Driven by market demand and policies, passenger cars equipped with L2 assisted driving functions have been mass-produced, which triggers enthusiastic market response and robust demand.

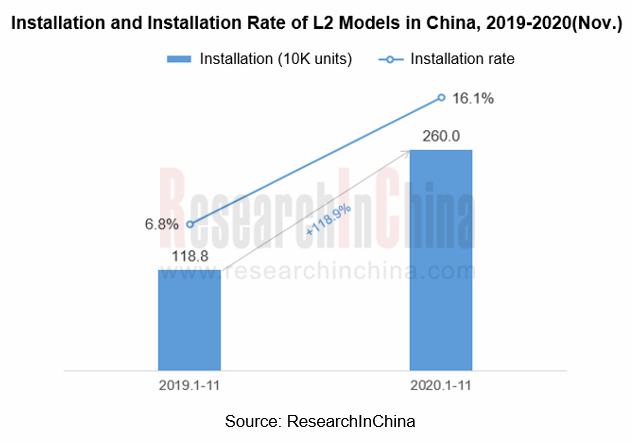

1. Installations of L2 autonomous driving functions increased by 118.9% year-on-year

In 2020, the automobile market was affected by the economic downturn and COVID-19. From January to November 2020, the number of passenger cars insured in China was 16.136 million, a year-on-year decrease of 7.5%. Among them, there were 2.60 million ones equipped with L2 autonomous driving functions, a year-on-year spike of 118.9%; the installation rate jumped 9.3 percentage points year-on-year to 16.1%. Plus multiple negative factors, installations of L2 autonomous driving functions bucked the trend to grow, with strong market demand.

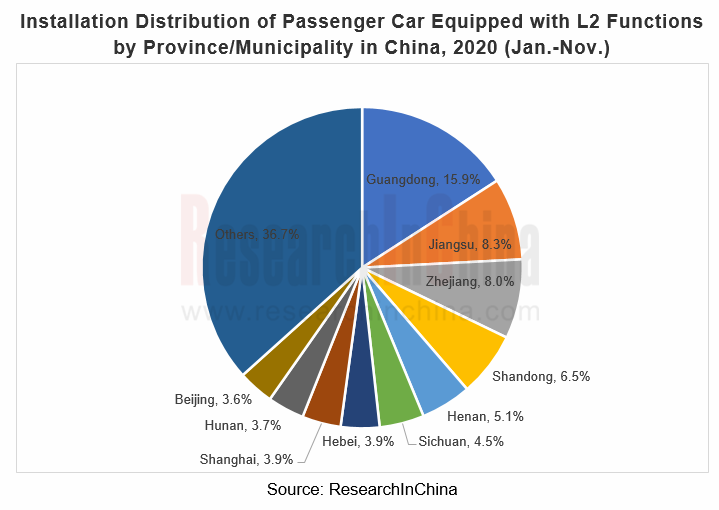

In terms of regions, models equipped with L2 autonomous driving functions are mainly sold to economically developed regions such as Guangdong, Jiangsu and Zhejiang. Among them, installations in Guangdong accounted for 15.9%, much higher than other provinces.

