High-precision Positioning Research: Competition from Chips, Terminals to Ground-based Augmentation Stations

Autonomous driving prompts the use of high-precision positioning technology in the realm of automobile where L3 autonomous driving requires decimeter-level accuracy and L4 or above centimeter precision.

Apart from the vehicle's own sensors for precise positioning, a high-precision positioning system outside the vehicle is also indispensable. For ground roads, a high-precision positioning system centering on 5G + BeiDou (or GPS) satellite + ground-based augmentation system is beginning to take shape; for parking lots, there may arise a V2X-centric (or UWB) high-precision positioning system.

The high-precision positioning infrastructure is not in place yet, the user base is still small, and the equipment is priced at least RMB10,000. Beijing Xilang Technology, for example, provides the products with a price range from thousands of yuan to more than RMB30,000, for autonomous buses, AGVs, smart agricultural machinery, inspection robots, etc.

The high-precision positioning solution launched by Qianxun SI in 2019 for low-speed autonomous driving integrates "services, hardware, and algorithms", reducing the cost of high-precision positioning equipment to thousands of yuan. The solution has been found in the products of low-speed autonomous driving companies like Neolix, Trunk, Cainiao, etc.

The cost reduction of high-precision positioning terminal also hinges on mass production. OEMs hope that positioning infrastructure will be built as soon as possible, which is facilitated by the new infrastructure projects under way in China.

Competition in Ground-based Augmentation Stations

China will launch in June 2020 the last satellite for Beidou-3 Navigation Satellite System, an array of 30 satellites that will provide services to global users, which will offer development opportunities for the high-precision positioning market based on BeiDou.

Since its inception in August 2015, Qianxun SI has deployed more than 2,500 ground-based augmentation stations across China. Its FindAUTO spatio-temporal engines can be spawned for automotive use and in readiness for L2.5 autopilot on expressways and L3 high-speed autonomous driving. In 2020, there will be six production models of carmakers with FindAUTO in the market.

In October 2019, China Mobile purchased 4,400 sets of base station equipment for HAP (high-precision satellite positioning base station), with a total budget of RMB336.11 million or so.

Sixents Technology, backed by China Telecom, Tencent and NavInfo, plans to build 2,000+ ground-based augmentation stations nationwide with China Telecom’s base station resources, core network resources and all-weather operation and maintenance systems.

In addition to Qianxun SI, Sixents Technology and China Mobile, GeeSpace invested by Geely, Starcart in the communications industry, Hi-Target, Huace, UniStrong and State Grid Shenwang LBS (Beijing) from the traditional surveying and mapping field also deploy ground-based augmentation systems.

State Grid Corporation of China is also striving to construct a nationwide electric power BeiDou ground-based augmentation system which is undertaken by State Grid Shenwang LBS (Beijing). As scheduled, State Grid will build 1,200 BeiDou (high-precision satellite positioning) base stations in its 27 provincial subsidiaries by leveraging its infrastructure nationwide.

For parking lot positioning, UWB technology provider Kunchen has successively signed contracts with Huawei, Desay SV, Qianxun SI, etc., targeting to cover more parking lots with UWB base stations.

Competition in Positioning Chips and Modules

In May 2019, Beijing BDStar Navigation developed Nebulas-IV, a 22nm positioning chip for automotive use.

In September 2019, Quectel, Qianxun SI and STMicroelectronics jointly released LG69T, a dual-frequency high-precision satellite and inertial navigation fusion positioning module for automotive use.

At the end of 2019, Jingwei Technology, a UWB positioning chip maker announced it raised tens of millions of yuan in Series A financing.

In February 2020, Qorvo announced the acquisition of Decawave, a UWB chip maker.

The BY682 board developed by BYNAV provides high-precision RTK services under good satellite signals and enables GNSS/INS integrated navigation through working together with Analog Devices Inc.'s ADIS16465 MEMS IMU.

High-precision Positioning Is Increasingly Used in Vehicles

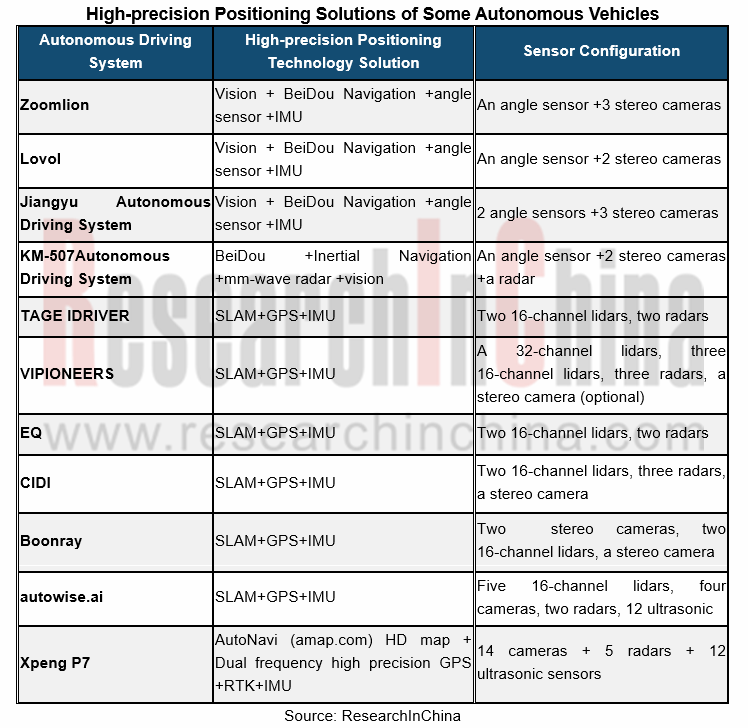

With the maturity of technology, high-precision positioning finds more application in vehicles. Besides the vertical industries such as autonomous agricultural machinery, autonomous mining, driverless sweeping vehicle, etc., high-precision positioning systems are pre-installed in passenger cars like Cadillac CT6, SAIC Roewe Marvel X, and Xpeng P7.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...