China Automotive Financial Leasing Industry Report, 2020-2026

-

May 2020

- Hard Copy

- USD

$3,200

-

- Pages:126

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZJF150

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

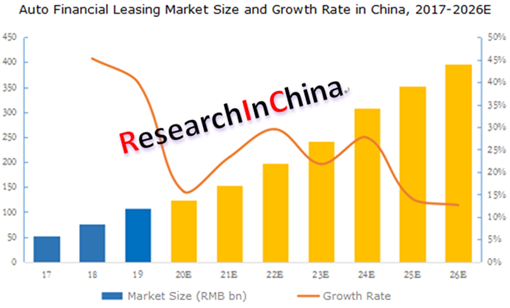

After ceaseless decline in 2018 and 2019, the Chinese automobile industry ushers in a period of recovery when the consumers are more prudent to buy cars and automobile consumer finance draws more attention, especially financial leasing as a key form of auto finance has a lower threshold for access than auto consumer credit and is advantaged and rooted in the third-line-below cities and rural markets, beneficial to both consumers and automakers. Following the galloping automobile industry in China over the past decade, auto financial leasing industry has sprung up with a market size in 2019 up to RMB107.3 billion, a figure projected to reach RMB396 billion amid the price cut of cars, the maturing industry and consumers’ growing acceptance of auto financial leasing.

Auto financial leasing started late in China, and the players in the industry are seeking for a suitable development route for own peculiarities. Not a leader has emerged in the industry that characterizes scattered development and mild competition and that desires to be concentrated. Nowadays, the most active internet-based auto financial leasing companies within the industry are expanding business presence most rapidly, while automakers and dealers are progressing slowly with limited input of resources in auto financial leasing since they still focus on traditional automobile credit business. Besides, professional leasing companies keep a low profile and have been making great strides in the industry thanks to its mature financial leasing business model.

Automaker-backed: such type of auto finance companies is advantageous in capital now that they can raise funds via stakeholders’ deposits, interbank borrowing, among others; additionally, it costs least for them to get cars but there are not so many car models;

Professional leasing companies: with mature business model and be competent enough for risk control;

Dealership companies: they are superior in the richness of car models and enjoy absolute advantage in customer acquisition for its full-fledged marketing channels;

Internet-based: such kind of financial leasing companies rapidly build own channels for customer acquisition by ways of mass advertising, ground promotion, the spread of outlets, etc.

Highlights in this report:

Automotive financial leasing (definition, classification, main models, development history, etc.);

Automotive financial leasing (definition, classification, main models, development history, etc.);

China’s automobile industry (production & sales, ownership, competitive landscape, used car trade);

China’s automobile industry (production & sales, ownership, competitive landscape, used car trade);

Automotive financing leasing development in China (policies, market size, competition pattern, financing channels, main products, development tendencies, etc.);

Automotive financing leasing development in China (policies, market size, competition pattern, financing channels, main products, development tendencies, etc.);

17 Chinese auto financial leasing companies including five automaker-backed financial leasing companies, five dealership companies, four internet-based companies and three professional leasing companies (operation, financial leasing business, financing channels, dynamics, etc.)

17 Chinese auto financial leasing companies including five automaker-backed financial leasing companies, five dealership companies, four internet-based companies and three professional leasing companies (operation, financial leasing business, financing channels, dynamics, etc.)

