Fuel Cell Research: FCV is Expected to Boom over the Next Decade

In our recent report Global and China Fuel Cell Industry Report, 2020, we analyze the advances and tendencies of fuel cell industry in China and beyond.

Hydrogen, as an efficient clean energy of strategic importance, is drawing widespread attention, and it is in the upswing. Hydrogen fuel cell which is efficient to convert fuel energy with low noise and zero emission, finds broad application in automobiles, ships and trains as well as stationary power plants.

Fuel cell has been such a concern of governments and companies worldwide that have lavished ever more on research and development, demonstration and commercial application. It is noteworthy that hydrogen and fuel cell have already been commercialized in some sectors, among which automobile makes the best of them. Through the lens of life cycle of automobile industry, ICE vehicle has matured, and traditional automakers, however, have quickened their pace of transformation weighed by the thriving new energy vehicle industry, and some leading automakers has been sparing no efforts in the development and application of hydrogen fuel cell vehicles.

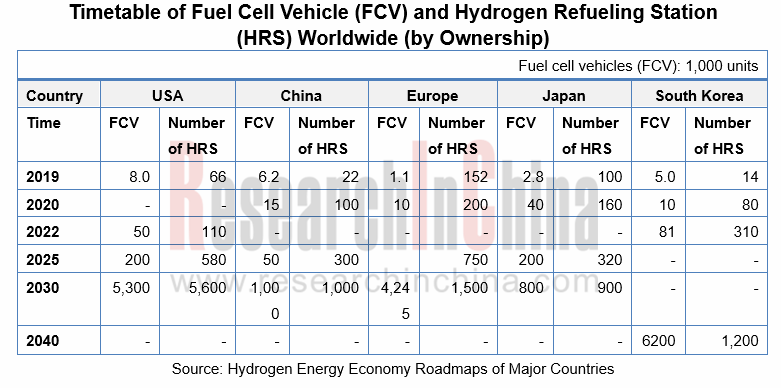

Status Quo and Planning of Global Fuel Cell Vehicle Industry

Globally, major countries are scrambling to mobilize enormous resources for the development of hydrogen fuel cell vehicles, hoping to take the lead in future competition in energy. For the moment, Japan, South Korea and China are the top three hefty investors in the fuel cell vehicle industry. The typical automakers, Toyota and Hyundai, stay ahead of their peers in production of fuel cell passenger cars, hydrogen buses and logistics vehicles. The discouragement from the Trump Administration in recent two years has hindered development of fuel cell vehicle in the US, but California as the biggest single market of fuel cell passenger cars is still a colossus in the whole industry. Europe has developed fuel cells from an early start, with traditional automakers like Mercedes-Benz and Tier1 suppliers such as Bosch all having forayed into the fuel cell vehicle field.

China is Close to Its Leading Peers in Fuel Cell System and Engine

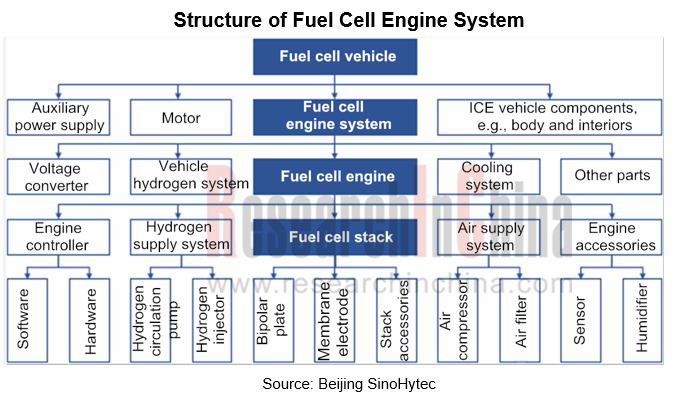

Fuel cell engine system is comprised of fuel cell engine, voltage converter (DC/DC) and vehicle hydrogen system, of which fuel cell engine packs such core components as stack, engine controller, hydrogen supply system and air supply system.

