Research on Automotive LiDAR Industry: How five technology roadmaps develop amid the upcoming mass production of high-channel LiDAR?

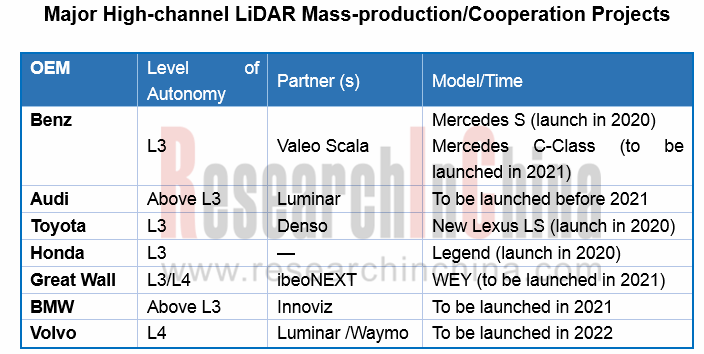

During 2020-2025, autonomous driving above L3 will be commercialized, for which LiDAR will become an important option. LiDAR vendors break through technical bottlenecks and work closely with OEMs to massively install high-channel LiDAR as soon as possible. Today, Audi has teamed up with Valeo/Luminar, BMW has cooperated with Innoviz, Volvo has collaborated with Luminar, Great Wall Motors has partnered with Ibeo, and Hyundai has joined forces with Velodyne. Even Mobileye, a proponent of visual ADAS, is developing its own LiDAR technology.

In early 2020, Bosch announced that it is making long-range LiDAR sensors production-ready-the first LiDAR (light detection and ranging) system that is suitable for automotive use. Continental delivers a 50-meter range 3D flash LiDAR sensor that's expected to find increasing application in commercial vehicles and off-highway machines in 2020. Valeo’s 16-channel SCALA 2, which can detect objects up to a distance of 150 meters, has won orders from some production vehicle models, and its SOP is expected in 2021. This shows that high-channel LiDAR is on the eve of mass production.

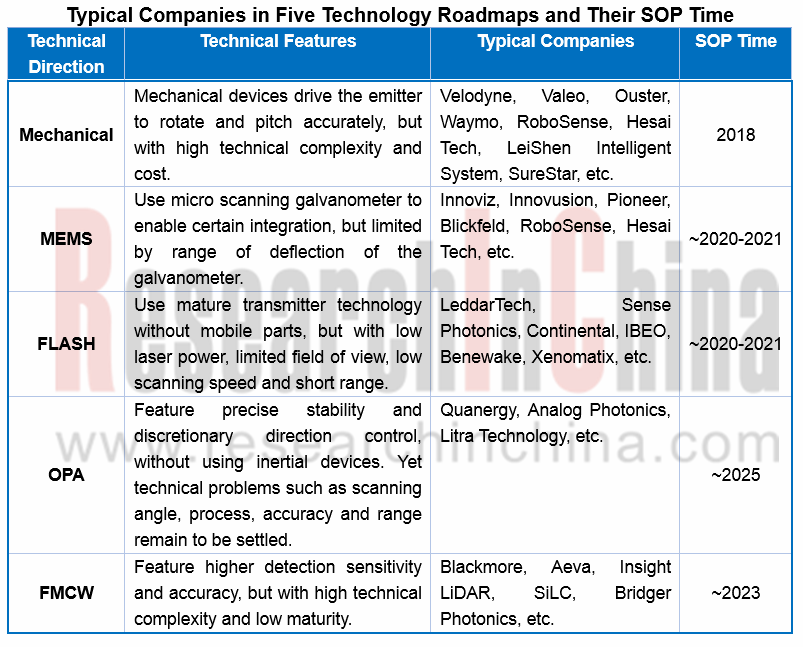

Still, the battle for technology roadmaps in the LiDAR field continues. There are now automotive LiDAR technology roadmaps encompassing mechanical, MEMS, FLASH, OPA and FMCW, among which FMCW is a coherent detection technology while the rest are pulsed ToF detection technologies.

