In 2025, China’s Installation of Automotive Wireless Communication Modules Will Reach 90 Million Units

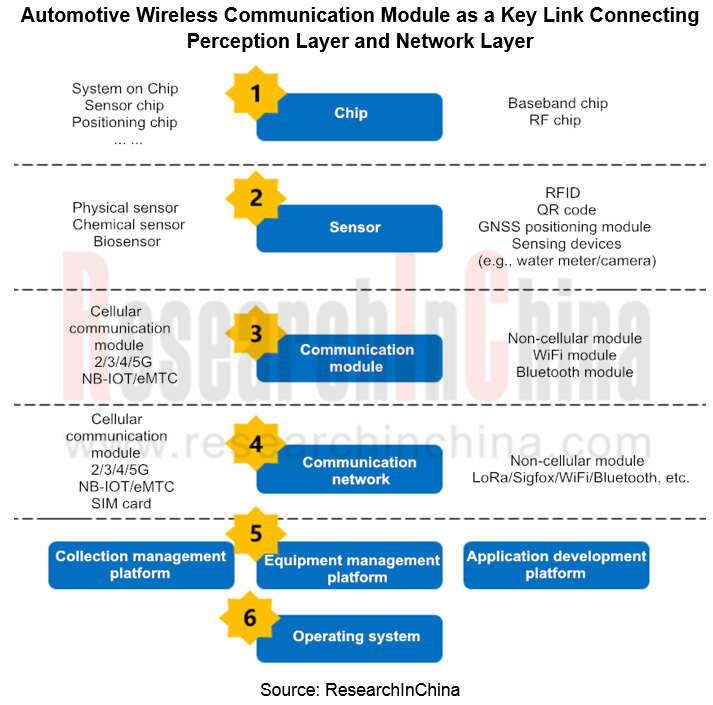

Wireless module is a functional module that integrates chip, memory, power amplifier and other devices into one circuit board and provides standard interfaces. Wireless module allows terminals to pack communication or positioning capability. Automotive wireless communication module is an underlying hardware installed to connect vehicles with telematics and internet for transmitting and collecting data. It enables direct communication and data exchange between vehicle and cloud, between vehicles, between vehicle and infrastructure, and between vehicle and pedestrians (mobile terminals) in a wireless way, which is a communication process that makes mobile communication macro network base stations unnecessary.

As a key link connecting perception layer and network layer of internet of things (including internet of vehicles (IoV)), the wireless communication module enables terminals and devices to be connected and transmit data.

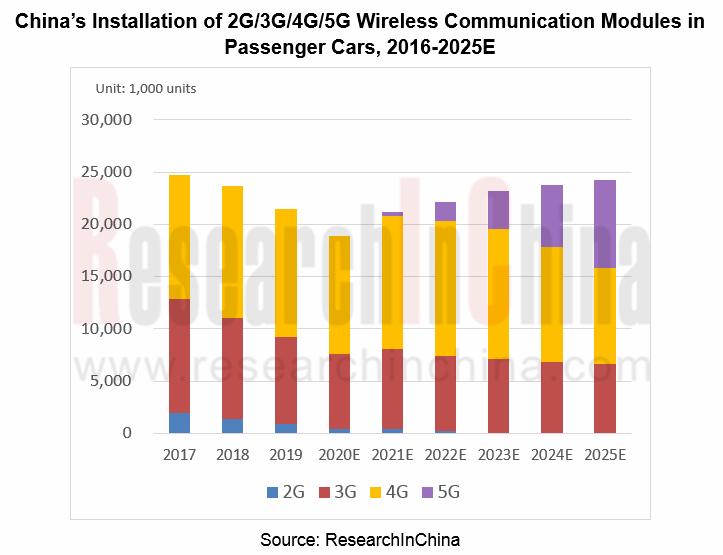

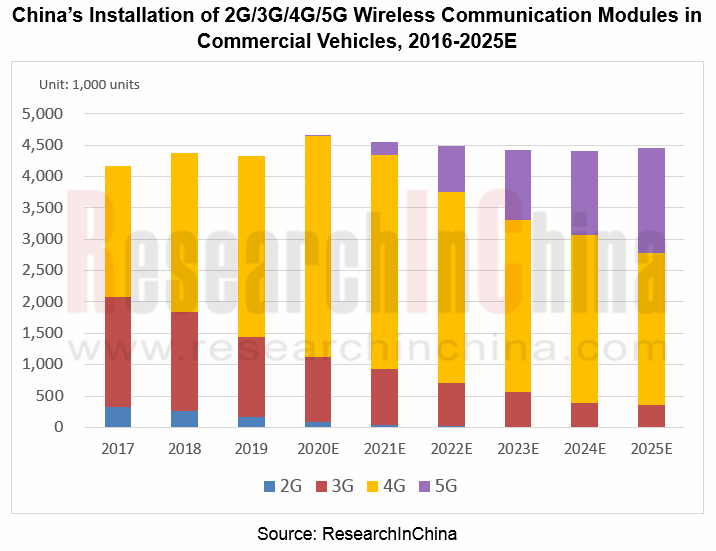

As estimated, 200 million units of automotive wireless communication module will be installed worldwide in 2025, sustaining a CAGR of roughly 15% between 2020 and 2025, including 90 million units to be installed in China with a CAGR of about 19% from 2020 to 2025.

China stays ahead in 5G development, with a bit more installation of 5G automotive wireless communication modules than the global average. And in the country, the 5G modules are installed more in commercial vehicles than passenger cars. It is predicted that China’s installation of 5G automotive wireless communication modules will reach 35% or so in 2025.

