China's auto finance which has undergone four stages of development now becomes a market featuring diversified competition, with penetration of 52% and being valued at RMB1,280 billion in 2019.

The sale of commercial vehicle has remained at more than 4 million units over the past two years. Despite the COVID-19 pandemic’s big bite of China’s commercial vehicle sales in the first quarter of 2020, faster progress in major infrastructure, logistics e-commerce and 5G will trigger the surging demand for commercial vehicles. In the first seven months of 2020, China sold 2.8318 million units of commercial vehicle, a like-on-like jump of 14.3%.

In China, the prospering commercial vehicle market invigorates the commercial vehicle finance market. In 2019, the penetration of commercial vehicle finance in China was roughly 55%, far below the 90% in the world’s mature markets, leaving vast room for growth. By 4.324 million commercial vehicles sold in 2019, China’s commercial vehicle finance market boasted a scale of 2.378 million units in 2019.

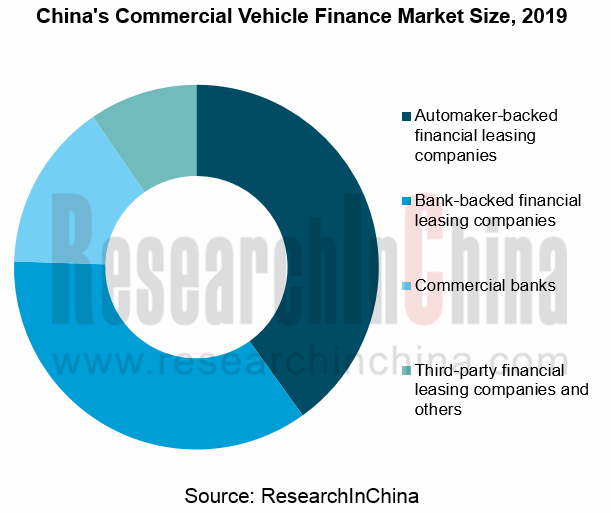

China's commercial vehicle finance market is now dominated firmly by automaker-backed and bank-backed financial leasing companies, sweeping a combined 75.5% of the market in 2019. Besides, commercial banks ranked fourth with a 14.9% share. Automaker-backed financial leasing companies stand out for most manufacturers have developed a closed loop in their efforts to transform from manufacture to marketing, and then to services.

The thorough development of commercial vehicle finance has been accompanied by imperfections of such services, like weak foundation of used-car evaluation system, unsound risk control system, blind competition, and huge financial capital demand and insufficient bank capital supply, all of which hinders the development of commercial vehicle financial services in China.

Yet, China's risk control system for commercial vehicle finance gets improved progressively. For one thing, advancing technologies such as big data offer better solutions to risk control in auto finance; secondly, the support from automakers, insurers, leasing and logistics companies helps perfect the risk control system.

In the forthcoming years, the favorable policies will foster the maturity of Chinese commercial vehicle finance market which is to feature more diversified products, better risk control system, lower credit threshold and higher penetration. It is forecast that the commercial vehicle finance market in China will boast penetration up to 80% and scale of 4.056 million units by 2026.

China Commercial Vehicle Finance Industry Report, 2020-2026 highlights the following:

China auto finance industry (development environment, development history, status quo, market size, competitive landscape, development trends, etc.);

China auto finance industry (development environment, development history, status quo, market size, competitive landscape, development trends, etc.);

China commercial vehicle finance industry (status quo, main players, competitive landscape, market size, risk control system, etc.);

China commercial vehicle finance industry (status quo, main players, competitive landscape, market size, risk control system, etc.);

16 commercial vehicle finance companies (profile, commercial vehicle finance business, etc.).

16 commercial vehicle finance companies (profile, commercial vehicle finance business, etc.).

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...