Global and China Intelligent Cockpit Platform for Automobiles Industry Report, 2020

Cockpit electronic system refers to a complete set of system composed of center console, full LCD dashboard, HUD, rear seat entertainment system, smart audio, telematics module, streaming media rearview mirror and telematics system.

Based on cockpit domain controller, intelligent cockpit system as a foundation of human-car interaction and V2X, provides intelligent interaction, intelligent scenarios and personalized services beyond capabilities of a cockpit electronic system, through a unified software and hardware platform.

Intelligent cockpit platform is a software and hardware architecture enabling sub-systems and features of a smart cockpit. It consists of hardware and software parts: hardware part is a hardware platform comprised of domain controllers and chips; software part refers to a software platform built by operating system, Hypervisor, middleware and support tools.

With advances in technologies about chip, software, among others, one-core multi-screen multi-system integrated cockpit platform as a way to integrate systems, cut costs and meet needs for multi-screen interconnection, intelligent interaction and intelligent driving capabilities that an usual cockpit cannot provide, becomes a mainstay in next-generation cockpit.

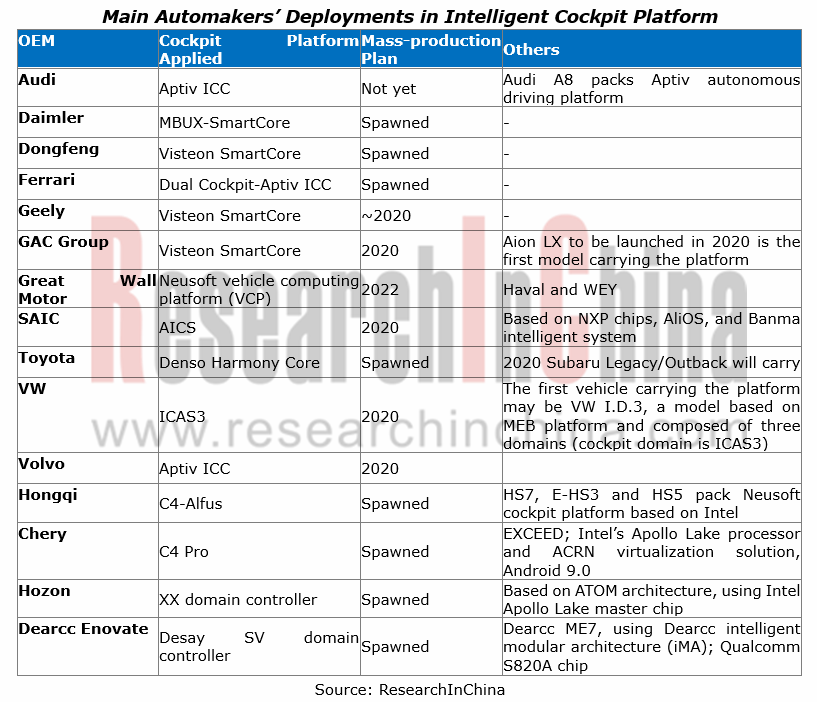

Quite a few automakers have set about deploying smart cockpit system. Some already equip the system on their production vehicles. Examples include MBUX system mounted on 2018 Mercedes-Benz A Class, and C4-Alfus 2.0 and C4-Pro, two domain controller-based cockpit platforms co-developed by Neusoft and Intel and installed in 2019 models like Hongqi HS7 and EXCEED LX.

