Chinese Brand Telematics Research: Telematics system installation rate is close to 50%

In 2020, the Chinese OEMs are scrambling to ever faster iterate infotainment systems and add new features, which have been first available to new mass-produced cars:

- In June, VENUS, SAIC Roewe’s new infotainment system mounted on Roewe RX5 PLUS, was launched on market, offering new functions such as voice cloning, Alipay applet and car-home interconnection.

- In June, BEIJING-X7 equipped with BAIC’s Magic Box system was rolled out, with capabilities like face recognition, home interconnection, and AR navigation.

- In July, BYD Han with BYD DiLink3.0 went on sale. The system features a 15.6-inch rotating center console screen and the "Littlie Di" voice icon;

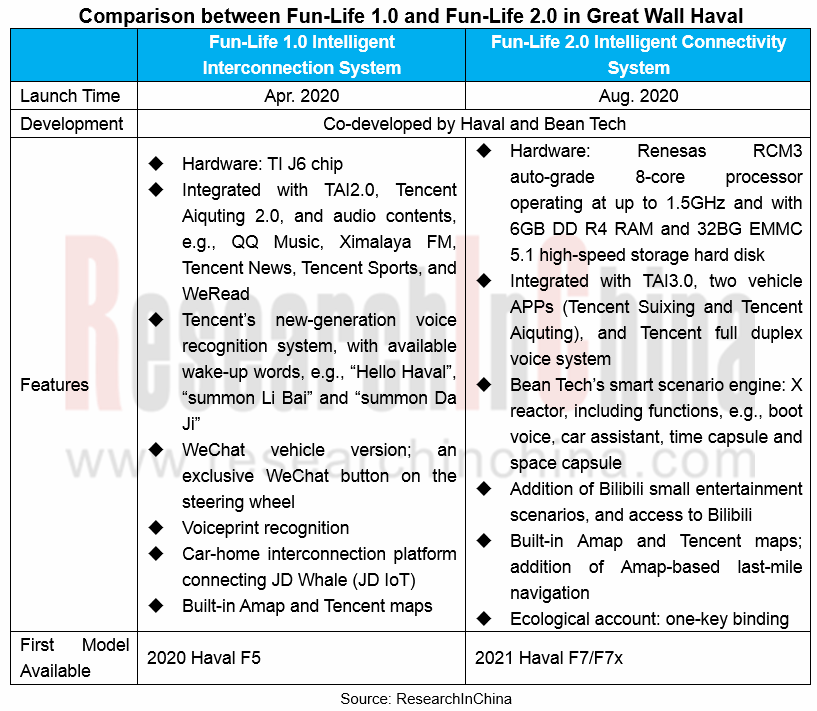

- In August, HAVAL Fun-Life 2.0 integrated with Tencent Auto Intelligence 3.0 (TAI 3.0) was first seen in HAVAL F7;

- In October, Chery i-Connect@Lion4.0 system was launched with Tiggo 8PLUS, and new functions such as “Xiaoqi” intelligent assistant and voiceprint recognition were added;

- In November, ORA ES11 (pre-sold in September), an electric car running ORA Smart-café? OS, was to become available on market.

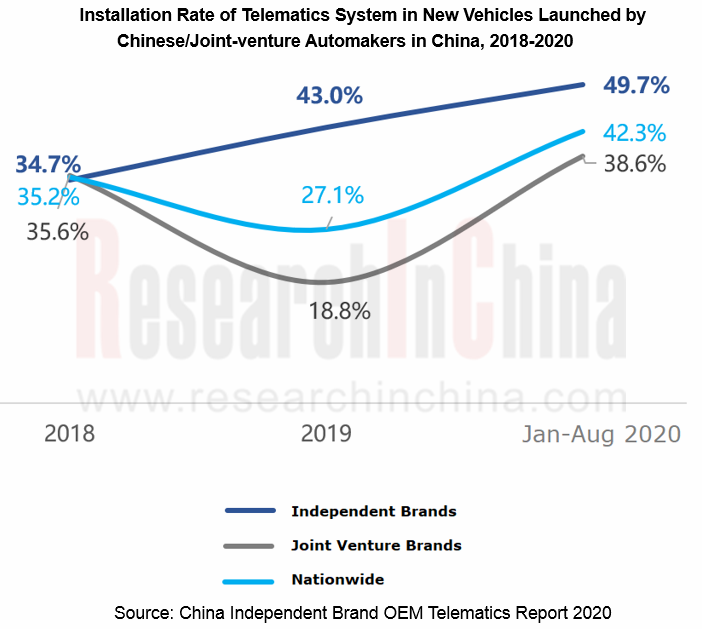

From January to August 2020, a total of 4.43 million new vehicles in China were equipped with Telematics system from January to August 2020, a like-for-like increase of 4.0%, of which 1.75 million units were Chinese brand vehicles, down by 4.8% from the prior-year period. Yet homegrown brands led in penetration and saw a rate of up to 49.7% in the first eight months of 2020, up 9.2 percentage points over the same period of last year, according to the statistics of ResearchInChina. This indicates that Chinese brands have begun to include Telematics system in standard configuration of their new vehicles.

The GKUI automotive intelligent system co-created by Geely and ECARX has been iteratively and functionally updated. As of July 2020, it has attracted more than 2 million users and been available to 40 models.

