T-Box Research: 46.7% of Passenger Cars Carry T-Box in 2020Q1

T-Box (Telematics-Box), also called telematics control unit (TCU), is comprised of GPS unit, outer interfaces for communications, electronic processing units, microcontrollers, mobile communication units and memory, enabling interaction between the terminal information in the car, the cloud and the roadside unit (RSU).

Around 2014, the mainstream solution of the first-generation T-BOX was a single-chip solution resorting to a combination of 2G+GPS. From 2015 to 2016, the second-generation T-BOX was added with memory, rich interfaces, and changed to employ Beidou/GPS dual-mode; also it was endowed with such new features as fault diagnosis, low power consumption design, dormant wake-up, SD card expansion, output power, RS232/485, USB and IO interfaces.

Since 2017, T-BOX communication has been upgraded to 4G, and the 4G module -- OPEN CPU technology solution has been prevailing in the industry as it boasts more powerful edge computing capabilities, supports vehicle Ethernet, over-the-air (OTA), fault diagnosis of protocols, Bluetooth, WIFI and other functions, and it even integrates gateways, CAN gateways, etc.

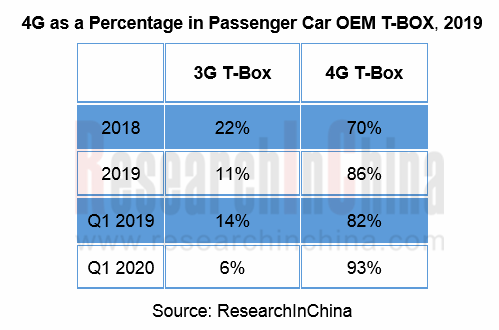

In 2019, 4G T-Box constituted 86% of passenger car OEM T-BOX, and the share rose to 93% in Q1 2020, according to ResearchInChina.

In China, 46.7% of passenger cars were installed with T-Box in Q1 2020, 14.2 percentage points higher than 32.5% in Q1 2019.

By price, the proportion of models worth RMB100,000-150,000 with T-Box rises fastest, from 34% in Q1 2019 to 40% in Q1 2020, largely thanks to Toyota (Corolla, LEVIN), Chevrolet (MONZA), Changan CS75 PLUS, etc.

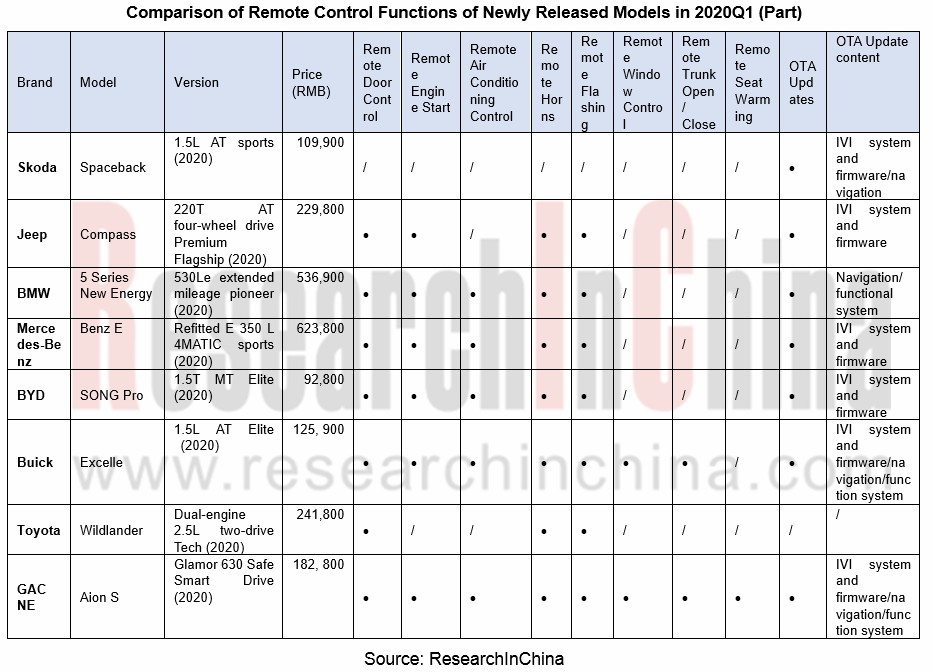

Among the new models launched in Q1 2020, GAC NE AionS has the most versatile remote functions enabling remote opening and closing of doors, windows and the trunk, remote engine start, remote air conditioning control, remote horns, remote flashing, and remote seat warming. For most models carrying T-BOX, there is universal availability of remote door control, remote horns, and remote flashing, while remote engine start-up, remote air conditioning control, remote seat warming, remote opening and closing of windows and the trunk are gaining ground.