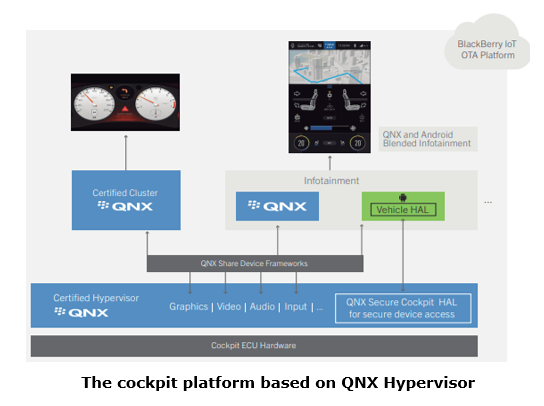

At CES 2020, Land Rover unveiled New Defender 90 and 110, the first ever vehicles to feature dual-modem, dual eSIM design for enhanced connectivity and functionality. Powered by the Qualcomm Snapdragon S820Am Automotive Platform with the integrated Snapdragon X12 LTE Modem, the New Defender can download Software-Over-The-Air (SOTA) updates without interruption and while streaming music and apps through the vehicle’s new Pivi Pro infotainment system. The New Defender is also the first Land Rover vehicle to include a domain controller that consolidates a number of Advanced Driver Assistance Systems (ADAS) and driver convenience functions built on top of the QNX Hypervisor.

Intelligent cockpit hardware platform tends to be a fusion of more and more sub-systems and capabilities. How to well manage these sub-systems and functions rests with the upgrading of cockpit processor and smart cockpit software platform.

Smart cockpit hardware platform becomes ever more powerful in the process of integration

As the base of an intelligent cockpit hardware platform, cockpit domain controller integrated with multiple electronic control units (ECU) outperforms others in safety, size, power consumption, weight and cost, enabling seamless human-machine interaction in combination with interaction ecosystem.

All automotive system integrators are stepping up their efforts to deploy smart cockpit platform. Among them, Tier1 suppliers like Visteon, Aptiv, Neusoft and Desay SV have spawned intelligent cockpit platforms; Continental, Panasonic, Bosch, Samsung, Huawei and so forth have also rolled out their new-generation intelligent cockpit platforms. In the forthcoming years, competition in cockpit platform field will prick up.

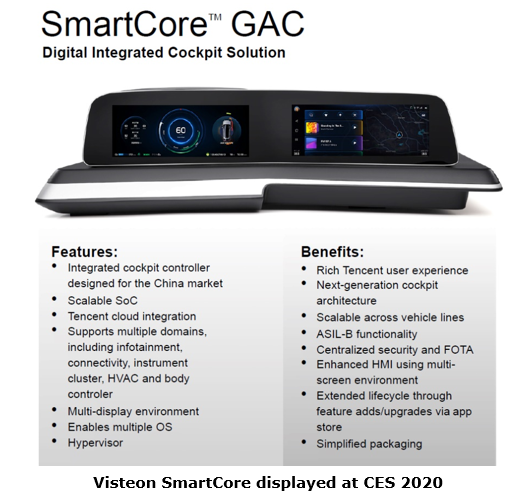

Visteon currently leads the intelligent cockpit domain controller industry. Visteon SmartCore has found massive application in Mercedes-Benz MBUX system early in 2018. At CES 2020, Visteon showcased its newest SmartCore?, an intelligent cockpit platform which is integrated with the Tencent Auto Intelligence (TAI) system and first available to GAC Aion LX, a new BEV model to be launched in 2020. Moreover, Dongfeng and Geely are also partners of Visteon.

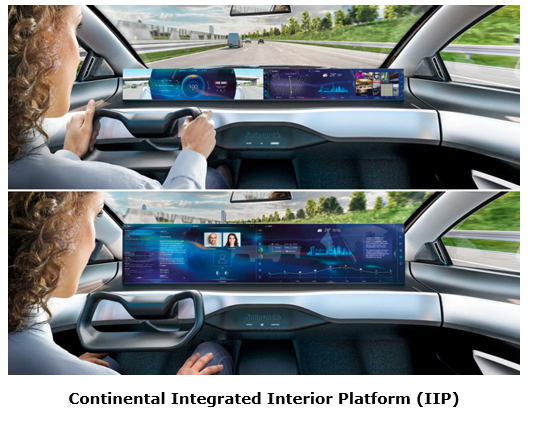

At the IAA 2019 in Frankfurt, Continental showcased the latest version of its Integrated Interior Platform (IIP), a new scalable cockpit platform favoring operating systems like QNX, Integrity, and Android. Continental plans to mass-produce the solution in 2021.