GKUI is a custom-made onboard system based on the Android system, having been iterated twice. The E01 SoC for GKUI 19 is defined by ECARX and designed by MediaTek. It uses a 64-bit quad core Central Processing Unit (CPU) that combines with dedicated Graphics Processing Unit (GPU) to support 1080p HD dual-screen display and a 4G modem. With AI Cloud, super voice, control interaction, versatile ID and other capabilities, GKUI 19 has been first available to 2020 Geely Boyue PRO. The E02 SoC with built-in 8-core CPU and independent neural processing unit (NPU) is expected to be mounted on vehicles in late 2020 or early 2021.

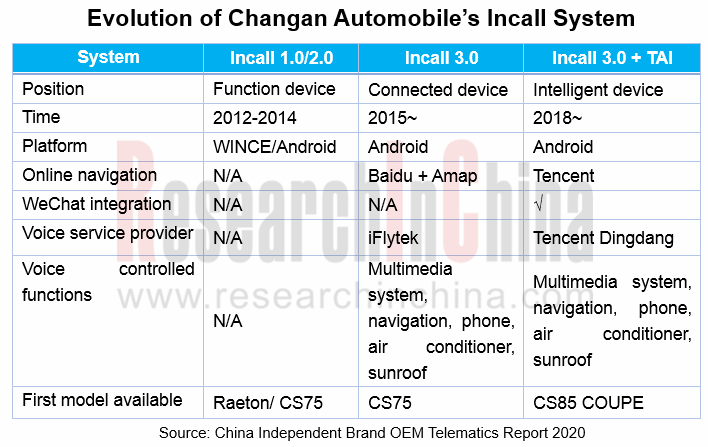

Incall, Changan Automobile's telematics information system has undergone two generations of upgrade: the first generation was iterated to 3.0 and the second generation fuses with TAI. In 2018, Changan Automobile established the joint venture "Phoenix Auto Intelligence" with Tencent to provide a telematics development platform and big data analysis. At present, new models, such as CS85 COUPE, UNI-T and CS75 PLUS, have started installation of the TAI-integrated Incall system. Among them, UNI-T, which was launched in June 2020, carries the latest UNI Life automotive intelligent interaction system whose underlying layer is Incall and which uses AI chip of Horizon Robotics and integrates with a range of interaction capabilities, e.g., WeChat vehicle version, Tencent Map vehicle version, Tencent Dingdang voice interaction system, face recognition, and Tencent Aiquting.

Great Wall Haval features two telematics systems: Hi-Life intelligent interconnection system and Fun-Life intelligent connectivity system. Of which, Fun-Life system is co-developed by Haval and Bean Tech, going through two iterations. Fun-Life 1.0 packing TAI 2.0 system, was first applied to 2020 Haval F5 and rolled out to the market in April 2020; the TAI3.0-integrated Fun-Life 2.0 was first found in 2021 Haval F7/F7x launched in late August 2020.

Chinese brand telematics is expected to be headed in following directions:

1. At present, the installation of telematics in new Chinese brand vehicles approximates 50%. Telematics is expected to become a standard configuration in over 100,000 models in future.

2. Chinese brands keep ahead of others by leveraging abundant ecosystem resources of internet giants like BAT (Baidu, Alibaba and Tencent). Examples include Banma Zhixing co-built by SAIC and Alibaba, Fun-Life system developed by Great Wall Motor together with Tencent, and i-Connect@Lion 4.0 Chery designed in harness with Baidu.

3. Since the outbreak of COVID-19, foreign brands have expedited deployments in telematics. In April 2020, SAIC Volkswagen announced an intelligent telematics system, and partnered with TAI, Amap, JD, Alibaba Cloud and China Mobile to strengthen localization. In July 2020, Dongfeng Nissan updated Nissan Connect system and launched the “Intelligent Connectivity Future” plan. In July 2020, BMW and Tencent formed a digital partnership to promote application of “Tencent Mini Scenarios” and WeChat vehicle version in BMW cars.

4. For functions, navigation, voice assistant, and entertainment ecosystem have become the standard configuration of new cars. All OEMs are enriching infotainment with capabilities such as large/multi-screen/jilt display, WeChat vehicle version, voice personalization/virtual image, onboard KTV, Douyin, car-home interconnection, fleet build-up and applets, as well as mobility services (refueling/washing/insurance). In future, ever more smartphone functions will be incorporated to in-vehicle infotainment system.

5. Advances have been made in the availability of 5G telematics technology in Chinese brand vehicle models. For example, Huawei 5G technology is used in production models like GAC Aion V (launched in Jun. 2020), BYD Han (launched in Jul. 2020), Roewe MARVEL R (presale in Sept. 2020), and BAIC BJEV ARCFOX αT (launched in Oct. 2020). In April 2020, Huawei initiated the “5G Automotive Ecosystem”, with 18 automaker members including FAW Group (FAW Hongqi, FAW Besturn, FAW Jiefang), Changan Automobile, Dongfeng Motor (Dongfeng Passenger Vehicle and Dongfeng Xiaokang), SAIC Group (SAIC Motor Passenger Vehicle and SAIC GM Wuling), GAC Group (GAC NE), BAIC BJEV, BYD, Great Wall Motor, Chery, JAC, Yutong Bus, SERES, NAVECO and T3 Mobility.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...