Autonomous Commercial Vehicle Industry Report, 2019-2020

-

Mar.2020

- Hard Copy

- USD

$3,800

-

- Pages:280

- Single User License

(PDF Unprintable)

- USD

$3,600

-

- Code:

BJ002

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,400

-

- Hard Copy + Single User License

- USD

$4,000

-

Self-driving commercial vehicle study: billions of dollars swarm into the field where fifty players compete fiercely, according to our recent report the Autonomous Commercial Vehicle Industry Report, 2019-2020

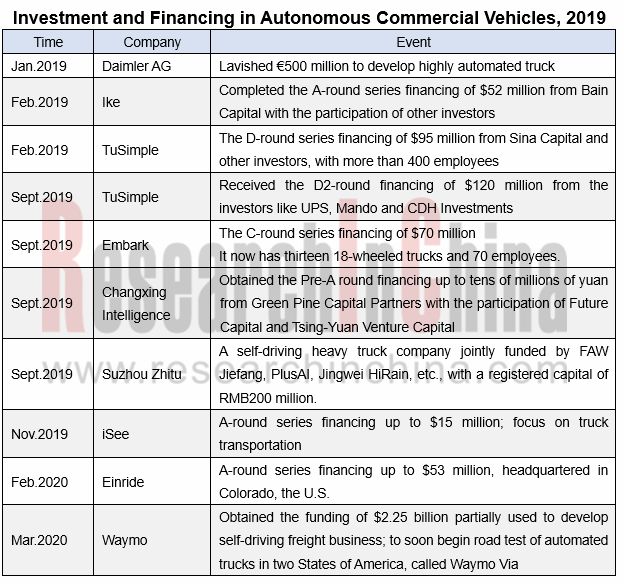

Automated commercial vehicle will be realized ahead of self-driving passenger car. The number of enterprises that forayed into commercial vehicle autonomy in 2019 doubled the prior-year figure. A case in point is TuSimple raised funds up to $215 million in 2019 and won 18 contract clients that devote themselves to transportation in the United States.

After over a year’s halt, Waymo restarted self-driving truck tests in May 2019. Pony.ai, a competitor in RoboTaxi operations and with the investment of $400 million from Toyota and other investors, was also pressing ahead with self-driving truck tests in 2019.

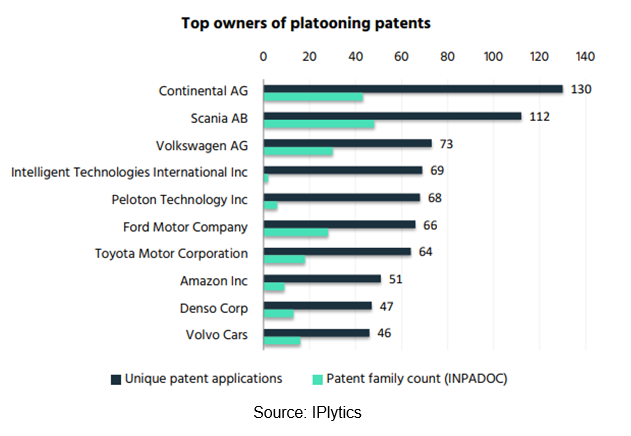

Truck platooning still remains the focus of automated truck test and gets increasingly combined with 5G technology in 2019, into which the companies have set foot including Daimler, CiDi, Scania, Iveco, Volvo, DAF, Peloton, SAIC, Foton, Huawei, TuSimple and Hyundai.

It can be seen from the top 10 holders of platooning patents that the competitive ones are Continental, Scania, Peloton, Ford, Toyota, among others. Chinese counterparts are rarely seen.

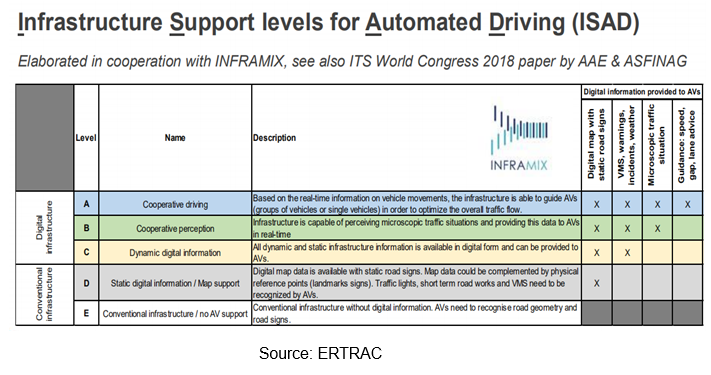

Commercial vehicle going smart coincides with road intelligence, about which the laws and regulations are getting perfect. Road infrastructure for automated driving is classified by ERTRAC (European Road Transport Research Advisory Council) into the five in the table below.

