Research into automotive cyber security: server and digital key are the ports vulnerable to attacks, for which OEMs have stepped up efforts in cyber security.

With advances in the CASE (Connected, Autonomous, Shared, and Electrified) trend, cars are going smarter ever with functional enrichment. Statistically, the installation rate of telematics feature to new cars in China is over 50% from January to October of 2020, a figure projected to rise to 75% or so in 2025. In terms of functionality, intelligent cockpit and advanced automated driving become trending, and the features such as multi-modal interaction, multi-display interaction, 5G connectivity, V2X, OTA and digital key finds ever broader application alongside the soaring number of vehicle control codes and more port vulnerabilities to safety threat.

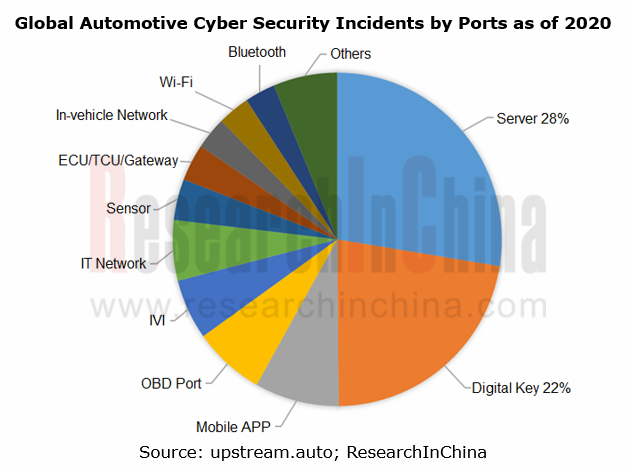

Currently, the automotive cyber security events arise mainly from attacks on server, digital key, mobile APP, OBD port among others.

Server acts as the most important port for cyber security, which is exposed to the attack by hackers on operating system, database, TSP server, OTA server and the like, thus issuing in data tampering, damage and vehicle safety accidents. Most tools of assault on servers are remotely accessible with lower costs, while the data storage over servers is of paramount importance, all of which lead to often a rather high share of attacks on servers.

Digital key, as the second port that matters most to cyber security, is a common media subject to vehicle intrusion and theft. In 2020, there will be 300,000 Bluetooth digital key installs in China, coupled with an installation rate at about 4%, with such more functionalities besides lock/unlock & start as account log-in, key sharing, vehicle trajectory record, and parcel delivery to cars, which has ever more implications on vehicle safety.

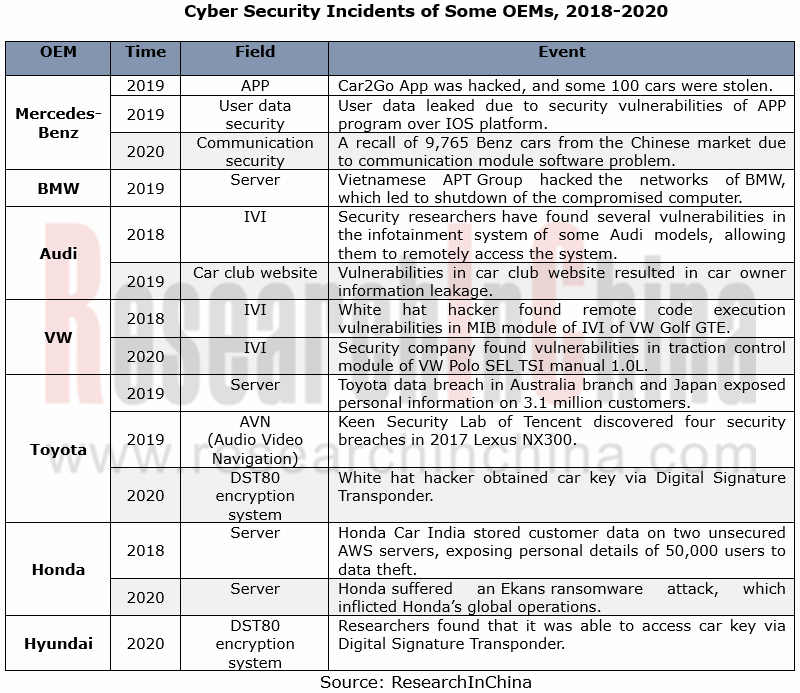

Different auto brands are subject to varied attack on vehicle security.

