Global and China Automotive Audio and Infotainment Industry Report, 2013

-

Dec./2013

- Hard Copy

- USD

$2,700

-

- Pages:155

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

ZYW161

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,950

-

- Hard Copy + Single User License

- USD

$2,900

-

Global and China Automotive Audio and Infotainment Industry Report, 2013 mainly covers the followings:

1. Recent Developments of Global Automotive Market

2. Recent Developments of China Automotive Market

3. Introduction to In-vehicle Infotainment (IVI)

4. Automotive Audio Market and Industry Research

5. Automotive Infotainment Market Research

6. 23 Major Automotive Audio and Infotainment Vendors

In 2013, global infotainment market size approximated US$30.1 billion, an increase of 4.2% from a year earlier; and the decelerated growth was due to the sluggish European automotive market and lower infotainment prices. The market is expected to restore growth from the next year, with the size up 12.2% to US$33.8 billion in 2014, US$40.1 billion in 2015 and US$45.6 billion in 2016.

Infotainment market growth is largely because its increased and upgraded functions have greatly raised price. High-end infotainment map will be upgraded to 3D map, with display up from 6-8 inches to 10-12 inches, and rear-seat entertainment system will be more popular, also accompanied by the adding of 3G or 4G network connection as well as the mushrooming of corresponding smart phone APPs.

Infotainment will also see qualitative leap i.e. added by advanced driver assistance systems (ADAS); thus HUD system is bound to be added in the future, which will significantly improve the cost, but also means instrument cluster companies need to collaborate with infotainment vendors. Japan’s Aisin AW and DENSO, U.S. Visteon and Delphi, Germany’s Continental and South Korea’s Mobis all have instrument cluster business, showing obvious future edges.

The massive prevalence of smart phones enables automotive infotainment to undergo a reform, 3G or 4G network connection will greatly improve automotive infotainment prices. At present, there are two camps for automotive networking, one of them is led by vehicle manufacturers, represented by GENIVI, whose founding members include Volvo, BMW, FAW, GM, HONDA, HYUNDAI, JAGUAR, JOHNDEER, NISSAN, PSA, RENAULT and SAIC. GENIVI uses general purpose platform, may be Linux with open-type application programming interface, high cost, high safety, long development cycle, infotainment embedded with 3G or 4G network connectivity, and the service charge will be high.

Another camp is led by smart phone vendors like MirrorLink and MHL. MirrorLink, jointly launched by three well-known mobile phone vendors – Nokia, Samsung and LG, six automakers – Daimler, General Motors, Honda, Hyundai, Toyota and Volkswagen, as well as two system suppliers - Alpine Electronics and Panasonic, embeds APP in phone and infotainment, connected by USB or WiFi, with very short development cycle, low cost, and a large number of products have been rolled out into the market. There is simpler MHL League, co-founded by Nokia, Samsung, Sony, Toshiba and Silicon Image, with higher transmission rate and lower prices.

Both camps have advocators. In the AM infotainment market, MirrorLink or MHL is definitely the leader. The OEM market is dominated by the vehicle manufacturer, whose development cycle is too long and costly, especially the 3G or 4G auto connectivity service fees are amazing, and so is the CTU (cost to use). In the future, the high-end market is expected to be dominated by the vehicle manufacturer, while the low- and medium-end market by mobile phone vendors.

In the industry, OEM market is by degrees expanding, while after market is just the opposite, because today’s high-end automotive configuration will become tomorrow’s low- and mid-end automotive configuration. Despite a shrinking trend, the aftermarket still attracts quite some small vendors due to the low threshold, especially the Chinese market gathers hundreds, many of them see annual revenue of less than RMB20 million. There is serious product homogeneity in the Chinese market, accompanied by fierce price competition. Large vendors, always, can’t bear the meager profit to declare bankruptcy, e.g. Huizhou Freeway Electronics Co., Ltd. which was closed down in August 2013.