Mechanical LiDAR

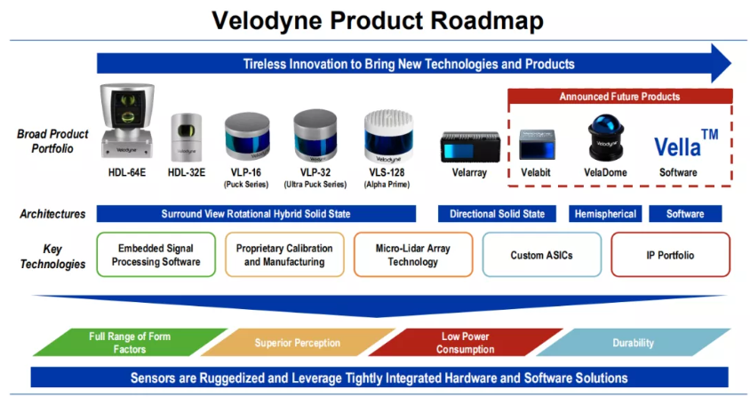

Mechanical LiDAR is the earliest developed and most mature product. Waymo's Honeycomb LiDAR is also based on mechanical technology. Although it has been criticized a lot, mechanical LiDAR is still the mainstream on the market. Representative companies of mechanical LiDAR include Velodyne, Valeo, Ouster, Waymo, RoboSense, Hesai Tech, SureStar, LeiShen Intelligent System, etc.

Most mechanical LiDAR vendors are pushing forward two strategies concurrently. On the one hand, they improve the mechanical LiDAR product line, try to reduce costs and enhance performance; on the other hand, they actively expand the solid-state LiDAR product portfolios (MEMS, FLASH, OPA, etc.).

For example, Velodyne has rolled out the all-solid-state Velarray LiDAR, and short-range VelaDome LiDAR perfect for automotive applications such as blind spot monitoring. Velodyne has acquired Mapper.ai, a HD map startup with a team of 25 talents, for quicker development of Vella software. In January 2020, Velodyne unveiled the cheap Velabit LiDAR priced only at $100.

Velodyne branches out to ADAS and other fields aggressively. Nowadays, the autonomous driving business only contributes a quarter of Velodyne's revenue, whereas the remaining earnings come from ADAS, robotics, surveying and mapping, smart cities, shuttles, and unmanned distribution, among which unmanned delivery, Robotaxi and ADAS will become main revenue contributors for Velodyne in the next four years. It is estimated that Velodyne will ship 8 million units by 2025.

MEMS LiDAR

Typical suppliers of MEMS LiDAR include Innoviz, Innovusion, Pioneer, Blickfeld, RoboSense, Hesai Tech, etc.. Using micro galvanometers, MEMS LiDAR is limited in size, vibration reliability and operating temperature range.

As concerns MEMS mirrors, foreign companies are at the forefront, such as Innoluce acquired by Infineon based in Germany, Mirrorcle and MicroVision in the United States, Hamamatsu in Japan, and STMicroelectronics in Switzerland. Their Chinese counterparts include Xi'an ZhiSensor, Taiwan Opus, Silicon Vision Microsystem, among others. A few LiDAR companies supply MEMS mirrors through alliances or independent development. For instance, RoboSense has invested in Silicon Vision Microsystem to deploy MEMS LiDAR; Hesai Tech PandarGT 3.0 uses self-developed MEMS mirrors.

MEMS LiDAR will be spawned by most vendors as early as 2020-2021.

Innoviz, which adopts the MEMS technology roadmap as a typical provider, has received more than USD210 million in financing within only four years since its inception. Innoviz is to date competent for mass production and has fetched orders from OEMs. BMW has selected Innoviz for series production of its autonomous vehicles, starting in 2021. Besides, Innoviz has allied with Tier1 suppliers Harman, HiRain Technologies and Aptiv. The latest Innoviz One has a detection range of 0.1-250 meters and will be produced on a large scale in 2021.

Zvision, a Chinese MEMS LiDAR company, secured RMB70 million in Series A+ round of financing in April 2020.

Flash LiDAR

Typical Flash LiDAR vendors are LeddarTech, Sense Photonics, Continental, IBEO, Benewake, Xenomatix and Ouster.

Sense Photonics as the first one to overcome technical challenges has introduced Osprey, its first modular FLASH LiDAR which was sold on the market in January 2020 at a price of $3,200. Continental’s Flash LiDAR, HFL110 featuring 1,064nm laser and hybrid InGaas/CMOS focal plane array, is expected to be spawned in 2020. IBEO’s NEXT LiDAR is about to be mounted on Great Wall VV7 in 2021.

Another company LeddarTech stands out for building Leddar Ecosystem. In July 2020, LeddarTech acquired VayaVision, a sensor fusion and perception software company. Their cooperative solution enables the fusion of camera, radar, and LiDAR for faster time-to-market, and allows for fusion of up to 15 different sensors for Level 2 to Level 4 autonomous driving applications. Two well-known sensor vendors First Sensor and Sunny Optical Technology also join LeddarTech Leddar Ecosystem.

OPA LiDAR

For OPA LiDAR, Quanergy previously released S3 but has yet to commercialize it. Some players like Analog Photonics and Shenzhen Litra Technology are in the phase of development and exploration. It will expectedly take them over 5 years to launch the technology.

