Global and China Low Speed Autonomous Driving Industry Report, 2019-2020

In 2019, low speed autonomous driving market tended to calm down, with more regular pilots but on small scale. In 2020, the COVID-19 pandemic brings new opportunities to low speed autonomous delivery industry.

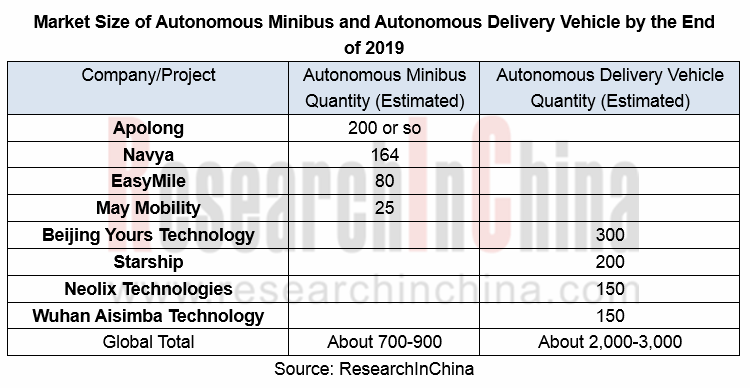

Autonomous minibuses aim to meet the needs for picking up passengers at the front and rear ends. A combination of factors such as technology, cost and rules impede the emergence of large, profitable autonomous minibus companies. Some players plan commercial operation in 2020. Navya as the one deploying the most autonomous minibuses worldwide had sold a total of 164 autonomous minibuses by the end of 2019. Yet it announced that it would no longer sell vehicles and turn to sales of system technologies considering high cost and meager profit, and that in future vehicles would be produced purely for research and development, test and exhibition. EasyMile and May Mobility have an autonomous minibus fleet of 80 units and 25 units, separately, with pilot run in the US, Europe and beyond.

In 2019, some companies realized normal commercial operation of projects on public roads, for example, EasyMile had more than 230 projects worldwide and enabled normal operation on some Canadian public roads.

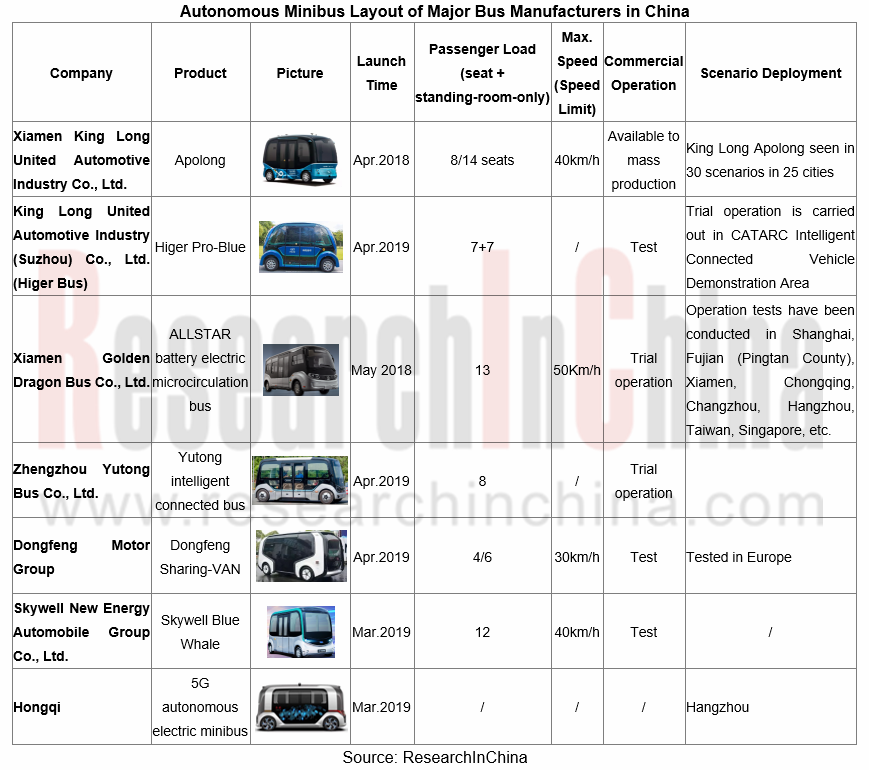

Baidu Apolong, an autonomous minibus which debuted in 2018, springs up the most rapidly in China. According to the data released, over 100 units of Apolong minibuses already go into operation. Apart from Apolong, in 2019 several bus manufacturers in China also rolled out their own autonomous minibuses. Examples include Uisee Technology which ran autonomous shuttle buses in places such as Guangzhou Baiyun International Airport, Nanning Garden Expo Park and Xingtai Garden Expo Park.