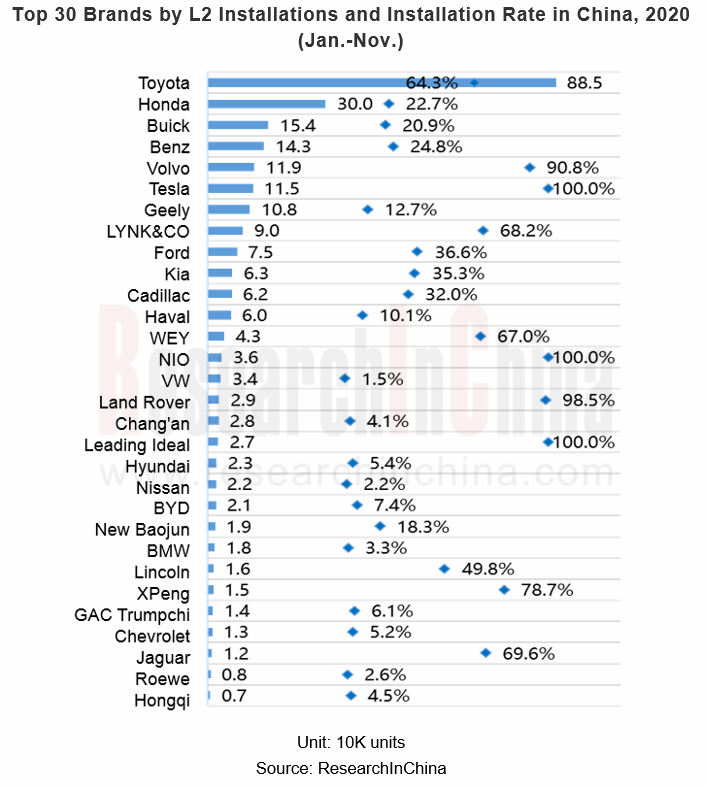

2. Emerging brands such as Tesla, NIO and Lixiang are more aggressive, with the L2 installation rate reaching 100%

From January to November 2020, a total of 57 passenger car brands (including 32 independent brands and 25 joint venture brands) in China launched L2 autonomous driving functions. Among them, 28 brands (including 11 independent brands and 17 joint venture brands) installed the functions on more than 10,000 cars.

From the perspective of installations, Toyota tops among the industry with 885,000 cars equipped with L2 autonomous driving functions. Its Toyota Safety Sense system has been installed on popular models such as Corolla, Levin, RAV4, AVALON, etc. to feature lane tracking assist (LTA), which can follow the preceding vehicle, provide some necessary steering operations, and keep the vehicle in the center of the lane when the lane line is difficult to identify in traffic jams, or follow the trajectory of the preceding vehicle at low speed.

As for installation rate, emerging automakers represented by Tesla, NIO and Lixiang adopt advanced electronic and electrical architectures to enable vehicles to achieve L2 or L2+ assisted driving functions through OTA upgrades, and further develop toward intelligence.

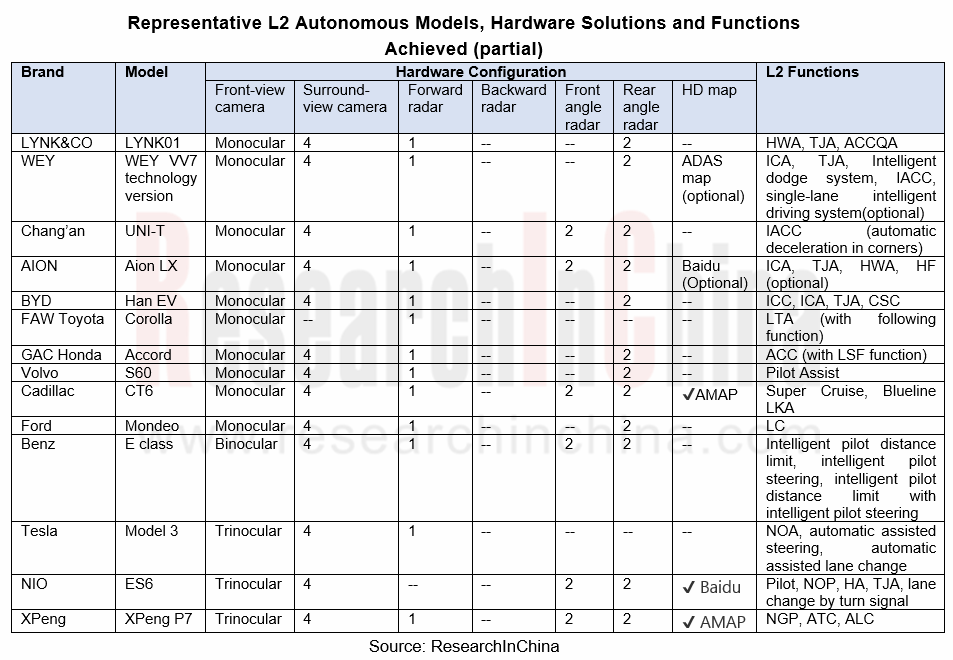

The current L2 autonomous driving functions are mainly divided into two categories: autonomous driving in a single lane, such as integrated adaptive cruise (ICA), traffic jam assist (TJA); autonomous driving that supports commanded lane changes, such as highway assist (HWA).