OPA LiDAR enables precise stability and discretionary direction control, without using inertial devices. Yet technical problems such as scanning angle, process, accuracy and range remain to be settled. Current integrated OPA technology fails to offer large aperture needed by mid- and long-range LiDAR, due to complexity, high power consumption or low optical efficiency. In August 2020, researchers at University of Colorado Boulder developed a serpentine optical phased array (SOPA) chip which can enlarge optical aperture for LiDAR.

FMCW LiDAR

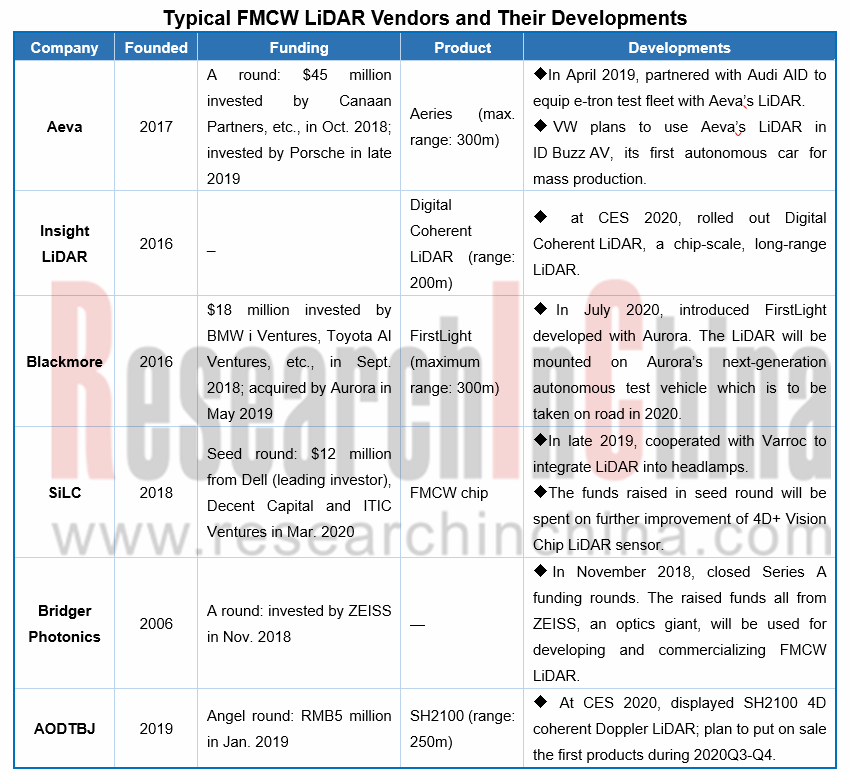

Coherent LiDAR is still in its infancy compared with pulsed ones. The leading technology for the LiDAR is frequency modulated continuous wave (FMCW), into which about 10 players worldwide get involved, including Aeva (invested by Porsche), Blackmore (acquired by Aurora in 2019), Strobe (acquired by Cruise in 2017), SiLC Technologies (invested by Dell), Bridger Photonics (invested by Carl Zeiss) and AODTBJ.

The reason why BMW, Toyota, Porsche, GM and Aurora select FMCW LiDAR lies in FMCW’s edges over pulsed ToF, on ability to directly detect speed (4D information) and high resolution range and permission to use cheap photoelectric detectors (e.g., PIN). The biggest challenge before FMCW technology is the need for being integrated with a plurality of optical components, e.g., laser, amplifier, phase and amplitude controlled low-noise photodiode, mode converter and optical waveguide, all of which should be further integrated into a commercial-scale compact FMCW LiDAR.

From the latest progress, it can be seen that Aeva’s Aeries FMCW system irons out the dependency between maximum detection range and point cloud density, and integrates multiple beams on a chip, achieving full range performance of over 300 meters for objects in addition to the ability to measure instant velocity for every point with a 120-degree field-of-view. The product is projected to be available for use in 2020, costing less than $500 once mass produced.

Furthermore, FirstLight, a LiDAR co-developed by Blackmore and Aurora, allows the Aurora Driver to see well beyond 300 meters even on targets that don't reflect much light, such as a pedestrian wearing dark clothing at night. Aurora has installed its Aurora Driver in six different vehicles, ranging from sedans and Chrysler Pacifica minivans to self-driving trucks. Aurora plans to use its FirstLight LiDAR in its fleet of self-driving development vehicles in 2020.

Actually, OEMs tend to choose more than one technologies. For example, Audi investing Blackmore, a typical FMCW firm, installed Valeo's 4-channel mechanical LiDAR into Audi A8 in 2018 and also has a plan to pack the to-be-produced cars in 2021 with Luminar’s solid state LiDAR.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...