Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2020 (I)

Leading Tier1 Suppliers’ Cockpit Business Research Report: Eight Development Trends of Intelligent Cockpit

Abstract: in the next two or three years, a range of new intelligent cockpit technologies will be in place and mounted on vehicles, according to the Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report.

High automation faces technical and regulation challenges and it takes a long period of time to build 5G network and roadside infrastructure. In this context, much enthusiasm for intelligent cockpit is being aroused before automated driving technology becomes mature enough. Intelligent cockpits featuring new design concept draw more attention from consumers than automated driving technology does.

Globally, OEMs and Tier1 suppliers are racing to explore how to launch new intelligent cockpit technologies. We expect that numerous intelligent cockpit products will be launched successively in the upcoming two years or three. Based on the picture at CES 2020, development trends for intelligent cockpit can be seen below:

(1) Cockpit domain control unit (DCU): next-generation intelligent cockpit systems are DCU-centric and enable features of cockpit electronic systems through a unified software and hardware platform, which incorporate intelligent interaction, intelligent scenarios and personalized services and serve as the foundation for human-vehicle interaction and V2X connectivity.

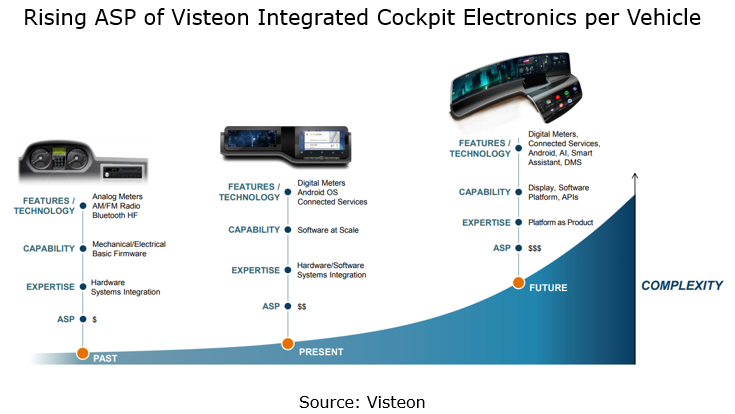

(2) Multi-display interaction: the cockpit design of dual-display interaction (center console, dashboard), four-display interaction (center console, dashboard, entertainment screen at the copilot’s seat, vehicle control display), or even five-display interaction (center console, dashboard, entertainment screen at the copilot’s seat, vehicle control display, rear seat entertainment display) is trending. Multi-display interaction needs complete cockpit domain architecture, and fusion of technologies, e.g., cockpit DCU, multi-chip (like TI automotive chips and Qualcomm entertainment chip), multiple operating systems (Linux, Android Automotive), Hypervisor virtualization technology, interaction logic, and HMI design. Tier1 suppliers are required to be more competent in product development and technology integration while seeking business growth amid the rising average selling price (ASP) of intelligent cockpit per vehicle.

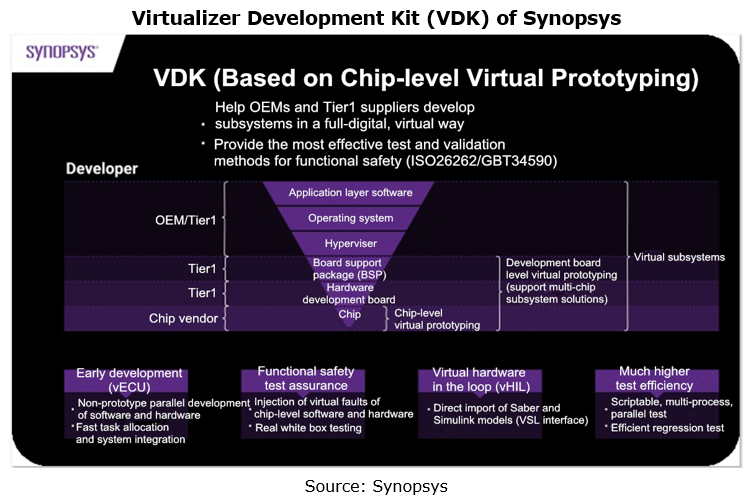

(3) Cockpit virtualization technology (separate development of software and hardware): virtual prototyping technology makes design, R&D and test of intelligent vehicles more efficient. Virtualizer Development Kit (VDK) based on virtual prototyping technology enables virtual simulation of electronic control units (ECU), e.g., chips, circuits and components. Automakers can commence development and test of software twelve months ahead of time before the availability of hardware, upgrading physical development to intelligent development in simulation environment. Also, ECUs for virtual simulation can accelerate and extend tests, and simulate various tests in extreme conditions, which is hard to achieve in real and physical circumstances and which secures faster roll-out of safer and more reliable products into market. The virtual prototyping technology is applicable to virtual development and test of all complex electronic systems such as intelligent cockpit and ADAS.