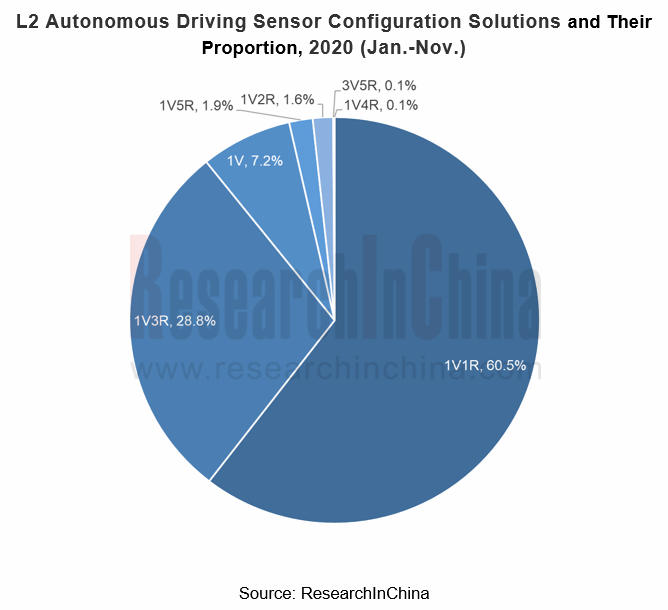

3. 1V1R is the mainstream sensor configuration solution

At present, the mainstream solutions of L2 autonomous driving include 1V1R (a camera + a forward radar) and 1V3R (a camera + a forward radar + 2 rear angle radar), which seize the combined market share of 89.3%; however, 1V1R enjoys the lion’ s share of 60.5%.

Given roadmaps or cost control, some automakers realize L2 autonomous driving through a single vision solution (1V). Some other manufacturers use 1V5R, 1V2R, 1V4R, 3V4R and the like to explore solutions and functions.

For example, NIO ES6 adopts the 3V4R solution

The 2020 NIO ES6 adopts a trinocular camera, 2 front-angle radars, 2 rear-angle radars, and a Mobileye chip to achieve Navigation on Pilot (NOP), Highway Pilot, and Traffic Jam Pilot (TJP), Auto-Lange Change (ALC) and many other L2 autonomous driving functions, and upgrade functions through OTA.

The trinocular camera used by NIO ES6 has wider field of view and higher accuracy than a monocular camera. The 52-degree camera detects general road conditions, the 28-degree camera detects long-distance targets and traffic lights, and the 150-degree camera detects the sides of the car body and cutting-in vehicles in short distance, with better front recognition performance.

In addition, ES6's NOP is based on the basic pilot functions, so that it can automatically switch high-speed lanes, enter or exit ramps according to navigation, and can intelligently adjust the cruising speed on the current road. Based on the realization of pilot lane keeping, ALC enables the automatic lane change of the vehicle by turning the turn signal lever.

4. L2 autonomous driving based on HD map is expected to prevail

With centimeter-level accuracy and rich road information, HD map has become an indispensable element of L3-L5 autonomous driving. But with the deepening of L2 autonomous driving, HD map is expected to find a new scenario.

Some top automakers have tried to apply HD map to L2 autonomous driving:

Tesla, NIO, Xpeng and other emerging automakers have launched L2+ highway cruise based on navigation/HD map, and enabled autonomous driving on highways through navigation path planning.

In July 2020, SAIC-GM Cadillac CT6 equipped with the Super Cruise driver-assistance feature officially debuted. With HD map, Super Cruise can control vehicles on highways and keep them within lanes.

Map suppliers have also introduced corresponding solutions.

Baidu released ANP, a high-level intelligent driving solution based on HD map

In December 2020, Baidu released ANP (Apollo Navigation Pilot), a high-level intelligent driving solution based on HD map.

ANP is a low-level Apollo Lite which is Baidu’s L4 autonomous driving solution. Equipped with the HD map tailored by Baidu for autonomous vehicles, ANP not only supports highways and city loops, but also fits for urban roads. Through CVIS, the driving experience is close to the L4 Robotaxi.

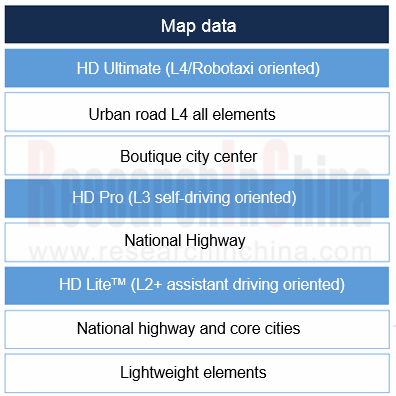

NavInfo launched LitePilot, an HD map product for L2+ autonomous driving

NavInfo has launched HD map for L2+, L3, and L4-5 respectively. LitePilot, an HD map product for L2+ autonomous driving scenarios, can help vehicles drive through ramps, roundabouts and intersections, as well as prepare to turn right.

NavInfo HD map products for different scenarios:

Focusing on L2+ autonomous driving, HD Lite is currently the main product of NavInfo. Compared with HD Pro, HD Lite has fewer map elements, but it can provide autonomous driving map services with lower cost, wider area coverage and higher update frequency, enable highway and city map services, and accelerate the implementation of L2+ autonomous driving technology.

Under the background that L3 autonomous driving features have not been mass-produced, OEMs, integrators, map vendors and other industry chain companies will strive to maximize the capability of L2 autonomous driving and move closer to L3. HD map is expected to find new market space herein.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...