Competitive Landscape of Wireless Communication Module Industry

As 4G network matures and 5G technology spreads, 2G/3G networks are inevitably squeezed out. The whole IoT and IoV industries are evolving towards NB-IoT, 4G (Cat.1) and 5G.

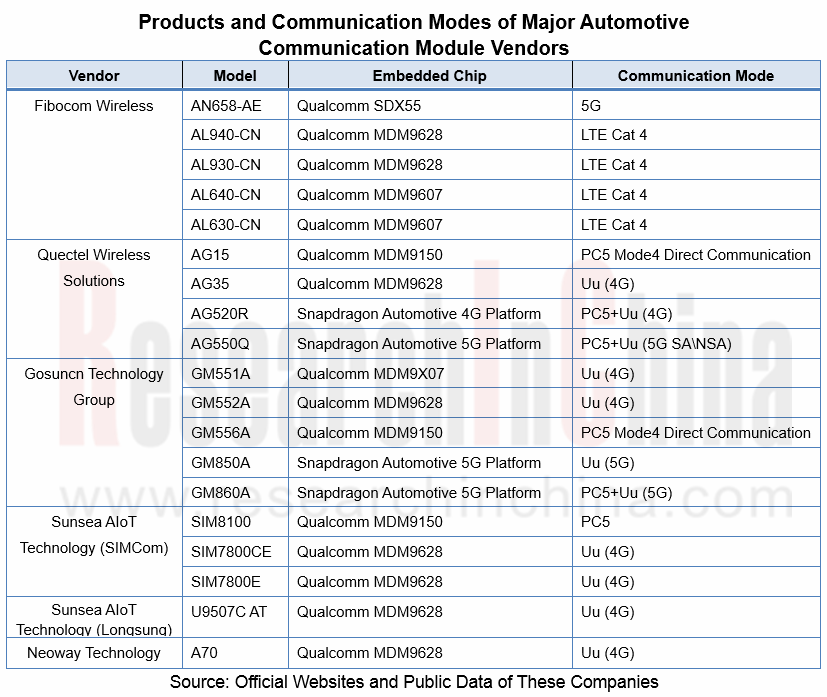

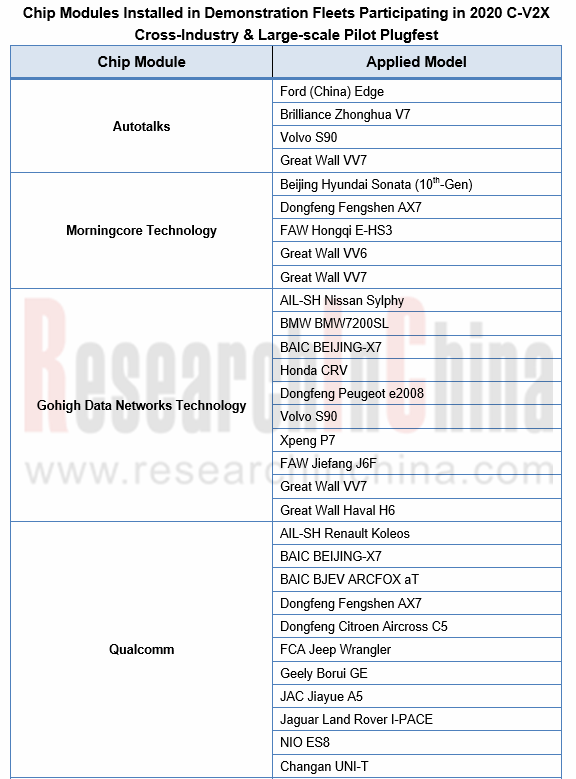

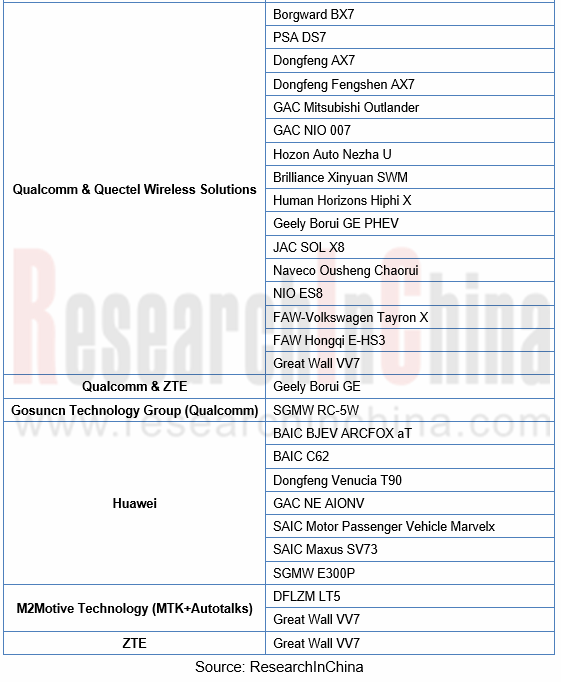

Chinese wireless communication module companies that have been roaring ahead in recent years, are catching up with foreign leaders and striving to overtake them. Currently, Gosuncn Technology Group Co., Ltd. and Quectel Wireless Solutions Co., Ltd. both have introduced automotive grade communication modules in efforts to make an expansion in telematics field. Automotive communication modules outperform general ones in real-time transmission, security and stability. Chinese wireless communication module vendors are heavyweights in communication module market.

As concerns automotive communication module product structure, Quectel Wireless Solutions Co., Ltd., Gosuncn Technology Group Co., Ltd. and Fibocom Wireless Inc. offer the most communication module products, a majority of which use Qualcomm’s chipsets.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...