Policies and the market players are pressing ahead with T-Box as a standard configuration.

Circular of the Ministry of Industry and Information Technology on Further Supervision over Promotion, Application and Security of New Energy Vehicles requires that the vehicles listed in the "Recommended Model Catalog for the Promotion and Application of New Energy Vehicles" must be packed with T-BOX.

On April 17, 2020, the Ministry of Ecology and Environment of China released Technical Specifications for Remote Emission Monitoring of Heavy Vehicles (Draft), which explicitly stipulates platform construction of remote emission system for heavy vehicles, T-BOX technology and measurement methodology, communication protocols and data formats.

With advances in Telematics, ADAS and OTA, in-vehicle systems will inevitably be interconnected with the cloud through T-BOX. At the same time, the massive data exchange between in-vehicle systems and remote terminals will beyond doubt fuel 4G T-BOX to head toward 5G T-BOX. Huawei is a leading enabler for 5G T-BOX.

In July 2019, Huawei rolled out the 5G automotive module -- MH5000.

In September 2019, Huawei unveiled the next-generation automotive T-Box platform at the Dongfeng Aeolus Smart Cockpit Conference, which substantially improves responsive agility and running speed of the smart cockpit and enabling remote start-up, air conditioning, vehicle control, and vehicle status review. Meanwhile, it features 5G capabilities like high speed and excellent reliability, allowing personalized interactivity such as intelligent scenario modes, voice via cloud, audiobooks and music.

In April 2020, BAIC BJEV's top-range brand ARCFOX installed the Huawei MH5000 T-BOX on its first production SUV -- ARCFOX α-T.

In May 2020, GAC Aion V pre-sales started. Aion V integrates 5G+C-V2X automotive intelligent communication system and Huawei MH5000.

Flaircomm Microelectronics, a leading Chinese T-BOX supplier, is conducting the IPO on the SSE STAR Market, with a plan to raise RMB239.84 million for 5G T-Box R&D and industrialization projects. The raised funds will be earmarked to develop the 5GNR technology-oriented T-BOX, a fusion of new technologies like CANFD, Ethernet and smart antennas.

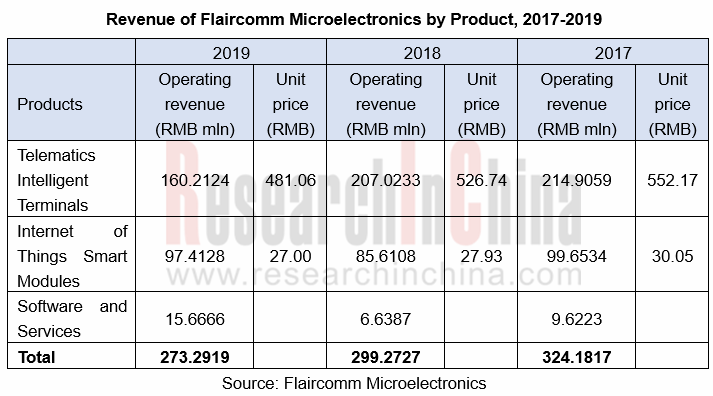

However, investors have doubts about Flaircomm Microelectronics whose revenue remains on a downswing over the past two years.

Like gateways, T-BOX, as a key integral of intelligent connected vehicle (ICV), involves OTA and network security. To take the initiative, OEMs tend to self-develop T-BOX software.

Amid OEMs enlarging software development teams, Tier1 hardware suppliers may turn into standard hardware vendors and have an ever weaker say. It is, indeed, a challenge not only to T-Box vendors but to Tier1 hardware suppliers.

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...