Research into Automotive Display: 10-Billion-Yuan Automotive Display Market Is Thriving.

In this report, those are analyzed and studied such as the market size, installation rate, display technology, development trends and suppliers of automotive displays (incl. cluster display, center console display, etc.).

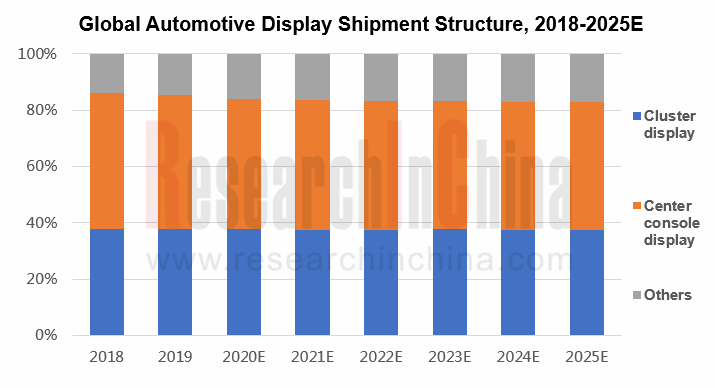

The Center Console Display Shipments Rank First, and the Installation Rates of Rearview Mirror Displays, Rear Seat Entertainment Displays and Vehicle Control Displays Continue to Grow.

Being bound up with automobile sales, automotive display shipments worldwide edged down 1.5% year-on-year to approximately 159 million units in 2019 when auto sales continued a bearish trend. In 2020, the COVID-19 pandemic drags down global automobile sales (a like-for-like slump of 25.5% in H1 2020, and may recover a bit in H2 2020), with a projected year-on-year plunge of 20% or so. Against this, global automotive display shipments are expected to fall 12.1% year-on-year to 140 million units in 2020. In the long run, the automotive display market, however, will resume growth alongside intelligent connected vehicles at a gallop, with shipments projected to reach 180 million units by 2025.

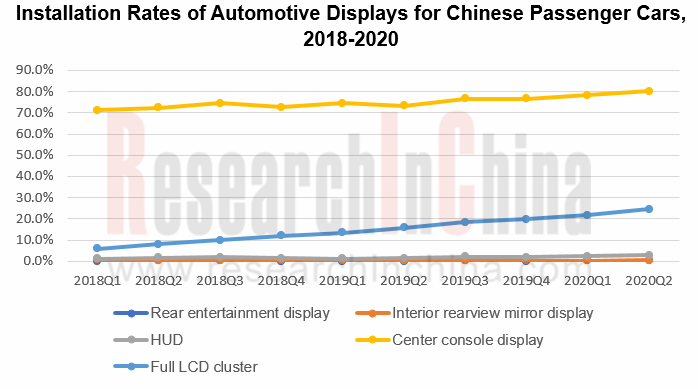

In the Chinese market, the installation rate of console displays exceeds 80%, while full LCD cluster displays see the fastest installation rate, accompanied by a marked rise in installation rates of rearview mirror displays, HUD, center console displays, among others.

In 2019, the automotive display shipments of global panel vendors grew concentrated ever, especially the top five’s rose by 4.3 percentage points. JDI led the pack in the market, while Tianma Microelectronics, the largest Chinese automotive panel supplier, took the third place in the world with its shipments growing at a far higher rate than those of JDI and LGD; however, BOE saw the quickest shipment growth rate as high as 73.2%. Chinese players are growing strong.

Automotive Display Technology: Given LCD Overcapacity, Suppliers Are Racing to Develop New Technologies such as AMOLED

LCD still prevails in the automotive display market, but Japanese and Korean panel makers led by JDI and LGD have been gearing from a-Si products to LTPS and even AMOLED to suit to the changing automotive demand.

Moreover, the rapid release of new LCD capacities will lead to a severer oversupply, ever lower prices and less meager profits, forcing vendors to cut production and seek for a transition and even a retreat from the LCD market.

BOE: it announced at the end of 2019 that it would stop investing in LCD capacity, but focus on OLED and next-generation Mini LED and Micro LED instead, with a plan to spawn Mini LED in Q4 2020.