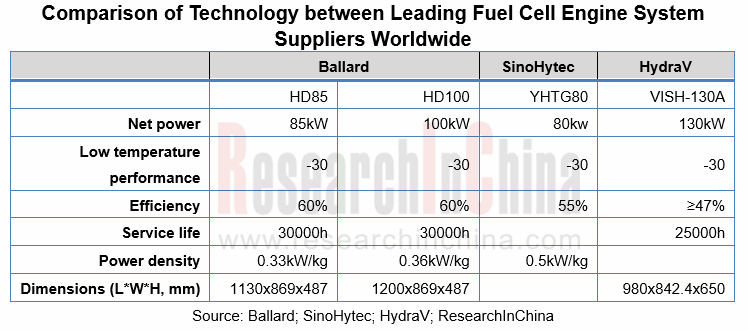

At present, China has come near to global leaders in fuel cell system and engine. In terms of fuel cell engine technology, fuel cell vehicles have been mature enough to be commercialized, with service life of fuel cells for commercial vehicles longer than 20,000 hours, meeting basic needs of vehicles for running; China’s hydrogen fuel cell engine system leads the world in several parameters, e.g., power density. Notably, on July 21, 2020, VISH-130A, a fuel cell engine of Wuhan HydraV Fuel Cell Technologies Co., Ltd. (under Vision Group), passed the certification of China Automotive Technology and Research Center Co., Ltd. (CATARC) and China National Accreditation Service for Conformity Assessment (CNAS), with stack power up to 145kW and engine system net output of 130kW. VISH-130A boasts the maximum power among hydrogen fuel cell engines having been certified by the CNAS so far.

China Remains Weak in Core Components and Materials of Fuel Cell with Heavy Dependence on the Imported

Although with the world’s advanced fuel cell engine technology, China still has weak foundation in supply chain of fuel cell engine system, having yet to build a mature components supply system. The country still needs to import most of core components and key materials including catalyst, proton exchange membrane and carbon paper, and falls far behind its foreign counterparts in technologies from membrane electrode and bipolar plate to air compressor and hydrogen circulation pump. Chinese companies still need breakthroughs in basic materials, core technologies and key components, especially in commercialization of key parts like membrane electrode.

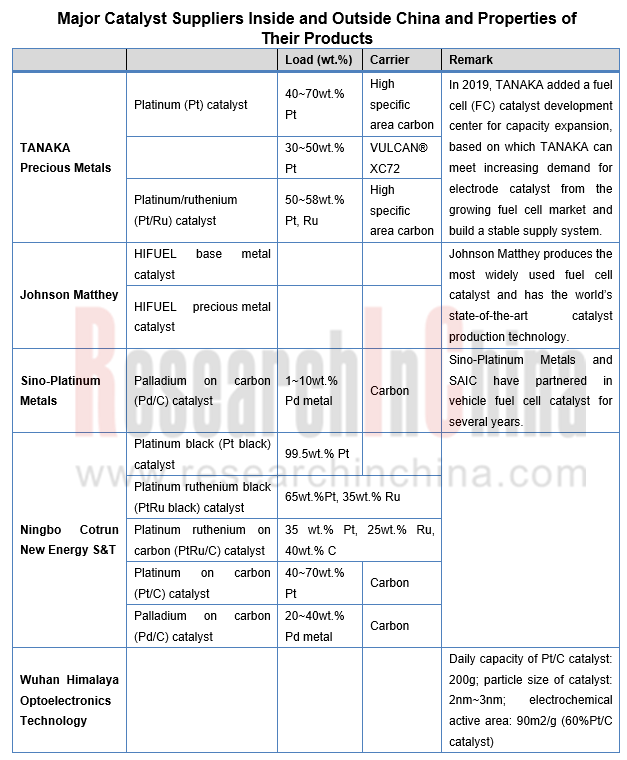

Fuel cell catalyst: it should perform very well in properties such as activity, stability and durability and could develop into a commercial product mature enough to be mass-produced only after long-term application. Now in China, catalyst verified abroad is the first option, mainly low platinum loading catalyst with high quality and high activity; homemade catalyst test is under way at the same time.

In the global fuel cell catalyst market, Toyota uses subsidiaries’ catalyst for fuel cell vehicles; Hyundai chooses fuel cell catalyst of a local producer (acquired by Umicore) in South Korea; Honda’s catalyst for fuel cell vehicles is supplied by TANAKA Precious Metals; Chinese fuel cell vehicles use catalyst from TANAKA Precious Metals and Johnson Matthey.

