Global and China Automotive Operating System (OS) Industry Report, 2019-2020

With advances in smart cockpit and intelligent driving, and enormous strides of Tesla, OEMs care more about automotive operating system (OS). Yet, it is by no means easy for both new carmakers and traditional OEMs to develop base software for intelligent cars. It is in the report that world’s vehicle OS vendors are compared and analyzed.

Auto OS is generally classified into four types:

1) Basic auto OS: it refers to base auto OS such as AliOS, QNX, Linux, including all base components like system kernel, underlying driver and virtual machine.

2) Custom-made auto OS: it is deeply developed and tailored on the basis of basic OS (together with OEMs and Tier 1 suppliers) to eventually bring cockpit system platform or automated driving system platform into a reality. Examples are Baidu in-car OS and VW.OS.

3) ROM auto OS: Customized development is based on Android (or Linux), instead of changing system kernel. MIUI is the typical system applied in mobile phone. Benz, BMW, NIO, XPeng and CHJ Automotive often prefer to develop ROM auto OS.

4) Super auto APP (also called phone mapping system) refers to a versatile APP integrating map, music, voice, sociality, etc. to meet car owners’ needs. Examples are Carlife and CarPlay.

OEMs are not only striving to gain control of vehicle base software and hardware and apt to use neutral OS, but exerting itself to reduce the development cycle and costs by more collaborations and leveraging open source software organizations.

Preference to Neutral and Free OS

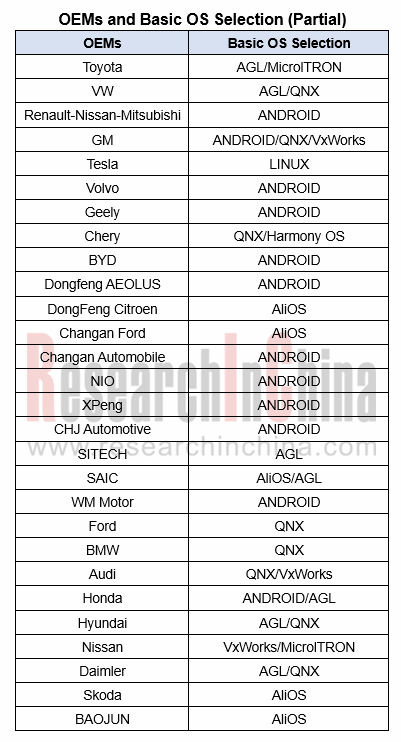

It can be seen in the table below that most Chinese automakers select Android, while foreign peers choose AGL. Both Android and and AGL are neutral and free operating systems.

AGL now has the support of 11 OEMs including Toyota, VW, Daimler, Hyundai, Mazda, Honda, Mitsubishi, Subaru, Nissan, SAIC , etc.

AGL addresses 70% of OS development work, while the remaining 30% can be developed by OEMs. This facilitates development progress and cuts costs significantly.

More than 140 AGL members work together to develop a common platform for infotainment, which will be further available to ADAS, OTA, gateway, V2X and automated driving in the future.

ANDROID ecosystem, compared with AGL, is more mature and widely used by Chinese OEMs. However, OEMs felt risky to apply ANDROID as Google banned Huawei from using the Google Mobile Services (GMS) on Huawei phones in 2019, giving vitality to other operating systems. For instance, AliOS has already been seen in at least nine auto brands.

Reduce Development Cycle and Costs with the Help of Open Source Software Organizations

The GENIVI Alliance was jointly founded by giants like BMW, GM and Intel in 2009, aiming to offer applicable standards and open source codes for in-vehicle infotainment (IVI) platform. The alliance associates with the users of Android, AUTOSAR, Linux, and other in-car software and the solution suppliers to form a productive and collaborative community of 100+ members worldwide encompassing leading automakers, Tier 1 suppliers, semiconductor suppliers, software developers and service providers. GENIVI alliance always leads in field of open source cockpit software development.

The successful operation of GENIVI Alliance shows the industry’s urgent need to reduce development costs and avoid the duplication of development via open source software organizations.

The Autoware Foundation is a non-profit organization founded in Dec. 2018, aiming to develop open source software for autonomous vehicle. With nearly 40 members globally, Autoware is adopted by over 200 organizations in the world.

IT firms Marry Cars and Various Smart Hardware via OS

LG acquired webOS (developed by Palm) from HP in 2013, and then extended webOS as a mobile phone OS to the suitable one for TVs, smart refrigerators, smart watches and smart cars. At present, LG has sold millions of its webOS-enabled Smart TVs. In the early 2020, LG’s webOS is increasingly seen in automotive sector.

Samsung has ambitious plans for Tizen, an open operating system, which has already been found in Samsung’s wearables and smart fridges, and will be applied to floor mopping robots, washing machines, air conditioners and even cars in future.

Huawei does alike in Harmony OS, a microkernel-based, distributed OS designed to deliver a 'smooth experience' across all devices in all scenarios. It enables seamless cross-terminal synergy across multiple devices and platforms including smart phone, TV, Tablet PC and automotive infotainment.

IT companies are attempting to realize intelligence of all scenarios from mobility, home to office by centering on OS. It remains to be seen whether OEMs will adopt the plan and when the plan will be actually carried out.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...