Autonomous Driving Tier1 Supplier Research: centralized implementation of L2+, middleware layout of Tier 1 suppliers

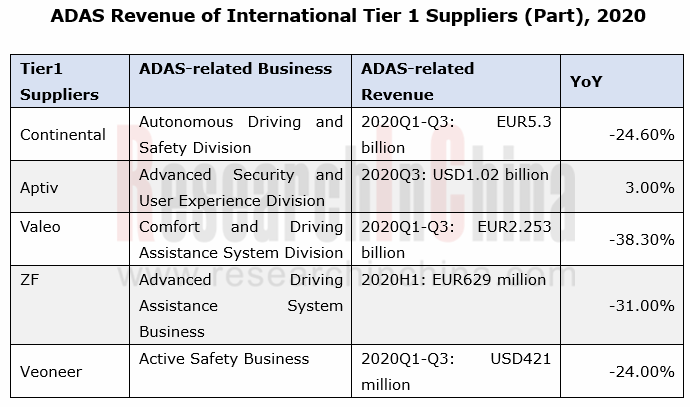

1. The ADAS revenue of foreign Tier 1 suppliers declines amid the pandemic

The outbreak of COVID-19 has led to the declining demand for automobiles and the temporary suspension of production in the automobile industry. In this case, the overall revenue of most Tier1 suppliers has fallen sharply as they have difficulties in business development. For example, more than 40% of Continental's 249 production bases around the world decided in April 2020 to temporarily suspend production for several days or several weeks in order to protect employees and respond to lower demand.

2. Tier 1 suppliers actively promote the mass implementation of L2 autonomous driving, and L3 autonomous driving enters the market

While Tier 1 suppliers' normal production is hindered, the technology of L2/L3 autonomous driving is advancing in an orderly manner.

From January to November 2020, 57 domestic auto brands launched 208 L2 models, and sold 2.60 million vehicles with a year-on-year upsurge of 118.9% thanks to the efforts of Tier 1 suppliers. For example, Bosch helped 40 local models achieve L2 autonomous driving in 2019, and focused on the implementation of L2+ autonomous driving in 2020.

Benefiting from the effective control over the domestic epidemic, Chinese Tier1 suppliers have constantly launched new products. Among them, Huawei and Baidu have attracted the most attention from the market. Huawei has successively unveiled perception layer products such as radar and LiDAR, as well as decision layer products like intelligent driving computing platform MDC and intelligent driving operating system AOS. Baidu APOLLO has released the autonomous driving computing platform ACU (1.0/2.0/3.0) and the L2 intelligent driving solution ANP, and also has successively landed in Changsha, Cangzhou, and Beijing with Robotaxi which is fully open to the society for operation.

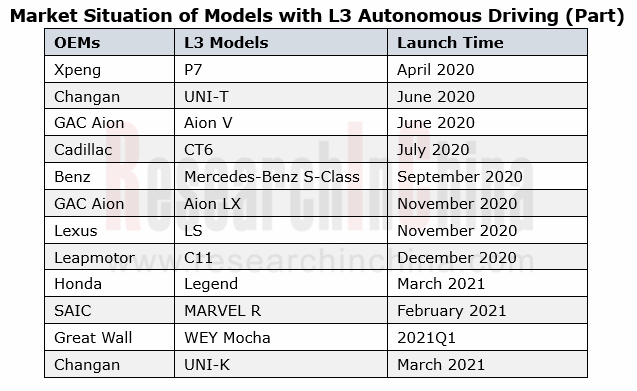

With the introduction of HD maps, Tier 1 suppliers have assisted OEMs to head towards L3 autonomous driving. Xpeng P7, GAC Aion LX and other models with L3 autonomous driving have debuted successively.