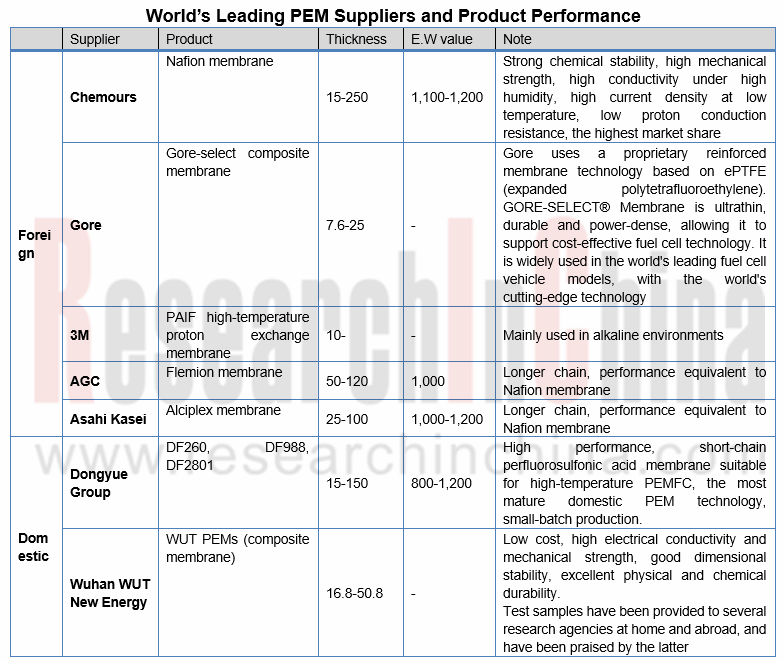

Proton exchange membrane (PEM) is the core component of a proton exchange membrane fuel cell, accounting for 30% of the entire fuel cell stack cost; and its quality determines the lifespan of the fuel cell. PEM basically transmits protons, ensure the passage of protons, and intercept electrons, hydrogen molecules, water molecules, etc., guaranteeing the performance and service life of the stack.

Concerning proton conductivity or stability, perfluorosulfuric acid membrane is the best option for the current automotive proton exchange membrane. Dongyue Group is the sole Chinese enterprise that has realized the industrialization of perfluorinated ion exchange resin, perfluorosulfonic acid proton membrane and ETFE and that can compete with foreign companies Gore and Chemours in proton exchange membrane.

Moreover, fuel cell carbon paper/powder is totally dependent on imports. Carbon powder is cheap and may well be completely imported, but from a technical point of view, the inadequate technical research on carbon materials and the weak foundation will have implications for entire research equipment of the fuel cell system in China.

In recent years, there have emerged a number of suppliers of core fuel cell components in China, but they are still heavily reliant on exports, and their technical level of core components needs improving.

China's fuel cell vehicle promotion: commercial vehicles go first

In the promotion of fuel cell vehicles in China, fuel cell commercial vehicles take precedence over the rest, due to a combination of factors such as fuel cell technology, cost, and infrastructure of hydrogen refueling stations. 100 models of fuel cell commercial vehicles are among the fuel cell vehicles listed in the Catalog of Recommended Road Vehicles released by the Ministry of Industry and Information Technology of China in 2019 but no fuel cell passenger car is on the list. Over the past five years, only SAIC, Chery and BAIC have showed fuel cell passenger cars, most of which were still prototypes, except a SAIC Roewe 750 car that was licensed in Weifang city of Shandong in April 2020. According to fuel cell vehicle promotion programs across China, buses, logistics vehicles, and special vehicles prevail but passenger cars are not taken seriously.

As concerns development route of fuel cell vehicles, foreign countries adopt the strategy of developing commercial vehicles and passenger cars in sync while China prioritizes commercial vehicles over passenger cars. In the next three or five years, fuel cell systems will be massively used in commercial heavy-duty and logistics vehicles in China, and passenger car will be an obscure corner still.

Product support programs of key suppliers of fuel cell components mirror China’s strategy of “commercial vehicles first, passenger car second”. SinoHytec's flagship product, hydrogen fuel cell engine system, targets commercial vehicle manufacturers who are early entrants in the fuel cell vehicle market, including Shenlong Bus, Beiqi Foton, Yutong Bus, Zhongtong Bus and Geely Commercial Vehicle.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...