1. Global Automotive Market and Industry

1.1 Global Automotive Market

1.2 Global Automotive Industry

2. China Automotive Market and Industry

2.1 Market Profile

2.2 Recent Developments

2.2.1 Passenger Car

2.2.2 Commercial Vehicle

2.3 China Automotive Industry

3. Status Quo and Future of Automotive Networking

3.1 Introduction to Infotainment

3.2 IVI, TSP, TELECOM, Hardware Market Size

3.3 GENIVI Alliance

3.4 MIRRORLINK

3.5 MHL

3.6 Typical IVI Design

3.7 Telematics@China

4. Automotive Audio Market and Industry

4.1 Introduction to Automotive Audio System

4.2 Automotive Audio System Industry Chain

4.3 Market Share of Global Automotive Audio System Vendors

4.3.1 Market Share of Global OE Automotive Audio System Vendors

4.3.2 Supply Ratio of Automotive Audio System Suppliers for World’s Major Automakers

4.4 China Automotive Audio Industry and Market

4.4.1 Supporting Conditions between Chinese Automotive Audio Vendors and Automakers

4.4.2 China Automotive Audio Market

5. Automotive Infotainment Market and Industry

5.1 Market Size

5.2 Automotive Infotainment Industry

5.3 China Automotive Infotainment Market

5.4 Status Quo of China Automotive Networking

5.5 Supply Ratio between Global Automotive Navigation Vendors and Auto Makers

6. Automotive Audio and Infotainment Vendors

6.1 HARMAN

6.2 Continental

6.3 Pioneer

6.4 Foryou Group

6.4.1 Shinwa (China) Industries

6.4.2 Foryou Multimedia Electronics

6.4.3 Foryou General Electronics

6.5 Alpine

6.6 Clarion

6.7 Delphi

6.8 Visteon

6.8.1 Yanfeng Visteon (YFV)

6.9 Hangsheng Electronics

6.10 Panasonic Automotive System (PAS)

6.11 FUJITSU TEN

6.12 AISIN AW

6.13 Denso

6.14 Panyu Vterk Automotive Audio

6.15 Mobis

6.15.1 Tianjin Mobis

6.16 Sonavox

6.17 Guangdong Coagent Electronics S&T

6.18 Shenzhen Baoling

6.19 JVCKENWOOD

6.20 BLAUPUNKT

6.21 Bose

6.22 Garmin

6.23 Desay SV Automotive

Global Light Duty Vehicle Production, 2011-2014E

Global Heavy Duty Vehicle Production, 2011-2014E

Global Automotive Sales Volume by Major Brands, 2010-2012

China’s Automotive Production, 2001-2013

China’s Annual Automotive Production and YoY Growth by Type, 2008-Oct. 2013

China’s Monthly Sales Volume of Passenger Cars and Growth Rate, Jan. 2012-Oct. 2013

China’s Passenger Car Sales Volume by Model, Jan. 2011-Oct. 2013

Sales Volume of Audi, BMW, Mercedes-Benz in China, Jan. 2011-Oct. 2013

China’s Passenger Car Sales Volume by Country, 2009-Oct.2013

Monthly Sales Volume of Medium and Heavy Duty Trucks in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Light Duty Trucks in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Mini Trucks in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Large Buses in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Medium Buses in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Mini Buses in China, Jan. 2011-Oct. 2013

Typical Diagram of Infotainment

Typical Indicators of Infotainment

Global Auto Connection Services IVI, TSP, Telecom, Hardware Market Size, 2009-2018E

Global Auto Connection Service Equipment Shipments, 2009-2018E

Global Connectivity Equipped Car Shipments by Region, 2013&2018E

Automotive Audio System Industry Chain

Introduction to Automotive Audio System Industry Chain

Market Share of Major OE Car Audio System Vendors in the World, 2011

Market Share of Major Automotive Audio System Vendors in European Union, 2008-2011

Market Share of Major Automotive Audio System Vendors in North America, 2008-2011