3. Foreign Tier 1 suppliers dabble in middleware, while domestic Tier 1 suppliers are deeply tied up with OEMs

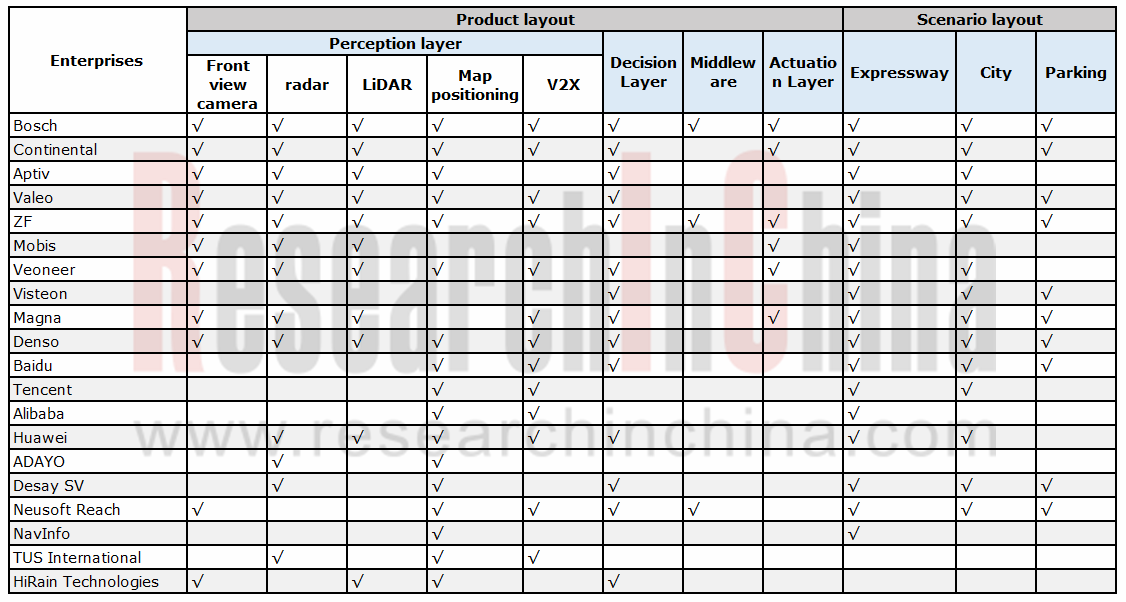

From the perspective of autonomous driving products and scenarios, Bosch, Continental and ZF have the most comprehensive layout among foreign Tier1 suppliers. Both Bosch and ZF launched middleware designed for autonomous driving in 2020. As for the domestic Tier 1 suppliers, Huawei and Desay SV take the lead in the perception layout; however, all the domestic Tier1 suppliers are absent in the field of actuation.

In July 2020, Bosch launched Iceoryx, a middleware for advanced autonomous driving, compatible with ROS2 and Adaptive AutoSAR interfaces to meet the requirements of different development periods (pre-ROS, mass production of Autosar).

In July 2020, Bosch launched Iceoryx, a middleware for advanced autonomous driving, compatible with ROS2 and Adaptive AutoSAR interfaces to meet the requirements of different development periods (pre-ROS, mass production of Autosar).

In December 2020, ZF released ZF Middleware, providing a modular solution that can be integrated into automakers' software platforms. At the same time, the middleware will be installed on mass-produced vehicles in 2024.

In December 2020, ZF released ZF Middleware, providing a modular solution that can be integrated into automakers' software platforms. At the same time, the middleware will be installed on mass-produced vehicles in 2024.

It is worth noting that foreign Tier 1 suppliers dabble in underlying system R&D and build a bridge between system and software applications while accomplishing functions. Bosch and ZF have successively released middleware products, hoping to centrally configure autonomous driving solutions for OEMs through a comprehensive sensor layout so as to simplify system integration, lower development costs and accelerate product launch.

The domestic Tier 1 suppliers (Huawei, Alibaba and Baidu) have teamed up with OEMs to launch autonomous driving and other technologies by in-depth cooperation or establishment of joint ventures to jointly help automakers build high-end brands or accelerate transformation to electrification, connectivity, intelligence and sharing.

Changan and Huawei. On November 14, 2020, Changan, Huawei and CATL established a new high-end smart car brand together. They will jointly develop the CHN smart electric vehicle platform, which will be equipped with Huawei's smart cockpit platform CDC, autonomous driving domain controller ADC, and some components of electric drive, batteries and electric control.