The smarter a car is, the more vulnerable to security attacks will be. Amid the intelligence trend, all OEMs, whatever Mercedes-Benz, BMW, Audi, VW, Toyota, Honda or Hyundai, have varied exposure to security attacks.

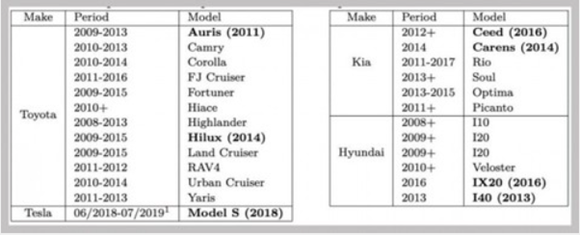

In March 2020, key encryption approaches of OEMs like Toyota, Hyundai and KIA were reported to have limitations with a possibility of intrusions and thefts largely due to the vulnerabilities of TI’s DST80 encryption system employed by them. A hacker just stands near the car that packs DST80 remote control key, using the inexpensive Proxmark RFID reader/transmitter for the ‘identity theft’ of the key and thus getting the encrypted information.

OEM quicken their presence in cyber security

To address serious challenges in automotive cyber security, the OEMs are sparing no efforts in security improvement in many aspects: a) information management inside the company and optimization of R&D process; 2) to build a team intended for cyber security; 3) cyber security protection of telematics.

> European and American OEMs: Diversified deployments of cyber security protection

The automakers from Europe and America are pushing ahead with cyber security construction roundly with technical superiorities, with a tightened control on information security management inside the company apart from improvements in cyber security protection of telematics. As concerns team construction, the majority of European and American OEMs as usual set up either an independent cyber security division or a subsidiary to ensure information security during a vehicle lifespan.

Mercedes-Benz, for instance, has such actions for cyber security in the three below:

Cloud computing: vehicle data protection enabled by a cloud platform through which the car owner takes control of data openness to the outside while driving, and at the same time relevant information will be eliminated automatically after the car owner leaves his/her car;

Factory: partnership with telecom carriers and equipment vendors to set up intelligent vehicle manufacturing factories with production data safety enabled by 5G mobile network;

Vulnerability protection: joins forces with third-party cybersecurity providers to test and repair the potential vulnerabilities of intelligent connected vehicle.

> Japanese and Korean OEMs: with a more focus on cyber security protection and management inside the company

Nissan Motor, for example, proceeds with intro-company management on information security and perfects the regulations concerned. Over the recent years, Nissan has been improving its R&D management system and cyber security platform, with its Tel Aviv-based joint innovation laboratory and collaborations with Israeli start-ups on cyber security testing and study. As yet, Nissan has more than ten cooperative joint prototype projects.