LGD: It will stop production of LCD panels in South Korea before the end of 2021 to slash losses.

AUO: It trims LCD capacity and quickens to develop new products.

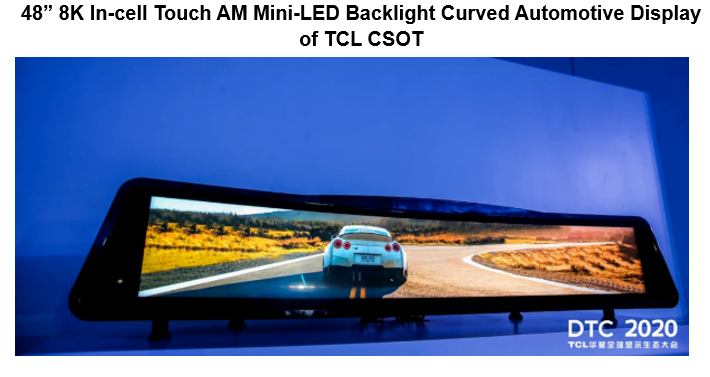

With the CASE (connected, autonomous, shared, electrified) trend in the automotive sector, automotive displays tend to be bigger, and in the form of conjugate displays and multi-displays. The rising of novel automotive displays such as vehicle control displays and curved displays has brought opportunities to Chinese vendors. Major suppliers have rolled out new technical solutions like AMOLED and Mini LED successively in 2020.

LGD: In February 2020, it provided a digital cockpit based on an OLED curved display for the new Cadillac Escalade. In June 2020, it announced that it will develop a retractable display before 2024.

Tianma Microelectronics: The ACRUS technology, debuted in January 2020, raises the contrast to over 30,000:1 by laminating LTPS double-layer panels.

Innolux: In July 2020, it launched a 29-inch free-form curved display incorporating a cluster board and a CID display, and planned to achieve mass production in 2022.

TCL CSOT: In October 2020, the 48” 8K In-cell Touch AM Mini-LED backlight curved automotive display was released, as the first 5096 partition AM Mini-LED backlight and 100% NTSC display in the automotive industry and the world’s first 6.7” AMOLED cloud scroll display.

Automotive Display Installation: Integrated Displays Grow a Standard Configuration, and OLED/AMOLED Displays Begin to Penetrate in High-end Cars.

At present, automotive dual-displays or even triple-displays represent a trend. A larger display spans the entire center console, featuring the functionality involved with the copilot. As per the center console display configuration of Chinese passenger cars in 2018-2020, the installation rate of multi-displays was up from 0.3% in 2018 to 1.3% in Q2 2020. The interiors of Mercedes-Benz, Volkswagen, Chang’an and other models in 2020 reveal that dual-displays have almost become the standard.

The multi-display layout is basically available in models priced above RMB150,000, except Chang'an Benni E-Star launched in April 2020, a mini-car priced below RMB100,000 that has full LCD cluster & center console dual-displays, signaling the penetration of dual-displays into the medium and low-end models.

With the evolvement of intelligent connectivity technology, cars are growing to be mobile smart terminals. In addition to cluster & center console dual displays, HUD, electronic rearview mirror displays, copilot recreation displays, rear seat entertainment displays, and transparent A-pillars have emerged. HOZON U, for instance, launched in 2019, is equipped with a vehicle control display and transparent A-pillars besides dual displays. ENOVATE ME7 unveiled in September 2020 carries 5 high-definition displays including a cluster display, a center console display, a copilot display and dual displays in the rear row.

According to the concept models released by OEMs, curved displays will shine in the automotive display field in future. Luxury brand cars and new energy vehicles are first making use of OLED displays.

Previously, only small displays such as transparent A-pillars, and Audi virtual rearview mirror displays applied OLED. In 2020, some production models use OLED on large displays for center consoles and the copilot. Mercedes-Benz S-class launched in August 2020 is provided with a 12.8-inch OLED curved center console display; the 2021 Cadillac Escalade will be packed with the industry’s first large-size curved OLED cluster display; Nissan’s IMQ concept uses a 33.1-inch curved display; Audi-Aicon concept adopts a surrounded display.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...