V2X (Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2019-2020

5G+V2X CVIS will be a strong driver for highly automated driving.

The V2X industry is thriving with advances in automotive connectivity, to which great importance has been attached by car producing powers worldwide, and it is vigorously promoted and deployed about which the development plans, laws & regulations, technical criteria and pilot construction are in full swing in different countries.

Till 2025, the intelligent vehicles with conditional autonomy will be spawned in China, LTE-V2X and other networks will be regionally viable, 5G-V2X will be progressively available on expressways and in some cities, and the high-precision spatial-temporal datum service network will be fully covered, according to the Strategy for Innovative Development of Intelligent Vehicles circulated by National Development and Reform Commission (NDRC) in February 2020. An intelligent vehicle system with Chinese standards will be established between 2035 and 2050.

Two V2X technology roadmaps prevail worldwide, i.e., IEEE802.11p (DSRC) and C-V2X (Cellular-V2X). Application layer standards are drafted differently by countries.

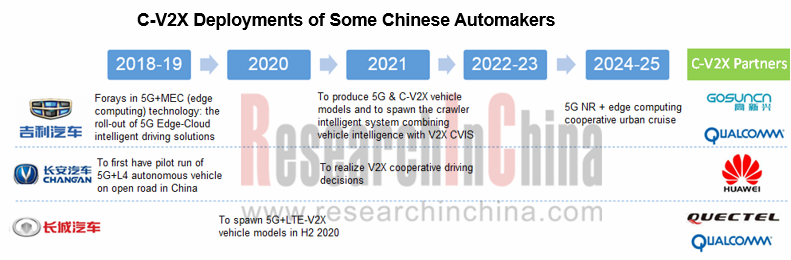

C-V2X springs up and wins the hearts of industry insiders since it is far superior to DSRC. C-V2X, encompassing LTE-V2X and 5G-V2X, gets energetically promoted in China.

In December 2019, Federal Communications Commission (FCC) passed a resolution with one accord that most spectrums of 5.9GHz band will be reallocated and they will be dedicated for the unlicensed spectrum technology and the C-V2X technology. Over the past two decades, 75MHz in the 5.9GHz band was used for DSRC, but FCC seeking to revise the rules pointed it out that DSRC is at a standstill for many years, particularly in April 2019 when Toyota stopped using DSRC V2X technology.

5G NR based V2X will boost the development of fully automated vehicles.

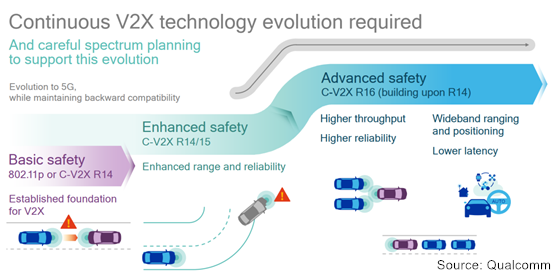

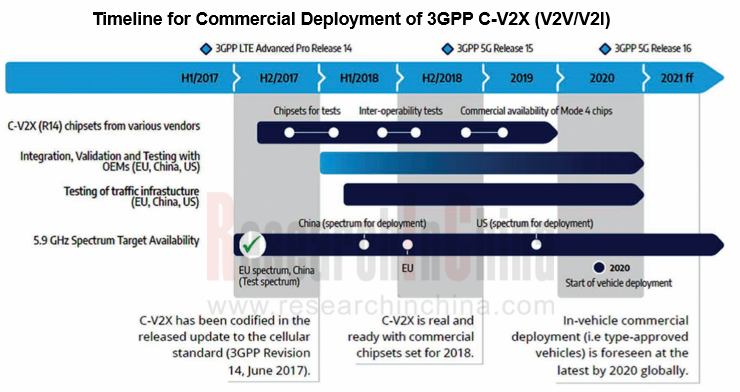

C-V2X (incl. LTE-V2X, 5G-V2X) is based on 3GPP specifications. LTE-V2X evolves towards 5G-V2X.

3GPP R14 standards supporting LTE-V2X was issued in 2017; 3GPP R15 standards that support LTE-V2X enhanced (LTE-eV2X) were formally completed in June 2018; 3GPP R16+ standards supportive for 5G-V2X started to be studied in June 2018.

LTE-V2X is designed mainly to enable driver assistance, improve road safety, efficiency and comfort. NR-V2X, a fusion of communication technologies, big data, artificial intelligence, among others, suffice autonomous driving and other new features better. 5G NR V2X standards are rapidly under way and physical layer specifications plan to be nailed down in March 2020.

Among the 25 projects about Rel-17 that were established at the 3GPP RAN Meeting held in Spain in December 2019, a standardization project -- 5G new radio sidelink enhancement -- will be a souped-up version of Rel-16 NR-V2X sidelink. Also, the technology roadmap of 3GPP 5G 3rd edition (Rel-17) was made explicitly during the Meeting. Noticeably, Chinese operators initiated and joined many projects of criteria constitution about 3GPP RAN R17.

