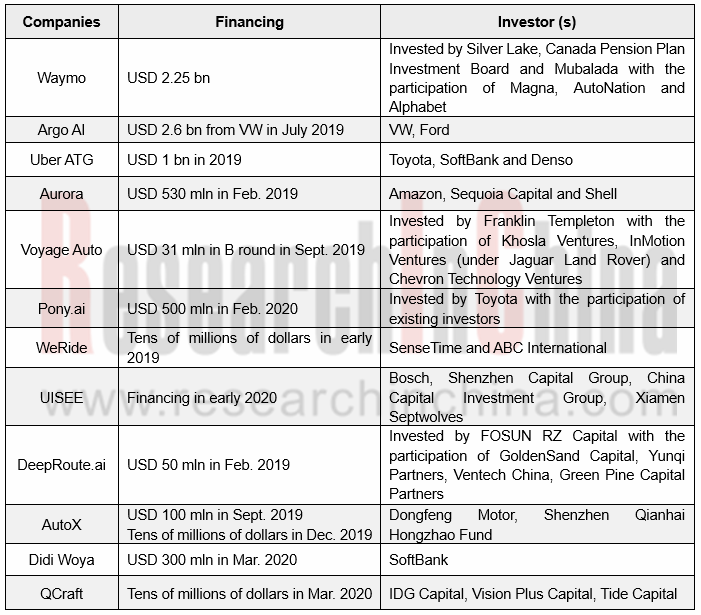

Giants gain high finance.

Progress of L4 autonomous driving is greatly hampered over the recent two years, causing OEMs’ and Tier 1 suppliers’ delay in L4 launches. Yet, the top L4 companies still raised huge funds in the past year.

In 2019, Baidu, Pony.ai and WeRide succeeded in commercial pilot of Robotaxi on complex urban roads in limited areas, a crucial step for L4 autonomous driving in China.

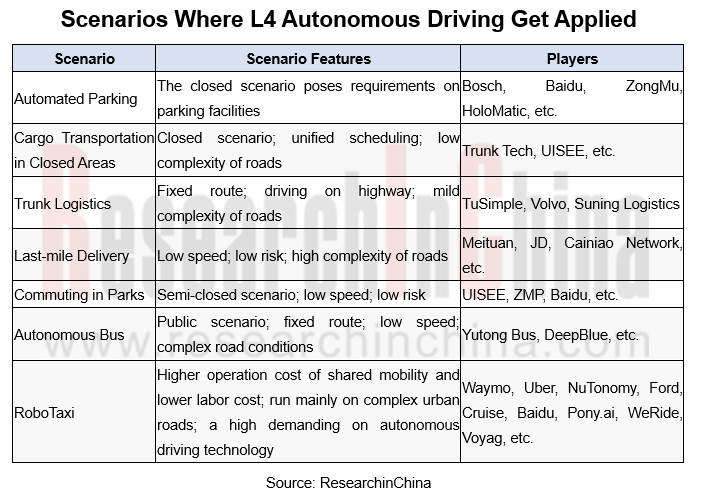

L4 autonomous driving technologies starts to find real application but gets deployed by most players first in one scenario or two as the current L4 cannot be perfectly suited to all driving scenarios.

It is shown from the planning of the OEMs and the providers of technical solutions for autonomous driving that L4 autonomous driving will be commercialized in limited scenarios ahead of open scenarios in the following three to five years.

Baidu, UISEE, DeepBlue and Trunk Tech all have conducted L4 trials in limited scenarios such as parks, ports, and airports. Besides, Baidu, Momenta, Bosch, ZongMu and UISEE are vigorously deploying in the parking lot scenario.

Deployments in open scenarios cover Robotaxi on urban roads and autonomous trucks on the expressways. In the Robotaxi field, Waymo, Baidu, Pony.ai, and WeRide have carried out pilot projects in both China and the U.S. in specific areas of a city, manned by safety officers, and WeRide is already fully open to the public in Nov.2019. Software & hardware technology iteration and larger-scale tests are essential for open Robotaxi in wider areas.

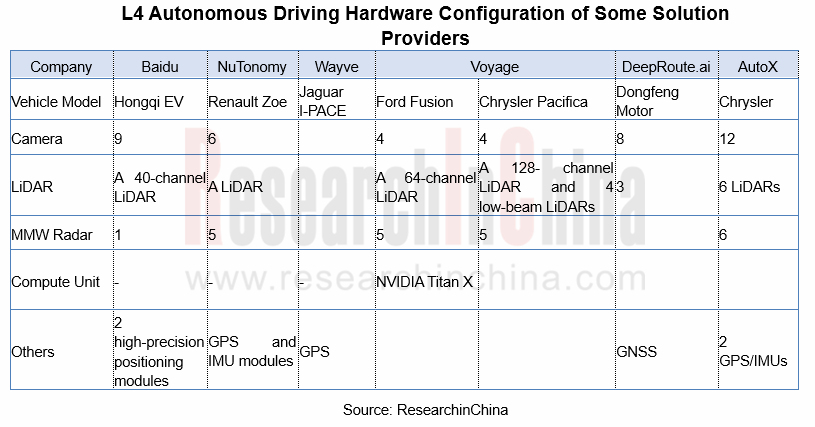

Technically, the current L4 autonomous vehicles for tests (or trial operation) are largely provided with the single-car intelligence solution. For safer autonomous driving, solution providers make vehicle’s environment perception capability optimized ever. For instance, Voyage’s G2 autonomous vehicle carries Velodyne's VLS-128 LiDAR system with a detection range up to 300 meters, tripling the capability of the 64-channel LiDAR installed on the 1st-Gen autonomous vehicle. Boasting 29 cameras, Waymo’s next-generation autonomous driving system enables a detection range of 500 meters whist improving LiDARs’ performance significantly.

Also, it is of vital importance to enhance vehicle’s motion perception competence. High-precision positioning can be realized by integrating high-precision positioning modules (composed of 5G modules, IMU and HD maps).

In the short term, either single-car intelligence solution or strong field terminal solution fulfills L4 autonomous driving in the confined areas, but in the long run, collaborative vehicle infrastructure system (CVIS) is the mainstream technology roadmap for L4 autonomous driving. Through CVIS, the vehicle is fully connected to the “X” as spatiotemporal dynamic traffic information are collected and integrated whilst the active safety control of vehicle and the collaborative management on roads are done for safer running of autonomous vehicle.

By analyzing the test data, Baidu concludes that CVIS can solve 54% of the problems encountered in road tests and 62% of the takeovers incurred by single-car intelligence, adding redundancy for autonomous driving safety.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...