At CES 2020, Samsung Electronics unveiled Digital Cockpit 2020, which utilizes 5G to link features inside and outside the vehicle and provide connected experiences for drivers and passengers alike. Digital Cockpit 2020 is the third co-development between Samsung Electronics and Harman International, and combines Samsung’s telecommunications technologies, semiconductors and displays with HARMAN’s automotive expertise. Digital Cockpit 2020 incorporates eight displays inside the vehicle, as well as eight cameras. The solution utilizes Samsung Exynos Auto V9 SoC (System on Chip), a semiconductor for vehicle electronics, and Android 10, which allow for several features to be run at the same time. Besides, Samsung’s integrated IoT platform SmartThings can work in tandem with the revamped “Bixby in the car” to enhance connectivity by allowing the vehicle to actively communicate with the driver. Once the driver logs in using either facial recognition or a smartphone fingerprint reader, the Center Information Display can be used to show the driver’s schedule and a range of other information. Unlike the 2019 Digital Cockpit, the 2020 solution allows for connections to be made wirelessly.

Panasonic Automotive revealed its latest fully connected eCockpit concept at CES 2020. The technology platform integrates Panasonic’s proprietary SkipGen 3.0 in-vehicle infotainment (IVI) system with Google’s Android Automotive OS running on Android 10. In the concept vehicle, SkipGen 3.0 is paired with the next generation cockpit domain controller, SPYDR 3.0. At the core, the single brain SPYDR 3.0 acts as a hypervisor and is capable of driving up to eleven displays.

As the kernel of cockpit domain controllers, cockpit processors are mainly supplied by Qualcomm, NXP, Intel, Renesas, Texas Instruments, NVIDIA, Allwinner, Samsung, MediaTek, Horizon Robotics, etc. Among them, Qualcomm, Intel and Renesas are the most competitive market players by virtue of their bombshells -- Qualcomm 820a / 835A, Intel A3900 and Renesas R-Car H3 / M3. The major processor chips differ in fabrication processes, cores, and especially GPU computing power which determines the infrastructure level of the cockpit hardware platform.

Software platform becomes the focus of differentiation; Cockpit will be defined by software in future

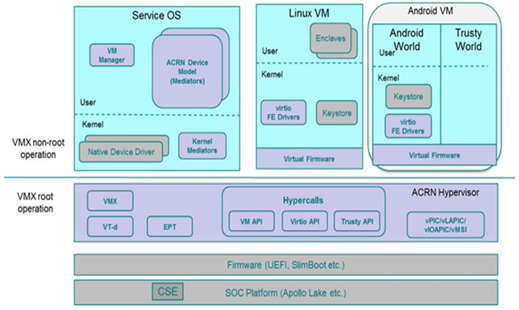

In intelligent cockpit software platform, hypervisor and vehicle operating system are the most important components. Hypervisor allows multiple operating systems and applications to share hardware as a middle software layer that runs between the underlying physical server and the operating system.

The prevailing automotive operating systems embrace QNX, Linux, Android, AliOS, etc., each of which has merits and demerits. Among them, QNX dominates the automotive cluster system market with high security; the open-source Linux has become the underlying system of custom-made operating systems; Android and AliOS are increasingly used by IVI systems due to rich application ecosystem.

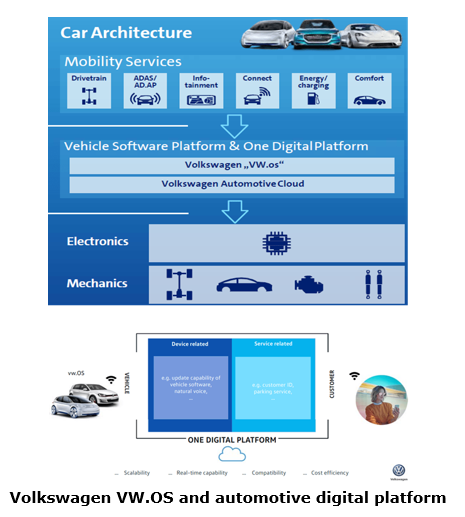

Under the software-defined car trend, operating system is crucial to the intelligent connectivity layout of automakers, and the focus of the emerging system integrators’ deployments. Tesla's self-developed operating system made a success. In 2019, Volkswagen announced to lavish huge on R&D of VW.OS. Several Chinese emerging automakers follow Tesla to develop operating systems by themselves. Yet, all Japanese automakers support AGL in which China-based SITECH also joined.