Low speed autonomous delivery vehicle market targets demand for last-mile delivery. In 2019, autonomous delivery vehicle market was advancing steadily. Quite a few companies explored scenario application, with normal trials under way. For instance, Neolix Technologies Co., Ltd. launched an autonomous retail vehicle and put it into trial operation in several parks of Beijing; in late 2019, UISEE deployed autonomous luggage vehicles for normal operation at Hong Kong International Airport.

The problems like high cost, imperfect policies and regulations as well as technical limitations are however still in the way of operating autonomous delivery vehicles on large scale.

In early 2020, autonomous delivery vehicles of companies including JD Logistics, Neolix Technologies, Idriverplus, Uisee Technology and Meituan joined in the fight against COVID-19, creating new opportunities for autonomous delivery industry.

The attempts on operation of autonomous delivery vehicles on real roads are a boon for large-scale deployments. For example, JD Logistics intelligent delivery robots navigated by Beidou satellites accomplished intelligent delivery from the JD Logistics Wuhan Renhe Station to the No.9 Hospital of Wuhan at a speed of 15km/h; in February 2020, Neolix Technologies had 18 autonomous vehicles in anti-epidemic efforts in Wuhan Leishenshan Hospital and communities of the city; during the outbreak, White Rhino Auto (Beijing) Technologies helped Wuhan Guanggu Mobile Cabin Hospital distribute materials, and provided autonomous delivery services (vegetables and fruits) for communities along a Haidian district demonstration road.

The roleplaying of autonomous vehicles during the epidemic is welcomed by people, in readiness for wider application of autonomous vehicles.

In this period, quite a few autonomous delivery vehicle companies closed a new funding round. Examples include Uisee Technology which finished a series B funding round (where Bosch was an investor) in February 2020; Neolix Technologies receiving investment for its A+ funding round from investors like Leading Ideal in March 2020; and White Rhino Auto raising funds from Chentao Capital in the angel funding round also in March.

In 2019, there existed altogether 700 to 900 autonomous minibuses worldwide, and about 2,000 to 3,000 autonomous delivery vehicles, a figure projected to outnumber 10,000 units in 2020.

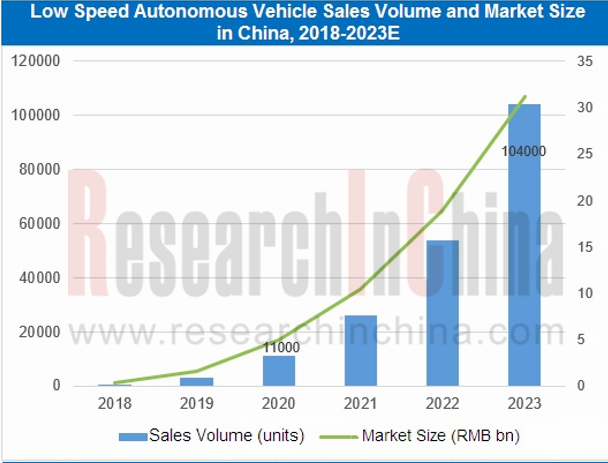

11,000 units of low speed autonomous vehicle will be sold in China in 2020, according to our prediction for the market in early 2019, but the sales figure in 2020 is now trimmed to 15,000 units considering that a few segments enjoy better-than-expected growth.

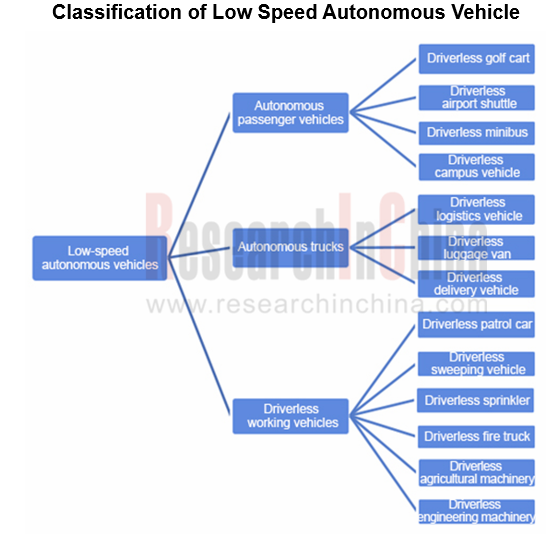

From our classification block diagram above, it can be seen that a report is unable to cover dynamics of all low speed autonomous vehicle segments. On the basis, we prepare two reports on low speed autonomous vehicle: Global and China Low Speed Autonomous Driving Industry Report, 2019-2020, and Global and China Special Autonomous Vehicle (Autonomous Working Vehicle) Industry Report, 2019-2020.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...