OEM Autonomous Driving Research: Successive Launch of L2 Models on Market, Foreign Plan for Mass Production of L4 Models Earlier Than China

I. L2/L2+ models are successively available on the market

Over years of rapid growth, mainstream OEMs have spawned L2 ADAS systems and upgraded related functions, equipping their vehicles with core capabilities e.g., ACC, lane keeping assist (LKA)/lane centering assist (LCA), active steering (under driver’s confirmation) and traffic sign recognition, at all speeds. Deep fusion of these capabilities is of the essence for mass production.

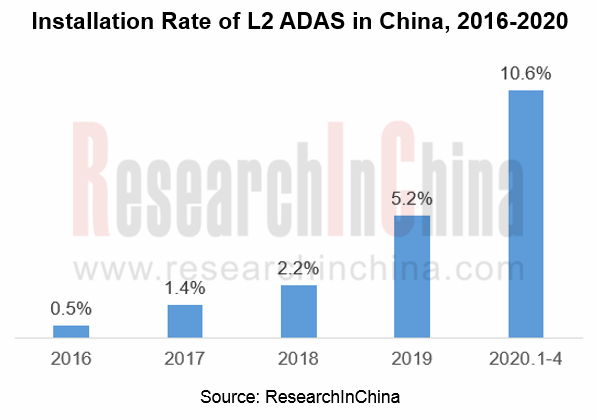

In China, installation rate of L2 ADAS was 10.6% in the first four months of 2020, 5.4 percentage points higher than in 2019. China has achieved initial success in development of ADAS/AD technology. Foreign brands like Volvo and Toyota, and new homegrown brands such as Lynk & Co, WEY, Geometry and EXEED stay ahead in installation.

II. L3 is expecting policy incentives

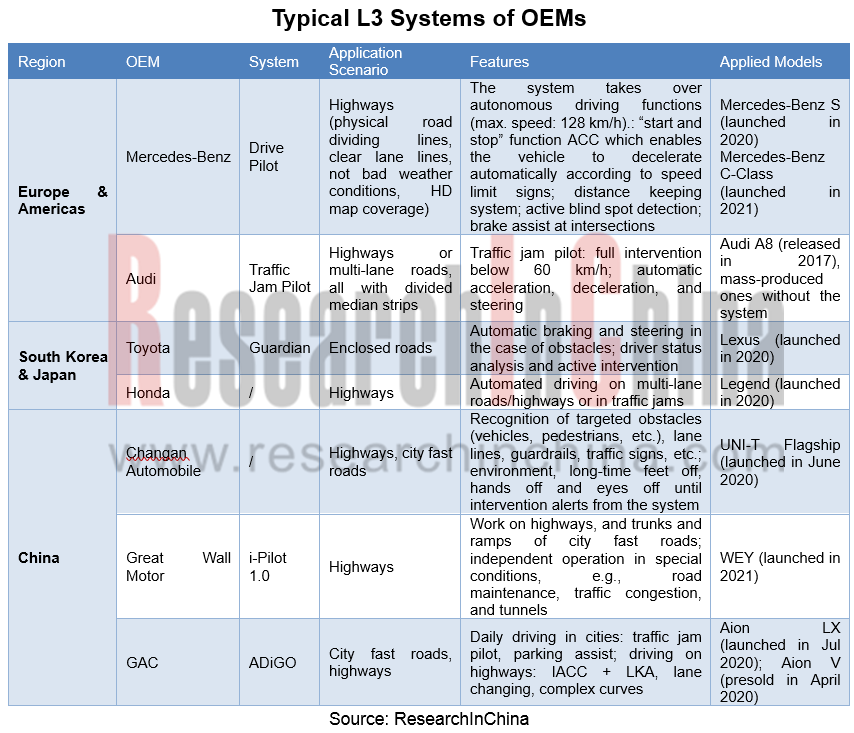

L3 automated driving is challenged as concerns technology and regulations. OEMs have mixed attitudes towards it:

South Korea has been the first one to release L3 standards: Hyundai is expected to make headway in market;

South Korea has been the first one to release L3 standards: Hyundai is expected to make headway in market;

Europe and the US have yet to loosen their policies: Audi slows its pace of commercializing L3;

Europe and the US have yet to loosen their policies: Audi slows its pace of commercializing L3;

China’s policy still remains unclear but OEMs calls for it: GAC and Changan Automobile already gear up for mass production; Geely and Chery will follow up at any time.

China’s policy still remains unclear but OEMs calls for it: GAC and Changan Automobile already gear up for mass production; Geely and Chery will follow up at any time.