Also, the new suppliers such as Huawei, ZTE, Alibaba and Baidu have rolled out self-developed operating systems successively. In the future, there will be cut-throat competition in the automotive operating system market. At length, only two or three mainstream operating systems may survive. In fact, there are three mainstream cockpit operating systems for automakers: QNX, Android, and Linux (AGL).

Due to high requirements on safety, most clusters apply QNX. IVI, co-pilot entertainment and rear seat entertainment systems mostly make use of Android. Chinese brands like Geely, Changan, BYD, Dongfeng, Great Wall Motor and GAC are all based on Android, while SAIC prefers AliOS. Audi launched Android-based MIB3 system in 2019. BMW is extending the reach of seamless connectivity in its vehicles with the introduction of Android Auto? starting in mid-2020.

Because intelligent cockpit supports multiple operating systems such as QNX, Android and Linux simultaneously, hypervisors running directly on physical hardware have been widely used. As an intermediate software layer, hypervisors allow operating systems and applications to share hardware. Hypervisors not only coordinate access to hardware, but also impose protection between virtual machines. Common hypervisors include QNX Hypervisor, ACRN, COQOS Hypervisor, PikeOS, and Harman Device Virtualization.

QNX Hypervisor 2.0 uses BlackBerry’s 64-bit embedded operating system QNX SDP 7.0, allowing developers to unify multiple operating systems to a single computing platform or SoC chip. Operating systems such as QNX Neutrino, Linux, and Android are supported on BlackBerry QNX Hypervisor 2.0. The cockpit platforms of Visteon, Denso, Marelli, WM Motor, etc., unexceptionally render QNX Hypervisor.

Global and China Intelligent Cockpit Platform for Automobile Industry Report, 2020 highlights the followings:

Definition, status quo, industry chain and trends of automotive intelligent cockpit platforms;

Definition, status quo, industry chain and trends of automotive intelligent cockpit platforms;

Comparison between automotive intelligent cockpit platform solutions, OEM cockpit platform solution layout;

Comparison between automotive intelligent cockpit platform solutions, OEM cockpit platform solution layout;

Status quo and trends of intelligent cockpit platforms, domain controller market size forecast, typical cockpit hardware platform domain controller solutions and their customers;

Status quo and trends of intelligent cockpit platforms, domain controller market size forecast, typical cockpit hardware platform domain controller solutions and their customers;

Major intelligent cockpit hardware platform vendors (Visteon, Panasonic, Continental, Aptiv, etc.) and product layout;

Major intelligent cockpit hardware platform vendors (Visteon, Panasonic, Continental, Aptiv, etc.) and product layout;

Applied cases of intelligent cockpit hardware platform (Tesla, Mercedes-Benz, Land Rover, etc.);

Applied cases of intelligent cockpit hardware platform (Tesla, Mercedes-Benz, Land Rover, etc.);

Comparison between intelligent cockpit processors. Major cockpit processor vendors (Qualcomm, Intel, NXP, Samsung, Allwinner, Horizon Robotics) and product development;

Comparison between intelligent cockpit processors. Major cockpit processor vendors (Qualcomm, Intel, NXP, Samsung, Allwinner, Horizon Robotics) and product development;

Composition and trends of major intelligent cockpit software platforms;

Composition and trends of major intelligent cockpit software platforms;

Status quo of automotive operating systems, underlying OS market share, major automotive operating system vendors and product development;

Status quo of automotive operating systems, underlying OS market share, major automotive operating system vendors and product development;

Intelligent cockpit software platform virtualization technology (Hypervisor) layout;

Intelligent cockpit software platform virtualization technology (Hypervisor) layout;

18 global and Chinese automotive intelligent cockpit platform solution integrators (cockpit platform solutions and planning).

18 global and Chinese automotive intelligent cockpit platform solution integrators (cockpit platform solutions and planning).

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...