China Highway & Transportation Society (CHTS) Automated Driving Working Committee and Automated Driving Standardization Working Committee issued the Intelligent Connected Road System Levels and Interpretations (Exposure Draft) in September 2019, according to which traffic infrastructure system is divided into I0 level (zero information/intelligence/autonomy), I1 (preliminarily digital/intelligent/automated), I2 (partially connected/intelligent/automated), I3 (conditional autonomy and high connectivity based on traffic infrastructure), I4 (highly automated and based on traffic infrastructure), and I5 (fully automated driving based on traffic infrastructure).

The importance of road intelligence was shown in the platooning test on the Beijing-Chongli Expressway (Yanchong Expressway Beijing Section) in December 2019 that has complex road conditions for more than 94% of the sections are tunnels and viaducts. In most cases, autonomous driving in the tunnel became difficult because the GNSS signal was bad. Moreover, it was the middle of winter and the outdoor temperature remained as low as -20°C, challenging a multitude of supporting equipment. Huawei has installed the 5G vehicle terminal T-Box with 5G+C-V2X technology on Foton Commercial Vehicles, and also provides roadside sensing terminal cameras, radars, road side unit, edge computing, C-V2X Server, etc. Through the C-V2X services for the entire road sections, the deficiencies in positioning, communication and perception in the tunnel can be compensated. Foton commercial vehicles completed a 14-km L4 platooning demonstration, including a 9.8-km continuous extra-long tunnel.

Billions of dollars flocked to the maturing self-driving commercial vehicle market in 2019. Vehicle intelligence is prioritized in foreign countries, while CVIS (Cooperative Vehicle Infrastructure System) prevails in China. There will be greater development space from 2020 on.

The report details technologies about automated driving of commercial vehicle, organizations, the status quo of the market as well as progress in platooning; nearly 50 suppliers’ and automakers’ investments, deployments, technical routes, products & solutions, business models, plans and goals, tests, collaborations, applied scenarios, etc.

