HUD Industry Research: the HUD installations to passenger cars soared 19.1% year-on-year in 2020Q1 thanks to homegrown brands

In contrast to the year-on-year nosedive of 41% in passenger car sales in Q1 2019, the HUD installations to passenger cars surged by 19.1% on an annualized basis and reached 72,500 units under the drive of Chinese brands.

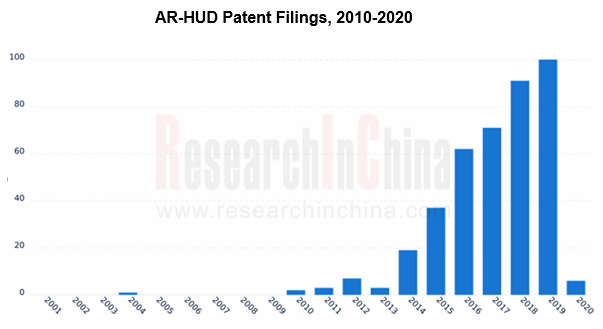

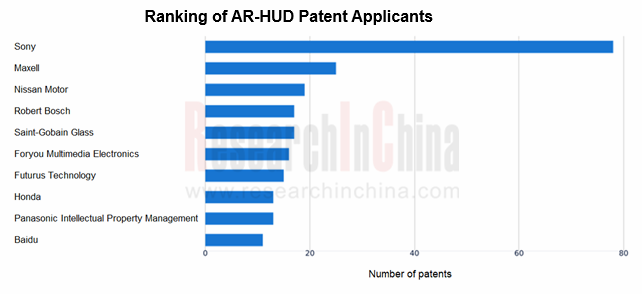

AR-HUD patent filings keep increasing year by year. Among the top ten vendors, Chinese players include Foryou Multimedia Electronics, Futurus Technology, and Baidu.

Jiangsu New Vision Automotive Electronics Co., Ltd, a leading Chinese supplier of HUD, has signed more than 10 production and R&D contracts with NextEV, Geely, Changan Automobile, Great Wall Motor, Chery, BAIC BJEV, among others. New Vision completed Series A financing round with BAIC and BDStar Navigation in 2018, and fulfilled Series B financing from the investors GP Capital, Haitong and Ying Capital in 2019.

Foryou Multimedia Electronics set up a team in 2012 which is in possession of over 100 HUD related patents to date. With the parent company Foryou Corporation’s expertise in smart cockpit electronics, Foryou Multimedia Electronics has built a full-fledged AR-HUD platform, encompassing the input of ADAS, instrumentation and navigation. It has won a number of production projects from domestic and overseas automakers.

Technically, AR-HUD needs to solve problems such as ghosting, resolution, and environmental fusion. Optical imaging, projection technology and system compute also limit the display effect and user experience of AR-HUD. Big footprint of optical modules and hardware is inconvenient for deployment in car interiors, which means AR-HUD awaits much optimization.

To miniaturize AR-HUD (over 20 liters), the industry is studying holographic optical waveguide technology solutions, which may downsize HUD to 2.4 liters.

In recent years, many vendors around the globe, including Digilens, Lingxi AR, Lochn Optics, Magic Leap and traditional optical giants Sony and Schott, have set foot in optical waveguides successively.

In May 2018, Continental lavished huge in DigiLens. With its additional investment, Continental held close to 18% of DigiLens after Series C financing round. Digilens has conducted five rounds of financing, totaling $135 million from the investors including Sony, Panasonic, Samsung, Mitsubishi Chemical, Foxconn, Universal Display, Niantic, Dolby, etc.

DigiLens announced its expansion into China together with its first China-based licensee, Crystal Optech, which is a leading optical elements manufacturer in optical coating, AR optics and semiconductor optics. The partnership will bring DigiLens Crystal waveguides to the market in 2020.

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...