leopard, AIMA’s Two Main Brands

AIMA’s Main Electric Vehicles and Their Performance

Revenue from Top 5 Clients of AIMA, 2016-2017

Procurement of Top 5 Suppliers of AIMA, 2016-2017

Main Production Bases of AIMA

Capacity of AIMA’s Main Production Bases and Investment

EV Distribution Network of AIMA

Revenue and Net Income of Yadea, 2013-2019

Yadea’s Revenue from Major Products, 2013-2018

Yadea’s Sales of Major Products, 2013-2018

Distribution of Yadea’s Distributors Nationwide by end of 2016

Profile of Yadea’s Wuxi Headquarters

Profile of Yadea’s Zhejiang Base

Profile of Yadea’s Tianjin Base

Profile of Yadea’s Guangdong Base

BYVIN’s Main Two-Wheeled Electric Vehicles

Configuration Parameters of BYVIN’s Main Electric Bicycles

BYVIN’s Main Three-wheeled Electric Vehicles

Main Parameters of BYVIN Spring Breeze Electric Tricycles

Main Parameters of BYVIN M8 Electric Vehicle

Main Parameters of BYVIN M7 Electric Vehicle

Main Parameters of BYVIN M6 Electric Vehicle

Major New Energy Power Technologies of BYVIN

Main Two-wheeled Electric Vehicle Products Bases of BYVIN

Distribution of BYVIN’s Production Bases

BYVIN’s Electric Vehicle Production Bases and Capacity Expansion Plans

Key Performance Indicators of BYVIN V7

Xinri’s Revenue and Net Income, 2014-2019E

Xinri’s Revenue by Product, 2014-2018

Xinri’s Revenue by Region, 2014-2018

Xinri’s Electric Bicycle Capacity, Output and Sales Volume, 2014-2018

SUNRA’s Major Two-wheeled Electric Vehicles

Environmental Effect Assessment of SUNRA’s Electric Bicycle Projects

SUNRA’s Major Three-wheeled Electric Vehicles

SUNRA’s Major AVTs

Distribution of Xinri’s Dealers

Basic Information of Tianjin Xinri

Basic Information of Hubei Xinri

Basic Information of Guangdong Xinri

Jinpeng’s Main Electric Vehicles

Capacity of Some Production Bases of Jinpeng

YOGOMO’s Sales Volume of LSEV, 2011-2019

Three Electric Vehicle Brands and Market Segmentation of YOGOMO

Main Configuration Parameters of YOGOMO 330

Main Configuration Parameters of YOGOMO Q Electric Vehicle

Main Configuration Parameters of YOGOMO A260 Electric Vehicle

Main Configuration Parameters of YOGOMO S325 Electric Vehicle

Main Configuration Parameters of YOGOMO X260 Electric Vehicle

Main Configuration Parameters of YOGOMO X6320 Cargo Van

Main Configuration Parameters of YOGOMO M6320

YOGOMO’s Main Production Bases and Products

Capacity and Products of YOGOMO's Main Production Bases

Marketing Network of Shifeng Group

Operating Revenue and Profits & Taxes of Shifeng Group, 2010-2019

Vehicle and Electric Vehicle Output of Shifeng Group, 2010-2019

Distributor Distribution of Tangjun

Main Performance Parameters of Tangjun Ouling T1 Electric Vehicle

Main Performance Parameters of Tangjun Ouling A6 Electric Vehicle

Main Performance Parameters of Tianshi Cheshen Electric Vehicle

Main Performance Parameters of FuluLetu

Main Performance Parameters of FuluLechi

Main Performance Parameters of FuluMeike

Main Performance Parameters of Fulu New Xiangrui (FLE360-F)

Main Performance Parameters of Fulu Q7

Main Technical Parameters of Dojo Pilot

Main Technical Parameters of Dojo CooYes

Main Technical Parameters of Dojo Dream Achiever

Parameters of Dojo Pioneer S

Main Production Bases of Dojo

Configuration Parameters of D80 Low-speed Vehicle

Main Configuration Parameters of D50 LSEV

Main Configuration Parameters of D70 LSEV

Configuration Parameters of LEVDEO Little Prince LSEV

Configuration Parameters of LEVDEO S50 LSEV

Configuration Parameters of LEVDEO LOTTO

LEVDEO i-Life Battery management System Technology

LEVDEO i-Control Motor Control Technology

LEVDEO Ladder Recycling of Lithium Batteries

Revenue and Net Income of Lichi, 2014-2019E

Mini (Low Speed) Electric Car Sales Volume of Lichi, 2014-2019E

Parameter Comparison of Lichi’s Main Electric Vehicles

Main Parameters of Rainchst A00 EV

Main Parameters of Rainchst A0 EV

Main Parameters of Rainchst A EV

Main Parameters of Rainchst MMPV EV

Main Parameters of Rainchst Electric Mini-trucks

Main Parameters of Rainchst Electric Sports Cars

Main Parameters of Rainchst Electric Sightseeing Vehicle

Main Technologies Adopted in Rainchst’s Production Bases

Main Technical Parameters of Xinyuzhou Yudea’s Electric Police Cars

Main Technical Parameters of XinyuzhouYudea’s Electric Sightseeing Carts

Main Parameters of Yudea T80

Main Parameters of Yudea T60

Main Parameters of Yudea T70

Main Production Bases of Yudea Group

Lithium Battery-powered Electric Vehicles of DURABLEV

History of Weifang Han Tang New Energy Vehicle Technology

Major Performance Parameters of Han Tang A1

Major Performance Parameters of Han Tang A3

Major Performance Parameters of Han Tang A6

Major Performance Parameters of Han Tang Q3

Major Performance Parameters of Han Tang Lingka

R&D Teams of Shenzhen Tian-Power Technology

List of Tian-Power’s BMS Products

Main Technical Parameters of Tian-Power’s LSEV BMS Products

List of Addenda’s Integrated Series of BMS

List of List of Addenda’s Distributed Series of BMS

Specifications for Reference of Product Tests

Guoxin Power’s Integrated BMS Series

Guoxin Power’s Distributed BMS Series

Guoxin Power’s Major Partners

BMS Products of Gold Electronic

BMS AIO Legend of Gold Electronic

Technical Parameters of Gold Electronic’s BMS AIO

Gold Electronic 10S BMS Module -EVBMM-1022

Low Speed Lithium Electric Management System --EViBMM-2412, 3212

BMS Products of Changsha Juli Electric Technology

Changsha Juli Electric Technology’s BMS Products for Low-speed EVs

Battery Monitoring Modules and Systems of Xi’an Jindee Electrical Technology

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...