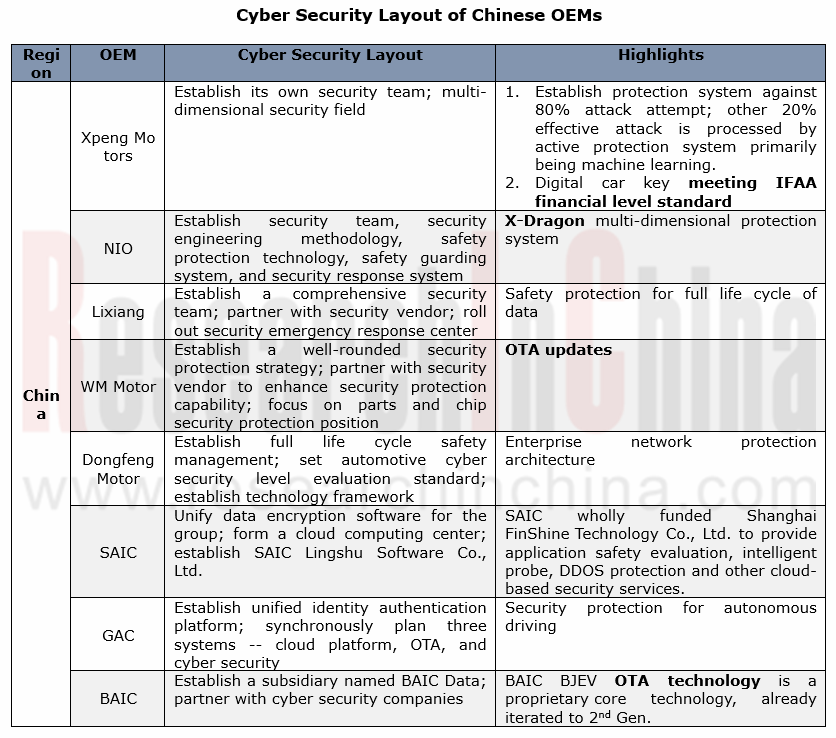

> Chinese OEMs: the emerging forces go ahead of the rest

The emerging carmakers are commendable in cyber security protection. Cases include XPENG Motors that boast concurrent deployments over cloud, vehicle and mobile phone by building a security team on its own and the partnerships with Aliyun, Irdeto, and Keen Security Lab of Tencent in order for a proactive protection system; and NIO that has built a X-Dragon multi-dimensional protection system through a self-owned security team and multi-party cooperation.

Also, the time-honored Chinese automakers follow suit, such as Dongfeng Motor, SAIC, GAC and BAIC that all prioritize the security stewardship during their life cycle. As concerns its overall deployment, SAIC, for example, incorporates its subordinates into the group’s cyber security protection and management system and applies the data encryption software (GS-EDS system) with one accord for data safety as a whole; secondly, SAIC builds a cloud platform independently and a proprietary cloud computing center delivering cloud-based security services; last, SAIC founded SAIC Lingshu Software Co., Ltd in charge of developing basic technology platform and sharpening software R&D competence.

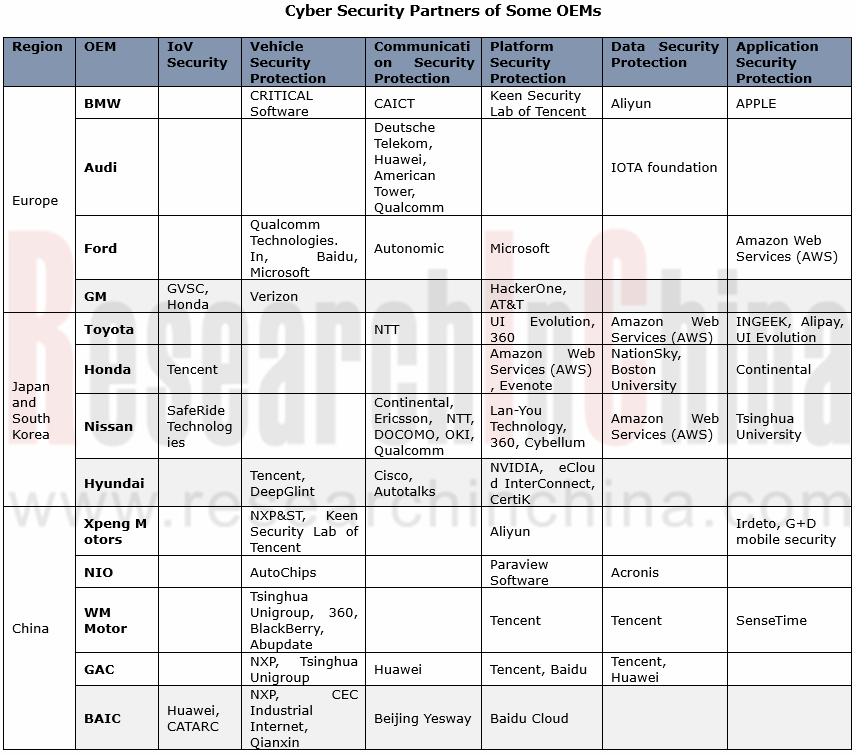

OEMs have ever broader cooperation in cyber security.

In addition to security enhancement, OEMs are vigorously seeking for external collaborations on vehicle, communication, platform, data, and application, to name a few.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...