Progress in C-V2X deployment

It is put forward in the Strategy for Innovative Development of Intelligent Vehicles to build a full-fledged intelligent vehicle infrastructure system, including (1) to build smart roads and next-generation national traffic control network, to expedite 5G construction and combination with telematics; (2) to study the licensing of special spectrums for automotive wireless communications, to hasten construction of wireless communication network for automotive use; (3) to accelerate construction of a unified national high-accuracy spatial temporal datum service capabilities by giving full play to the existing Beidou satellite positioning reference station network; (4) to develop the intelligent vehicle maps with unified standards, to build a perfect geographic information system containing road network information, to offer real-time kinematic (RTK) data services; (5) the existing facilities and data resources will be leveraged to build a national intelligent vehicle big data cloud-enabled platform.

5G+V2X, as a crucial infrastructure to autonomous driving, is booming with policy support. V2X started from 2019 to be piloted successively and will be more popular with 5G deployments in 2022. Meanwhile, 5G NR V2X is being tested and certified, setting the stage for large-scale application of intelligent vehicles with higher autonomy in 2025.

The traditional automotive terminals like T-Box are on the brink of a revolution. The automotive TCU (Telematics Control Unit) integrates 4G/5G module, C-V2X module, onboard navigation module and so forth, which means the opportunities and challenges to the providers of both cockpit electronics and conventional telematics.

Huawei Technologies rolled out the C-V2X T-Box compatible with both 4.5G and 5G; PATEO launched 4.5G C-V2X T-box; Neusoft released T-Box 3.0 combining C-V2X, 5G, Ethernet and other technologies; Samsung Harman announced the availability of TCU in-built with cellular NAD and Autotalks’ 2nd-Gen chipset, offering C-V2X capabilities.

Telematics evolves from initially TSP platform to intelligent connectivity platform and then to autonomous driving cloud-enabled platform (cooperative vehicle infrastructure system). 5G T-Box, a portal for big data of intelligent vehicles in future, will be the core product for smart hardware producers. Automakers also have collaborations with Tier 1 suppliers and plan to have the to-be-launched models configured with 5G+V2X successively.

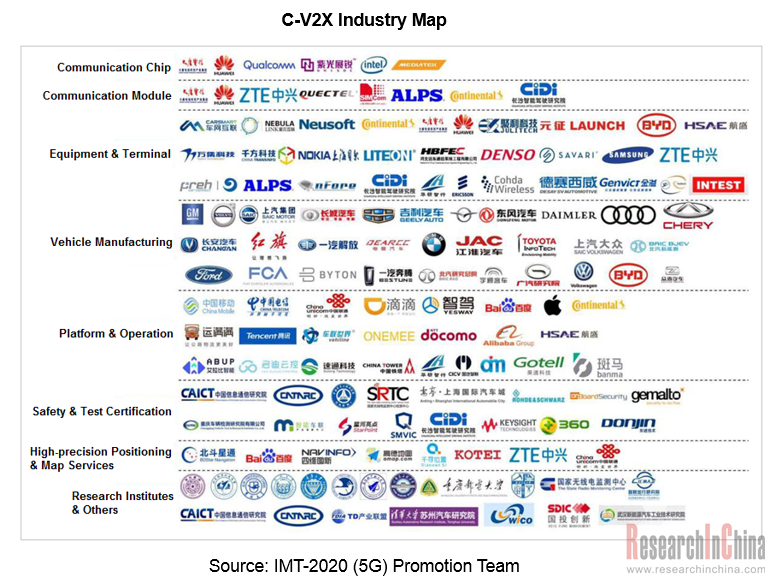

Perfection of C-V2X industry chain in China

C-V2X industry chain involves communication chip, communication module, terminals & equipment, vehicle manufacturing, test & certification, operation services, etc., where there are many players such as chip vendors, equipment manufacturers, OEMs, solution providers and telecom carriers. In October 2019, C-V2X ‘Four Crosses’ (cross-chip module, cross-terminal, cross-vehicle, cross- safety platform) connectivity demonstrations were successfully held, a full interpretation of C-V2X complete chain technology competences and facilitating further C-V2X deployments at home.

Huawei make great strides in C-V2X and has unveiled C-V2X chip, gateway, T-Box, RSU (Road Side Unit) to end-to-end solutions. In 2019, Huawei launched 5G in-car module MH5000 which is highly integrated with 5G and C-V2X technologies and is packed with 5G baseband chip Balong 5000 with such features as one-core multi-mode, high rates, downlink-uplink decoupling, support of SA (5G standalone) and NSA (5G non-standalone) dual-mode network, support of C-V2X, to name a few.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...