(4) Higher value of cockpit electronics software: the more complex vehicle system software means it makes up ever more of the total cost of a vehicle. OEMs and Tier1 suppliers are expanding software developers in R&D workforce. Examples include Desay SV, an intelligent cockpit bellwether in China, which boasted about 1,300 software engineers in 2019, a 70% share of its headcount; and Bosch in possession of 30,000 software talents, or 41% of the total staff in 2019 endeavoring to recruit more software developers. Between 2019 and 2020, Bosch set up Bosch China Innovation and Software R&D Center and Bosch Digital Cabin (Shanghai) R&D Center.

(5) Cockpit “terminal-cloud” integration, T-BOX and V2X as gateway of data from inside and outside vehicle, and cockpit big data as core competitive edge of products: intelligent cockpit will be a combination of terminals and cloud, in which all kinds of service contents, timely information sharing and complex computation will be offered and done over cloud, more than acts as a stand-alone terminal. In future cockpit big data will be the core competitive edge of products, making center console and dashboard, center information display (CID) navigation, T-BOX and air-conditioner controller, integrated.

(6) Evolution of vehicle display from flat rectangular screen to large curved screen: in January 2020, Corning’s high-performance Gorilla cold-rolled glass was first available to GAC Aion LX; in early 2020, Visteon and Corning joined hands to further develop ColdForm technology which will be spawned by Corning for automotive curved display systems; in July 2020, Rightware under Thundersoft, and LG Electronics partnered to develop the industry’s first curved OLED display for 2021 Cadillac Escalade.

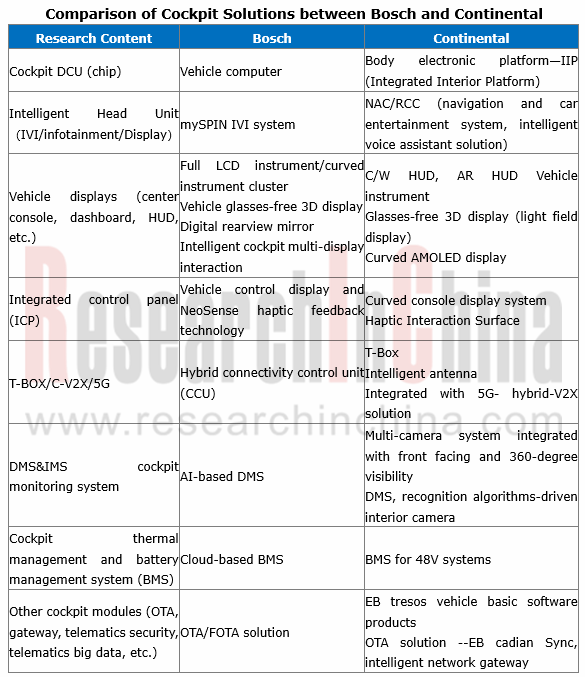

(7) Glasses-free 3D display: 3D effect makes eyes capture information more quickly. Bosch, Continental and more all focus on mass production and installation of glasses-free 3D displays in the next two year or three. At CES 2020, Continental showcased its 3D Lightfield display technology which was co-developed with Leia Inc. and mass production is arranged in 2022.

(8) Driver monitoring system (DMS) or interior monitoring system (IMS): IMS based on camera and AI is the core product of Tier1 suppliers. DMS will play a crucial role in whether a new vehicle model can be rated five stars by Euro NCAP. For example, Continental plans to mass-produce DMS in 2021 and Bosch in 2022.

The Global and China Leading Tier1 Suppliers’ Cockpit Business Research Report studies in depth strategies, technologies and products of leading Tier1 suppliers of intelligent cockpit, and highlights the following: (1) strategic plan and business layout of intelligent cockpit; (2) layout of intelligent cockpit technology centers, R&D centers and production bases; (3) intelligent cockpit product line, products and technical solutions, typical customers and vehicle models, mass production schedule, etc.; (4) intelligent cockpit product roadmap and development plan; (5) suppliers of intelligent cockpit products, technology and modules.

The Global and China Leading Tier1 Suppliers’ Cockpit Business Research Report has two parts, of which:

Part 1 with 320 pages in total covers 6 Tier1 suppliers, i.e., Bosch, Continental, Denso, Valeo, Faurecia and Panasonic.

Part 2 with 350 pages in total covers 7 Tier1 suppliers, i.e., Aptiv, Visteon, LG Electronics, Hella, Samsung Harman, Desay SV and Joyson Electronics.

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...