Market Share of Major Automotive Audio System Vendors in Asia-Pacific, 2008-2011

Supply Ratio of Major Automotive Audio System Vendors for Toyota, 2013

Supply Ratio of Major Automotive Audio System Vendors for Honda, 2013

Supply Ratio of Major Automotive Audio System Vendors for Nissan, 2013

Supply Ratio of Major Automotive Audio System Vendors for General Motors, 2013

Supply Ratio of Major Automotive Audio System Vendors for Ford, 2013

Supply Ratio of Major Automotive Audio System Vendors for Volkswagen, 2013

Supply Ratio of Major Automotive Audio System Vendors for BMW, 2013

Supply Ratio of Major Automotive Audio System Vendors for Benz, 2013

Supply Ratio of Major Automotive Audio System Vendors for Hyundai, 2013

Supply Ratio of Major Automotive Audio System Vendors for PSA, 2013

Market Share of Major OE Automotive Audio Vendors in China, 2013

Global Automotive Infotainment Market Size, 2011-2018E

Global Automotive Infotainment Shipments, 2011-2018E

Global Automotive Infotainment Penetration, 2011-2018E

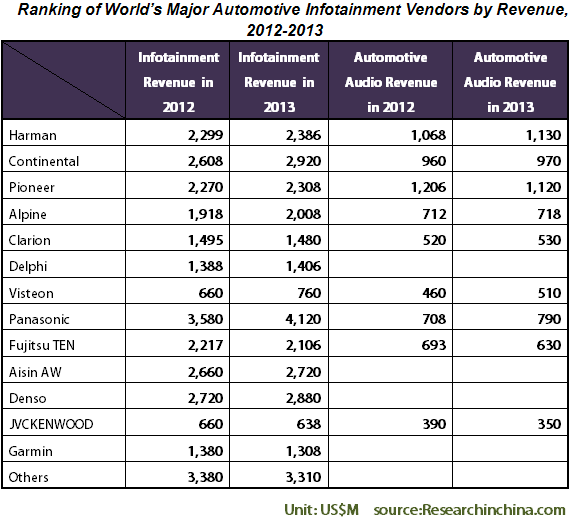

Ranking of World’s Major Automotive Infotainment Vendors by Revenue, 2012-2013

China’s Automotive Infotainment Shipments, 2011-2016E

Market Share of Major Automotive OEM Infotainment Vendors in China, 2013

Ranking of Top 10 Automotive AM Infotainment Vendors by Sales Volume, 2012

Ranking of Top 10 Automotive AM Infotainment Vendors by Sales, 2012

Supply Ratio of Major Automotive Navigation Vendors for Toyota, 2013

Supply Ratio of Major Automotive Navigation Vendors for Honda, 2013

Supply Ratio of Major Automotive Navigation Vendors for Nissan, 2013

Supply Ratio of Major Automotive Navigation Vendors for General Motors 2013

Supply Ratio of Major Automotive Navigation Vendors for Ford, 2013

Supply Ratio of Major Automotive Navigation Vendors for Volkswagen, 2013

Supply Ratio of Major Automotive Navigation Vendors for BMW, 2013

Supply Ratio of Major Automotive Navigation Vendors for Benz, 2013

Supply Ratio of Major Automotive Navigation Vendors for Hyundai, 2013

Revenue and Operating Margin of Harman, FY2004-FY2014

Sales and EBITDA Margin, Q1 FY2012-Q1 FY2014

Revenue Breakdown of Harman by Business, FY2010-FY2016

Gross Margin of Harman by Sector, FY2010-FY2013

Revenue Breakdown of Harman by Region, FY2006-FY2013

Client Structure of Harman, FY2008-FY2011

Harman Infotainment and Lifestyle Backlog, FY2009-FY2013

Revenue of Harman in China, FY2009-FY2014

Major Clients for Harman’s Automotive Audio

Harman’s Manufacturing Bases Worldwide

Sales and EBIT of Continental, 1998-2012

Sales Breakdown of Continental by Region, 2008-2012

Sales Breakdown of Continental by Sector, 2008-2012

Number of Continental’s Employees by Region, 2008-2012

Number of Continental’s Employees by Sector, 2008-2012

Revenue and Operating Margin of Continental Automotive - Interior Division, 2007-2013

