Domain control unit shipments will boom in 2021.

When the one-to-one correspondence between the growing number of sensors and electronic control units (ECU) leads to underperforming vehicles and adds circuit complexity, more powerful centralized architectures like domain control unit (DCU) and multi-domain controller (MDC) come as an alternative to the distributed ones.

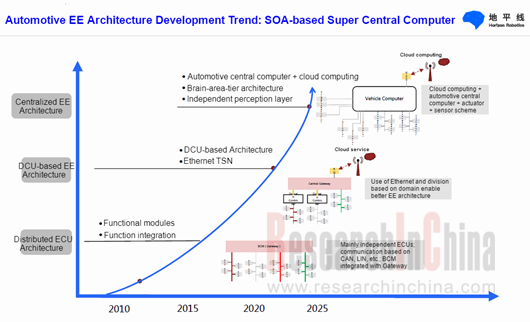

As concerns the tendency of domain controller, Vector conceives three stages of E/E architecture development: controller-centric, DCU, and central computer. Intelligent vehicle will ultimately be a mobile super computer and data center, and a new Wintel will come into being. In future, computing platform, operating system and application software will matter the most to the highly automated vehicles; multimedia multi-domain controllers and central domain controllers are likely to be combined into one.

In response to the disruption, Volkswagen plans adoption of a unified automotive E/E architecture; BMW will introduce central communication services and service-oriented architecture (SOA) in its next-generation E/E architecture; the smart vehicle architecture (SVA) launched by Aptiv breaks the bottleneck of conventional architectures, providing frame scalability for next-generation intelligent vehicles. The new E/E architectures will be built on the concept of central computer-layer-area, embodying the philosophy of SOA.

As to DCU, next-generation smart cockpit system based on cockpit DCU enables functionality of cockpit electronic system on a unified software and hardware platform. Cockpit electronic system offering intelligent interaction and scenarios as well as personalized services, will be a foundation for human-vehicle interaction and vehicle-to-everything (V2X) communication. Visteon argues that by 2023, intelligent cockpit integrated with LCD dashboard, center console and co-pilot infotainment system will be based entirely on single-ECU domain control platform.

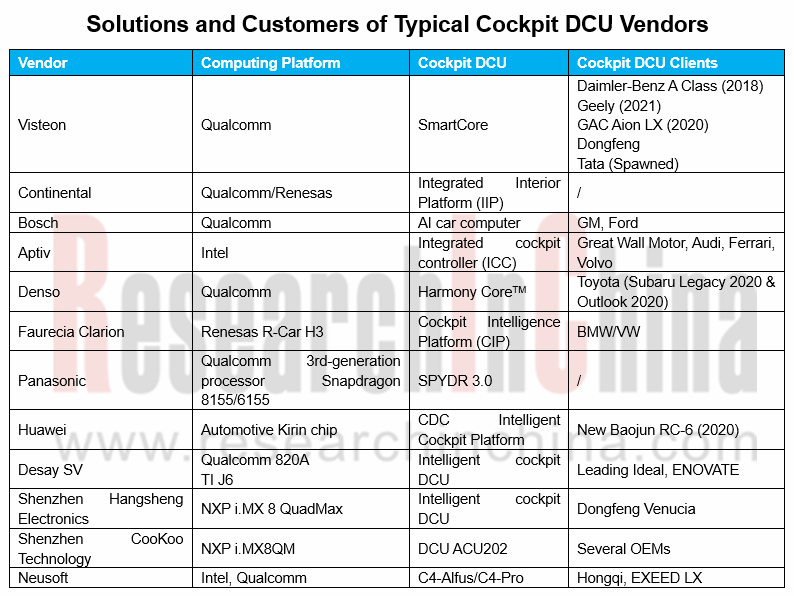

Globally, Visteon, Continental, Bosch and Aptiv dominate the cockpit DCU market; Chinese players like Huawei, Desay SV, Shenzhen Hangsheng Electronics and Neusoft race to unveil their cockpit DCU solutions.

As for cockpit chip, typical products are comprised of Qualcomm 820A, Intel Atom, NXP i.MX8, Renesas R-CAR H3 and TI Jacinto family. Notably, the prevailing Qualcomm 820A processor platform has been ordered by 18 out of the 25 world-renowned OEMs, with the order intake recording $5.5 billion or so.

In the ADAS/AD DCU market, most of those in use for Level 1 driving assistance employ separate ECU to control. ADAS ECU which is developed mainly for Level 2 driving assistance is utilized to combine LDW/LKA and AEB. It is in the era of Level 2+, Level 3 and Level 4 automated driving that the demand for autonomous driving domain control unit (AD DCU) will be soaring.