1. Overview

1.1 Definition & Classification

1.2 Main Modes

1.3 Development History

2. Chinese Automotive Industry

2.1 Market Size

2.2 Pattern

2.3 Car Ownership

2.4 Used Car Trade

3. Auto Financial Leasing Industry

3.1 Policy Environment

3.2 Automotive Finance Industry

3.3 Market Size

3.4 Main Products and Prices

3.5 Financing and Cost

3.6 Competitive Landscape

3.7 Development Trends

4. Auto Financial Leasing Companies

4.1 SAIC-GMF

4.1.1 Profile

4.1.2 Main Products

4.1.3 Developments

4.2 Ford Automotive Financial Leasing (Shanghai) Limited

4.2.1 Profile

4.2.2 Main Products

4.3 Herald International Financial Leasing

4.3.1 Profile

4.3.2 Auto Finance Business

4.4 Toyota Leasing

4.4.1 Profile

4.4.2 Main Business

4.5 BYD International Leasing

4.5.1 Profile

4.5.2 Main Products

4.6 Pang Da Orix

4.6.1 Profile

4.6.2 Main Business

4.7 Lei Shing Hong Leasing

4.7.1 Profile

4.7.2 Main Business

4.8 Great China Finance Leasing Co., Ltd.

4.8.1 Profile

4.8.2 Auto Finance Business

4.9 Yongda Finance

4.9.1 Profile

4.9.2 Main Business

4.10 All Trust Leasing

4.10.1 Profile

4.10.2 Main Business

4.11 eCapital

4.11.1 Profile

4.11.2 Auto Finance Business

4.12 Huasheng Haoche

4.12.1 Profile

4.12.2 Main Business

4.12.3 Development

4.13 Souche

4.13.1 Profile

4.13.2 Financing

4.13.3 Auto Financial Leasing

4.13.4 Development

4.14 Dafang Car Rental

4.14.1 Profile

4.14.2 Auto Finance Business

4.15 Billions Leasing

4.15.1 Profile

4.15.2 Auto Financial Leasing

4.16 Oranger

4.16.1 Profile

4.16.2 Main Products

4.17 Jiayin Financial Leasing

4.17.1 Profile

4.17.2 Auto Finance Business

Classification of Auto Financial Leasing

Role of Auto Financial Leasing

Comparison between Auto Financial Leasing and Bank Car Loan

Auto Financial Leasing Model – Direct Leasing

Auto Financial Leasing Model – Sale-leaseback

Development Course of Automotive Finance

Development History of Auto Financial Leasing Industry

Automobile Output in China, 2010-2026E

Automobile Sales Volume and Growth in China, 2012-2026E

Passenger Car Production and Sales by Type in China, 2018-2019

Passenger Car Sales Volume in China, 2010-2019

Commercial Vehicle Sales Volume in China, 2010-2019

Top10 Passenger Car Manufacturers by Sales Volume in China, 2019

Top10 Passenger Car Brands by Sales Volume in China, 2019

Sales Volume Structure of Passenger Car by Country in China, 2019

Automobile Ownership in China, 2014-2026E

Passenger Car (Origin of Country) Ownership Rankings in China, 2018-2019

New Energy Vehicle and Battery Electric Vehicle Ownership in China, 2015-2019

Used Car Trade Volume and Value in China, 2015-2019

Used Car Trade Volume Structure by Model, 2019

Top 10 Provinces/Municipalities by Used Car Trade (by Model), 2019

Chinese Policies and Laws & Regulations on Auto Financial Leasing Industry

Transfer of Regulatory Responsibility for Chinese Financial Leasing Industry

Implications of Regulatory Responsibility Transfer for Auto Financial Leasing Companies

Penetration of Auto Finance in China, 2015-2026E

Auto Finance Market Size in China, 2017-2026E

Penetration of Auto Financial Leasing in Major Countries

Market Size and Penetration of Auto Financial Leasing in China, 2017-2026E

Key Elements for Auto Financial Leasing Product Design

Some Reference Models for Auto Financial Leasing Product Design

General Types of Major Auto Financial Leasing Products on the Market

Causes for Quite High Rates of Auto Financial Leasing in China

External Financing Means of Chinese Auto Financial Leasing Companies

Chinese Auto Financial Leasing Companies’ Capital Use in Order of Priority

Ways of Debt Cooperation between Auto Financial Leasing Companies and Banks

Merits of Auto Financial Leasing Companies’ Asset-backed Securities (ABS) Financing

Auto Financial Leasing ABS Issuance Scale in China, 2015-2019

Classification of Participants in Auto Financial Leasing Industry

Competitive Edges of Different Types of Auto Financial Leasing Companies

Customer Acquisition Channels of Different Auto Financial Leasing Companies

Life Cycle of Chinese Auto Financial Leasing Industry

Used Car Trade Volume and Value in China, 2018-2026E

Equity Structure of SAIC-GMF

Leasing Schemes of SAIC-GMF

SAIC-GMF’s Financial Leasing Procedure for Car Purchase

Comparison of Ford Auto Financial Leasing Schemes

Brands Supported by Herald International Financial Leasing

Main Auto Finance Products of Herald International Financial Leasing

Auto Financial Leasing Products of Toyota Leasing

Business Handling Flow of Toyota Leasing

Main Types of Lease and Products of Toyota Leasing

Direct Financing Lease Schemes of BYD International Leasing

Sale-leaseback Schemes of BYD International Leasing

Work Flow of BYD International Leasing

Operating Leasing and Financial Leasing of Pang Da ORIX Auto Leasing

Auto Financial Leasing Procedures of Pang Da ORIX Auto Leasing

Sale-leaseback Business Process of Pang Da ORIX Auto Leasing

Regional Presence of Pang Da ORIX Auto Leasing

Business Diagram of Lei Shing Hong Leasing

Major Partners of Great China Finance Leasing

Development Course of Great China Finance Leasing

Main Products of Great China Finance Leasing

Features of Great China Finance Leasing

Online Car Purchase Application Procedures of Great China Finance Leasing

Financial Businesses of Yongda Automobiles

Six Advantages of Financial Leasing of Yongda Automobiles

Regional Presence of Yongda Finance

Major Financial Leasing Schemes of All Trust Leasing

Financial Leasing Procedures of All Trust Leasing

Major Partners of eCapital

Development Course of eCapital

Financial Leasing Schemes of eCapital

Features of Huasheng Haoche’s Financial Leasing Schemes

Financial Leasing Business Process of Huasheng Haoche

Presence of Huasheng Haoche’s Direct-sale Stores in China

Cooperative Brands of Souche

Financing of Souche

Main Features of Tangeche

Total Expense Structure of Tangeche

Main Advantages of TANGECHE

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Six Advantages

Dafang Car Rental’s Platform (usedcar.dafang24.com) -- Procedures

Major Auto Finance Products of Billions Leasing

Main Operations of Oranger

Direct Financing Lease Model of Oranger

Sale-leaseback Model of Oranger

Presence of Oranger’s Outlets in China

Equity Structure of Jiayin Financial Leasing

New Car Financing Schemes of Jiayin Financial Leasing

Used Car Financing Schemes of Jiayin Financial Leasing

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...