Revenue Breakdown of Continental Automotive - Interior Division by Region, 2009-2012

Revenue and Operating Margin of Pioneer, FY2006-FY2014

Revenue Breakdown of Pioneer by Sector, FY2007-FY2013

Revenue and Operating Margin of Pioneer - Automotive Electronics Division, FY2007-FY2014

Revenue Breakdown of Pioneer by Region, FY2012-FY2014

Pioneer Car Electronics Sales Plan in Emerging Markets

Capacity Statistics of Pioneer Car Audio Manufacturing Bases Worldwide

Organizational Structure of Pioneer Car Audio in China

Client Distribution of Shinwa (China) Industries

Revenue and Operating Margin of Alpine, FY2006-FY2014

Revenue Breakdown of Alpine by Business, FY2012-FY2014

Revenue and Operating Margin of Alpine – Car Audio Division, FY2006-FY2013

Revenue and Operating Margin of Alpine - Information & Communication, FY2005-FY2013

Revenue Breakdown of Alpine by Region, FY2005-FY2013

Profile of Alpine Branches in China

Revenue and Operating Margin of Clarion, FY2006-FY2014

Revenue Breakdown of Clarion by Region, FY2009-FY2013

Organizational Structure of Clarion in China

Revenue and Gross Margin of Delphi, 2004-2013

Revenue and Operating Margin of Delphi, 2007-2013

Revenue and EBITDA Margin of Delphi, 2007-2013

Revenue Breakdown of Delphi by Product, 2009-Q3 2013

EBITDA of Delphi by Sector, 2010-Q3 2013

Client Distribution of Delphi, 2010-2013

Revenue Breakdown of Delphi by Region, 2010-2013

Organizational Structure of Delphi Before and After the Merger

Revenue Breakdown of Delphi Before and After the Merger by Region

Organization of YFV

Organization of Yanfeng Visteon Electronics

Revenue Breakdown of YFV by Client, 2012

Revenue Breakdown of YFV by Product, 2012

Distribution of YFV in China

Revenue of YFV, 2002-2012

Organizational Structure of YFV - Electronics

Production Bases of YFV – Electronics

Key Events of YFV – Electronics

Revenue Breakdown of YFV by Client, 2010

Revenue Breakdown of YFV by Client, 2011

Revenue Breakdown of YFV by Product, 2010

Vehicle Infotainment Products of Hangsheng Electronics

Major Clients of PAS

Revenue Breakdown of PAS by Region, FY2012

Revenue Breakdown of Panasonic Automotive Sector by Product, FY2012

Organizational Structure of Panasonic Automotive Systems Dalian

Revenue and Operating Margin of FUJITSU TEN, FY2005-FY2013

Revenue Breakdown of FUJITSU TEN by Sector, FY2005-FY2013

Revenue and Operating Margin of Aisin, FY2007-FY2013

Non-Toyota Client Structure of Aisin, Q2 FY2014

Non-Toyota Client Structure of Aisin, FY2009-FY2011

Non-Toyota Client Structure of Aisin, FY2012-FY2013

Revenue and Operating Income of Aisin AW, FY2007-FY2014

Navigator Production of Aisin AW, FY2008-FY2014

Revenue and Operating Margin of Denso, FY2006-FY2014

Client Structure of Denso, FY2008-FY2013

Revenue Breakdown of Denso by Client, Q2 FY2013/2014

Revenue Breakdown of Denso by Product, FY2012-FY2014

Organizational Structure of Tianjin Mobis

Organizational Structure of Guangdong Coagent Electronics S&T

Revenue and Operating Income of JVCKENWOOD, FY2007-FY2014

Revenue Breakdown of JVCKENWOOD by Sector, FY2008-FY2013

Models Using Bose Audio

Sales and Operating Margin of Garmin, 2007-2013

Sales Breakdown of Garmin by Business, 2009-2013

Operating Income of Garmin by Business, 2009-2013

Sales Breakdown of Garmin by Region, 2009-2012

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...