Changan and Huawei. On November 14, 2020, Changan, Huawei and CATL established a new high-end smart car brand together. They will jointly develop the CHN smart electric vehicle platform, which will be equipped with Huawei's smart cockpit platform CDC, autonomous driving domain controller ADC, and some components of electric drive, batteries and electric control.

SAIC and Alibaba. On November 26, 2020, SAIC and Alibaba jointly founded a high-end battery-electric vehicle brand "IM", which will adopt Alibaba's Banma Telematics system and SAIC's electric drive, battery, electric control and intelligent driving technologies.

SAIC and Alibaba. On November 26, 2020, SAIC and Alibaba jointly founded a high-end battery-electric vehicle brand "IM", which will adopt Alibaba's Banma Telematics system and SAIC's electric drive, battery, electric control and intelligent driving technologies.

Geely and Baidu. On January 11, 2020, Geely and Baidu erected a smart electric vehicle company. Baidu will fully empower the joint venture with technologies such as artificial intelligence, autonomous driving, Apollo, and Baidu Map.

Geely and Baidu. On January 11, 2020, Geely and Baidu erected a smart electric vehicle company. Baidu will fully empower the joint venture with technologies such as artificial intelligence, autonomous driving, Apollo, and Baidu Map.

4. Summary

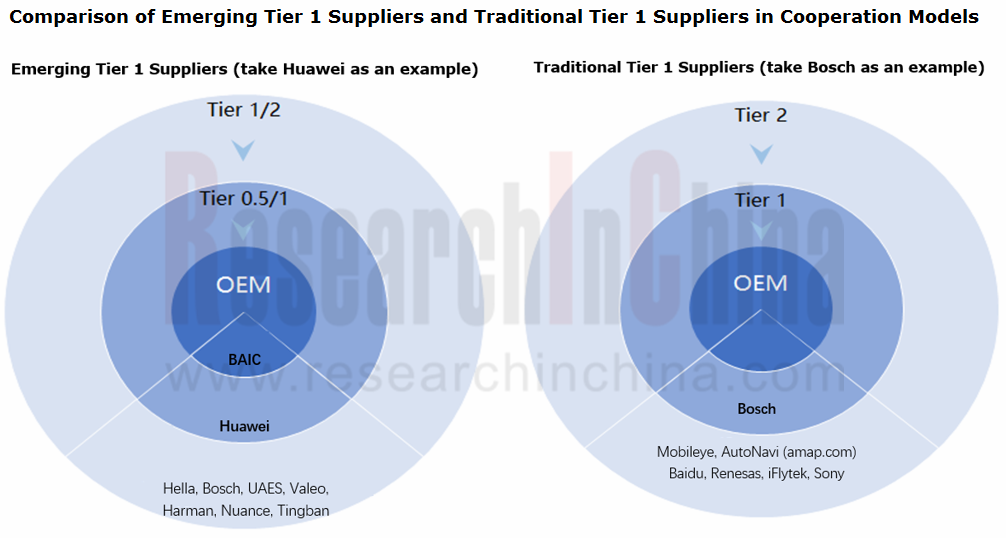

Comparing the development models of Tier 1 suppliers at home and abroad, emerging Tier 1 suppliers represented by Huawei and Mobileye directly penetrate into OEMs, deeply participate in product R&D, and position themselves as Tier 0.5 suppliers. For example, at the beginning of BAIC ARCFOX R&D, Huawei directly took part in R&D of many system functions of the vehicle, including smart driving, smart cockpit and smart electronics. Similarly, Mobileye acted as a Tier 0.5 supplier amid the cooperation with Geely Lynk & Co. Previously, Mobileye only supplied semi-finished components to Tier 1 suppliers, but now it is responsible for the complete solution stack for the first time, including hardware, software, drive strategy and control. Mobileye will also provide a multi-domain controller and provide software OTA updates after the system is deployed.

The emergence of the Tier 0.5 cooperation model will reshape the cooperation pattern of the traditional automobile industry chain.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...