Tier 1 suppliers for autonomous driving: Chinese Tier 1 suppliers have not embarked on the actuation layer, and L3 will spread after 2022

Amid the controversy in L3, some media believe that Audi will give up L3, which is later denied by Audi saying it only elevate the L3 research to Volkswagen Group.

Most OEMs plan to launch L3 models in 2020 except Volvo, Ford and NextEV that will skip L3.

Strictly speaking, the L3 models to be launched by OEMs in 2020 may be prototypes of some high-end models or not real L3 models.

Tier 1 suppliers are not in readiness for large-scale supply to L3 models. Continental, for instance, focuses on L2 + models between 2019 and 2022, and will commercialize L3 models after 2022. Bosch will also begin commercializing the L3 highway pilot (HWP) function after 2022. To increase redundancy of the system, Bosch renders a dual-domain controller architecture to further ensure the system security.

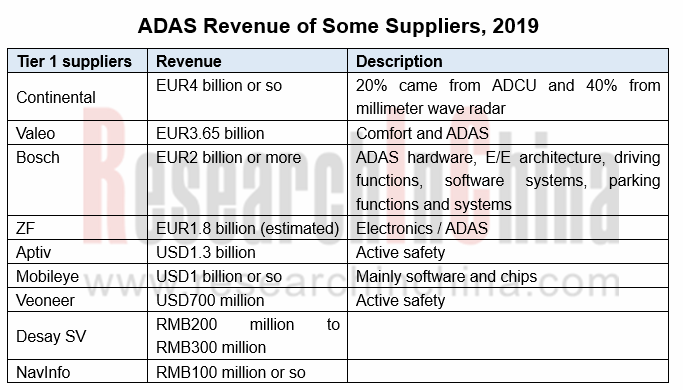

In the realm of autonomous driving, Tier 1 suppliers profit mainly from ADAS. Although Mobileye enjoys the largest market share in terms of ADAS algorithms (including software and chips), it did not secure the highest revenue in 2019 in the ADAS market which also covers control units, millimeter wave radars, map positioning systems, etc.

A case in point is Continental whose ADAS revenue in 2019 posted €4 billion (20% from ADAS domain control unit (ADCU) and 40% from radars).

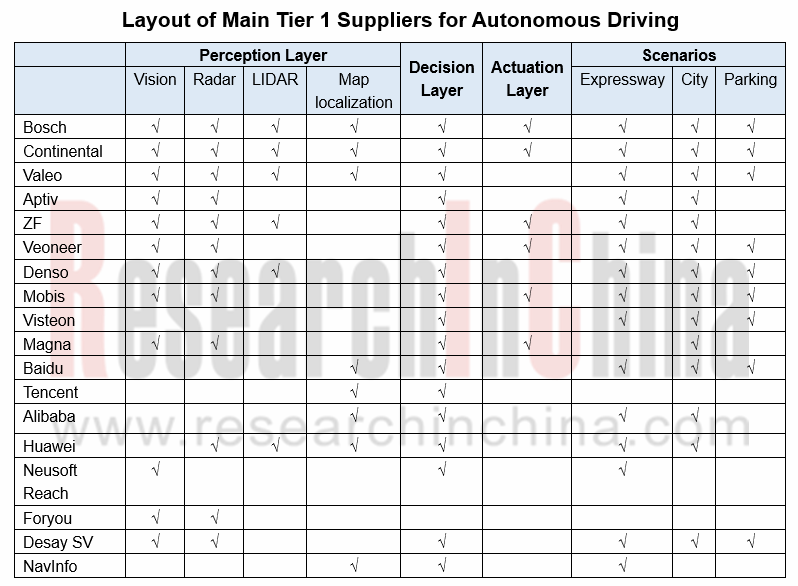

It can be seen in the table below that Bosch, Continental and Valeo stay ahead by deployments among foreign Tier 1 suppliers, and Huawei deploys most widely in Chinese Tier 1 suppliers.

Chinese Tier 1 suppliers have not embarked on the actuation layer, which is undoubtedly their biggest shortcoming. Without the know-how about actuation technology, they cannot control the autonomous vehicles accurately nor have the initiative. It is expected that they will invest in or acquire related companies in the near future to address inadequacies.

Despite lagged far behind foreign Tier 1 suppliers in the underlying hardware of autonomous driving, Chinese Tier 1 suppliers delve more into application scenarios and V2X than foreign counterparts who usually deploy in expressways, urban roads, and autonomous parking, for the three of which Valeo, for example, launched Cruise4U, Drive4U, Park4U , respectively.

Chinese Tier 1 suppliers have laid out more scenarios. Together with partners, Baidu is present in such scenarios as autonomous cleaning, autonomous agricultural machinery, autonomous shuttles, RoboTaxi, autonomous delivery, autonomous buses, autonomous trucks, and AVP.

Alibaba is pivoted on autonomous logistics vehicle to bolster its e-commerce business.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...