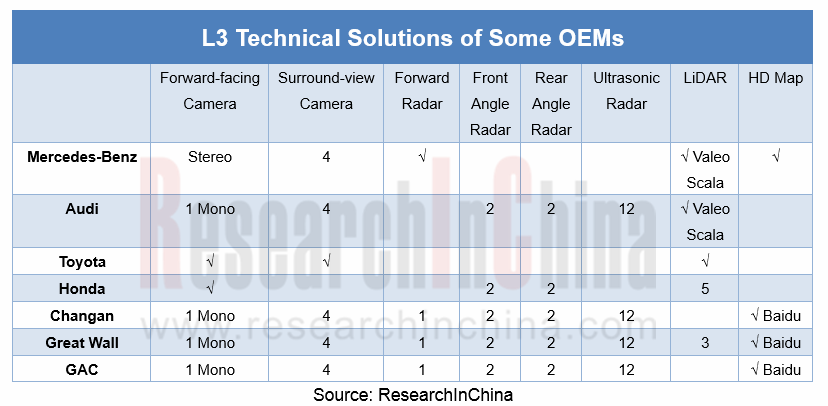

The released L3 solutions integrated with LiDAR and HD map, allow for hands-off steering wheel in the scenarios of highways and city fast roads but require good road conditions, e.g., physical road dividing lines and clear lane lines.

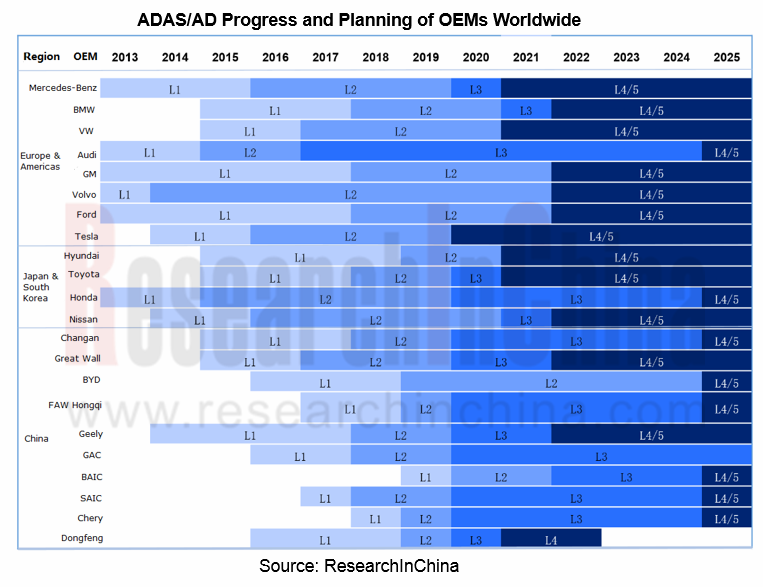

III. Foreign plan for mass-production of L4 models is earlier than China

European and American OEMs stay ahead of others in L4 development; Mercedes-Benz and GM have carried out L4 pilot projects; BWM, VW and Audi have unveiled implementation plans in details;

European and American OEMs stay ahead of others in L4 development; Mercedes-Benz and GM have carried out L4 pilot projects; BWM, VW and Audi have unveiled implementation plans in details;

Korean and Japanese OEMs begin to seek external collaborations for faster launch of L4. Examples include Hyundai’s cooperation with Pony.ai and Honda’s partnership with GM Cruise. Toyota originally planned to roll out L4 at the Tokyo 2020 Olympic Games but the COVID-19 pandemic makes the plan uncertain;

Korean and Japanese OEMs begin to seek external collaborations for faster launch of L4. Examples include Hyundai’s cooperation with Pony.ai and Honda’s partnership with GM Cruise. Toyota originally planned to roll out L4 at the Tokyo 2020 Olympic Games but the COVID-19 pandemic makes the plan uncertain;

Chinese OEMs see L4 as a long-term plan. Only few of them, like Changan Automobile and FAW Hongqi are attempting at L4 tests.

Chinese OEMs see L4 as a long-term plan. Only few of them, like Changan Automobile and FAW Hongqi are attempting at L4 tests.

In late June 2020, Volvo and Waymo announced that Waymo becomes “the exclusive global L4 partner for Volvo”. Volvo will leverage Waymo autonomous driving technology to build electric robotaxi and equip its two sub-brands Polestar and Lynk & Co. With the help of Waymo, Volvo is hopeful to be one of the first-movers in L4 camp.

In 2020, autonomous driving bellwethers secure enormous investments and leading automakers seize more of the market. Third or fourth-tier auto manufacturers go bankrupt at a faster pace. The ultrahigh technical barriers of autonomous driving encourage the survival of the fittest among OEMS.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...