1. Overview of Autonomous Commercial Vehicle Industry

1.1 Overview of Autonomous Commercial Vehicle

1.1.1 Definition of Commercial Vehicle

1.1.2 Necessity of Autonomous Commercial Vehicle

1.1.3 Advantages of Commercial Vehicles Popularizing Autonomous Driving Technology

1.1.4 Development Stage of Autonomous Commercial Vehicle at Home and Abroad

1.1.5 Expected Development Path of Autonomous Commercial Vehicle

1.1.6 Development Stage of Autonomous Trucks

1.1.7 Features of Autonomous Trucks by Development Stage

1.2 Autonomous Commercial Vehicle Technology

1.2.1 Typical Applied Scenarios of Autonomous Commercial Vehicle and Technologies

1.2.2 Technology Solutions for Typical Applied Scenarios of Commercial Vehicles

1.2.3 Key Technologies for Autonomous Commercial Vehicle

1.2.4 Reference Architecture of Autonomous Commercial Vehicle

1.2.5 Evolution of Autonomous Commercial Vehicle

1.2.6 ADAS Features Required by L1-L2 Commercial Vehicle

1.3 Autonomous Commercial Vehicle and Regulations

1.3.1 Timeline of Regulations on Brake Control and ADAS (by Region) Worldwide

1.3.2 Active Safety and ADAS Are the Compulsory Requirements in Laws & Regulations of All Countries

1.3.3 China's Regulations on Active Safety and ADAS Are Rapidly Advancing

1.3.4 Latest Regulations and Policies in 2019

1.4 Challenges and Supporting Facilities for Autonomous Commercial Vehicle

1.4.1 Challenges to Autonomous Commercial Vehicle

1.4.2 Acceptance of Autonomous Commercial Vehicle

1.4.3 Challenges for and Impacts of Autonomous Trucks

1.4.4 Impact of Autonomous Driving on Stakeholders in the Truck Industry

1.4.5 Autonomous Commercial Vehicle Needs Related Infrastructure

1.4.6 Classification of Autonomous Driving-related Infrastructure (Road) (Europe)

1.4.7 Classification of Autonomous Driving-related Infrastructure (Road) (China)

1.5 Autonomous Truck Market Size Forecast

1.5.1 Global and China Autonomous Truck Market Size Forecast

1.5.2 Autonomous Truck Market Size Forecast by Type

1.6 Organizations Concerned and Important Projects

1.6.1 EATA

1.6.2 ENSEMBLE

1.6.3 Milestones of ENSEMBLE

2. Commercial Vehicle Platooning

2.1 Truck Platooning

2.1 Introduction to Truck Platooning

2.1.1 Key Truck Platooning Components and Functions

2.1.2 Evolution of Truck Platooning Technology

2.1.3 Value of Truck Platooning

2.1.4 Fuel Saving of Truck Platooning Tests

2.1.5 Status Quo of Truck Platooning in the World

2.1.6 Truck Platooning Projects Worldwide, 2018-2020

2.1.7 Comparison of Some Truck Platooning Projects

2.1.8 Development History of Truck Platooning

2.1.9 Truck Platooning Patent Analysis

2.2 Status Quo of Truck Platooning in Europe

2.3 Status Quo of Truck Platooning in US

2.3.1 Truck Platooning Overview in US

2.3.2 Truck Platooning Projects in US

2.3.3 Truck Platooning Test in US

2.3.4 Platooning Regulations in US by State

2.4 Status Quo of Truck Platooning in China

2.4.1 Representative Truck Platooning Projects in China, 2018

2.4.2 Cainiao’s Self-driving Truck Platooning Technology Solution

2.4.3 The First Large-scale Commercial Vehicle Platooning Trial in China

2.3.4 Platooning Is an Important Part of ICV Standard System Construction Guide

2.3.5 Truck Platooning Tests in China, 2019

2.4 Status Quo of Truck Platooning in Japan and South Korea

2.4.1 Platooning Projects in South Korea

2.4.2 Development Roadmap of Autonomous Trucks in South Korea

2.4.3 Platooning Participants in Japan

2.4.4 Platooning Development Roadmap in Japan

3. Foreign Providers of Autonomous Commercial Vehicle Solutions

3.1 Starsky Robotics

3.2 Embark

3.3 Peloton Technology

3.4 BestMile

3.5 Oxbotica

3.6 Einride

3.7 WABCO

3.8 Knorr-Bremse

3.9 Kodiak Robotics

3.10 Thor Trucks

3.11 WAYMO

3.12 Pronto

3.13 Ike

3.14 iSee

3.15 Outrider

Comparison of Foreign Autonomous Commercial Vehicle Solution Providers (including revenue, workforce, financing, major products, business models, major customers, partners, support for self-driving trucks, autonomous driving tests, truck platooning tests, etc.)

Conclusions

4. Chinese Providers of Autonomous Commercial Vehicle Solutions

4.1 Tsintel Technology

4.2 TuSimple

4.3 Westwell

4.4 FABU Technology

4.5 PlusAI

4.6 TRUNK

4.7 CiDi

4.8 Inceptio Technology

4.9 SuperG AI

4.10 Changxing Intelligence

4.11 Suzhou Zhitu

4.12 In-Driving

Comparison of Chinese Autonomous Commercial Vehicle Solution Providers (including location, registered capital, financing, headcount, main products, business models, major clients, partners, support for remote control, support for autonomous trucks/buses, autonomous driving tests, planning and goals, etc.)

Conclusions

5. Autonomous Driving Layout of Foreign Commercial Vehicle Makers

5.1 Volkswagen

5.2 PACCAR

5.3 Volvo

5.4 Daimler

5.5 SCANIA

5.6 Hino

5.7 Iveco

Comparison of Foreign Commercial Vehicle Companies (including revenue and growth rate, sales volume, profit, nationality, planned investment in autonomous driving, foreign investment, major products, ICV partners, investment in autonomous trucks / buses, autonomous driving tests, planning and goals, etc.)

Conclusions

6. Autonomous Driving Layout of Chinese Commercial Vehicle Makers

6.1 Beiqi Foton Motor

6.2 Dongfeng Motor

6.3 SINOTRUK Group

6.4 FAW Jiefang

6.5 China Shaanqi

6.6 SAIC Hongyan

6.7 Beiben Trucks

6.8 JMC

6.9 Zhengzhou Yutong Bus

6.10 King Long Bus

6.11 CRRC Electric Vehicle

6.12 Xiamen Golden Dragon Bus

6.13 Anhui Ankai Automobile

6.14 Skywell

Comparison of Chinese Commercial Vehicle Companies (including revenue and growth rate, sales volume, profit, registered capital, autonomous driving investment, main products, ICV partners, autonomous driving tests, launch time, planning and goals, etc.)

Conclusions

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...