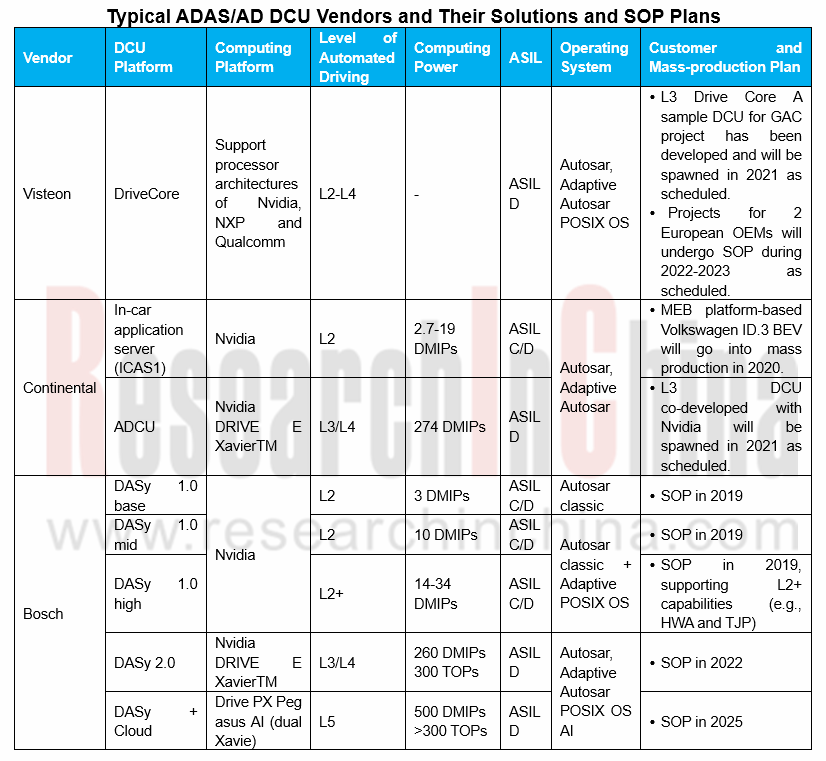

Tier-1 suppliers worldwide already deploy ADAS/AD DCU such as Visteon DriveCore, Bosch DASy, Continental ADCU, ZF ProAI, Veoneer Zeus and Magna MAX4. In China, such typical products include iECU (co-developed by SAIC and TTTech), Huawei MDC (MobileData Center) intelligent driving DCU, IN-DRIVING TITAN, and Neusoft Reach CPDC-II DCU/CPDC-III central computer.

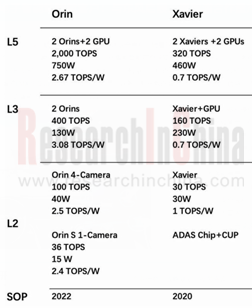

When it comes to autonomous driving chip, Nvidia is absolutely the leader with Nvidia Drive PX2 and Nvidia Drive Xavier being widely deployed by vendors. In December 2019, Nvidia introduced DRIVE AGX Orin, a software-defined platform for Level 5 automated driving, with nearly 7x the performance of the previous generation SoC Xaiver. The Orin SoC integrates NVIDIA’s next-generation GPU architecture and Arm Hercules CPU cores, as well as new deep learning and computer vision accelerators that, in aggregate, deliver 2,000 TOPS.

Other autonomous driving chips include TI TDA4, Qualcomm? Snapdragon Ride?, NXP S32 family, and Mobileye EyeQ family.

In the next three to five years, among DCU market segments, cockpit DCU will see a faster growth rate and a larger market than autonomous driving DCU because it is easier to spawn cockpit DCUs at lower cost; the surging demand for intelligent cockpits, which is fueled by the availability of 5G in vehicles, will drive up cockpit DCU shipments to explode in 2021 on the basis of OEM’s and Tier1’s progress in mass production.

In the ADAS/AD DCU field, inadequate regulations and immature technologies will expectedly make it hard to apply Level 3/Level 4 automated driving technologies on large scale in the upcoming three to five years. OEMs, tier-1 suppliers and chip vendors are working to mass produce L2+ autonomous vehicles. It is predicted that production of Level 3/Level 4 autonomous vehicles will peak around 2025, but business-oriented vehicles will play the key role, with roughly 5 million units of ADAD/AD DCUs for passenger cars to be shipped worldwide in 2025.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...